In this blog, we explore the role of Finance and Risk (F&R) in managing and enhancing the quality of data for use within internal and external (financial) reports. We take into account the challenges between source data versus financial data, and the role of the group in relation to that of its subsidiaries. We also take a look at the difference between data governance and reporting governance.

Transitioning to a data-driven finance function

Within the industry, we notice a lot of commonality between financial institutions in their approach to establishing a Finance & Risk data capability and the challenges they face in doing so. They strive to achieve the highest possible standards, driven by their own desires to enhance decision making, but also due to regulatory requirements at national and – for banks – even European level (such as the Principles for Effective Risk Data Aggregation and Risk Reporting covered under increasing attention BCBS #239 by ECB).

Compared to the status five years ago, significant improvements have been made to enhance the F&R data management and consumption capability, further enabling timely and high-quality data at the appropriate level of granularity reports. However, in an increasingly demanding regulatory landscape, F&R must have a robust and adaptive change capability if they are to continue to meet (often ad hoc) regulatory reporting challenges that lie ahead.

Challenges in managing an organization-wide asset in a fast-moving and complex environment

Data quality and availability requirements are growing and adhering to regulatory expectations will remain a challenge for banks in general. It requires substantial effort to establish the right data capabilities; from identifying the appropriate data sources and being able to process this data to ultimately use it for internal decision making and (external) reporting needs. Typical challenges we encounter at financial institutions include:

Insufficient operational agility. The F&R functions have difficulty absorbing structural change and ad-hoc requests within day-to-day operations, with limited resources often seen as the main constraint. This limits time for testing changes and performing re-runs if there are (initially) errors in the reporting. Moreover, setting common priorities between the Finance and Risk departments requires time-consuming alignment, often resulting in sub-optimal compromises and work-arounds.

Lack of a holistic approach to the IT architecture. Functional teams within the F&R functions often only focus on their own part of the IT landscape and data flows, meaning that technical and functional interdependencies and opportunities for cross-functional optimization are insufficiently explored when change requests are defined. Complexity in the IT landscape, operational priorities and short lead times often drive this behavior. This often results in suboptimal workarounds, additional (manual) corrections down the line and overall inefficiencies.

Insufficient data governance, quality & remediation guidelines in place.Data governance is not always clear, and since timelines for implementing new data requirements are often very challenging, data quality often suffers as a consequence. Source data is often incomplete or inaccurate, which leads to more work on resolving reporting errors and the need for data remediation measures. Banks are also facing the challenges from poor historical data (data quality debt) which is still required for modelling and reporting for today.

No common data culture & literacy requirements. At some financial institutions there is a lack of common understanding between data consumers and producers on the amount of effort required for data modeling and definition. This misalignment leads to unrealistic and frustrated expectations and results in the additional need for “quick fixes” that also put data quality and reporting timelines at risk.

The vision – a high performing Finance & Risk data capability

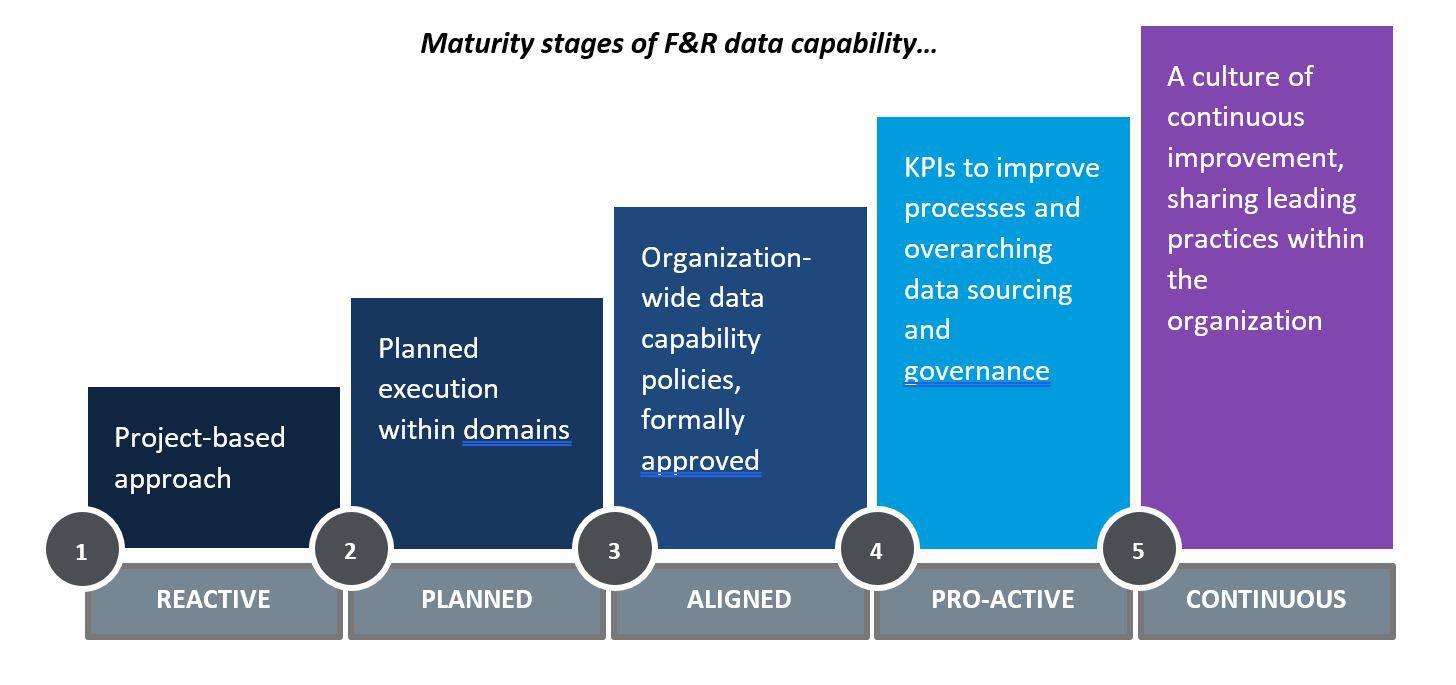

Over the past few years, improvements by financial institutions have been made to the reporting architecture, including the ever-increasing scope and detail of available data. Therefore, it is important that the F&R data capability is on par to continue to improve (the quality of) the data within the organization. Overall, we see five compounding stages of maturity in regards to a financial institution’s data capability, when comparing the various financial institutions with each other; from heavily lagging to market leading. We consider the pro-active stage the minimum level for adequately meeting the various internal and – in particular – external data capability requirements.

Practical tips – Organizing the governed lane, safe-guarding data lineage and fixing data-quality issues

For Financial Institutions striving to reach the pro-active or even continuous maturity level for their F&R data capability, we observe a number of accelerators that can be applied to improve the performance:

- Ownership of the organization wide F&R data management and consumption capability, starting with clear board sponsorship

- Formalized governance prior to execution to realize impactful reporting processes

- Defined robust data sourcing strategies (what, when, how)

- A structured and agreed data roadmap

- Data quality improvement initiatives (and follow the approved governance to prevent additional rework)

- A data culture to sustain long-term success

It is recommended to set up a multidisciplinary team within the F&R teams to provide the accelerators to ultimately start delivering the (new) data roadmap.