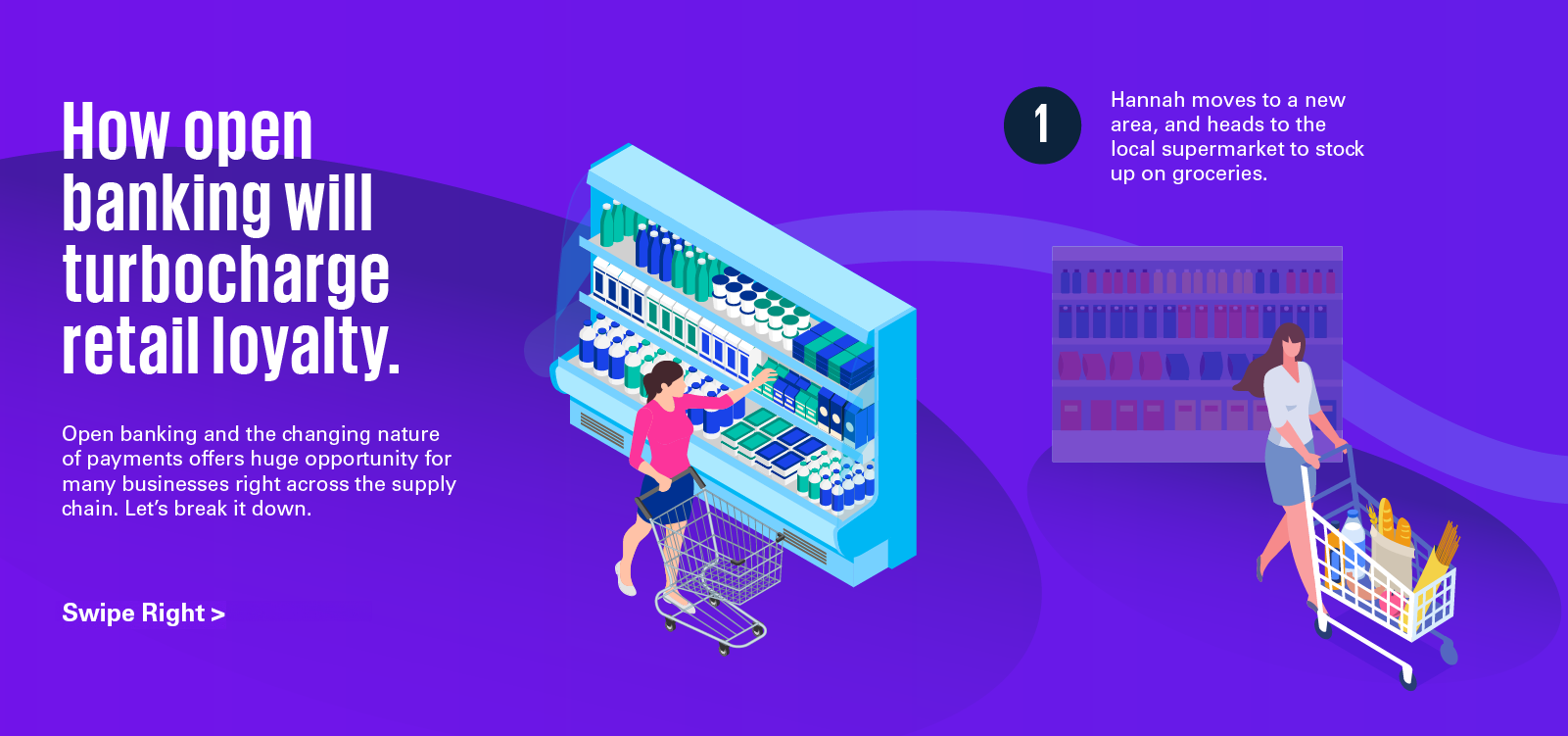

The payments ecosystem is continuously evolving due to regulation, changing customer needs, technology advances, geo-political changes and the fact that the payments data now carried is central to the revenue payments can drive across the ecosystem. We understand that market changes such as RTGS renewal, the potential impact of the Future of Payments Review, ISO 20022 migration, Open Banking and Central Bank Digital Currencies (CBDC) all require banks and building societies to react.

