Global report | KPMG FPI analysis | Key highlights | Movements of KPMG FPI score across Indonesia | Sector moves | KPMG FPI quarterly sector moves | KPMG FPI movement by subsector | Indonesian economy | Zombie | KPMG FPI trends across key industries for the Indonesian economy | About | How we can help | Get in touch

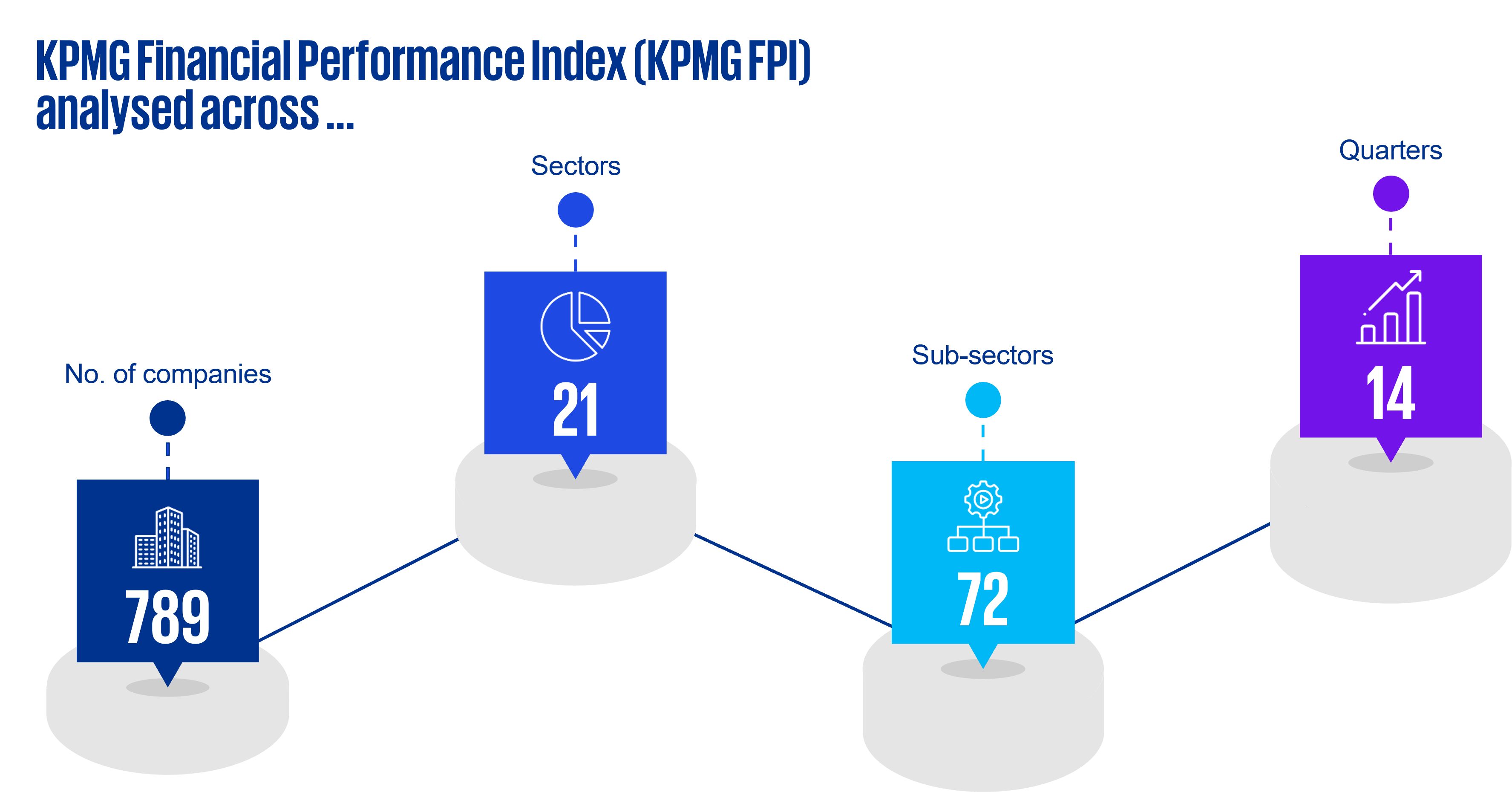

We are pleased to share with you the fourth edition of our semi-annual KPMG Financial Performance Index (FPI) publication. We provide our insights into the changing state of corporate health across all Indonesian markets and sectors, following the end of the reporting season for the six months to March 2024. KPMG FPI data is refreshed on a monthly basis, with our analysis presented every six months. For more information, visit the KPMG FPI page.

