Supply of labour rises at fastest pace in over four years

The availability of staff increased sharply in March, with the rate of growth the quickest seen since December 2020. Recruiters noted steeper upturns in both permanent and temporary labour supply, with the former registering the sharper rate of expansion. The increases in availability were often linked by panel members to redundancies and fewer job openings.

Vacancies fall at softer, but still marked rate

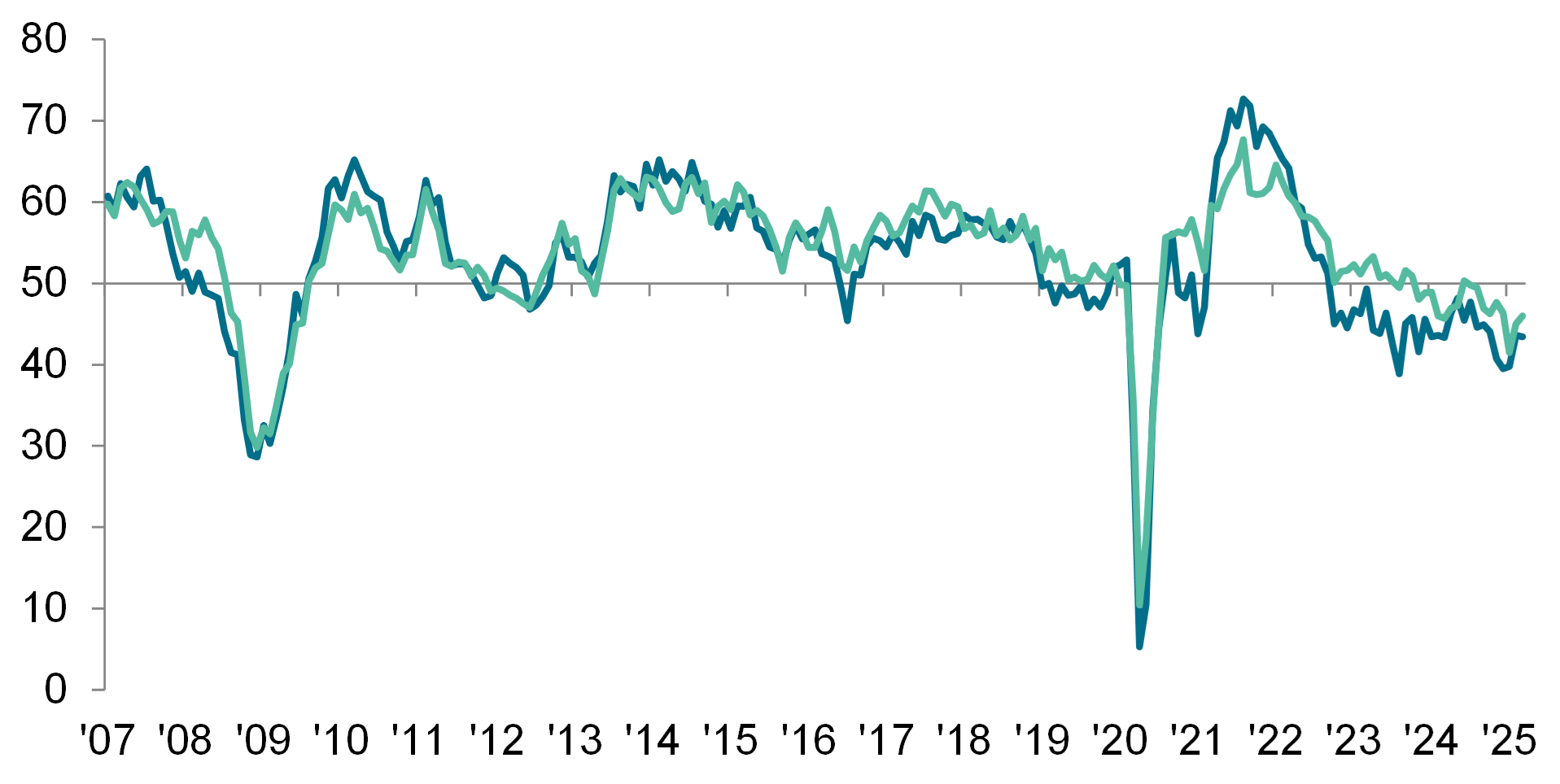

Overall demand for staff continued to weaken at the end of the first quarter, with the respective seasonally adjusted index posting in contraction territory for the seventeenth month in a row. Though sharp, the pace of decline was the softest recorded since last October, as both permanent and temporary job openings fell at slower rates.

Pay trends remain historically subdued

The rate of starting salary inflation picked up from February's four-year low, but remained comfortably below the survey's long-run average in March. Concurrently, temp wage growth improved slightly to a three-month high, but was only modest. Anecdotal evidence indicated that while many employers increased pay to attract suitably-skilled candidates, panellists also acknowledged that tighter client budgets, muted demand for workers and improved staff supply had suppressed rates of growth.

Regional and Sector Variations

Three of the four monitored English regions signalled a reduction in permanent placements, with the steepest fall in the North of England. London bucked the wider trend and recorded a renewed, albeit modest, expansion.

All four monitored English regions recorded lower temp billings in March, with the steepest reduction seen in the North of England.

Demand for permanent staff fell across all ten monitored job categories during March. Retail saw by far the steepest drop in vacancies, followed by Secretarial/Clerical and Executive/Professional sectors. Meanwhile, the Construction sector saw the softest decline.

As was the case for permanent vacancies, Retail saw the sharpest reduction in temporary staff demand in March, closely followed by the Executive/Professional sector. Engineering noted the softest drop in temp vacancies and saw only a marginal reduction.

Commenting on the latest survey results, Jon Holt, Group Chief Executive and UK Senior Partner KPMG, said:

“At a time when global uncertainty is peaking and businesses are assessing the impact of market volatility alongside rising employment costs, the latest data demonstrates how the economic reality continues to weigh heavy on the labour market. With cost management a focus, those employers who are hiring are focused on securing the best talent, and while the rate of pay inflation has improved from last month’s four-year low, growth in starting salaries remains below the historic average.

“Recent global events have put pressure on any growth prospects in the UK, so it is unlikely that we will see an improvement in the data in the near term. Therefore, redoubling employee engagement programmes and maintaining morale for existing employees, who will also be concerned about uncertainty in the market, will ensure that businesses are ready to take advantage of any green shoots when they do appear.”

Commenting, Neil Carberry, REC Chief Executive, said:

“Today’s report shows that there were some signs of progress in the jobs market in March with permanent hiring in London ticking up a little, while the drops in other locations were not as sharp as those seen at the start of the year. The decline in temp billings at the UK-level also moderated. Given the substantial effects of the Government’s decision to increase payroll taxes hugely, these figures were if anything slightly better than expected and suggest that there is potential in the market. Nevertheless, activity in the UK jobs market has now been subdued for almost two and a half years.

“A cyclical hiring upturn was always likely in 2025, but the near-term prospects for this have been made all the more uncertain by the actions of the US Government in upending the global trade system. We can’t ignore the immediate and second-order effects of this context even if the UK is better positioned than many nations to weather the storm. Announcing support for the auto sector is one thing but the faster we have clarity on how the industrial strategy will support all sectors the more likely employer sentiment on hiring and investing will remain stable. And it is even more important now that the Government reconsiders the scale of rising costs of employment after this week’s rise in National Insurance – a full review of the impact of the Employment Rights Bill, and changes to simplify compliance costs, would be welcomed by businesses across the country.”