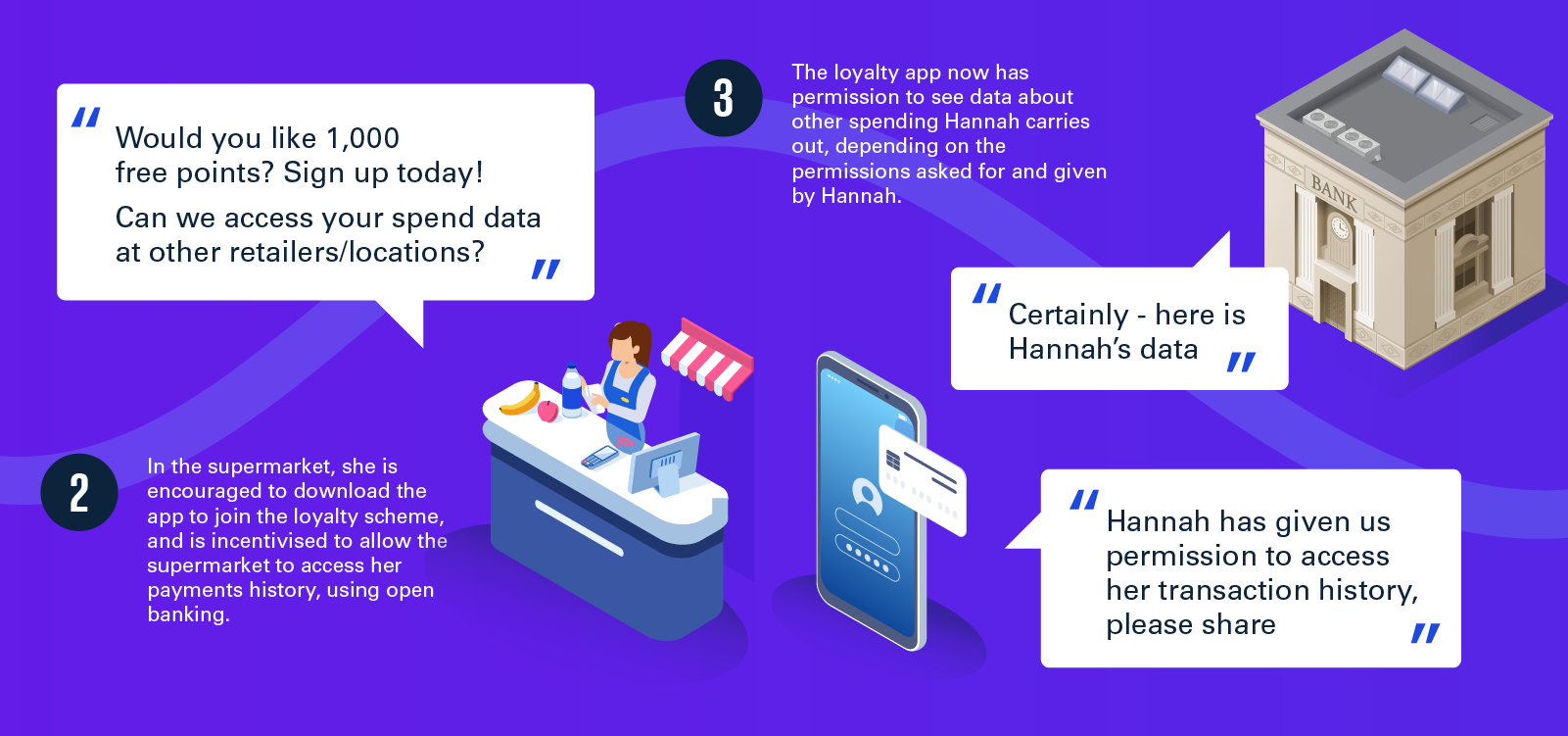

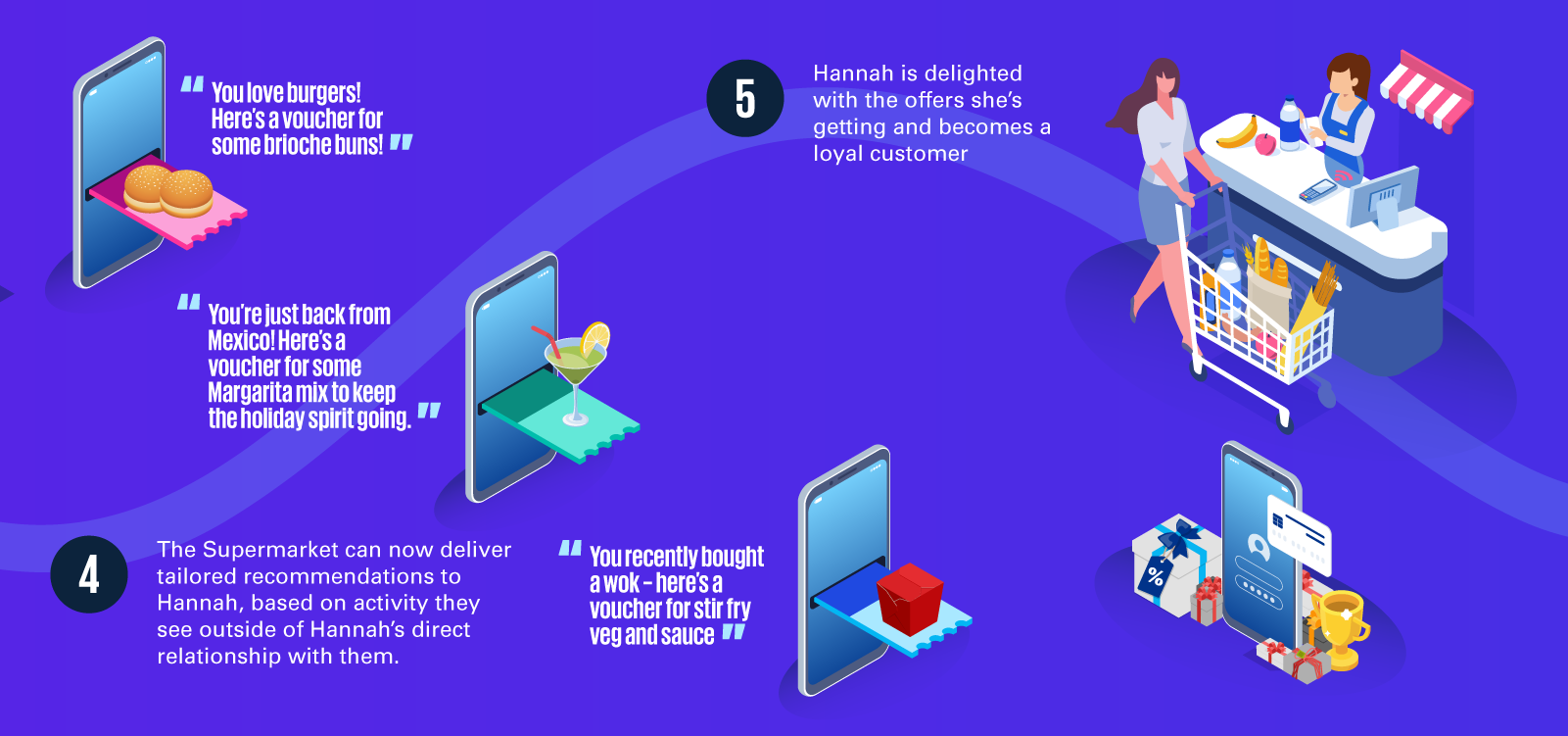

Financial institutions must deal with the new Consumer Duty requirements, as well as tougher regulation on fraud, money laundering and sanctions detection. The development and delivery of any new payment rails in the UK will lead to improvements to the UK's existing interbank payment systems but will impact major banks and building societies across the UK. Firms must also consider how they evolve from Open Banking compliance to product development and commercialisation, or risk falling behind.

Financial institutions must deal with the new Consumer Duty requirements, as well as tougher regulation on fraud, money laundering and sanctions detection. The development and delivery of any new payment rails in the UK will lead to improvements to the UK's existing interbank payment systems but will impact major banks and building societies across the UK. Firms must also consider how they evolve from Open Banking compliance to product development and commercialisation, or risk falling behind.