Following the joint press release from the Governments of the Crown Dependencies on 17 May 2024 outlining their commitment to continue to work co-operatively in relation to the OECD’s Pillar 2 project (in simple terms, the project under which multinational enterprises (“MNEs”) with consolidated annual turnover in excess of €750million are required to pay an effective tax rate of 15% on the profits generated in each of the jurisdictions in which they operate), the respective Islands have now provided further details of their plans and, currently, there are some clear differences of approach proposed.

The proposals announced by each Island are summarised below.

Isle of Man

The Isle of Man was first to release further details on 20 May 2024 (see: here) which outlined the intention to introduce a Qualified Domestic Minimum Top-up Tax (“QDMTT”) with effect from 1 January 2025. This will have the broad effect of ensuring that MNEs with global annual turnover in excess of €750million and which operate in the Isle of Man will pay a minimum of 15% tax on the profits generated on the Island, by “topping-up” any tax payable under the Island’s 0/10 corporate income tax system to 15%.

It is expected that the required legislation will be taken to Tynwald (the Isle of Man’s Parliament) in the autumn of 2024, with continued engagement with affected businesses taking place in the meantime.

A decision on whether to introduce an Income Inclusion Rule (“IIR”), which will have most impact on MNEs headquartered in the Isle of Man, will be taken later in 2024. No comment was made in respect of the introduction of an Undertaxed Profits Rule (“UTPR”) and it is assumed that there is no plan to do so, at least for the time being.

The Isle of Man Government has previously confirmed that the 0/10 corporate income tax system will otherwise remain untouched.

Guernsey

Guernsey released further details of its plans around Pillar 2 on 21 May 2024 (see: here). Similar to the Isle of Man position, it was announced that Guernsey would introduce a QDMTT with effect from 1 January 2025; however, Guernsey also indicated its intention to implement an IIR, impacting MNEs headquartered in Guernsey, from the same date. In the press release Guernsey also indicated its intention to engage with the business community through a targeted consultation process on some specific design elements of the QDMTT, so as to inform the forthcoming legislative drafting process.

No comment was made in respect of the introduction of a UTPR and, similar to the Isle of Man position, it is assumed that there is no current plan to do so.

Although the Guernsey press release did not explicitly confirm the point, the fact that the QDMTT is a top-up tax would appear to confirm our understanding that the current 0/10 tax system will not be impacted by the plans.

Jersey

Jersey was the last of the Crown Dependencies to release further details of its plans, on 22 May 2024, and once again these reflect a different approach (see: here). Similar to Guernsey, there are plans to introduce an IIR from 2025 but, rather than implementing a top-up tax, Jersey is proposing the introduction of a new domestic tax measure, known as multinational corporate income tax (“MCIT”) to sit alongside Jersey’s existing 0/10 corporate income tax system, which will remain unaltered.

The Jersey Government has confirmed that the MCIT will align with the OECD’s Global Base Erosion (“GloBE”) Model Rules so that Jersey companies and Jersey branches of in-scope MNEs will pay an effective rate of 15% on their taxable profits. In terms of rationale for the difference of approach the Government of Jersey has stated that the MCIT “is the right approach to Pillar 2 implementation for Jersey. It will support our diverse geographical investment base and, where relevant, will address certain unintended double taxation challenges that Pillar 2 implementation creates for some taxpayers. It will also operate independently of our existing tax regime, thereby reducing the need for top-up calculations and maintaining administrative simplicity to the greatest extent possible.”

The Jersey Government indicated that remaining details of the MCIT will be finalised in the coming weeks and draft legislation will be released in the summer, when it is lodged with the States Assembly, Jersey’s Parliament.

The Jersey Government also explicitly confirmed its intention not to enact a UTPR at the current time.

Summary

So where do these announcements leave us at the end of May 2024? Although the Islands indicated their intention to work co-operatively, it is clear that each Island is adopting differing approaches, driven by their differing economies, client bases and administrative considerations.

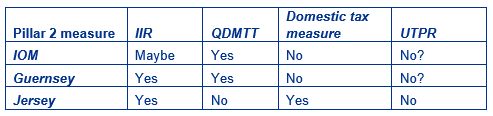

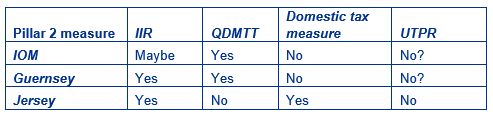

The following table summarises the state of play as at the end of May 2024, with the only question marks being whether the Isle of Man will introduce an IIR and whether we will get any further clarification of the Isle of Man and Guernsey’s approach concerning the UTPR:

The release of the relevant draft legislation will be the point at which the differences between the approaches becomes more definitive and KPMG will keep you updated through regular updates.

Please get in touch with us if you have any queries.

Robert Rotherham

Partner, Tax

KPMG Crown Dependencies

Paul Eastwood

Head of Tax (KPMG CD)

KPMG Crown Dependencies

Sarah Graham

Associate Director, Tax

KPMG Crown Dependencies

Matt Thomas

Director, Tax

KPMG Crown Dependencies