“Just because you have tech, doesn’t mean you’re going to get value,” says Ganga. “You can be tech rich but value poor.” To plug any leaks in their digital transformation strategies, consumer and retail companies must prioritize defining value.

Defining value and monitoring tech debt helps organizations stay on track

Transforming with intent is not a simple exercise. “There’s a fundamental issue around how to define and deliver value,” says Ganga. “Many technology leaders struggle to do so in business terms — it’s not a natural state for them.”

When they define value for tech investments, leaders should look beyond traditional business metrics, such as financial performance. For example, value might mean using tech to improve employee wellbeing, meet ESG requirements or mitigate supply chain risks. It could also mean renovating data architectures to support the integration of sophisticated technologies such as predictive analytics. A retail company, for instance, might decide it wants to reduce the disconnects between contact channels to create seamless customer engagement journeys. If it knows it is aiming for this kind of agility for customers, the company can work out which technical and data capabilities it needs to build an omnichannel environment where channels are integrated to deliver more convenience for shoppers.

When they upgrade their tech stacks, organizations also need to continually monitor their tech debt to maximize and retain value. “Everybody has tech debt, it’s just the cost of doing business,” says Ganga. “But if you haven’t defined value properly, then it’s impossible to find out if the tech debt is, say, servicing better financial performance or employee productivity.”

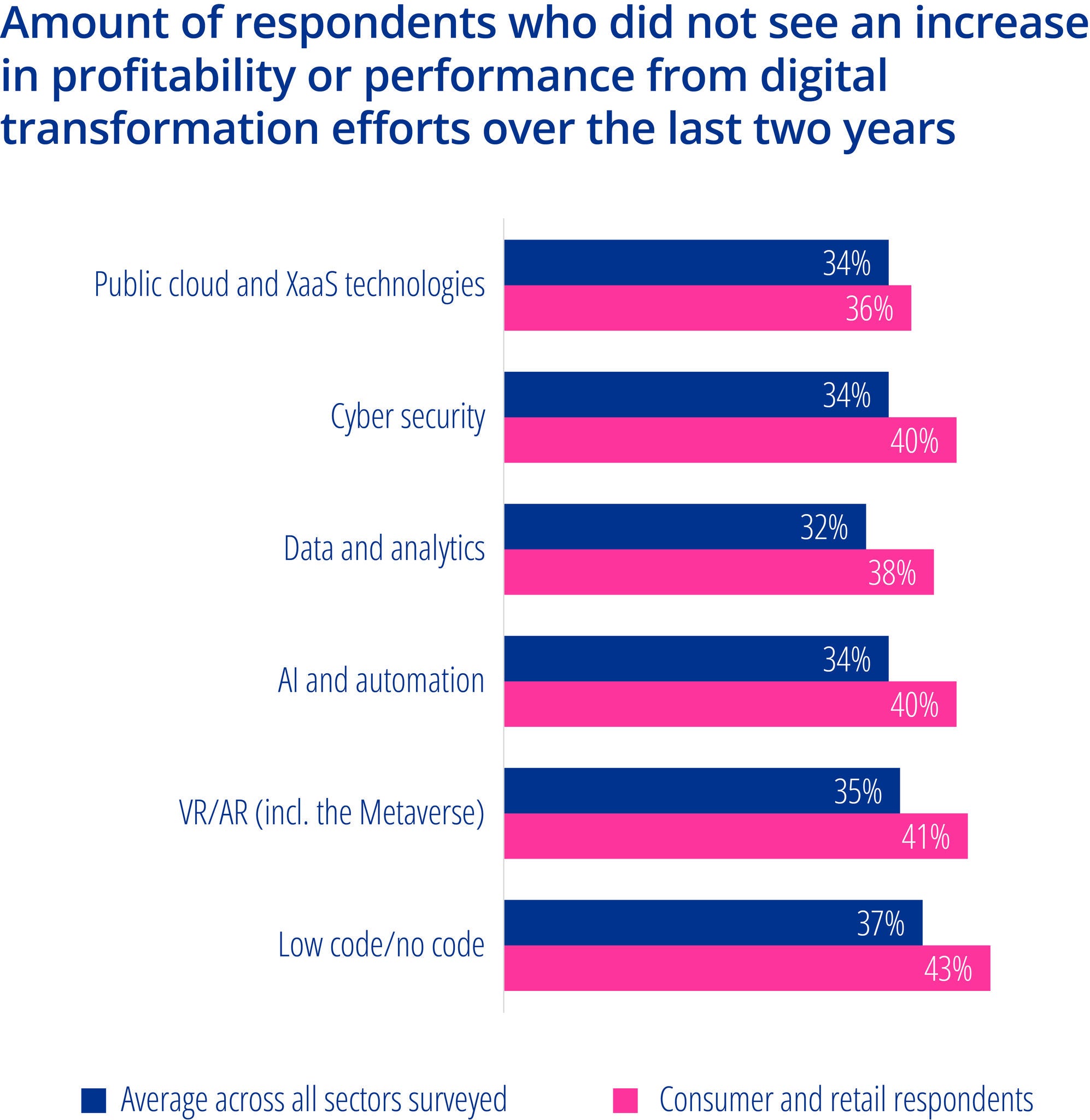

The good news is that most consumer and retail executives in the KPMG survey (65 percent) are aware of the productivity impact and financial costs of their existing tech debt. But the sector is behind the average across all sectors surveyed (70 percent), so it could benefit from increasing its awareness levels to avoid complacency. Accumulated tech debt can rear its head, in the form of unaddressed security vulnerabilities or functionality errors that cause suboptimal performance, and complicate digital innovation plans. So, alongside their innovation efforts, consumer and retail companies must keep a close eye on managing tech debt to stop it from draining value from digital transformation projects.

