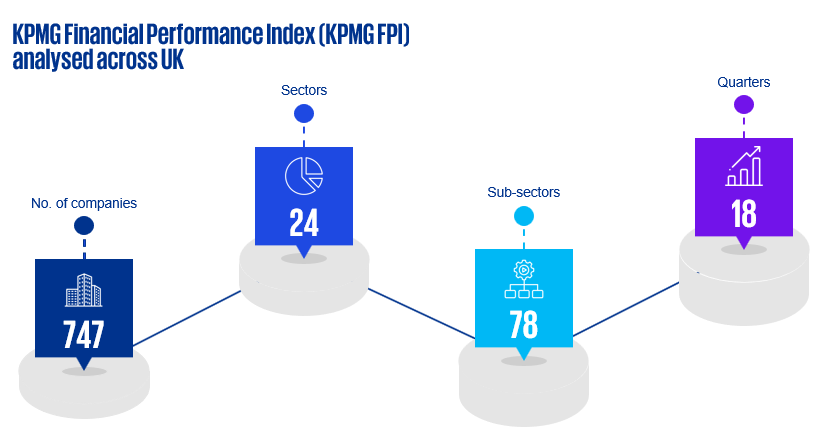

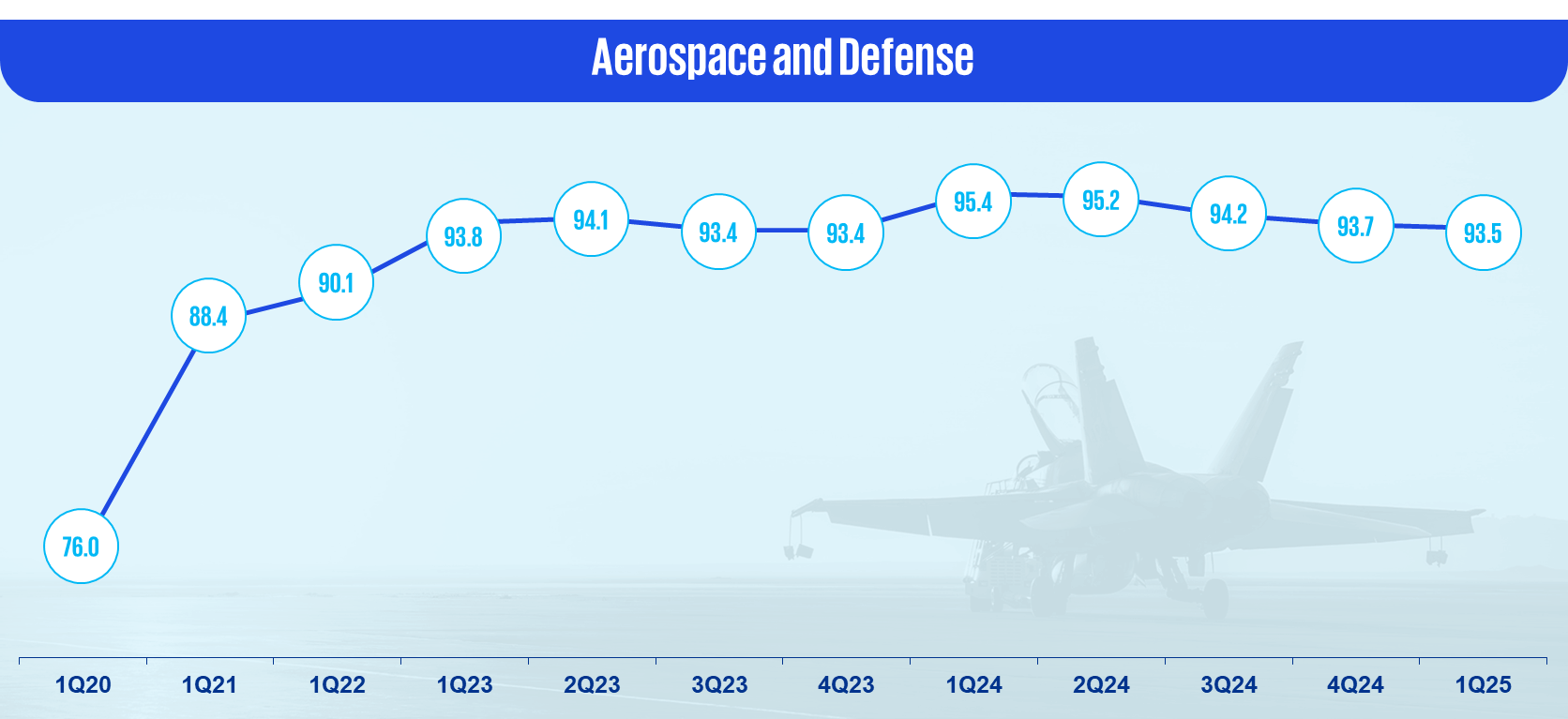

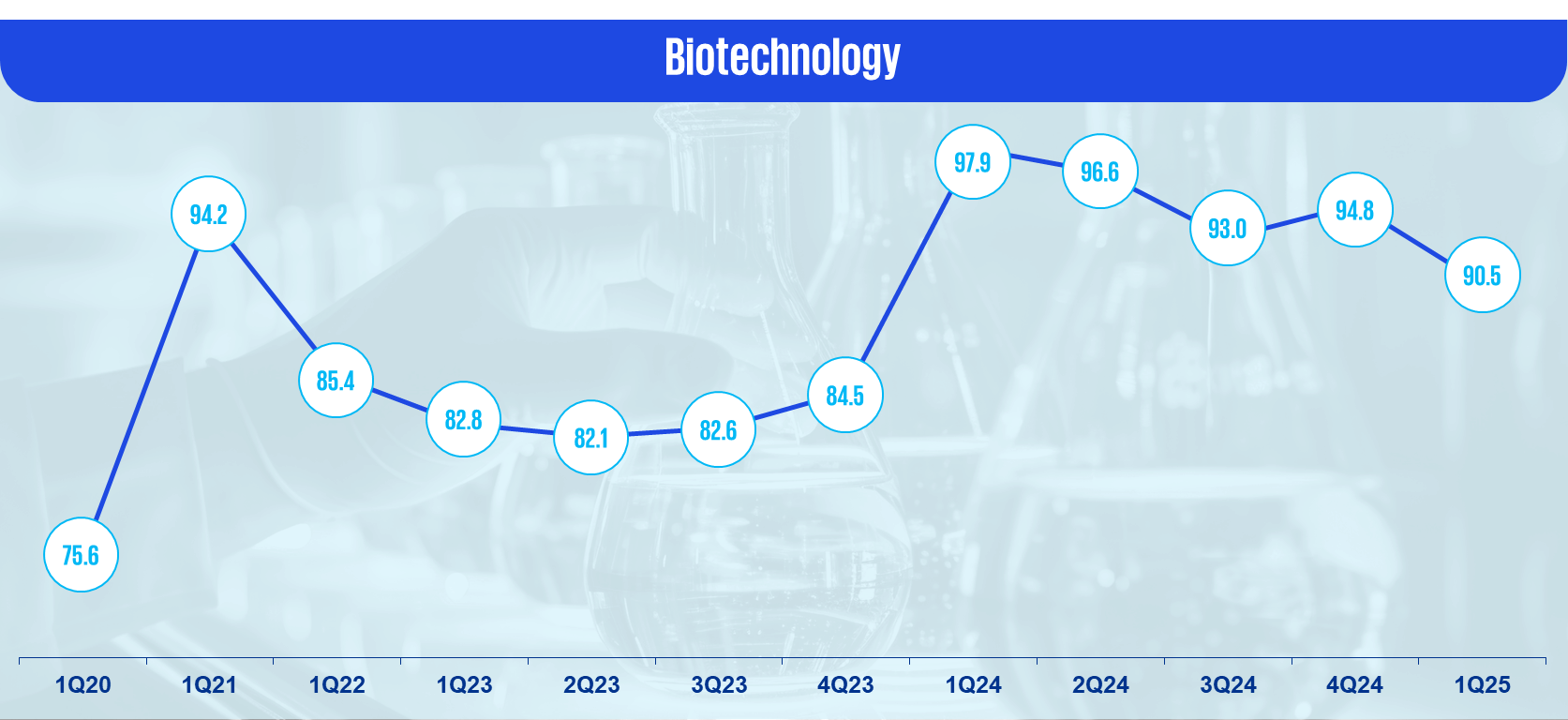

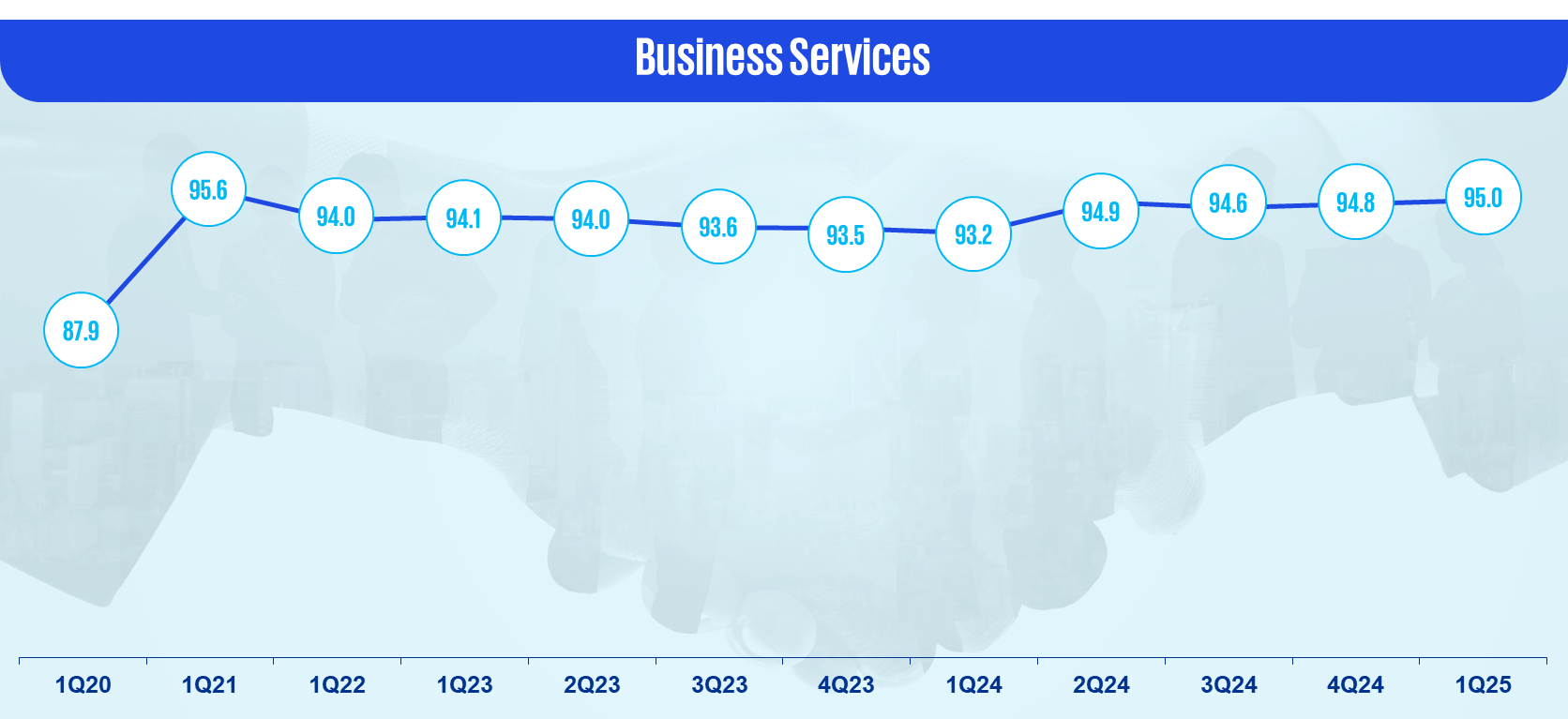