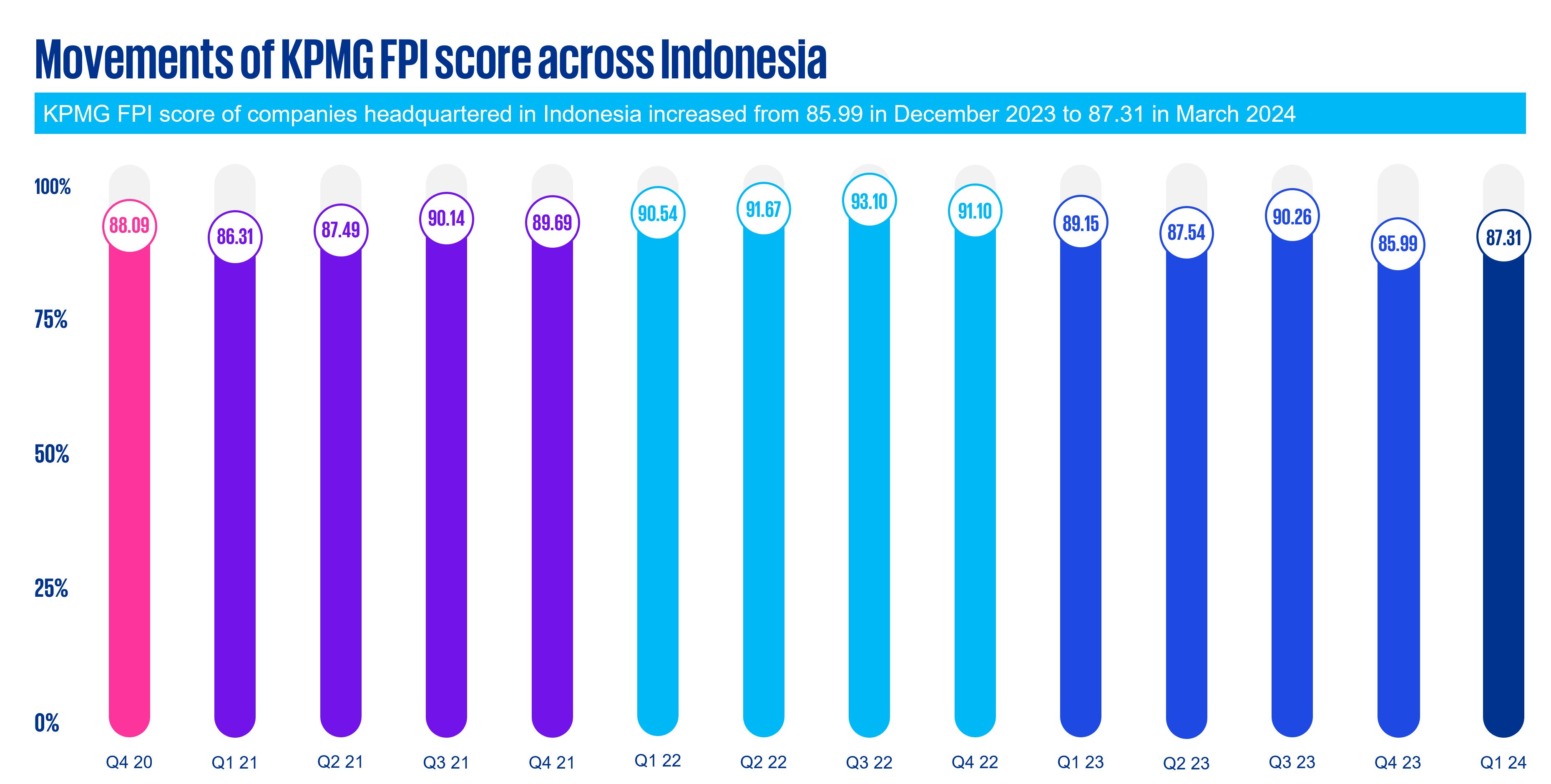

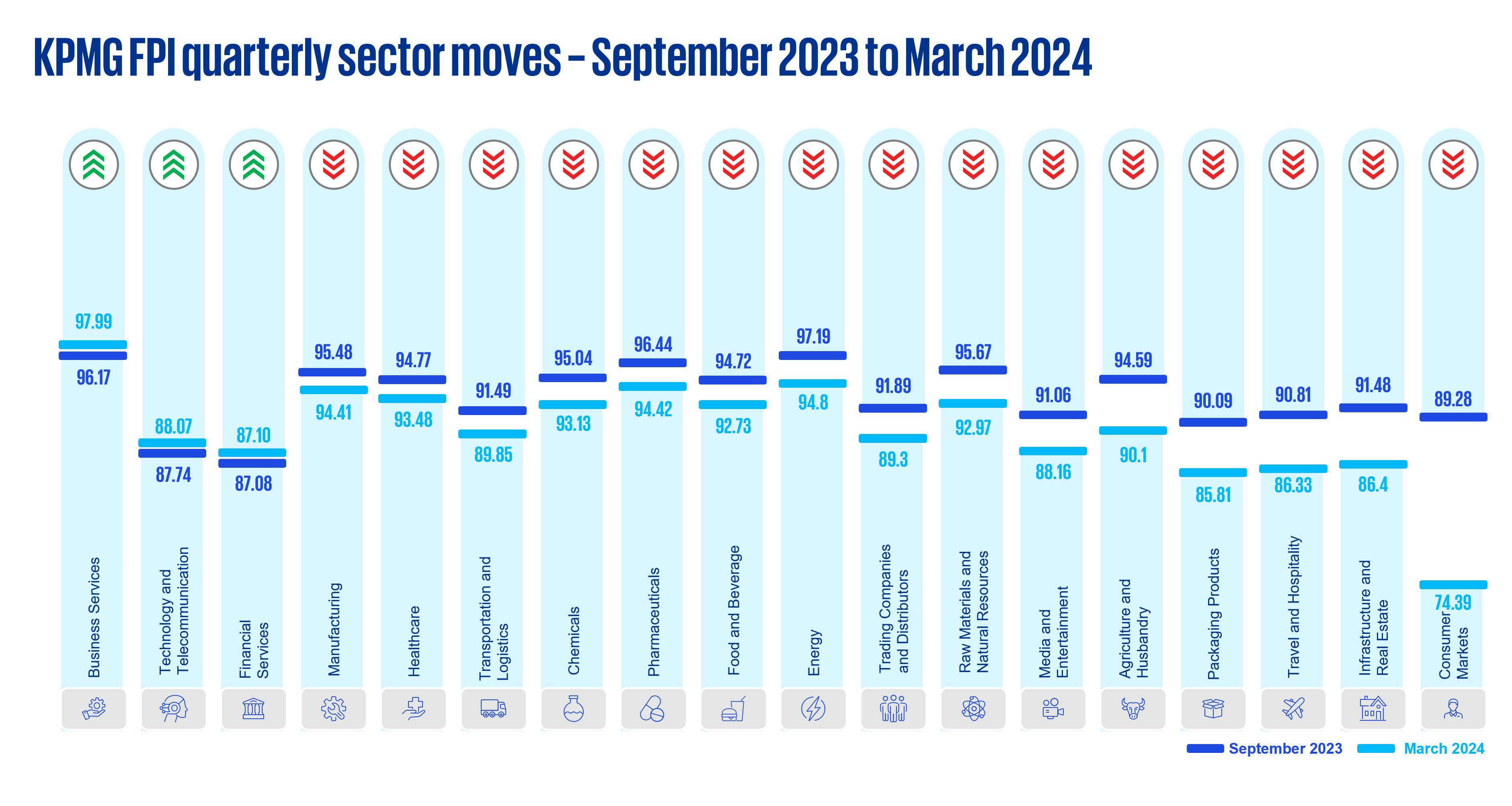

Between October 2023 and March 2024, we observed a decrease in the Indonesian KPMG FPI from 90.26 to 87.31. This denotes increased turbulence in the financial corporate health of companies headquartered in Indonesia. Only three among all 21 sectors analyzed, have shown an increase in the KPMG FPI score.

