Why do Financial Institutions want to transform their finance function?

Organizations within the Financial Services are continuously balancing operational and performance improvements in combination with costs, regulatory requirements and compliance needs. Banks face ever increasing regulatory demands that strongly affect their Finance & Risk data & IT architecture. Insurance companies are starting to catch up on other finance function improvements, having spent the last five years implementing IFRS 9 & 17. Meanwhile, companies active in the Pensions sector are focused on disruptive reforms that are taking place and learning how the rest of the organization, including the finance function, can follow suit to arrive at a new strategic Target Operating Model.

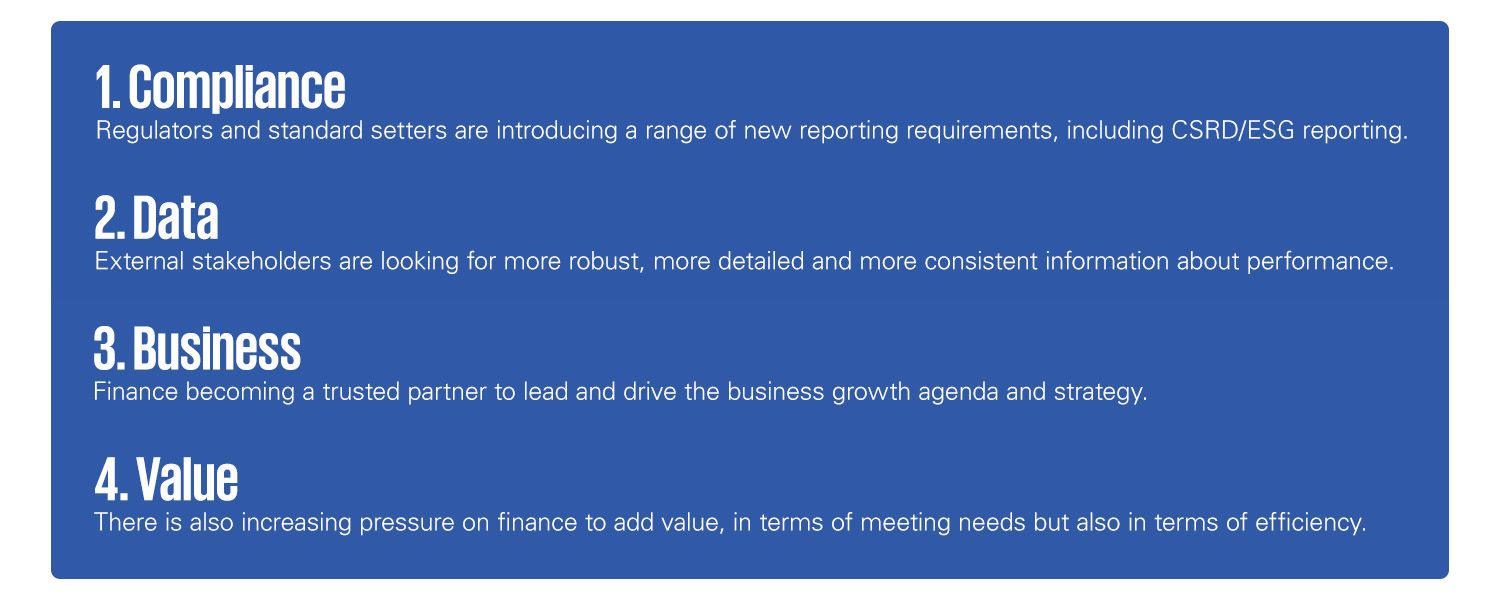

Against this backdrop, Finance needs to transform in order to become better, faster, more efficient and compliant. We recognize four main drivers for this:

These drivers affect the four core capabilities of the Finance & Risk function: Financial Management, Performance Management, Capital Management and Risk Management. Realizing change within these capabilities requires an orchestrated shift in the way the Target Operating Model is implemented, affecting the processes, data architecture, technology deployment and the way people work together.

KPMG has a leading Finance Transformation practice in the Netherlands, building on a proven track record at a wide range of financial institutions, with a local and global presence. We are eager to demonstrate our experience and thought leadership in this matter, so check back here frequently for inspiring insights that we update on a regular basis.

Blog series

Practical deep dives with insights on how financial institutions are transforming their Finance Function