Climate change is already transforming the investment landscape, but this is especially true for those investing in infrastructure because not only is the asset class specifically exposed to a range of physical and transition risks, but also it is one of the world’s largest emitting industries, accounting for about 79% of global emissions. However, for all the risks, the decarbonisation opportunities are even greater. The race to develop alternatives to carbon-intensive materials, modern methods of manufacturing, and globally reliable renewable energy sources will likely dominate the investment strategies of tomorrow.

Regulations are reshaping capital allocations

As we continue to approach the limits of world’s carbon budget, we are likely to see an increase in carbon pricing, both in terms of the price of a single credit, and in terms of the number of markets implementing carbon pricing. This may have an adverse effect on the valuation and yield of assets by driving up the cost of constructing, operating, and maintaining infrastructure. As an example, the implementation of the EU’s Cross-Border Adjustment Mechanism (CBAM) is expected to increase the import cost of extensively used inputs like aluminium by 17% and iron steel by 12%, leading to a significant increase in total costs of EU infrastructure projects in the short term.

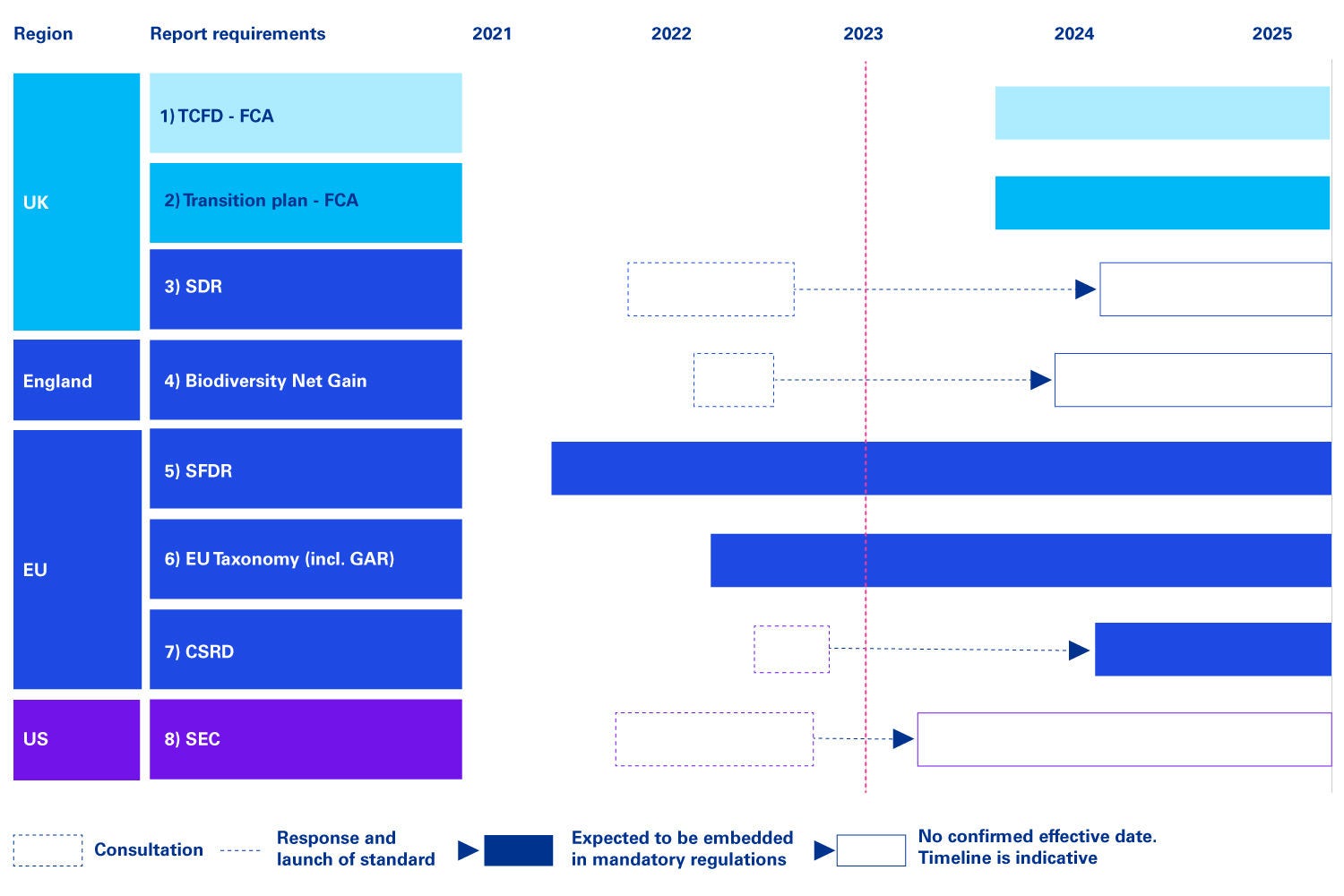

In addition, countries around the world are tightening climate-related regulation more broadly, particularly in relation to their disclosure requirements. In the UK, the Financial Conduct Authority’s (FCA) new policy (PS 21/24) requires asset managers to publish TCFD aligned climate disclosures, with those managing over £5bn of assets in scope to report by June 2024 at the latest. The EU’s Sustainable Finance Disclosure Regulation (SFDR) has increased pressure on European asset managers to disclose their ESG impact at the fund level and asset level. In 2024, reporting requirements for asset managers as well as their portfolio companies are expected to further increase with the introduction of Corporate Sustainability Reporting Directive (CSRD) that requires companies to disclose non-financial ESG data, such as science-based targets, and climate-related risks. The infographic below indicates the different regulatory requirements along with the expected timelines for implementation.

The concurrent challenges of increasing operational costs as we transition to a low carbon economy, as well as the intensifying disclosure requirements on environmental and societal impact, are reshaping infrastructure investment decisions. Investors are increasingly required to understand impacts and develop transparent plans to mitigate these impacts, but many investors are now going beyond the need to just comply with disclosure requirements and actively engaging with the climate agenda as part of their long-term investment strategies.

The climate challenge can be an investment opportunity

In contrast to the significant risks arising as a result of climate change, revolutions in mobility, digitisation, and energy – as well as broader changes to consumer preferences – are clear examples of the opportunities presented by the climate transition. Infrastructure as an asset class continues to expand, creating new types of core, core-plus and opportunistic investments.

