What inspires consumers’ loyalty? How do organizations earn and keep customers’ loyalty? In this hyper competitive world, consumer and retail companies need to appeal to their customer’s hearts as well as their minds and wallets.

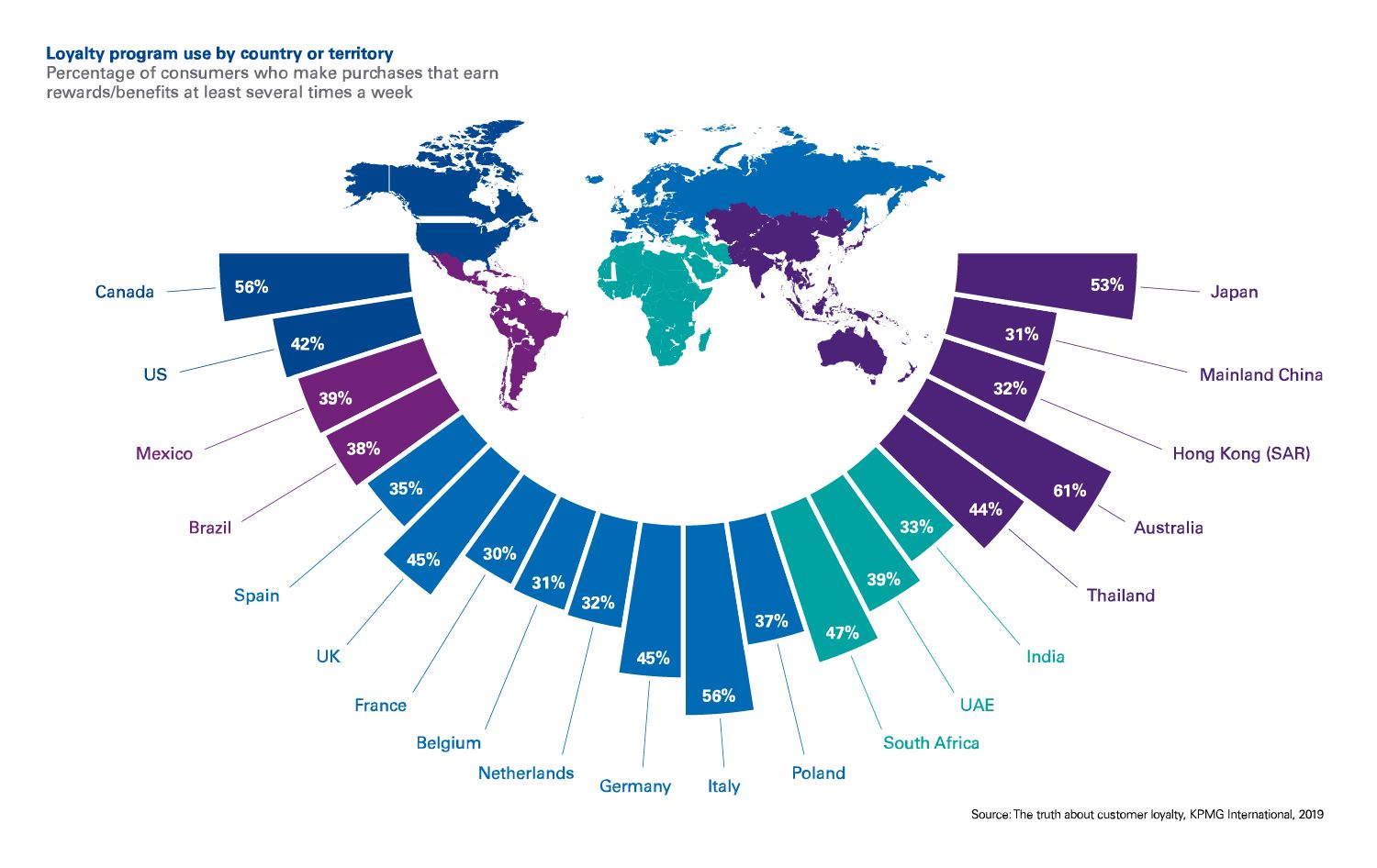

KPMG’s survey of 18,520 consumers from more than 20 countries explores the truth about customer loyalty and how brands and retailers can attract and retain customer loyalty through enhancing customer loyalty programs.

How do customers define loyalty?

Customer loyalty is alive and well but digital disruption and new generational influences show that the nature of loyalty is changing. Overall, only 37 percent of respondents identified points and rewards as one of the most effective ways to secure their brand loyalty. In almost every country, points and rewards were less likely to earn loyalty than corporate transparency and honesty. Customer loyalty is too critical to be left to a customer loyalty program.

When a customer is loyal to a brand:

— 86 percent will recommend a company to friends and family

— 66 percent are likely to write a positive online review after a good experience

— 46 percent will remain loyal even after a bad experience

What inspires loyalty?

Do their loyalty programs truly reflect what matters most to their customers? The truth about customer loyalty survey, 74 percent of consumers said product quality inspired loyalty, 66 percent value for money and 56 percent customer service. Could it be that, as brands and retailers develop their customer loyalty propositions, they are making life too complicated for consumers — and for themselves?