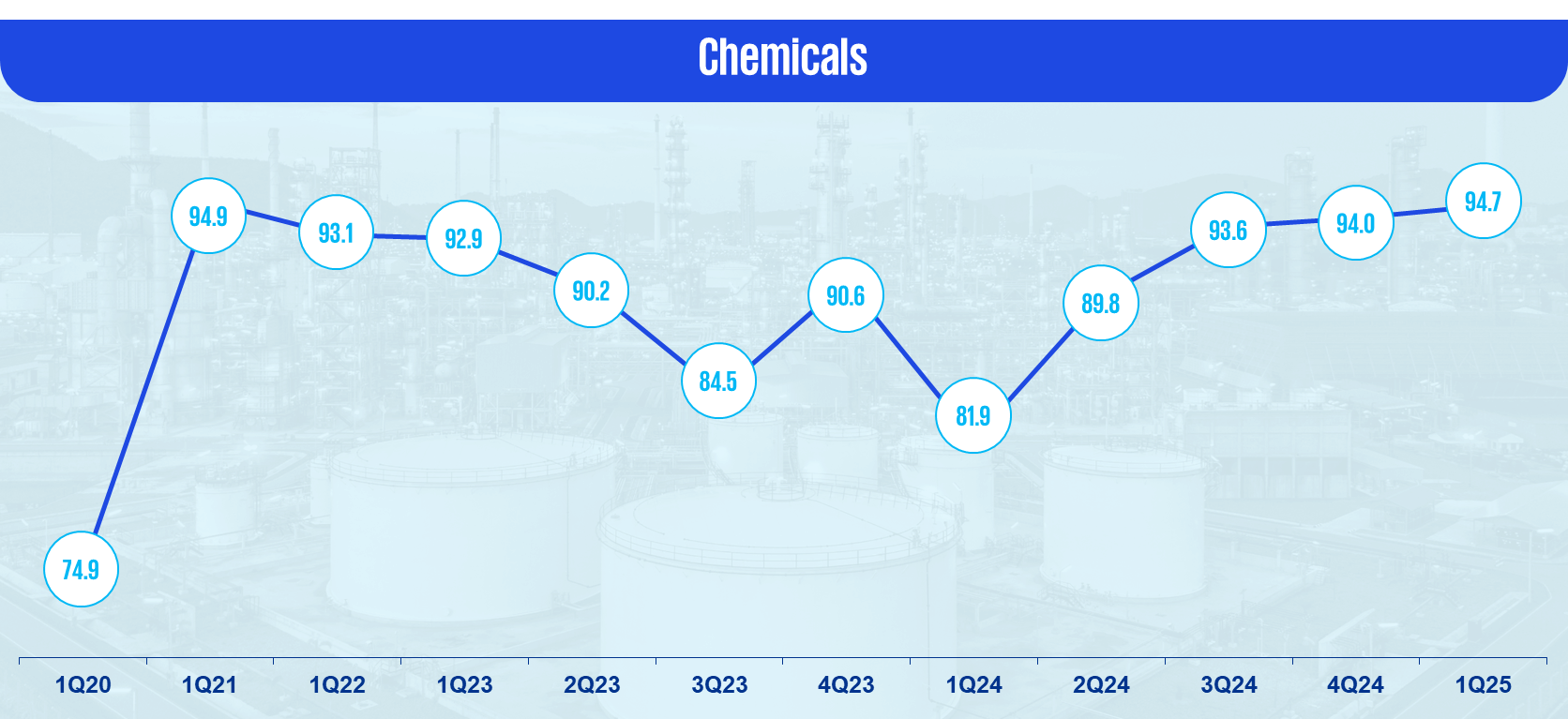

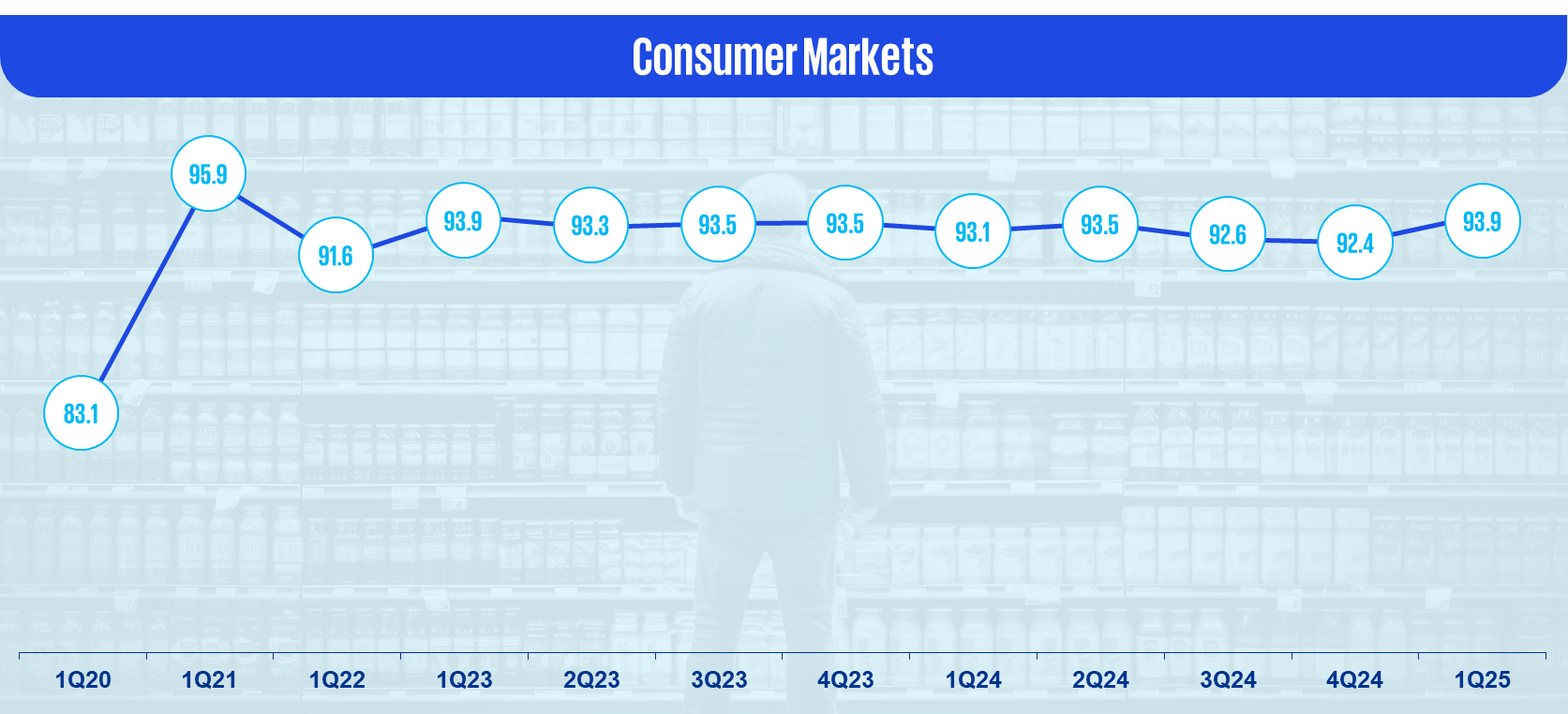

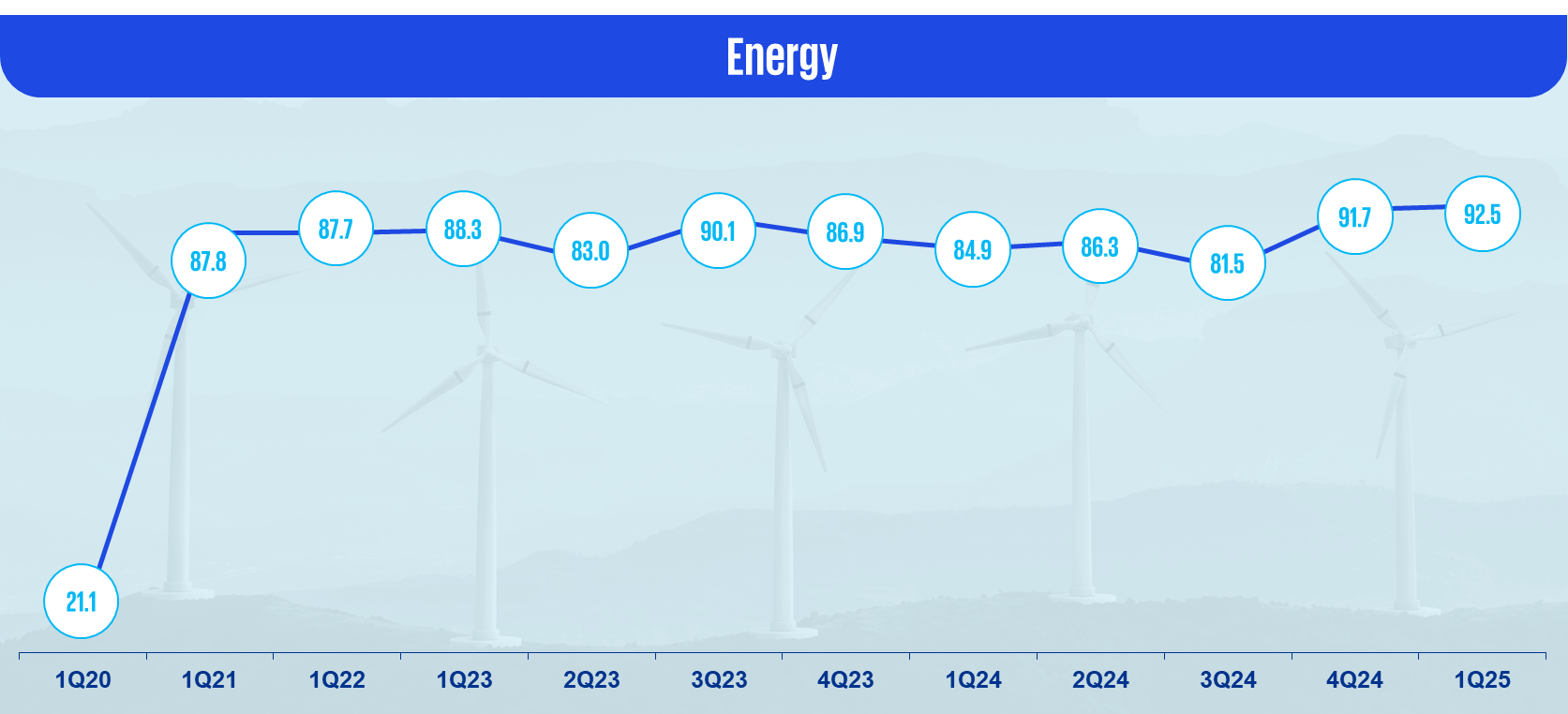

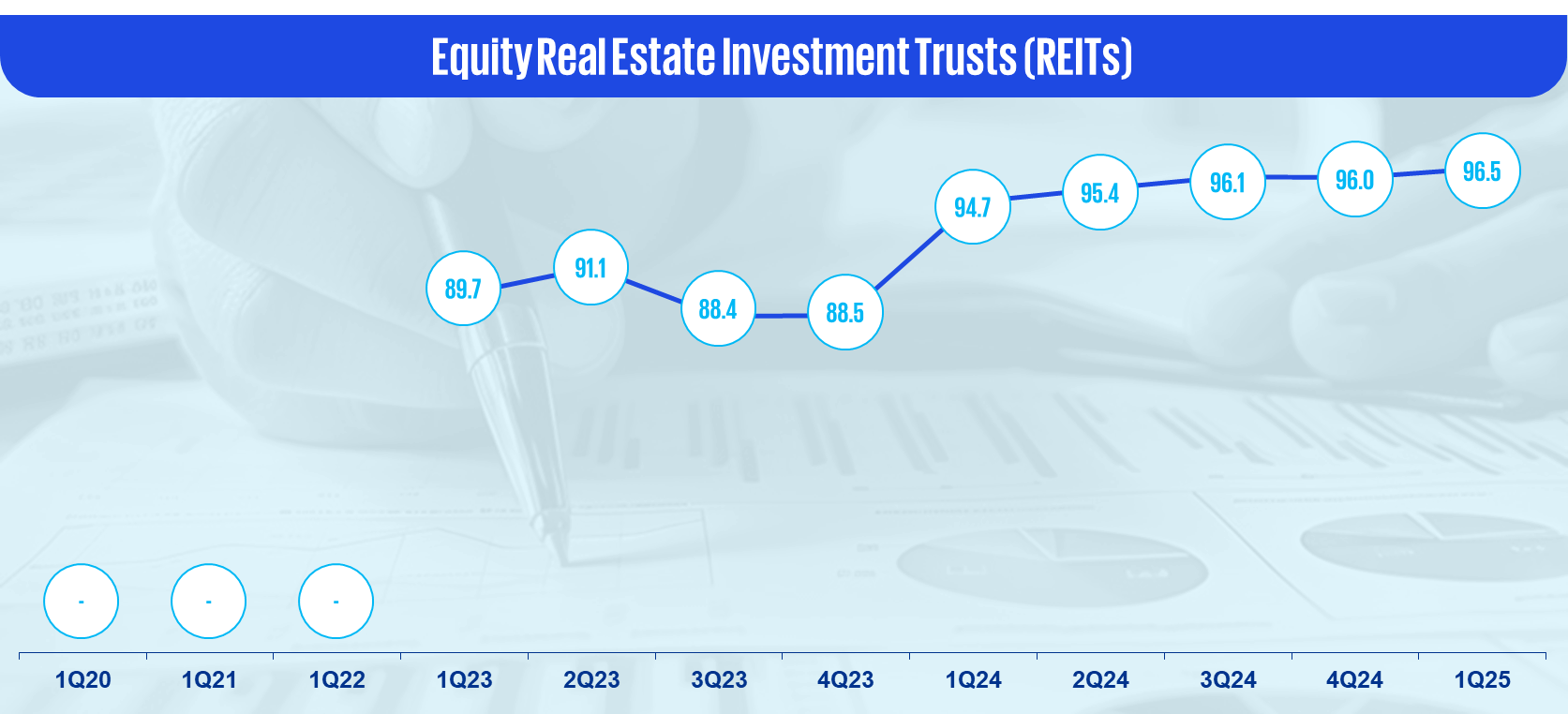

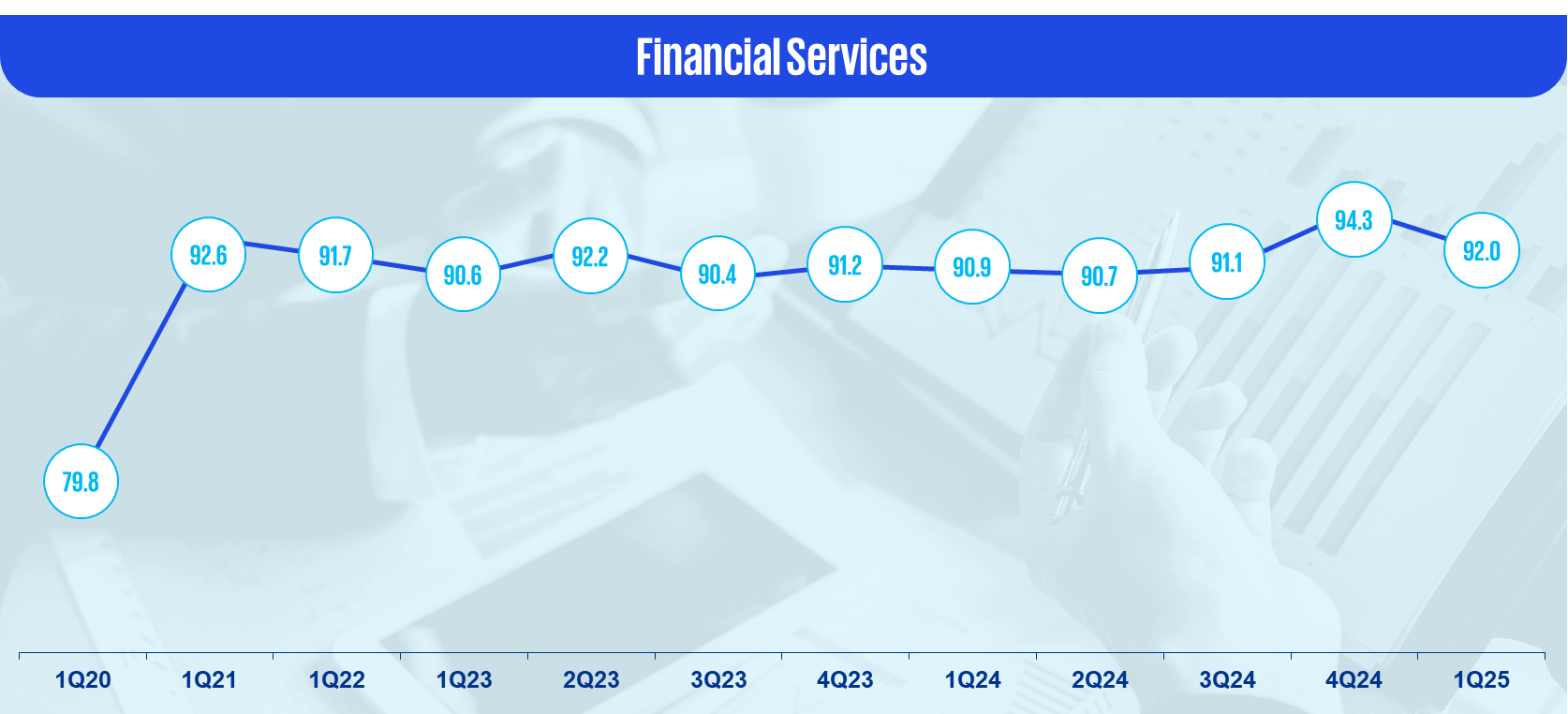

