Slightly stronger increase in starting pay

Latest survey data indicated that the rate of starting salary inflation picked up from November and was sharp overall. That said, the increase was the second-slowest recorded since March 2021 and below the historical trend. Temp pay growth likewise quickened, climbing to a four-month high, but remained below the long-run average. Recruiters commented that while competition for suitably qualified staff had contributed to further increases in pay, there were indications that employers' budgets were under greater pressure.

Availability of workers continues to rise markedly

Candidate availability continued to rise at the end of the year, with panel members frequently mentioning that redundancies and a slowdown in hiring had pushed up labour supply. Although easing from the near three-year records seen in November, rates of expansion for both permanent and temporary candidate numbers remained rapid overall.

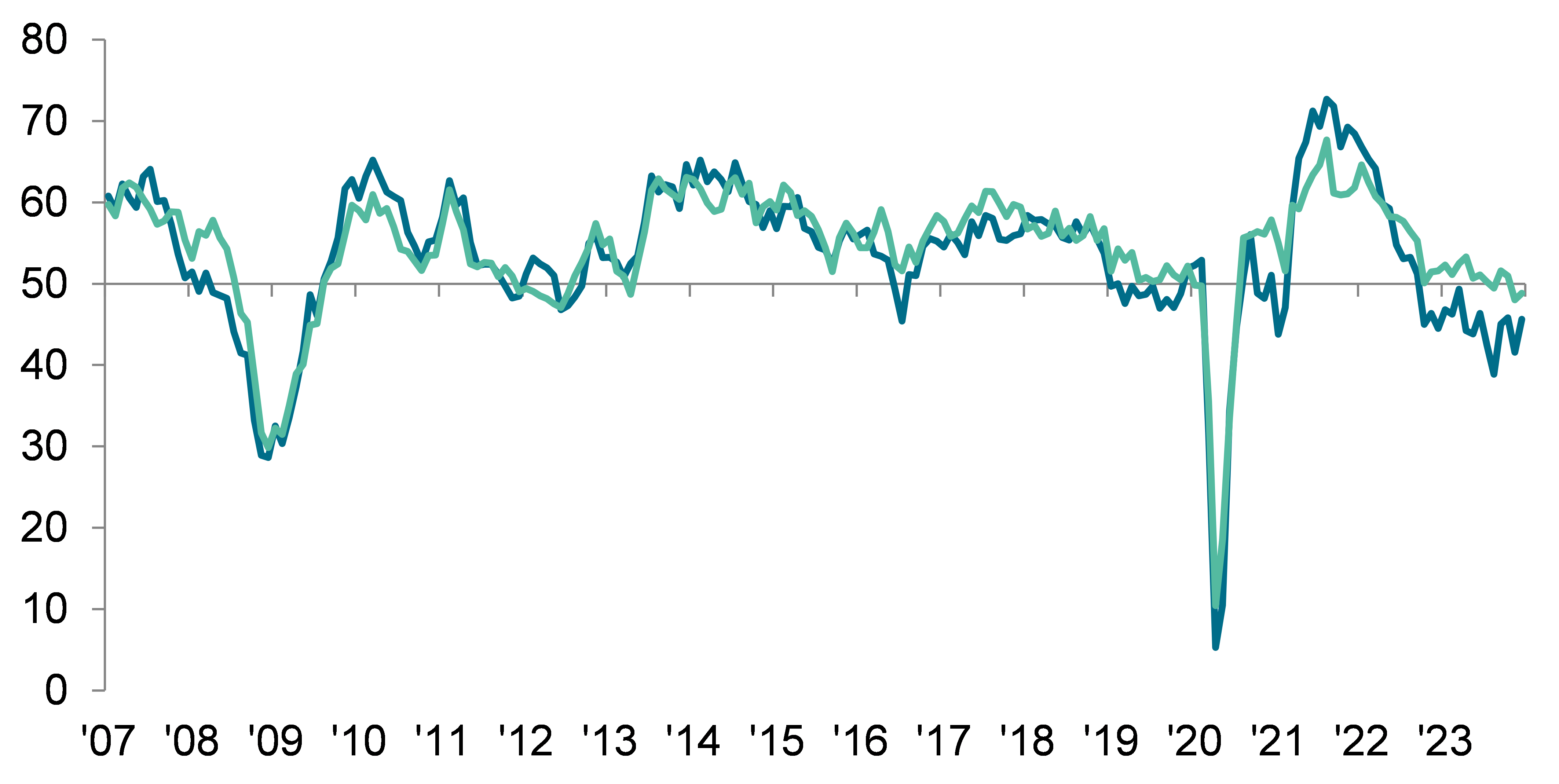

Demand for workers remains subdued

Total vacancies fell for the third time in the past

Continued…

four months during December. That said, the rate of decline was little-changed from November and only marginal. This reflected a slight reduction in permanent staff demand for the fourth successive month, while growth in temp vacancies eased to a 37-month low.

Regional and Sector Variations

All four monitored English regions noted a decline in permanent staff appointments at the end of the year, with the Midlands recording the sharpest pace of contraction.

Trends for temp billings continued to diverge on a regional basis. While the North of England and London recorded higher billings, declines were seen in the South of England and the Midlands.

Demand for permanent staff increased in the public sector during December, but fell further in the private sector. Notably, this marked the first rise in public sector permanent vacancies for four months. In contrast, demand for temporary workers continued to increase across the private sector at the end of 2023, albeit at a softer pace. Short-term vacancies meanwhile continued to contract slightly in the public sector.

Four of the ten monitored employment categories registered greater demand for permanent workers during December, led by Nursing/Medical/Care. The fastest falls in permanent vacancies were meanwhile seen in the Construction and IT & Computing sectors.

Hotel & Catering saw by far the steepest increase in short-term vacancies of the six categories to see improvements in demand at the end of the year. The Construction and Retail categories meanwhile recorded the sharpest declines in demand for temporary workers.

