What is performance management

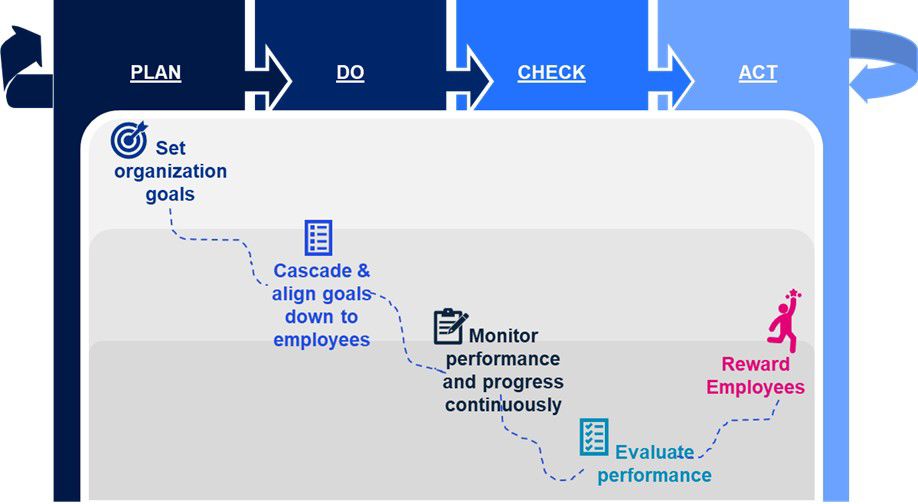

Performance management is the method by which the organization manages the organizational and employee performance. Every organization has some form of Performance Management implemented, so that they can agree on budgets and targets, measure progress, discuss deviations and make new plans for the future. This Plan-Do-Check-Act cycle is heavily engrained into the budgeting and forecasting processes and forms the basis for annual reviews, strategic (re)orientation and renumeration.

Taking a holistic perspective

Many different methodologies exist for performance management because in practice, the definition of Performance Management becomes more diffused, when the level of detail, the alignment with risk and controls, the degree of business partnering and the embedding at team or employee level is considered:

Level of detail refers to the definition, cascading and operationalization of Key Performance Indicators. This can be as little as the definition of some high-level, overarching group KPI’s on the one hand, to the creation of a value-tree with operational drivers, heavily rooted in data analytics with a data-driven and automated update, on the other hand

Alignment of risk and controls relates to the guiding philosophy the organization takes on operational excellence and effective control. These are essentially two sides of the same coin, and taking a holistic view of a value chain from both a KPI and a KRI (Key Risk Indicator) perspective can help drive and protect value simultaneously

The degree of business partnering refers to the Performance Management activities that the finance function undertakes to deliver insights to its stakeholders (specifically the business), engage with the business on value-enhancing initiatives and advise on strategies to achieve business goals. This requires a specific skillset, sometimes at odds with the traditional administrative & accounting skills the finance function is famous for

Finally, embedding performance management at team or even individual level, expands the steering from a strategic and tactical focus to also an operational focus, where modern tooling such as process mining can deliver factual insights on performance bottlenecks and underpin the creation of action plans and improvement initiatives, aligning individual performance with overall business performance

In our view, the key to effective performance management is to integrate strategic, tactical and operational perspectives and activities such that it becomes clear how strategic goals are driven on the tactical and operational levels and everyone understands their contribution to the organization. Therefore organizational goals should be cascaded down and aligned with employees, monitored, evaluated and rewarded. The following figure depicts the core idea of this and includes some key elements within the Plan Do Check Act cycle to take into account.

Pitfalls of current performance management

We see most organizations striving to achieve a full-scope performance management capability within their finance function and observe a number of pitfalls that complicate the development:

Leadership not owning the process: too often, performance dialogues spend more time raising questions rather than making decisions – to the extent that sometimes the questions seem designed to avoid making a decision. The latter is usually a sign there is insufficient trust toward the team, which should be addressed immediately

Finance only observing, not serving: Finance playing the ‘bean counter’ role where they are merely observing and not serving. Typical characteristics are a lack of business and process knowledge, empathy, communication skills, leadership and drive to move the organization forward. This creates a dynamic where teams are hesitant to overstep their organizational problems and prevents Finance from becoming a part of the solution

Not understanding the data: not understanding what exactly is captured by the data and appropriating an inappropriate level of trust. Financial data is typically better controlled and as such more complete and reliable. Non-financial data is often more detailed but perhaps not fully complete or controlled. It is important to understand and communicate data limitations and its implications

Ineffective performance review: assessing performance and having good dialogue on this is difficult and there is a myriad of reasons that frustrate effective performance reviews. Lack of a proper script, judgement from (senior) leadership, not discussing bottlenecks and lack of, or vague agreements are common reasons organizations do not come to effective performance reviews. As a result performance review is perceived like a routine review of an action list and bureaucratic add-on to an otherwise already busy workload.

Conflict of interests: conflicts of interest can exist if people start chasing their own targets, disregarding the overall goals, just as long as their contribution is recognized. Innovation and collaboration can take a dip, threatening the future of the organization. These situations can occur when organizations are not thorough enough on how individual targets relate to the overarching company goals and are unable to strike the right balance between individual and team contributions.

Reaping the benefits of performance management

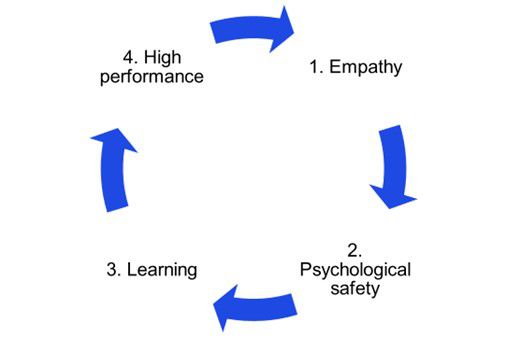

In the diagram below we visualize the process for cultural development of performance management, starting with showing empathy as leadership to establish an environment where psychological safety prevails, so that people and teams can learn by doing to become high performers.

Understanding the basics of learning and habit building is essential to be able to reap the benefits of performance management:

- Role modelling. As the saying goes, people do as leaders do, not as leaders tell them to do. Therefore, from the very go, senior leaders need to model behaviour to lead the way in performance management.

- Focus on learning. Although performance management implies it is all about monitoring output, research in what drives performance reveals that monitoring the learning may be a lot more effective than pushing for outcomes. Minimizing pressure on the ‘threat system’ in our brain will open a broader realm of creativity, engagement and commitment, leading to a bigger learning yield and thus fuelling stronger performance. It is up to the leaders to engage in the performance dialogue with empathy and curiosity to support the individual in learning about how results are produced.

- Take a long term perspective. Sure, implementing a new performance management system should be organized like a project, with specific criteria to determine the project phase is passed and performance management is the new normal. However, that is just the beginning. The goal is not to have implemented a performance management system, it is to sustain and improve this system continuously. Plan to recalibrate and update the way of working to ensure performance management becomes habitual rather than a top down ‘must do’ ritual.