Investors are already taking advantage of the opportunities arising from climate change, but many have highlighted the need for enhanced regulatory support for new technologies. One example is in wind energy, which has seen significant investment over the last decade thanks to targeted support. Our interactions with infrastructure investors indicate the need for tax incentives and fiscal stimulus to further boost clean energy investment and production. Investors also agree that they would have to increase their risk appetite to support alternative technologies such as hydrogen and Carbon Capture Utilisation and Storage (CCUS) that are yet to reach a commercial tipping point.

There are two broad approaches to integrating climate considerations

There is a spectrum of approaches that infrastructure funds can take as they integrate climate considerations. On one end of this spectrum, funds can take a risk mitigation approach to manage and monitor climate risk, and on the other end, funds can proactively capture value from the transition to low-carbon economy.

Managed approach: Funds seek to control climate risk by excluding certain sectors, assets, and regions that have high exposure to climate change physical and transition risks. Under this approach, funds follow a risk-first methodology to identify climate risk at asset screening stage to exclude investments that might negatively impact their upfront exposure to climate risk. This strategy can help funds to assess and manage the impact of climate change on asset yield, and its approach to disclosure is primarily about compliance.

Proactive approach: Funds aim to create and capture value through opportunities that arise from climate change transition. Climate considerations are fully integrated into the investment lifecycle e.g., developing climate roadmaps at origination, conducting climate due diligence at screening, and identifying decarbonisation levers for portfolio companies. A clear understanding of the climate metrics at each stage helps these funds to price in the climate risks in valuation and define a path of decarbonisation for assets/portfolio companies. Funds taking a proactive approach also unlock value by investing in emerging asset classes and technological innovations required for Net Zero transition of infrastructure sector.

Both approaches have their positives and negatives, in part because climate change poses both risks and opportunities for the sector. There is a compounding longitudinal imperative to this analysis as well as a moral one; the moral imperative is that infrastructure is both a source of high emissions and simultaneously a critical pillar for global development goals, so we must somehow find a path to global development in a sustainable way. The longitudinal perspective does offer some cause for optimism. To stay ahead of the curve, negative screening won’t suffice as it does not minimise the financial impact of climate risks on grey assets nor captures value of new asset classes. Funds that adapt to the green transition will see sustained valuations and returns in the long-term, whilst themselves enabling the transition to greener infrastructure.

In the next article, we explore how asset managers can reorient different stages of their investment process and what are the key enablers required for successful ESG integration.

Our sustainability insights

Something went wrong

Oops!! Something went wrong, please try again

Get in touch

Discover why organisations across the UK trust KPMG to make the difference and how we can help you to do the same.