KPMG China’s Business Tax Advisory services team is dedicated to providing top quality comprehensive tax advisory services to our clients. This covers Chinese Mainland tax issues and challenges arising from business start-up, investment, operations, restructuring, IPO as well as exit from investment, assisting our clients to achieve compliant, efficient and sustainable growth. With our deep technical expertise, rich practical experience, and thorough understanding of domestic and international market dynamics, as well as sector-specific business models and local commercial practices, we aim to build a long-term partnership with you and provide customized services to meet your tax needs along the journey.

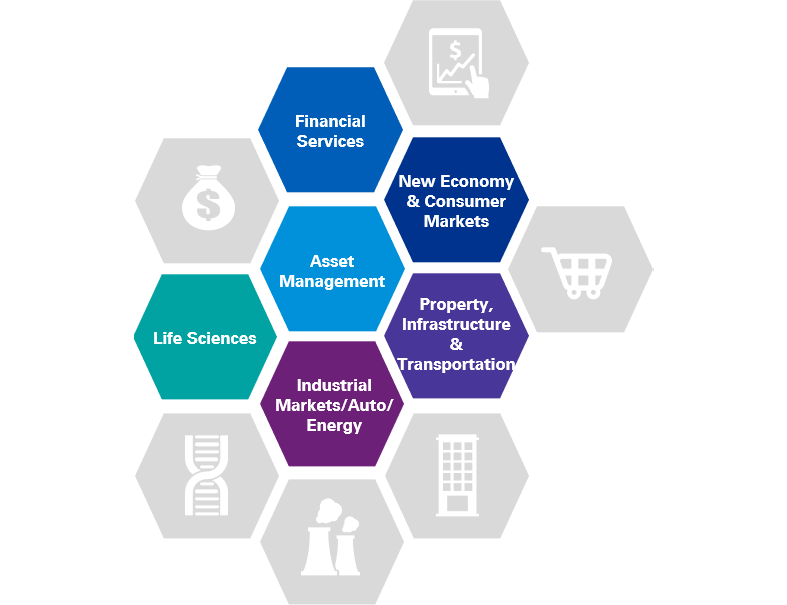

Key industry sectors

Our China’s Business Tax Advisory service team has extensive industry knowledge and experience, and deep insights into tax hot topics, pain points and difficulties that companies encounter. We devote ourselves to providing customized, efficient, innovative, and feasible tax solutions to clients in the following sectors, to support companies in their long-term growth.

Scope of service

Our team works together with our KPMG global network to deliver high-quality professional services and meet our clients’ diversified business needs and goals. We provide business tax advisory services on topics including but not limited to the following:

- Operational tax issues

- Investment and financing

- Design and optimization of holding structure

- Business and transaction model planning

- Group restructuring

- Tax incentives

- IPO tax compliance

- Tax health check