Overall candidate numbers rise at accelerated pace

The slowdown in hiring and reports of redundancies pushed up the availability of workers for the ninth straight month in November. While the upturn in permanent staff supply continued to exceed that seen for temp candidates, both rose at rapid rates that were the sharpest since December 2020.

Slower increases in starting salaries and temp pay

Recruitment consultancies signalled a further easing in the rate of starting salary inflation in the latest survey. Though sharp, the increase in permanent starters' pay was the least pronounced since March 2021 and below the series long-run trend. At the same time, temp wages rose at the slowest rate in 33 months. While competition for suitably-skilled workers continued to push up pay overall, budgetary pressures at clients had reportedly weighed on overall growth.

Vacancies decline slightly for second time in three months

Overall demand for staff weakened slightly in November, after stabilising in October. This marked only the second time that total vacancies had fallen since February 2021. Underlying data highlighted that permanent staff vacancies fell slightly for the third month running, while growth of demand for temp workers remained much softer than the historical trend and only modest.

Regional and Sector Variations

London recorded by far the steepest reduction in permanent placements of all four monitored English regions. The Midlands was the only area to see an increase, albeit one that was mild overall.

Divergent trends were seen at the regional level, with temp billings falling in the South of England and London but rising slightly in the Midlands and the North of England.

Latest data signalled that permanent vacancies fell in both the private and public sectors, with the latter noting the quicker rate of decline. The overall upturn in demand for temporary staff was meanwhile supported by the private sector, as short-term vacancies continued to fall in the public sector.

Sector data revealed that demand for permanent staff fell in half of the ten monitored categories. Construction saw the steepest rate of decline, followed by Executive/Professional. The Nursing/Medical/Care and Engineering sectors meanwhile saw the strongest upturns in demand.

Short-term vacancies rose in just over half of the ten monitored employment categories during November. Hotel & Catering saw the quickest rise in demand for temporary staff. Of the four sectors that saw demand weaken, the steepest drop in vacancies was signalled for Retail staff.

Comments

Commenting on the latest survey results, Claire Warnes, Partner, Skills and Productivity at KPMG UK, said:

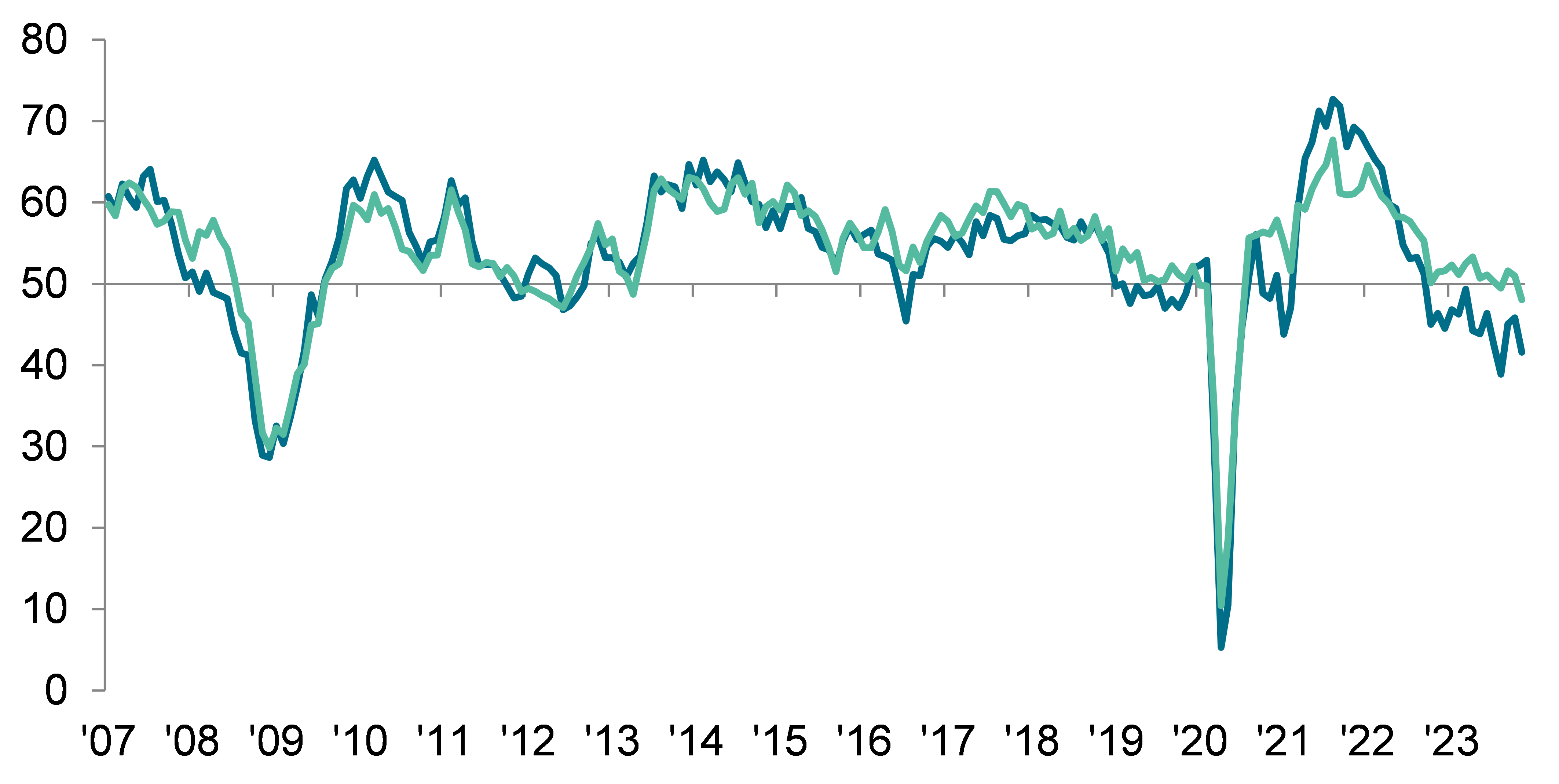

“The UK labour market remains tight as we move towards the end of a difficult year for the UK economy. The balance of supply vs demand is out of sync: we’re seeing even more people looking for work, with candidate supply rising at the fastest pace since the initial pandemic wave three years ago, but the number of available roles falling again in November. Employers are reining in hiring and continuing with redundancies in response to the sustained economic slowdown.

“Businesses want to plan for the year ahead, but the prospect of faltering UK economic growth means the certainty they need isn’t there. This is now impacting starting salaries, as pay inflation isn’t as sharp as in previous months.

“Even temp staff billings - which have given much needed flexibility to employers in key sectors such as health & care and IT - are facing some contraction. And with the Bank of England looking like it will be keeping interest rates high for now, businesses will need to stay resilient to manage this period of flux.”

Neil Carberry, REC Chief Executive, said:

“2023 has been a testing year in our labour market, with permanent hiring dropping and temporary hiring flat or growing only a little. That’s the story again in this month’s data, though the market is quieter overall as firms start to move activity into 2024 rather than pressing ahead now. The averages hide a great deal of variability in regions and sectors though. The Midlands and the North both saw strong performances for temporary and permanent roles, in sharp contrast with London and the South, with permanent hiring in London especially slow. The ongoing stronger performance of the private sector on new vacancies is also a notable positive signal.

“Anecdote from REC members supports our client survey finding that employers are considering coming back to the market, but that in many cases the activity will be next year. So, while these figures represent a further slowdown in current hiring conditions, recruiters are more positive about the new year.

“For policy makers, any return to growth will put strain on a labour market with embedded shortages – this week’s pro-election rather than pro-economy decision on immigration will exacerbate that. Any return to growth could drive domestically-generated inflation unless we adopt a proper plan for workforce capacity, embracing better welfare-to-work support, finally reforming the Apprenticeship Levy, funding Further Education properly and the kind of support for school leavers suggested by today’s Broken Ladders report from EDSK and REED on the school-to-work transition.”

Contact