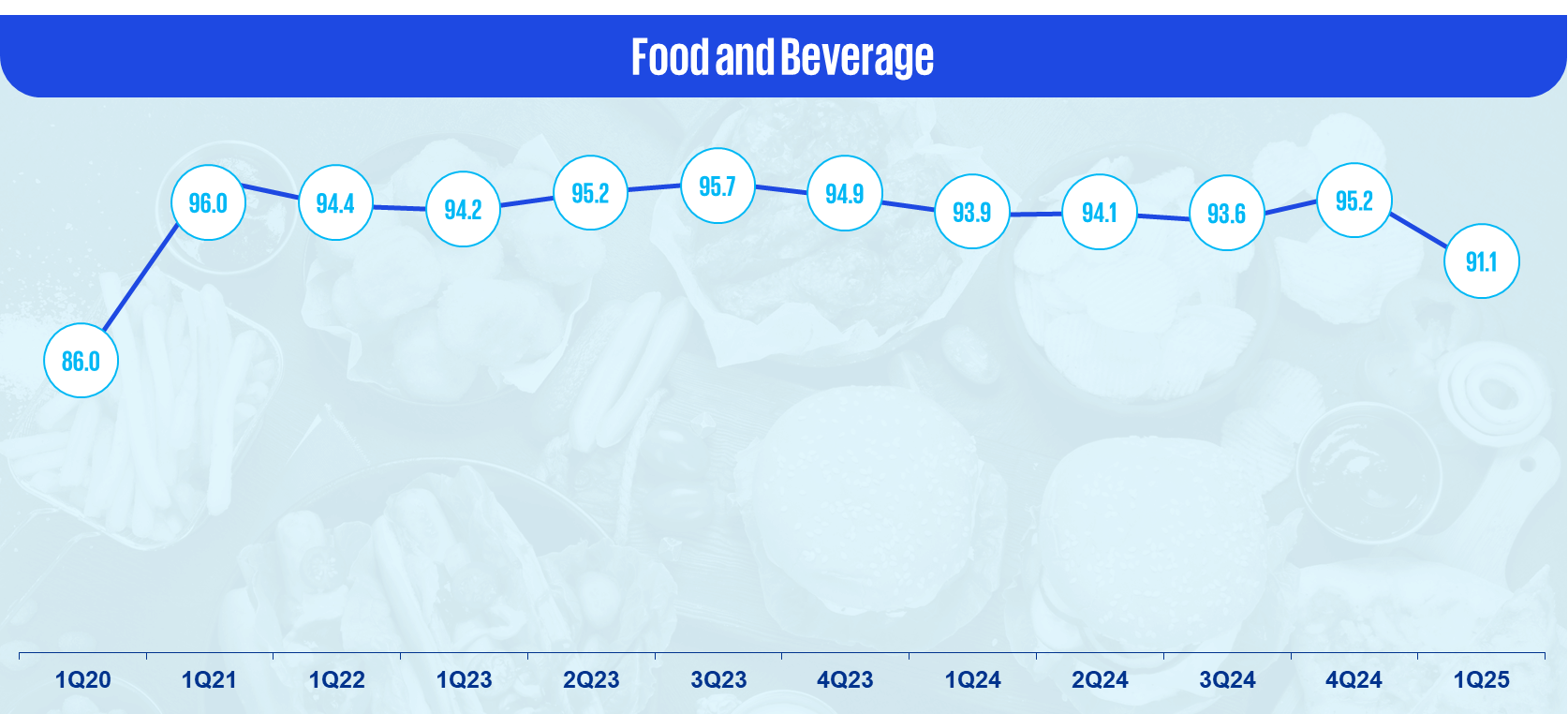

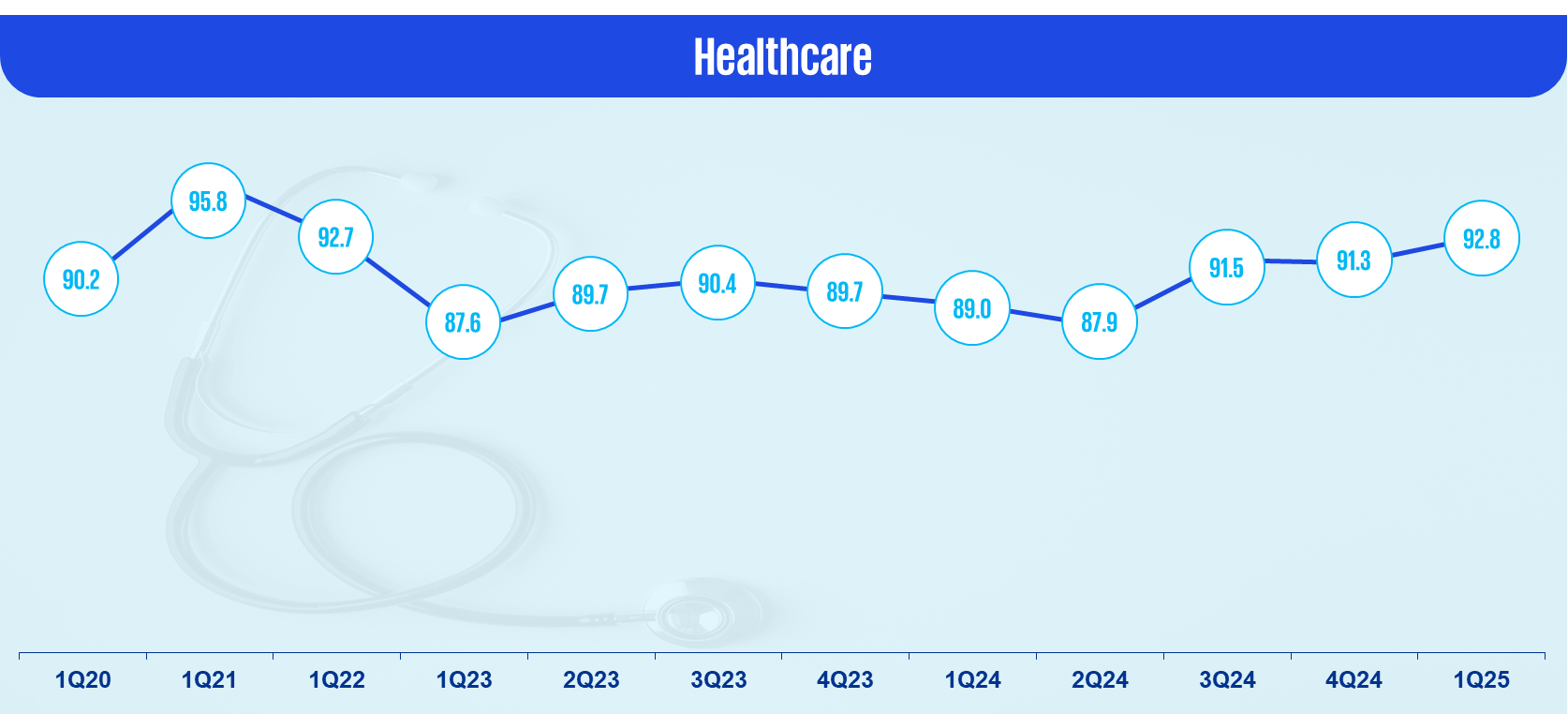

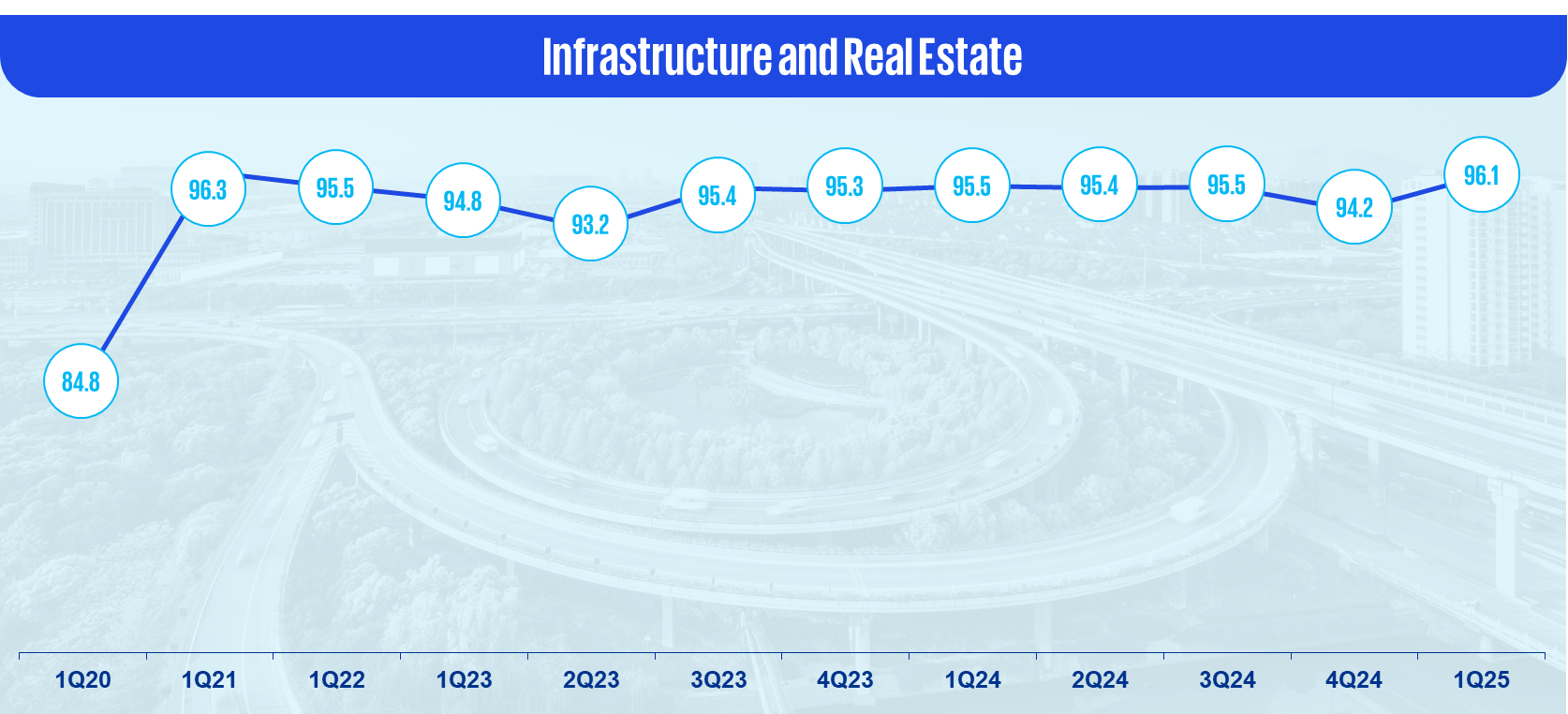

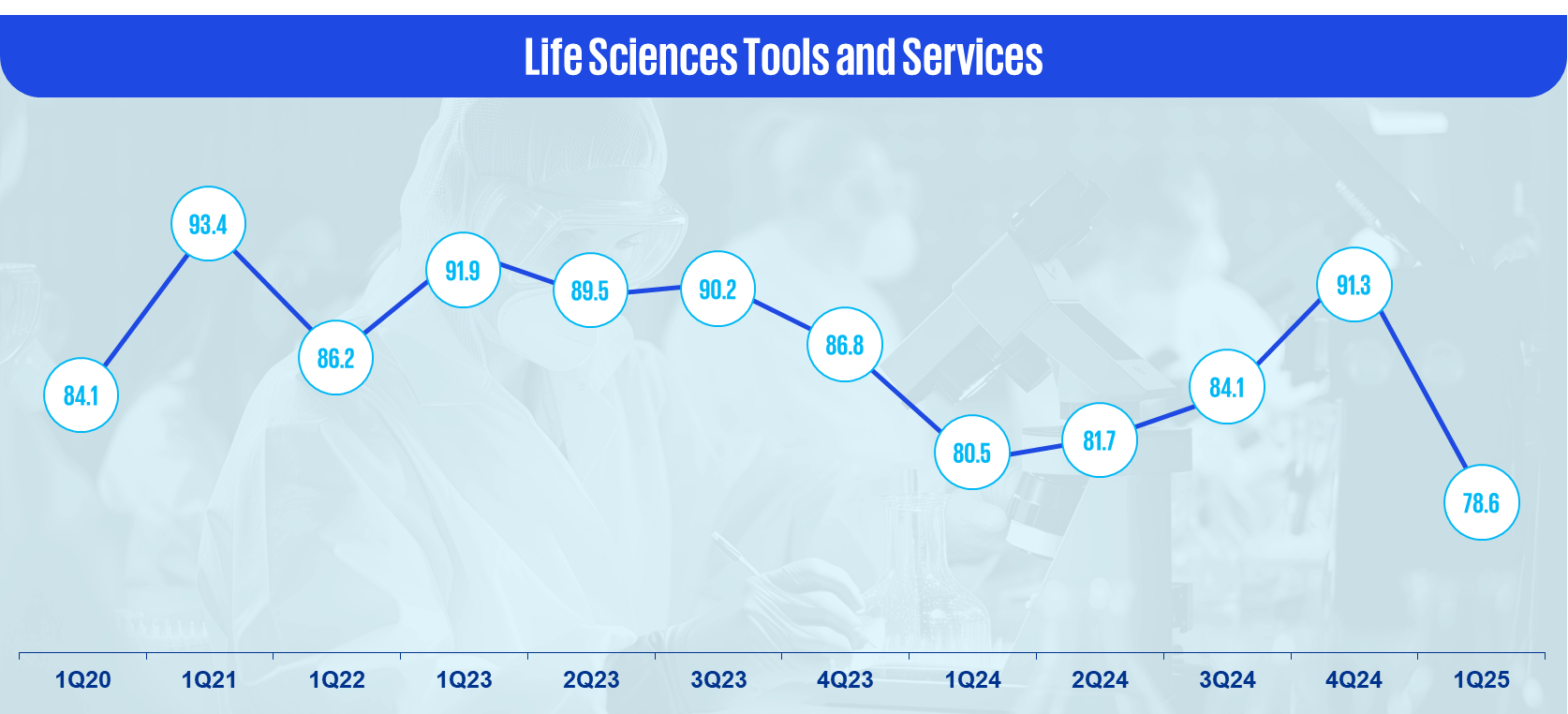

