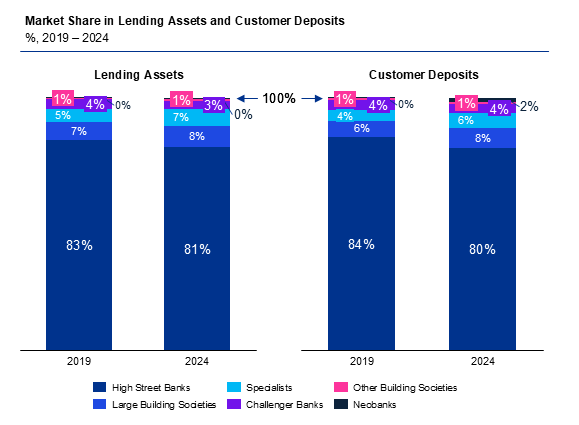

Consumers are increasingly moving their deposits from high street and challenger banks to specialist lenders and building societies, attracted by higher returns in a high-rate environment. As a result, high street banks have seen their share of the deposit market drop from 84% in 2019 to 80% in 2024.

Meanwhile, specialist lenders and building societies are gaining ground in lending assets, driven by niche offerings and flexible underwriting criteria.

Neobanks, however, are struggling to convert their large deposit books into loans, with low loan-to-deposit ratios (<30%), potentially putting into question their ability to sustain profitability. The question now isn’t just growth - it’s whether the model can truly deliver sustainable returns.