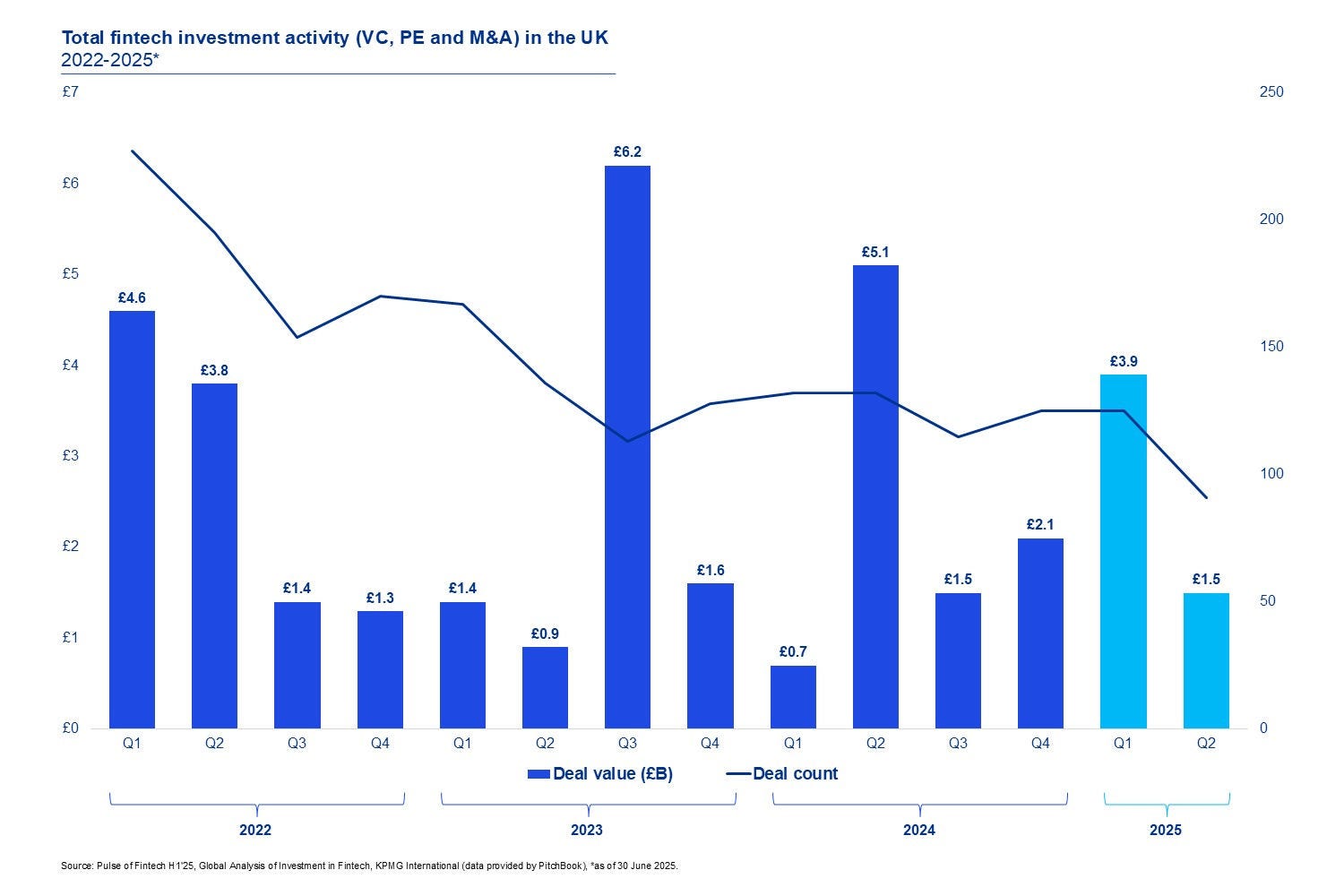

216 UK M&A, PE and VC fintech deals were completed in H1 2025, up slightly from 198 in H1 2024. H1 2025’s investment total was strengthened by the size of many of the deals, including the £2.3 billion buyout of private markets data group Preqin by Blackrock, a £371.5 million VC round by cross border payments platform Rapyd Financial Network, and a £371.5 million raise by the wealth and asset management technology platform FNZ.

Geopolitical uncertainty, market volatility and global concern around macroeconomic growth rates have all contributed to more subdued levels of UK fintech investment, compared to the record highs experienced in 2021.

Q2 2025 saw a slowdown in deals compared to the first quarter of the year, UK fintech investment in Q1 2025 was £3.9 billion across 125 deals compared with £1.5 billion in Q2 2025 across 91 deals.

After single-quarter tallies skewed by significant outliers, Q2 2025 sees a slowdown in the pace of dealmaking

- After some very slow quarters, fintech dealmaking in the UK has regained some momentum, albeit far from the peaks of 2021. That is attributable to the same pressures experienced by businesses around the world, primarily market volatility and macroeconomic growth rate concerns.

- Key initiatives to keep an eye on in the UK’s fintech scene include the FCA’s partnership with Nvidia wherein banks can tinker with computing and AI enterprise software solutions, primarily for testing and research prior to deployment.

- Elsewhere in fintech segments, the periodic resurgence of M&A such as the acquisition of information provider Preqin by Blackrock speaks to the ongoing consolidation across the ecosystem as well as the uptick in PE buyouts of mature fintechs.

Key insights from the EMEA region

The UK remains the centre of European fintech investment, with British fintechs attracting more funding than their counterparts in the rest of EMEA combined.

The Europe, Middle East and Africa (EMEA) region was the only major region to see fintech investment grow—from £8.2 billion across 780 deals in H2’24 to £10.2 billion across 759 deals in H1’25.

The largest EMEA deals outside of the UK included the buyout of cloud platform Esker for £1.2 billion by the investment group Bridgepoint.

Global insights

- Global fintech investment saw the softest six-month period since H1’20, with just £33.2 billion in investment across 2,216 deals.

- Global M&A deal value fell from £19.9 billion in H2’24 to £14.8 billion in H1’25, while PE investment fell from £3.3 billion to £1 billion; global VC investment remained steady over the same timeframe, rising marginally from £17 billion to £17.3 billion.

- The Americas attracted the most fintech investment in H1’25, with £19.9 billion invested across 1,092 deals in H1’25—down from £26.5 billion across 1,150 deals in H2’24.

- The ASPAC region had the softest level of fintech investment, with just £3.1 billion across 363 deals in H1’25, compared to £5.4 billion across 444 deals in H2’24.

- At the sector level, crypto, AI, and regtech were all trending well ahead of 2024’s investment levels at mid-year. Crypto had £6.2 billion in investment in H1’25—compared to £8 billion during all of 2024, while AI saw £5.4 billion in investment—compared to £6.6 billion in all of 2024.

Conversion rate accurate as of August 2025 from USD to GBP.

Pulse of fintech UK - H1 2025

Biannual analysis of global fintech Funding

Our fintech insights

Something went wrong

Oops!! Something went wrong, please try again

Our people

Get in touch

Discover why organisations across the UK trust KPMG to make the difference and how we can help you to do the same.