In this series, KPMG’s leading Finance Transformation specialists discuss some recent examples and leading practices on what other financial institutions are doing to successfully modernize their finance function, balancing the need for control, compliance, efficiency and impact.

In this article, we explore the future state IT architecture for the finance function and what considerations can be made when new technology is deployed in order to maintain compliance with regulatory requirements and initiatives.

Leading practices in Finance data & IT Architecture

Building an integrated Finance data and IT systems architecture is a core capability needed to deliver quality financial reporting faster, better and cheaper. It is also a key enabler for Finance to become more agile to respond to new reporting needs and requirements, as well as to improve and maintain control. A leading-class end-state architecture will consider integrating data flows, harmonizing data sourcing and aligning calculation modules with centralized data storage for downstream use.

In designing the end-state architecture, it is important to build for expansion as well as incremental changes, to adopt a modular solution architecture and consider cloud-based infrastructure to enable easier and cheaper future expansion. Inspire the finance function change leaders by starting from the vision for Finance Transformation, reimagining the data & systems IT architecture from the end-state perspective and adopting an agile, prototyping-based delivery model expressed and phased out in interim target states. The latter allows for smaller implementation teams while improving quality of delivery and reducing delivery risk. Key is the data backbone and establishing one source of financial, risk and – more and more often nonfinancial – data for reporting, which is reconciled and reused, driving standardization and consistency.

Making the right technology fit is essential for a successful Finance Transformation

It follows that making the right IT architecture choices is a critical success factor. Since many of the IT solutions on the market today offer a relatively competitive basic functionality, the solution is very likely to provide a sufficient functional fit to the institutions’ must-have functional requirements. There are of course subtle differences that can be material when reviewed in isolation, but when regarded as a whole, the functional differences often become less relevant for technology decisions. This means that other aspects become more important. For example, whether 1) the IT solution has a proven track record, 2) can provide preconfigured content & industry-leading practices and 3) the amount of implementation effort required for the solution to go live. Some related key observations and considerations are described below, along with the functional and architectural requirements.

- Proven technology: Often, financial institutions' varying tech readiness and willingness to embrace innovation can lead to regulatory scrutiny and challenges. Consider leading-edge adoption or to follow peers for controlled implementation and stakeholder confidence.

- Existing leading practices: Incomplete knowledge of end-to-end processes and data flows across departments hampers building a new system. They use preconfigured data models and calculation engines from the industry to accelerate implementation and address documentation gaps.

- Implementation effort: A limited change capacity and reliance on external support can hinder Finance Transformation and restrict knowledge to a few key staff members. Consider technology with available external resources, provider engagement, and commitments for future support.

- Functional requirements: Broad functional requirements are crucial to seize transformation opportunities, preventing a mere transfer of the status quo. Inspire the finance function to envision a future end state and drive functional requirements based on innovative ways of working.

- Architecture requirements: The IT department can strongly influence decisions for Finance IT solutions with preferred partners and architectural views. Allow for support and question IT architectural requirements to allow strategic choices while enabling discussion and deviation from standard guidelines.

Three technology choices to consider

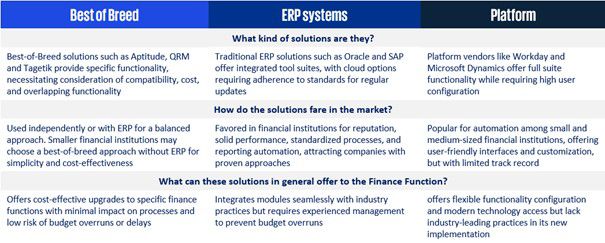

Roughly speaking, there are three main technology choices to consider when selecting IT systems: Best of Breed, ERP systems and Platform. The differences between these three choices are highlighted in the table below. Although presented as distinct options, combinations are possible and might even be strategically likely and preferred.

Increasing the chance of success when selecting and implementing new IT systems

The implementation of new IT systems in the Finance (and Risk) domain can be complex and risky due to the ever-increasing demands on data lineage, quality and auditability in conjunction with tight timelines and potential penalties from regulators. We conclude this blog with some examples of practical items to include on your checklist when considering new IT systems, beyond the usual functional and architectural requirements:

- Availability of documentation: such as end-to-end process taxonomy, process flows with controls and leading practices & design considerations.

- Adequacy and completeness of the data model: does the solution contain a preconfigured dictionary for products, preconfigured validations on data inputs and a standard model for accounting and regulatory reporting?

- Standardized accounting & reporting content: availability of predefined configurable business events, accounting rules and posting patterns, reporting templates and preconfigured KPIs and controls.

- Standardized calculations engines: IFRS / regulatory compliance modules for risk-based calculations covering cost allocations, returns, capital and liquidity.

- Prebuilt controls: aligned with the aforementioned end-to-end process taxonomy including reconciliation reports and templates.