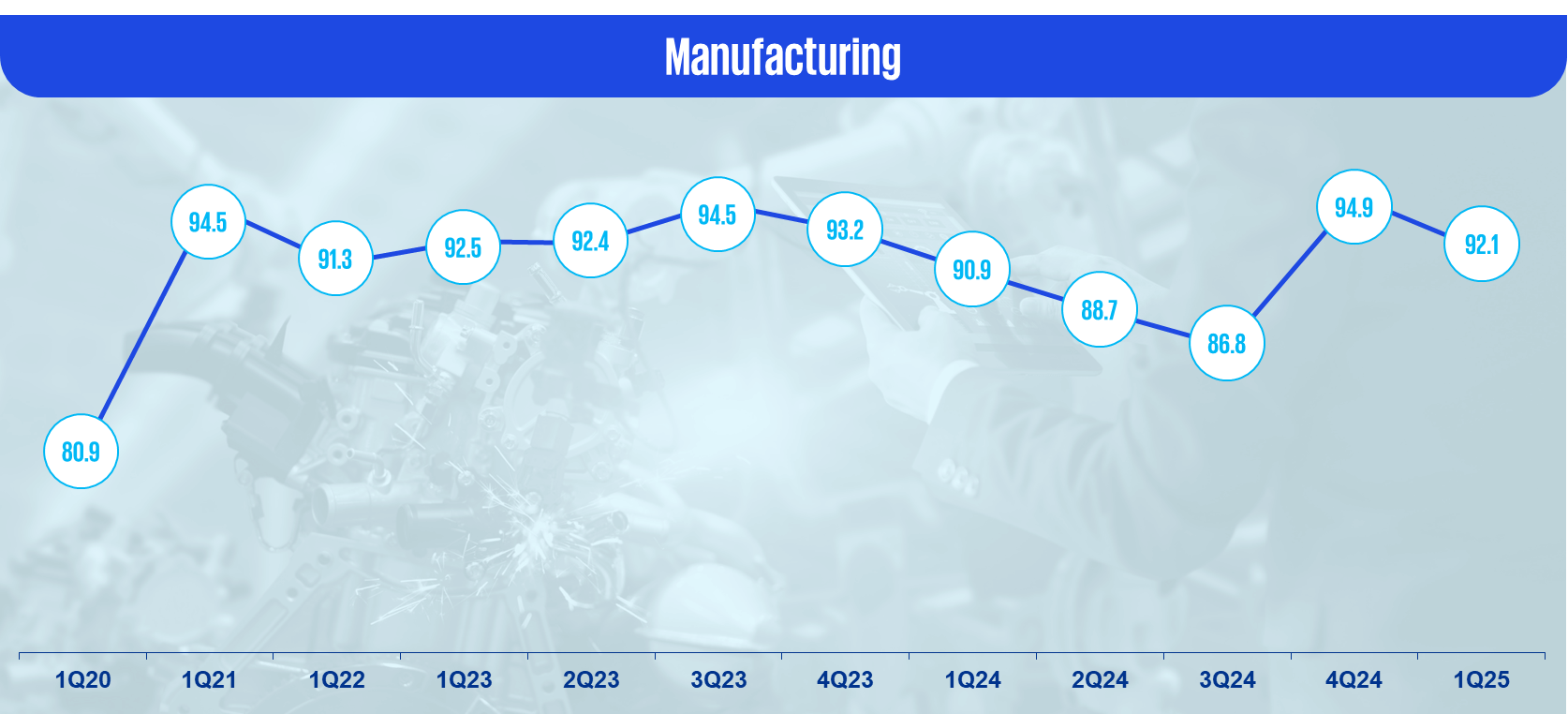

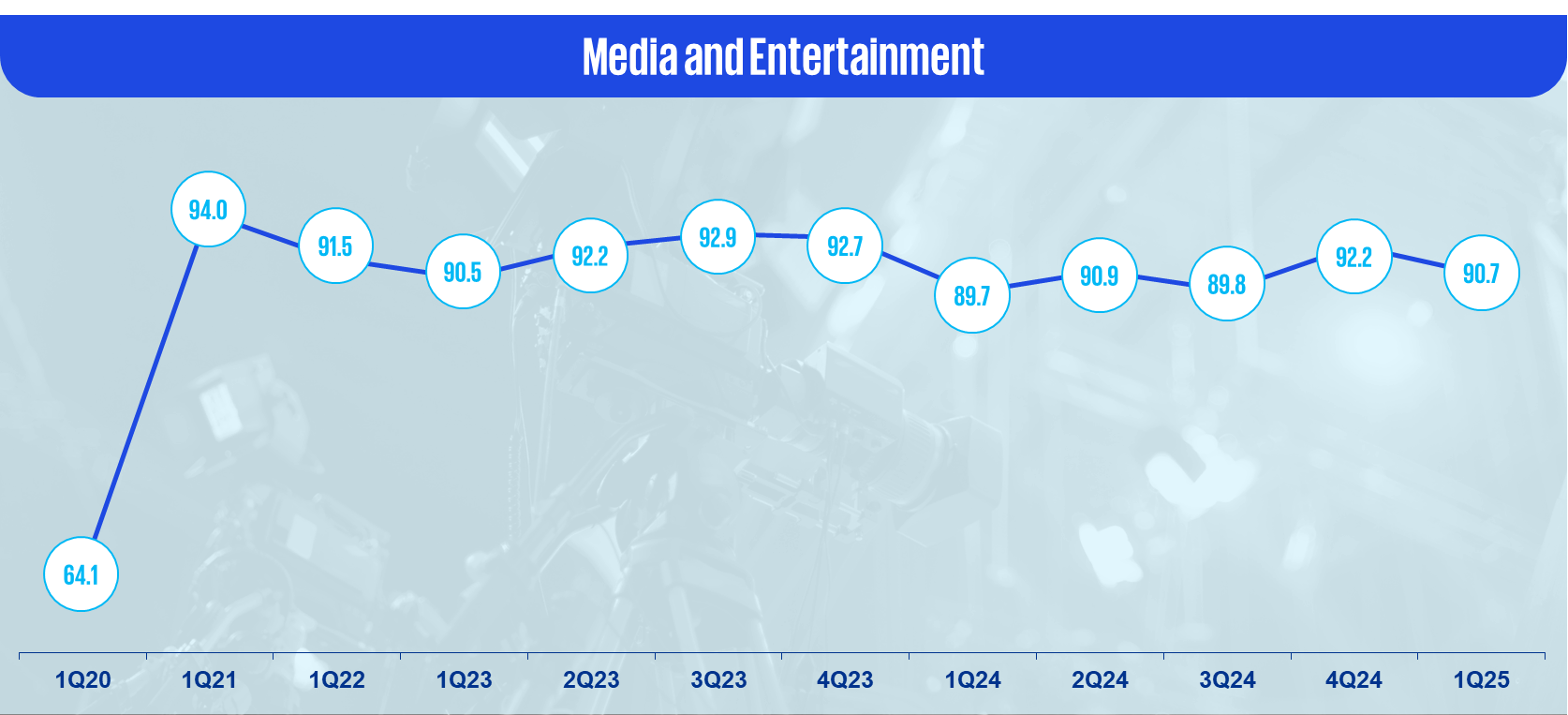

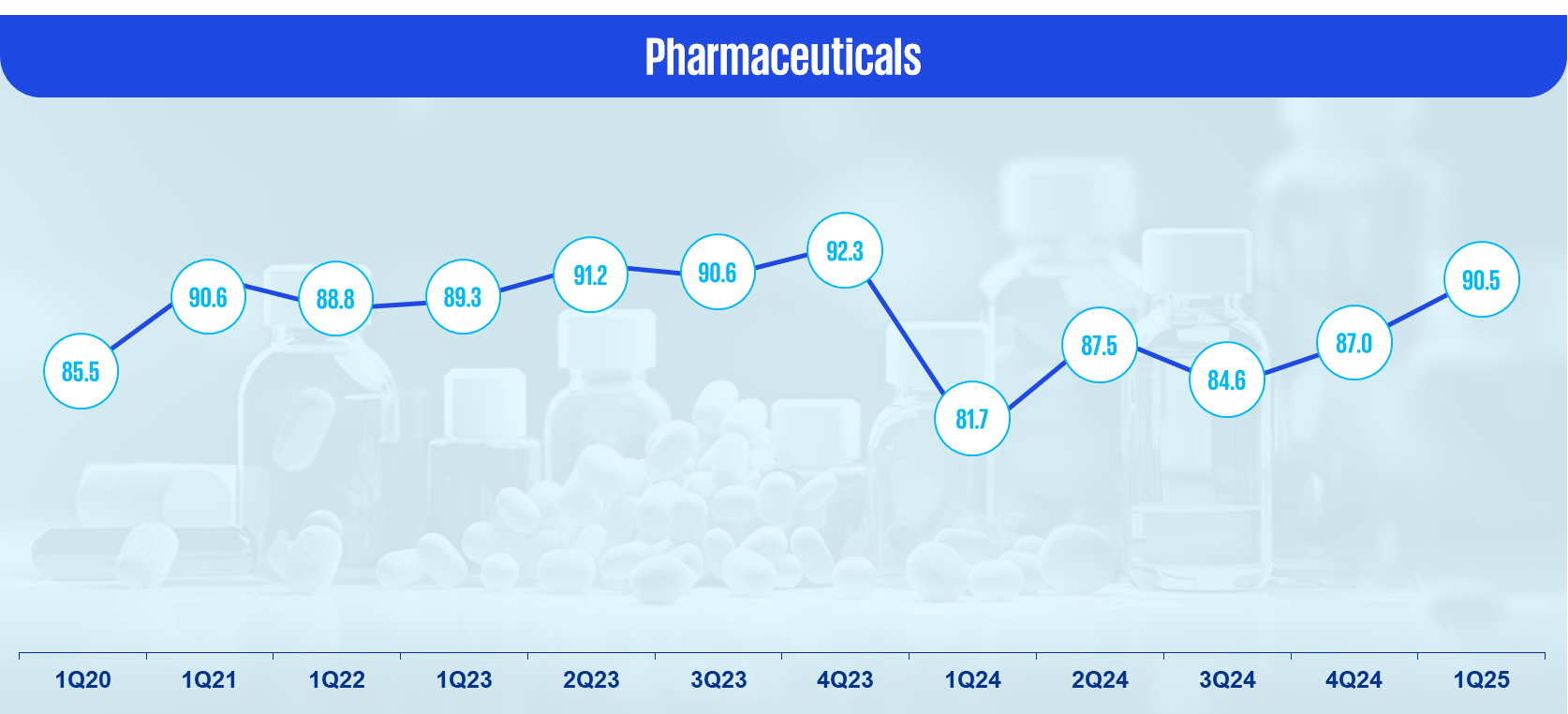

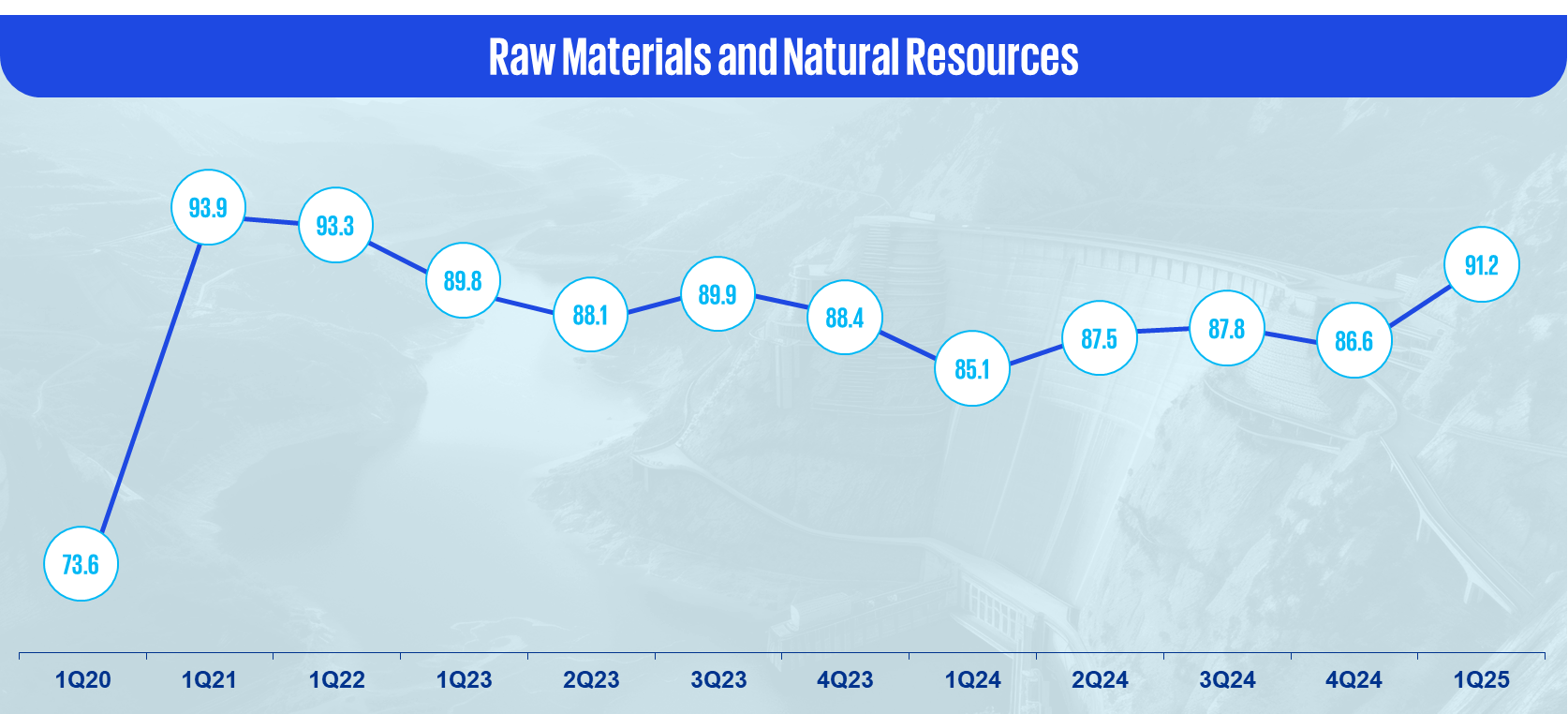

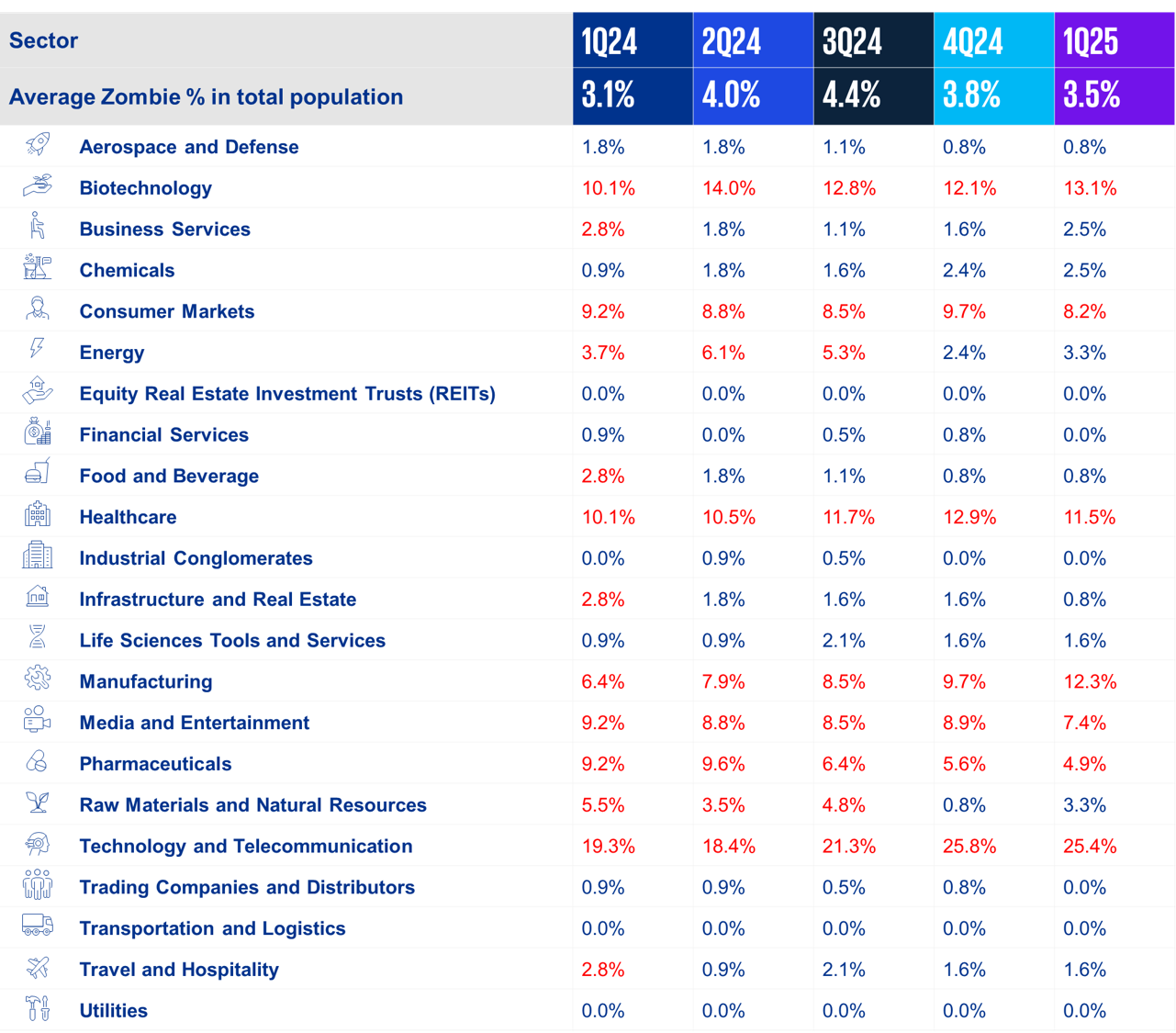

We are pleased to share with you the Q125 edition of our quarterly KPMG Financial Performance Index (FPI) publication. In this edition we provide our insights into the changing state of corporate health across all UK markets and sectors.

The KPMG FPI is a metric used to measure a company’s financial health by its ‘probability to default’. The analysis has been prepared using the probability to default formula which takes into account financial information and market data, as designed by John Y. Campbell, Jens Hilscher, and Jan Szilagyi.

