In response to heightened regulatory scrutiny and the increasing sophistication of financial crime, firms must demonstrate effective, risk-based controls. Our expert operational and surge support for financial crime management, supported by advanced analytics, helps protect your business, customers, and shareholders. We work with you to transform control environments, improving both effectiveness and efficiency while meeting regulatory expectations. Preventing and detecting financial crime remains a significant challenge, impacting not only monetary losses but also reputation, employee morale, business relationships, and regulatory standing.

Understanding the economic crime landscape

Navigating financial crime compliance

Industry challenges & KPMG’s strategic solutions

Our global reach

KPMG operates a network of global member firms.This enables us to leverage local language, culture and expertise across 155 offices worldwide supported by 46 fully accredited forensic practices, and 21 eDiscovery Data Centres.

With our Digital Forensic Services, you can access our expertise anywhere in the world, assured of consistency across the globe in tooling, processes, and standards.

Data can be hosted in any of these locations according to your requirements and specifications. KPMG FTech has 720 technology specialists to worldwide support projects of all sizes.

- Americas

- EMA

- ASPAC

- Argentina

- Mexico

- Brazil

- United States of America

- Canada

- Venezuela

- Colombia

- Austria

- Denmark

- Germany

- Italy

- Nigeria

- South Africa

- Turkey

- Bahrain & Qatar

- East Africa

- Greece

- KPMG Islands Group (KIG)

- Norway

- Spain

- United Kingdom

- Belgium

- Finland

- Gulf Holdings

- Luxembourg

- Oman & UAE (Lower Gulf)

- Sweden

- Zambia

- Central & Eastern Europe (CEE)

- France

- Ireland

- Netherlands

- Portugal & Angola

- Switzerland

- Australia

- Japan

- Pakistan

- China

- Korea

- Singapore

- India

- Malaysia

- Taiwan

- Indonesia

- New Zealand

- Thailand

Why choose KPMG for financial crime risk management

KPMG economic crime expertise

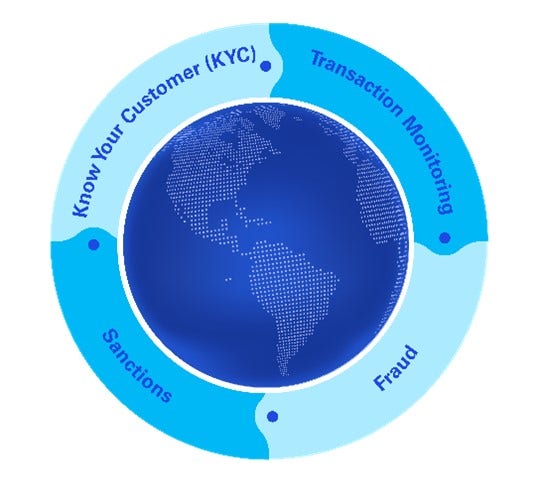

We assist financial institutions with comprehensive KYC solutions that adhere to global regulatory standards. Our approach includes:

- Comprehensive Customer Profiling: Utilising cutting-edge technology to provide thorough due diligence and enhanced customer profiling.

- Risk Assessment and Management: Tailored risk assessment frameworks that align with regulatory requirements and the specific risk profiles of your clients.

- Continuous Monitoring: Implementing robust screening processes to ensure ongoing compliance, mitigating potential risks associated with new and existing customers.

- Technological Integration: Leveraging advanced software to streamline and automate KYC processes, reducing operational burdens while maintaining accuracy and compliance.

Our transaction monitoring solutions are designed to detect and prevent suspicious activities, ensuring compliance and reducing the risk of financial crime. Our resource set offers both operational efficiency and SME guidance, helping clients to deal with high volume alerts/cases to meet regulatory requirements. Key features include:

- Real-Time Assistance: Offering resource to work hand in hand with clients as investigators at all levels. Supporting MLROs with recommendations and SAR activities.

- Advanced Analytics: Utilising machine learning and AI to identify patterns and anomalies that may indicate fraudulent activities.

- Customisable Rule Sets: Creating and maintaining customisable rule sets that fit the specific needs and risk appetite of your organisation. (Automated Alert Discounting)

- Regulatory Reporting: Ensuring timely and accurate reporting to regulatory bodies, mitigating the risk of penalties and fines.

We support financial institutions in navigating the complex and evolving sanctions landscape by providing specialised assistance with UN, EU, U.S., UK, and other sanctions regimes. Our expertise spans across the three lines of defence, offering advice on policy optimisation, technology deployment, and sanctions screening effectiveness. We understand the impact of regulatory changes driven by geopolitical factors and advancing technology, which can increase sanctions exposure risk and compliance costs. With regulators leveraging technology to enhance their efficiency in combating financial crime, organisations must balance effective compliance with cost management. Our team ensures that firms have robust processes and controls to prevent and identify emerging sanctions risks, using the latest technology to support sanctions screening, investigations, and advisory services.

- Workflow Tools: Implement advanced technology solutions for sanctions screening and compliance.

- Sanctions Expertise: Offer expert guidance on sanctions compliance and effective risk management strategies.

- MI Expertise: Utilise management information (MI) systems to enhance sanctions compliance frameworks.

- Operational Efficiency: Balance effective compliance with cost management to meet regulatory expectations.

Mitigating fraud is a cornerstone of our services, employing advanced methodologies to protect financial institutions and their clients. Our fraud prevention capabilities include:

- 24/7 Support: Leveraging diverse team locations to ensure round-the-clock-operations.

- Fraud Detection Systems: Utilising AI and machine learning to identify and prevent potential Fraud.

- Investigation and Response: Offering comprehensive support from initial detection to resolution.

- Policy and Procedure Development: Assisting in creating fraud policies and procedures that meet regulatory standards and best practices.

- Fraud Risk Assessment: Performing comprehensive evaluations to identify potential vulnerabilities and recommend strategies to mitigate fraud risk.

- Training and Awareness: Providing specialised training programmes to keep staff informed and vigilant against potential fraud threats.

Testimonials

Our success stories

UK retail & commercial bank - CDD remediation

Global financial services - Sanctions alert clearance

US based global bank – TM investigations