In this blog, we evaluate how finance functions are responding to (Generative) Artificial Intelligence, what opportunities we are seeing in this regard, and we present some tips and practices on how finance functions can start to adopt this new technology.

The hype and reality of Artificial Intelligence

Artificial Intelligence (AI) has been with us for a long time. From automated decision-making, predictive analytics and fraud detection, which have been used for decades within the financial services, to facial recognition, voice assistants and non-player characters, which we encounter in our daily lives, we are, perhaps unknowingly, very familiar with the concept.

So, what has changed? Well, a great deal, or perhaps not much, depending on your perspective. With the onset of Generative Artificial Intelligence (or GenAI), we are witnessing a surge in capabilities that promise greater productivity, quality, and control. Could this resemble the response to the emergence of the Internet (compared to (Gen)AI), landing almost overnight and becoming accessible through the rise of Personal Computer (like ChatGPT)? Looking back, that triggered a major change: it turbocharged productivity on a global scale. Then we began interconnecting networks, paving the way for heightened forms of revolutionary collaboration, and ultimately laying the foundation for disruptive new business models, leading to some of the largest companies the world has even seen. But it all started with simple courses on how to use it, for example, how to use a search engine. In today’s eyes, that is hard to imagine.

We observe that most financial institutions are reviewing and experimenting with the opportunities GenAI may potentially yield, with a similar air of unfamiliarity, apprehension, opportunity and ambition to harness the power that it potentially brings.

Searching for a needle in a haystack

Most finance functions, however, are still figuring out where to start: where can it best be deployed and how to move from concept to production? We see the following challenges:

Ownership – Currently, most GenAI experimentation is IT led and distant from the finance function. Business use cases are relatively easier to identify, particularly in sectors focused on client interaction. We see leading finance functions starting their own initiatives by gathering ideas, reviewing possibilities, and mobilizing their teams to get started. Real-life cases are emerging, and we expect proven successes to become evident soon. However, this approach is challenging, as development remains too tech driven instead of value driven. This siloed development approach slows down the speed of developing, scaling, and adopting new technologies within larger organizations.

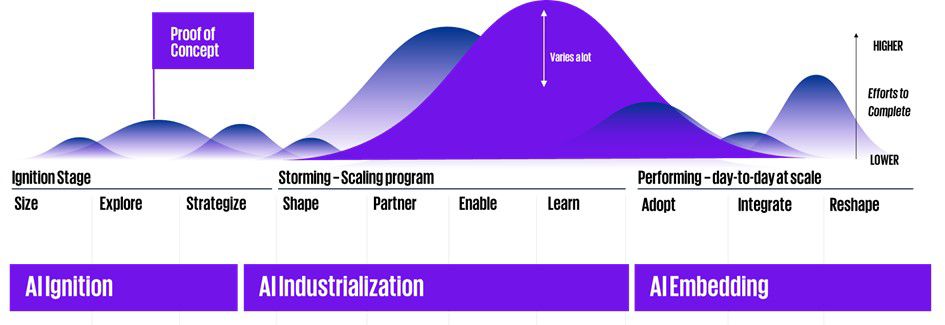

Scalability – Experimenting with GenAI, like most new technologies, is typically conducted in smaller, secured and siloed environments. Developing these proof of concepts (POCs) can be done with minimal risks and limited involvement from different parts of the organization. However, this siloed approach presents a significant challenge when it comes to scaling GenAI solutions across the entire organization. The lack of involvement from key departments and stakeholders during the experimentation phase results in insufficient overall GenAI and data governance. Additionally, the infrastructure and architecture are often not designed to support the new GenAI technology at scale. Transitioning from POC to a full-scale implementation is one of the biggest hurdles. Successful scaling requires the engagement of the CFO function, value-driven business applications, and a robust transformation plan. Embedding GenAI without a human-empowered adoption process is impossible.

Data Quality – If there is one overarching lesson we have learned in finance over the last decade, it is that the basics need to be right first. Brilliant forecasting models, scenario analysis and – now – (Generative) Artificial Intelligence capabilities are futile if the data quality is lacking. In the new world, ‘garbage in’ becomes ‘garbage multiplied’. Moreover, finance functions have invested millions in establishing transparent data lineage and meeting the control and reconciliation requirements imposed by themselves, the accountant, and regulators. To improve data quality within the large datasets from multiple sources across the organization, AI is increasingly used to enhance data classification and quality. Effective data management is essential to enable GenAI; and leveraging GenAI to improve data management can enhance accuracy and speed within the finance function. Part of this data management challenge is also the accessibility of data that GenAI brings to the surface. Enabling Gen AI tooling like Microsoft CoPilot, might confront companies how in-compliant they are in terms of access to data that they should not have. So, having the right data quality also involves cleaning up databases and being compliant in terms of GDPR and many of the other regulations, like the Data Act and recently approved EU AI Act.

AI Models – It is understandable that a technology known to be less transparent may need time to be adopted within the finance function. Because besides data quality, the AI models' quality is still a discussion too. How can we be sure that the model is giving the right information? And that the model is not hallucinating? While the most often applied LLMs (e.g., GPT-4, Gemini and Llama 2) are generally the best models, they might lack specific specialized functions. We therefore see an increase in the application of more dedicated open-source models that are pre-trained (e.g., BloombergGPT) for specific niche functions, like the finance function. And of course, the obligatory (according to the to-be-applied EU AI Act) Human-in-the-loop is something that should be considered in evaluating the enablement of AI solutions within business processes.

People – Most individuals experience both natural concern and curiosity regarding GenAI. The primary concern is that many roles and activities will be taken over by GenAI. Satya Nadella, the CEO of Microsoft, has stated: “AI will make us more human, not less. AI cannot replace human qualities like creativity, empathy, and judgement. Instead, AI will amplify our human capabilities and help cultivate our creative spirit.” Finance function leaders must reiterate these messages. GenAI can be a key driver in freeing up more capacity for business control and business partnering activities. Meanwhile, essential accounting and reporting processes will still require human interaction for judgement and oversight.

Change management – Related to the challenge and role of people, finance functions often struggle with adopting new technology. The finance function is known for its strong adherence to principles like ‘Straight-Through Processing’ and ‘First Time Right’, which can make it difficult to embrace innovations such as Robotic Process Automation (RPA), Business Process Management (BPM) and Process Mining, especially given their complex IT architectures and processes. Some experienced finance professionals may require additional convincing that GenAI will bring real benefits and will not merely distract from ‘simply getting the job done’.

Starting with the basics and taking it from there

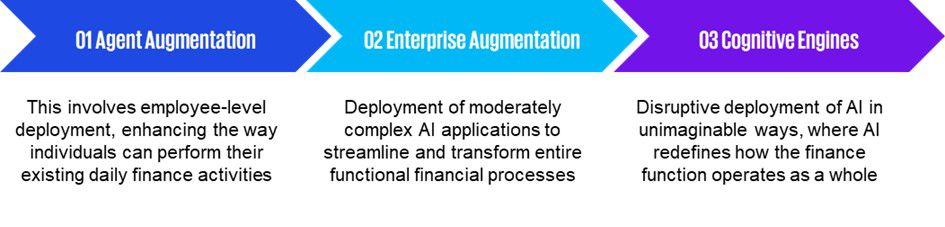

GenAI is an ambiguous term, and knowing where to start and how to structure a GenAI initiative is a key prerequisite for success. We have seen three key stages of GenAI transformation, which are outlined below. Although the greatest impact may be found in the 3rd stage, we expect it will be very difficult to identify those opportunities without going through the first two stages.