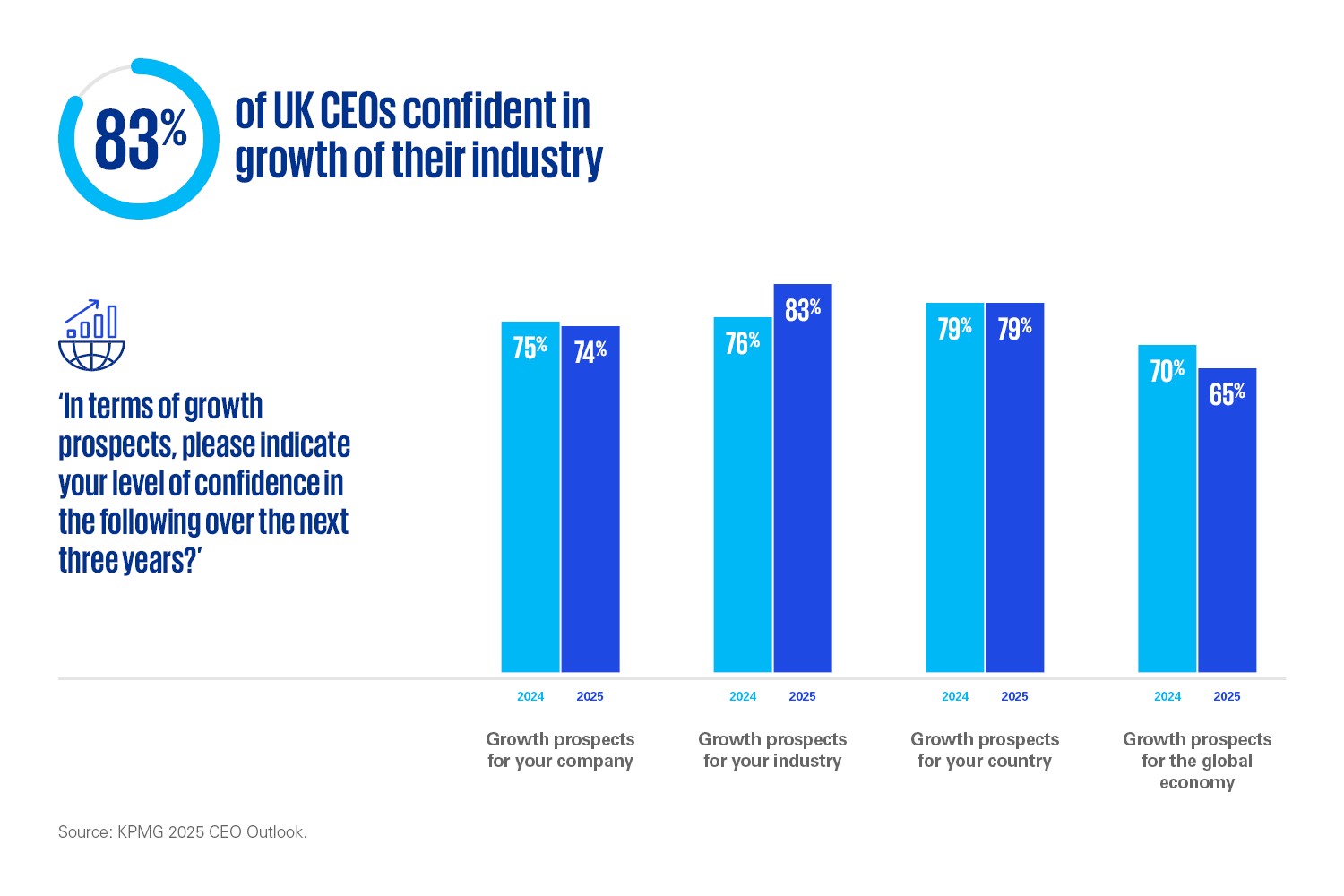

While global headwinds are still creating a tough trading environment, the results of our 2025 CEO Outlook paint a picture of UK corporate leaders who are positive about the prospects for growth, with 83% saying they’re confident or very confident about the growth prospects for their industry over the next three years. That’s up 7 percentage points on last year. This year, 64% of UK chief executives say they’re expecting an increase in their organisation’s earnings over the next three years of 2.5% or more. That compares to just 48% in 2024.

They’re not feeling as positive about the global economy though – 65% say they’re confident, compared to 70% in 2024. That’s likely driven by geopolitical instability and this year’s headlines around US tariffs – which is reflected in our findings. Levels of confidence in the global economy across our full global sample are at their lowest since 2021.