e-Tax alert 161 eng- One-time Transfer Pricing Adjustment Rules – Important points and disclosure-related matters

One-time Transfer Pricing Adjustment - e-Tax alert 161

In order to allow companies to reflect the economic substance of transactions in timely manner and to ensure companies’ profits are determined in accordance with arm’s length transfer pricing principle and bear reasonable tax burden, the Ministry of Finance(“MOF”) has released the tax ruling “One-time Transfer Pricing Adjustment Rules” on November 15, 2019, where companies that engage in controlled transactions, in the occurrence of non-controllable market conditions or environmental factors, and where the companies have met relevant requirements and paid relevant taxes and fees, may perform one-time transfer pricing adjustment before the end of fiscal year.

In order to allow companies to reflect the economic substance of transactions in timely manner and to ensure companies’ profits are determined in accordance with arm’s length transfer pricing principle and bear reasonable tax burden, the Ministry of Finance(“MOF”) has released the tax ruling “One-time Transfer Pricing Adjustment Rules” on November 15, 2019, where companies that engage in controlled transactions, in the occurrence of non-controllable market conditions or environmental factors, and where the companies have met relevant requirements and paid relevant taxes and fees, may perform one-time transfer pricing adjustment before the end of fiscal year.

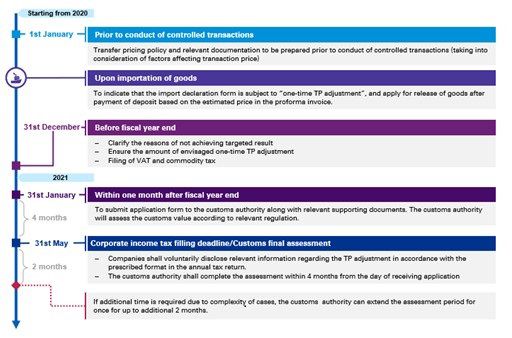

Taking the companies with calendar year for illustration, the important dates, relevant taxes and fees for companies which perform one-time TP adjustment for fiscal year 2020 are summarized as below:

Relevant taxes, fees and disclosure deadlines

Transaction on import of goods

Customs duty: Upon importation of goods, the import declaration form shall be noted that it is subject to “one-time TP adjustment”, and apply for release of goods after payment of deposit based on the estimated price in the proforma invoice. Within one month after fiscal year end, submit application form to the customs authority along with relevant supporting documents, and the customs authority will assess the customs value according to relevant regulation.

‒VAT: To be paid in conjunction with customs duty, and to pay/refund by the customs authority after assessment of customs value.

‒Commodity tax: To be paid in conjunction with customs duty, and to pay/refund by the customs authority after assessment of customs value.

Transactions other than import of goods

‒VAT: To be filed together with the sales amount, VAT payable or VAT refundable during the last filing period of the fiscal year with the local tax authority.

‒Commodity tax: To be filed together with the amount of tax payable of last release of goods from the factory during the fiscal year with the local tax authority.

‒Withholding tax: To pay or refund tax withheld in accordance with the Income Tax Act.

Information to be disclosed during filing of annual tax return

The MOF has announced the format of FY2020 annual tax return form, where a new section and form has been added for companies which perform one-time TP adjustment to disclose relevant information as summarized below:

Information to be disclosed

Other than the total amount of one-time TP adjustments to be made during the fiscal year, the following information should also be disclosed in accordance with parties engaged in the controlled transactions:

‒Transaction type

‒Transaction price before and after adjustment

‒Total amount of adjustment

‒Relevant accounts regarding the adjustment

‒Reasons of making the adjustment

Information to be declared

‒Prior to conducting controlled transactions, written agreement (with transaction terms and factors affecting price) shall be in place, where relevant account receivables/payables shall also be recorded.

‒Counterparties involved in controlled transactions should also perform the corresponding adjustment simultaneously. All relevant taxes and fees have been paid in accordance with the regulations.

The aforementioned relevant taxes and fees include but not limited to: customs duties and relevant taxes levied by the customs authority (for transaction on import of goods); VAT, commodity tax and income taxes, including withholding tax (for transactions other than import of goods).

Documents to be submitted

During the filing of annual tax return for the relevant fiscal year, the company should also submit a copy of agreement, supporting document regarding the corresponding adjustments being made by the related parties and relevant supporting documents for the tax adjustments made.

Important dates when performing one-time TP adjustment

KPMG Observations

The implementation of the one-time TP adjustment rules has defined the basis of compliance procedures for adjustments relating to transfer pricing. This has provided another option for companies who are unable to reflect their transfer prices in timely manner due to fluctuations in the market or environmental factors, to perform reasonable allocation of profits between related companies during the evaluation of transfer pricing strategy, which ensures the related parties’ profits are determined in accordance with the arm’s length transfer pricing principle and bear relevant tax burden in accordance with the regulations and reduce the risks of double taxation within the group.

In addition, companies that perform one-time TP adjustment are not exempted from tax investigation on a transfer pricing audit during the filing of annual tax return. In the case of tax investigation and any cases of non-conformity of arm’s length principle, the tax authority will still assess according to the arm’s length principle and perform relevant tax adjustments. Nevertheless, the relevant taxes which have been adjusted and paid due to the one-time TP adjustment can not be applied to the customs authority or competent authority for subsequent correction. Hence, it is suggested that companies that perform one-time TP adjustment shall evaluate the costs and benefits of performing the one-time TP adjustments to achieve the overall tax burden considered by assessing the arm’s length profit allocation wisely, reach a consensus on factors that may affect the transfer price between the parties engaged in the controlled transactions and prepare reasonable supporting documents regarding the adjustments, and be aware of any other impact of relevant taxes and fees that may incur.

Authors

Sherry Chang Partner

Anita Lin Partner

Mirenda Shen Associate Director

Emily Chen Associate Director

© 2026 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。