If you’re trying to build brand loyalty today, an emotional connection is no longer a nice-to-have, it’s a need-to-have.

The paradox of personalization

The industry consensus is that most consumers want personalization but this survey suggests that there is a gap between rhetoric and reality. Only one in five consumers globally saw personalization – be it in terms of service, communication, promotions and offers – as a leading benefit of loyalty programs.

Truly personalized offers can cut through the clutter. In this context, relevance drives revenue.

The value that consumers place on personalized offers from their loyalty programs varies by country. Although Europeans in Italy (20 percent), France (16 percent), Belgium (16 percent) and Spain (15 percent) were among the respondents most likely to value personalized offers, Germans were among the least likely, and likewise were the most likely (28 percent) to say that behavior tracking was a key deterrent to joining loyalty programs at all.

The drive for personalization is likely to come into conflict with public concerns about — and regulators’ growing interest in — data privacy. Germany is not alone in their aversion to having purchase behavior tracked — this concern is also relatively high in mainland China and Hong Kong (23 and 29 percent), Canada, and the UK (both 20 percent).

The truth about Millennials

Millennials — too often described as fickle, narcissistic or entitled — have been studied more intensely than any other previous generation. Yet the survey challenges many of these fashionable stereotypes.

— More than six out of ten Millennials say they prefer to donate their loyalty rewards to a good cause than redeem them personally vs. 40 percent of Baby Boomers.

— 69 percent of Millennials say loyalty programs are difficult to join and to earn rewards vs. 49 percent of Baby Boomers.

— One in seven Millennials do not belong to any program. Of those who do, 81 percent say their membership increases their spend with the company concerned – compared to just 66 percent of Baby Boomers.

Transparency, sustainability and innovation have a strong influence on loyalty, especially among Millennials and Generation Z consumers. These demographic groups are also more likely to be swayed by positive online reviews, influencers and social media.

Millennials are seen as having a sense of entitlement but this is a misunderstanding. They like to use technology to do things ‘smart’ and this is now available, encouraging them to try out new things.

Four customer loyalty program enhancements

According to Paul Martin, Head of Retail, KPMG in the UK, there are five varieties of loyalty programs. All of these coexist in the consumer and retail sector, yet, for Martin, the direction of travel is clear: “If major brands and retailers are to successfully reinvent their loyalty schemes, they will want to be offering, directly or indirectly, privilege loyalty programs with personalized and customized offers.”

About: Point-based loyalty reward cards, with point accummulation on every purchase.

Pros for retailers: Access to purchase related data.

Cons for retailers/customers: Low customer participation/retention - unused points act as liability for the retailers.

About: Advanced loyalty reward cards, offering vouchers/coupons in addition to redeemable points.

Pros for retailers: Enables cross-selling, product bundling - using insights derived from transactional data.

Cons for retailers/customers: Unable to meet growing customer demand, who seek more value than just reward points or vouchers.

About: Multi-brand, tier-based loyalty reward cards, with an option to use across multiple retail brands.

Pros for retailers: Enhanced customer engagement - one card for a group of retailers.

Cons for retailers/customers: Expensive scheme for retailers with little customer insight around each individual brand.

About: Privilege loyalty program, with personalized and customized offers.

Pros for retailers: Increased engagement - offers ecosystem of value, service and content; additional income as subscription fees.

Cons for retailers/customers: No tier-based rewards; no single interface to access grocery shopping, video or music.

About: Umbrella loyalty program, with enhanced convenience - everything under one ecosystem - along with rewards.

Pros for retailers: Ability to offer integrated experiences between online and offline channels; tracks the entire consumer behavior inside the ecosystem.

Cons for retailers/customers: Limited availability outside of China

In The truth about customer loyalty survey, 96 percent of respondents agreed that customer loyalty programs can be improved and 75 percent of all consumers say they would switch brands for a better loyalty program. Those views and the fact that 59 percent of consumers who have signed up for loyalty programs do not use them to shop every week is vivid proof that brands and retailers have work to do when it comes to customer retention.

Our survey data suggests that however brands and retailers refine their customer loyalty proposition, they should consider four factors in particular.

- Make loyalty programs easier to use: Lengthy registration processes, rules and conditions that are not always adequately explained (and often change), technical difficulties with redeeming awards are all likely to deter customers from making the most of these programs and diminish the company’s return on investment.

- Clarify their purpose: It is not uncommon for customers to forget they have enrolled in a program, lose track of the points they have accumulated and conclude, often on the basis of boredom or ignorance, that the rewards on offer are unexciting.

- Raise awareness: More than one in three consumers who do not belong to any loyalty programs say it is because they are not aware of any. Of those, many are unlikely to ever join because they are wary of their privacy or simply don’t believe in them but some may not even be aware of a company’s program.

- Freshen them up: True loyalty is defined by empathy and emotional engagement, so an effective new reward might be to donate to a good cause, offer an exclusive experience or an unexpected offer.

Loyalty programs need to be consistent, but we know that consumers like novelty. A good loyalty program can introduce new and different benefits that excite customers at a reasonable cost.