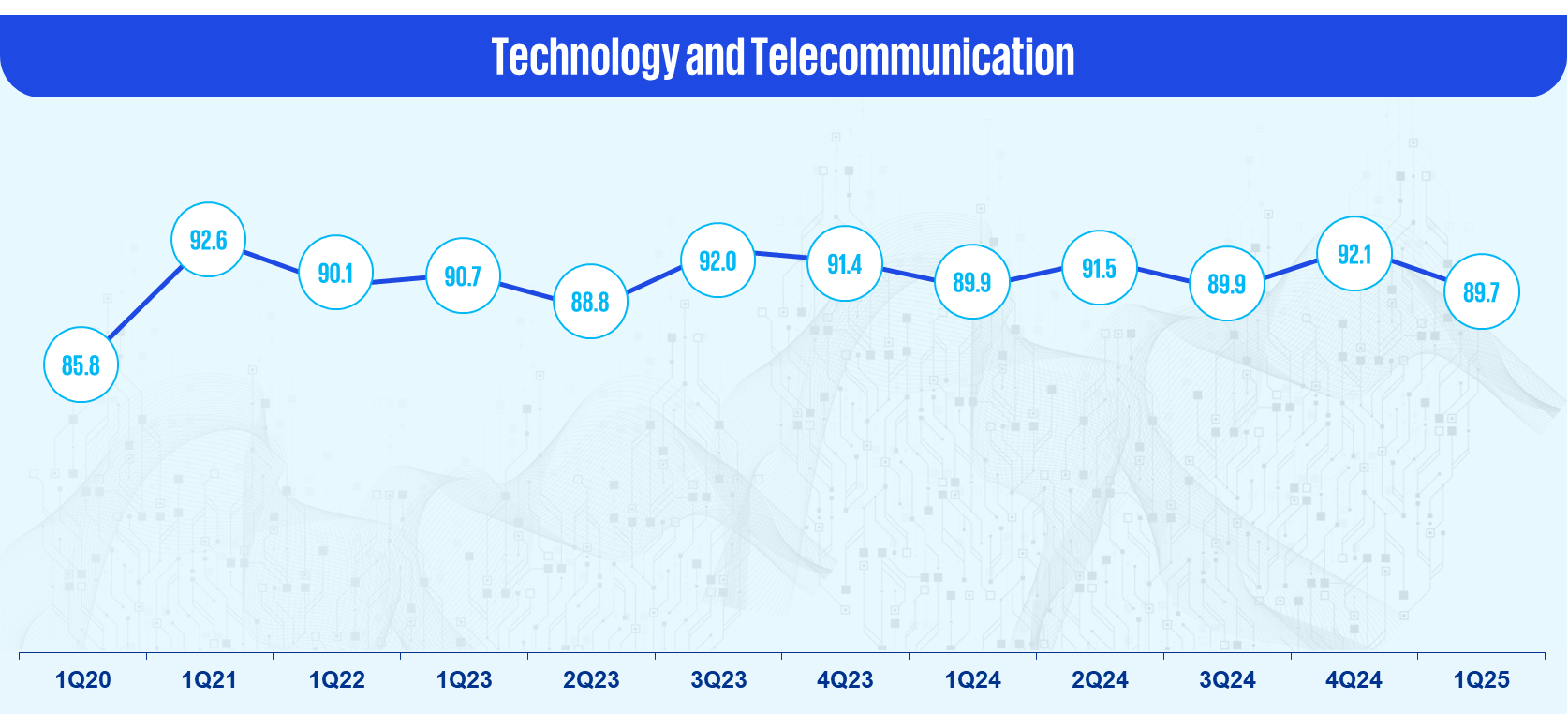

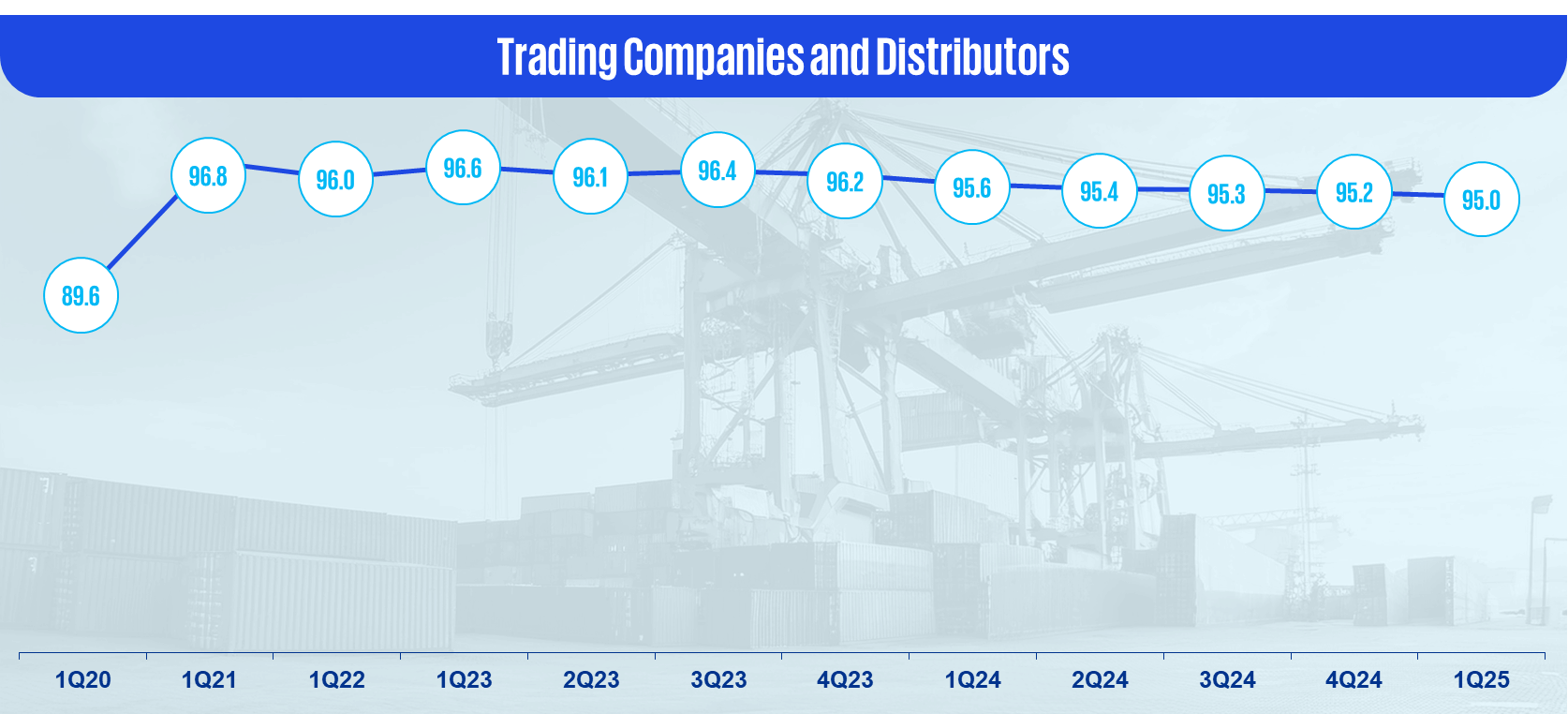

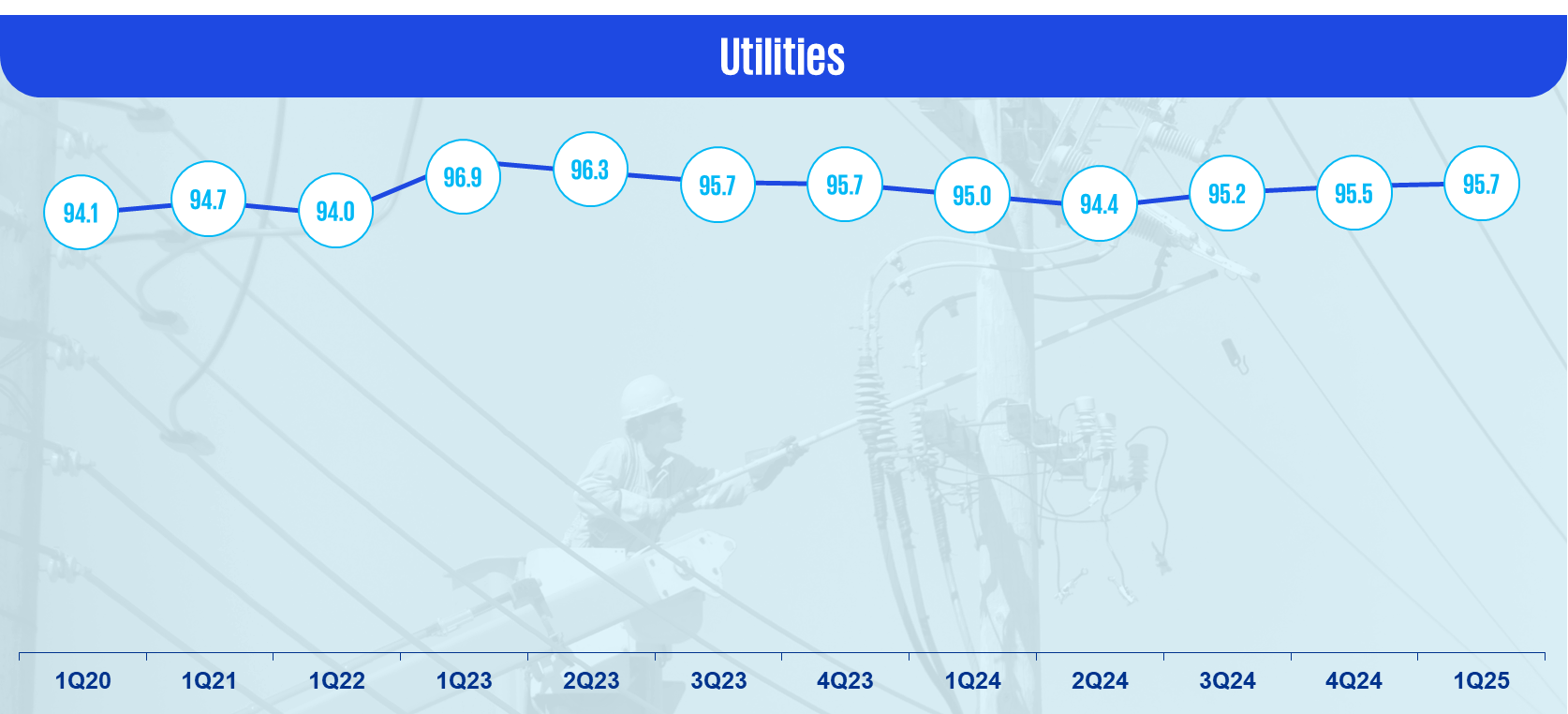

The FPI score ranges from 0 - 100. The lower the score, the more likely a company is to default. In contrast, the higher the score, the less likely it is to default. In this analysis, released every three months, we analyse the KPMG FPI score movements of publicly listed companies in the UK to draw insights into corporate health across the UK economy.

KPMG FPI combines both market and financial information to determine a company’s relative financial distress levels. Combining these information sets creates a more complete picture of corporate health than either source in isolation. For more information please visit the KPMG FPI page.