Key highlights:

- Indonesia experienced a decrease from 90 to 87 in KPMG FPI score from the third quarter (Q3) of 2023 to the first quarter (Q1) of 2024. Recent elections impacting investment, rising interest rates, combined with depreciating Rupiah value contributed to the slow economic growth experienced during this period.

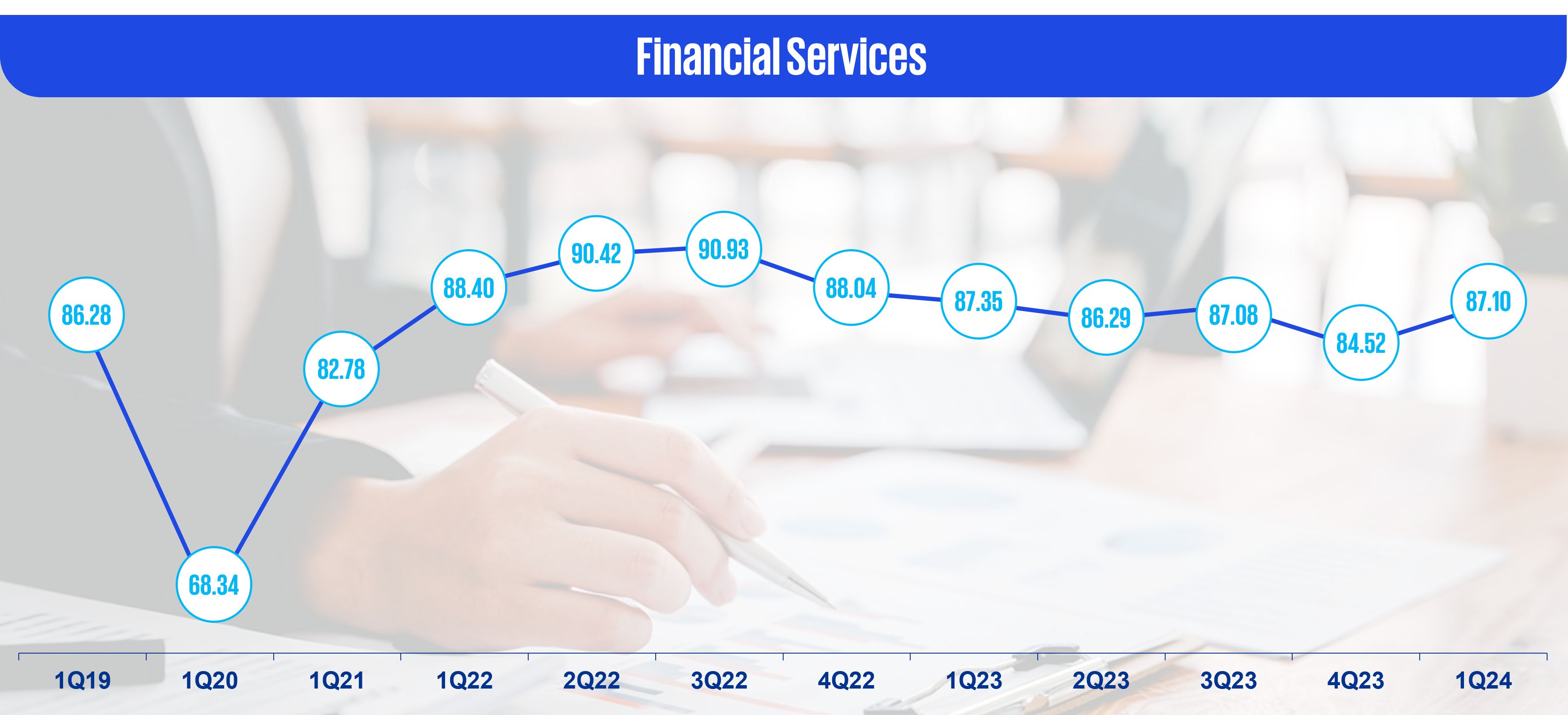

- Out of the five largest sectors by market capitalization, in Q1 2024, all sectors had a FPI score greater than 90, except for financial services (87) and technology and telecommunication (88). While consumer markets (74) registered FPI score of below 85.