Prioritizing the right value levers can improve employee wellbeing

Employee productivity is one area where the consumer and retail sector has successfully generated value through digital transformation. Over half (58 percent) of consumer and retail executives surveyed say their digital transformation initiatives have beaten expectations in this area — 7 percentage points higher than the average across all sectors surveyed. This is a valuable return: higher productivity is likely to produce faster responses to customer queries, which can remove friction from shoppers’ experiences.

Increased employee productivity can also offset any reduced output caused by the sector’s high employee attrition rates, according to Ganga. As seen in the research, consumer and retail executives are less confident than all other sectors surveyed in their ability to enhance employee satisfaction and wellbeing using their current tech stack. Martin Sokalski, Consumer and Retail Technology Leader at KPMG in the US, says that this could be a result of increasingly complex ecosystems and legacy tech debt that retail staff often have to navigate through.

“Employees across the consumer and retail industry are being asked to handle increasingly disjointed platforms and poor-quality, siloed data,” says Sokalski. “These become intense pain points and cause burnout for employees trying to fulfill the expectations of their daily role while balancing business and functional aspirations for greater technology enabled insights and innovation.” Flaws in tech stacks often block staff from focusing on more meaningful, value generating activities that will benefit the organization and its customers.

That’s why Sokalski believes it’s important for organizations to do anything they can to augment their workforce with the right tools and assets. “As these efforts can tremendously improve both employee wellbeing as well as the outcomes for the organization overall,” Sokalski explains.

Modern technology architectures and solutions have the power to boost productivity and, more importantly, have ability to disrupt the paradigm of ways of working. “For example, leveraging AI to augment the daily tasks of a finance analyst has the potential to revolutionize that employee’s working life. Benefits including – improved workflows, outcomes, productivity, engagement, and overall wellbeing of the individual employee. At scale, these sorts of tech upgrades can have a major impact on organizational cultures overall,” says Sokalski.

Tracking and measuring the performance of digital transformation initiatives can help to minimize tech-induced employee and customer frustration levels. “Once you’ve built a culture that is able to assess whether a project or innovation is delivering value [to your employees and or customers] and adapt accordingly, then the people piece will sort itself out,” says Ganga.

Data complexity is hampering innovation

The quality of data infrastructures and handling practices can directly affect whether the value of a digital innovation initiatives can reach its full potential. And growing data complexity appears to be complicating retailers’ innovation plans. Consumer and retail executives in the research say that data volume and complexity is one of the top three tech stack challenges holding back their innovation efforts. In comparison, the consensus across all sectors surveyed did not see data complexity ranked as a top three innovation challenge.

Puneet Mansukhani, Partner & Co-Lead Consumer & Retail, KPMG in India says “Data has been at the heart of the sector for much longer than other industries. Retailers have monetized data by selling it to CPG [consumer packaged goods] companies, and CPG companies used to spend millions purchasing data. Now, CPG companies are collecting their own data for the first time.”

But when it comes to data, high volume does not necessarily equal high value. To avoid being overwhelmed by data and use it responsibly as an asset, consumer and retail companies must first understand what insights they really need. This can accelerate the process of generating valuable returns.

This all comes back to the importance of defining value upfront — especially when it comes to digital transformation. “Only then,” says Mansukhani, “can retail and CPG companies figure out how to use data [in the right way], improve ways of working and implement the best technologies for their business.”

Key takeaways

- Transform with intent: More tech doesn’t necessarily equal more value. Define the desired business outcome first and then choose which technology will help you achieve that.

- Adopt emerging capabilities, like generative AI, to improve ways of working: this will increase productivity and employee wellbeing.

- Get the most from your data: Make sure you lay the right data foundations (i.e., through data governance and management). Having the right foundations will allow your business to become more skilled at defining value and measuring its desired business outcomes. Over time, be sure to develop your data foundations by integrating new trusted analytical capabilities with a view to achieve scale and self-service. This can enable you to adapt to market changes and continuously deliver a seamless customer experience.

How KPMG can help

At KPMG, we have extensive knowledge and expertise in business technology. Our transformation, innovation and industry specialization positions KPMG professionals to address market challenges and provide in-depth industry perspectives.

We use technology in ways that can increase competitive advantage for consumer and retail organizations, from enterprise-wide transformations, embracing the power of artificial intelligence and GenAI through to applying data analytics to gain trusted insights. We leverage our strong network of alliances with some of the world’s leading technology, data and services companies to help deliver change for businesses all along the value chain, from agribusiness, to consumer products to brick-and-mortar retail stores and consumer platforms and direct to consumer models.

We can help find solutions to achieve greater consumer centricity.

Get in touch to learn more about how KPMG can support transformation in your organization.