Comments

Commenting on the latest survey results, Justine Andrew, Partner and Head of Education, Skills and Productivity at KPMG UK, said:

“It’s a muted end to the year for the labour market, which despite some loosening during 2023, continues to be tight. While the data for December shows hiring activity for both permanent and temporary roles fell at a softer rate than the previous month, businesses are still making redundancies and pausing hiring due to a lacklustre economic outlook. This has driven a further decline in permanent job opportunities, while we continue to see a rising number of people looking for new work.

“For those lucky enough to start a new role there was another sharp increase in starting salaries due to competition for skilled workers. But the rise wasn’t as high as those seen in recent months as businesses face ongoing pressure on their budgets. Recruiters tell us this pressure is now impacting temporary contracts, with fewer people employed on a short-term basis.

“Businesses which successfully planned and managed their workforce through the intense Christmas period will be breathing a sigh of relief and hoping 2024 brings some much needed certainty to boost the UK economy and overall productivity.”

Neil Carberry, REC Chief Executive, said:

“The slowdown in our labour market seems to be easing a bit. Given that December is a time when employers generally postpone activity into the new year, this is a positive sign that the labour market is weathering the current economic storm.

“Recruiters went into 2024 with hope that an upturn is coming, based on feedback from clients. Driving this economic growth would be a huge benefit for us all, leading to more successful firms, higher pay, and the ability to cut taxes and fund public services. But the growth must come first. The Chancellor has already set a date for the Budget – he should use it to set out steps that set firms free to grow the economy, from skills reform to regulatory change, including a more balanced debate on immigration for work and its impact on growth.

“Rising demand for healthcare staff emphasises again the importance of supporting NHS performance. Recruiters can see the impact on long NHS waiting lists in the supply of candidates looking for work – addressing this will be a key way to tackle inactivity. But the plan for NHS staffing needs to deal with 21st Century labour market realities. Medical staff have choices in and power over their careers – working with unions, agencies and other stakeholders on a plan will get the NHS farther than diktat from Whitehall.”