Sector movers:

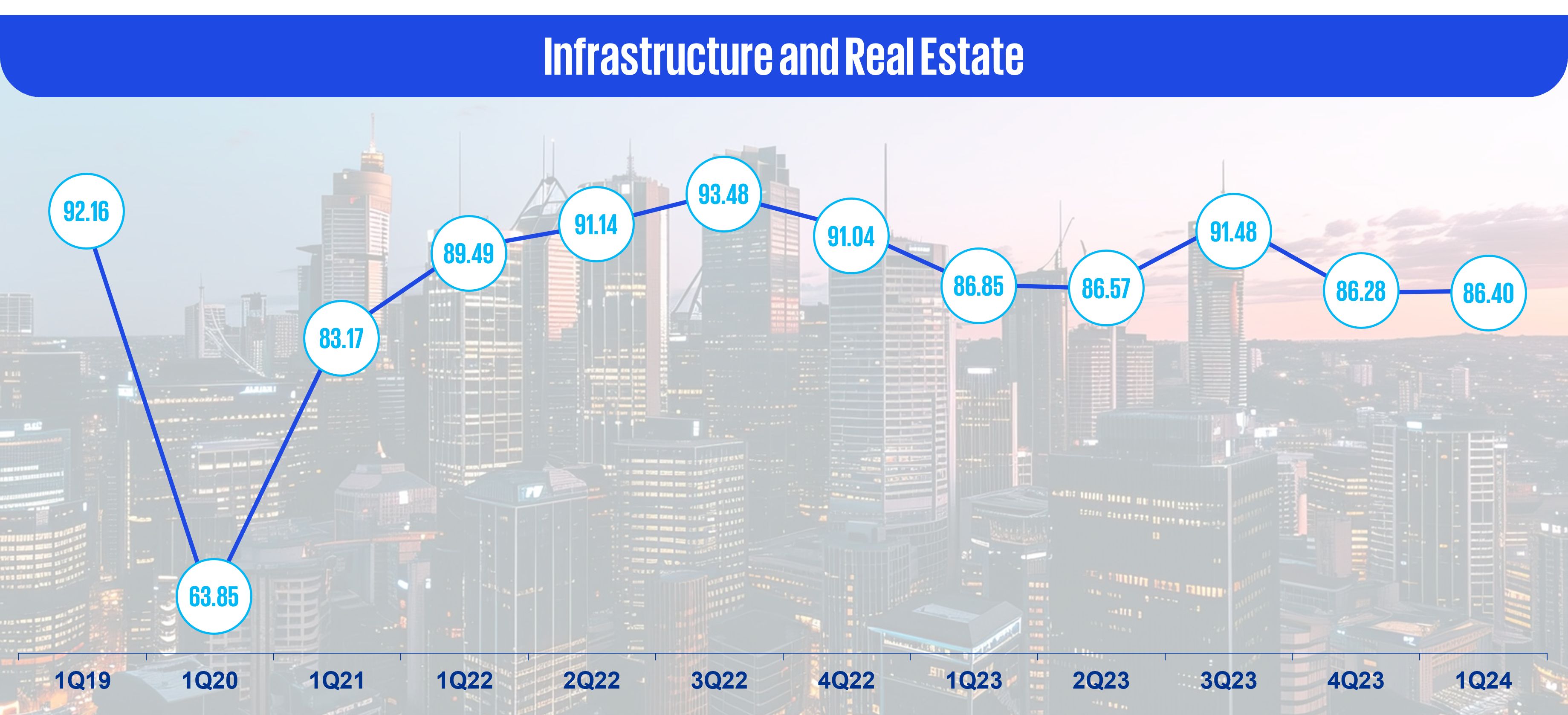

- The overall decline in FPI score in Q1 2024 compared to Q3 2023 was primarily driven by the consumer markets (down by 16.68 percent), infrastructure and real estate (down by 5.55 percent), and travel and hospitality (down by 4.93 percent) sectors.

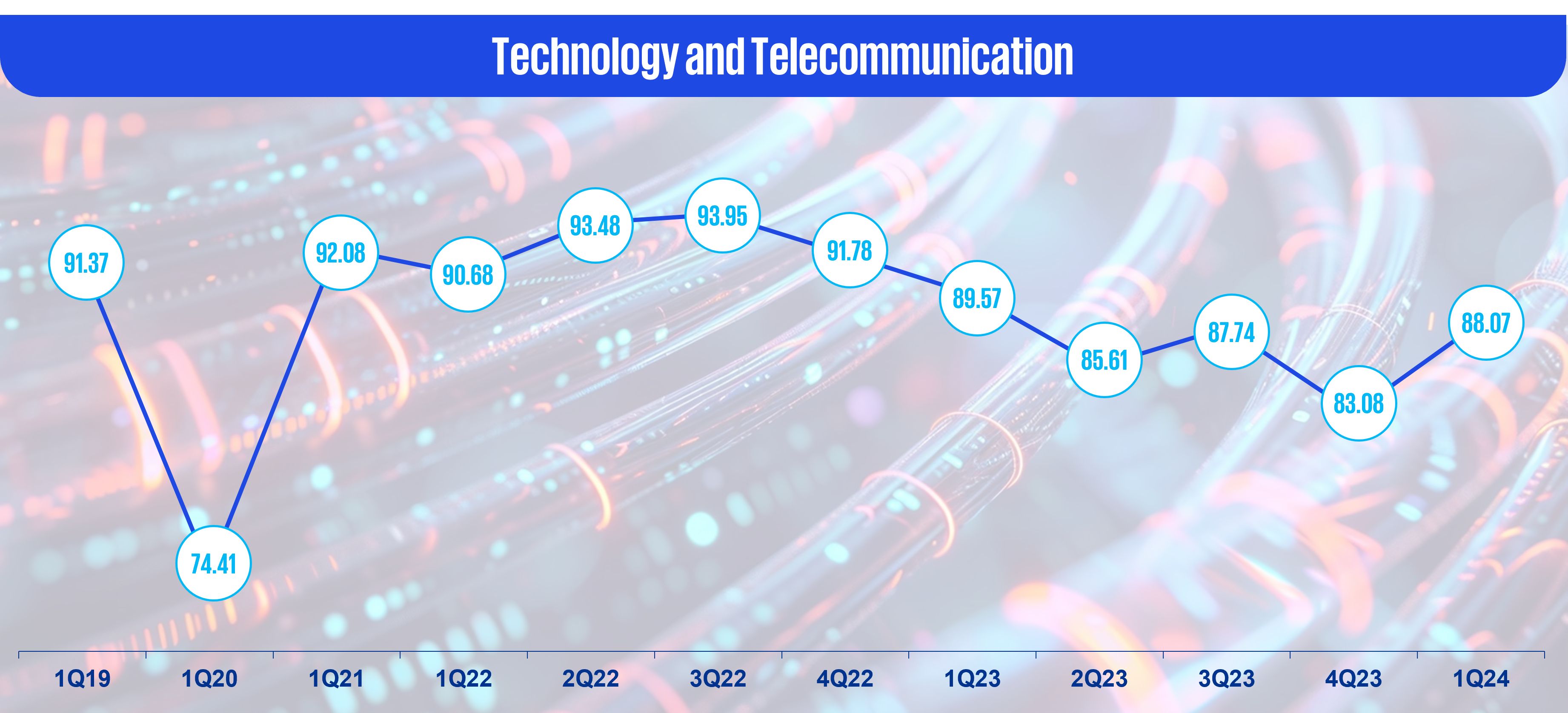

- The top-performing sectors in the past six months were business services (up by 1.89 percent) and technology and telecommunication (up by 0.38 percent). The growth in these sectors can be attributed to the influx of investments from large technology players.

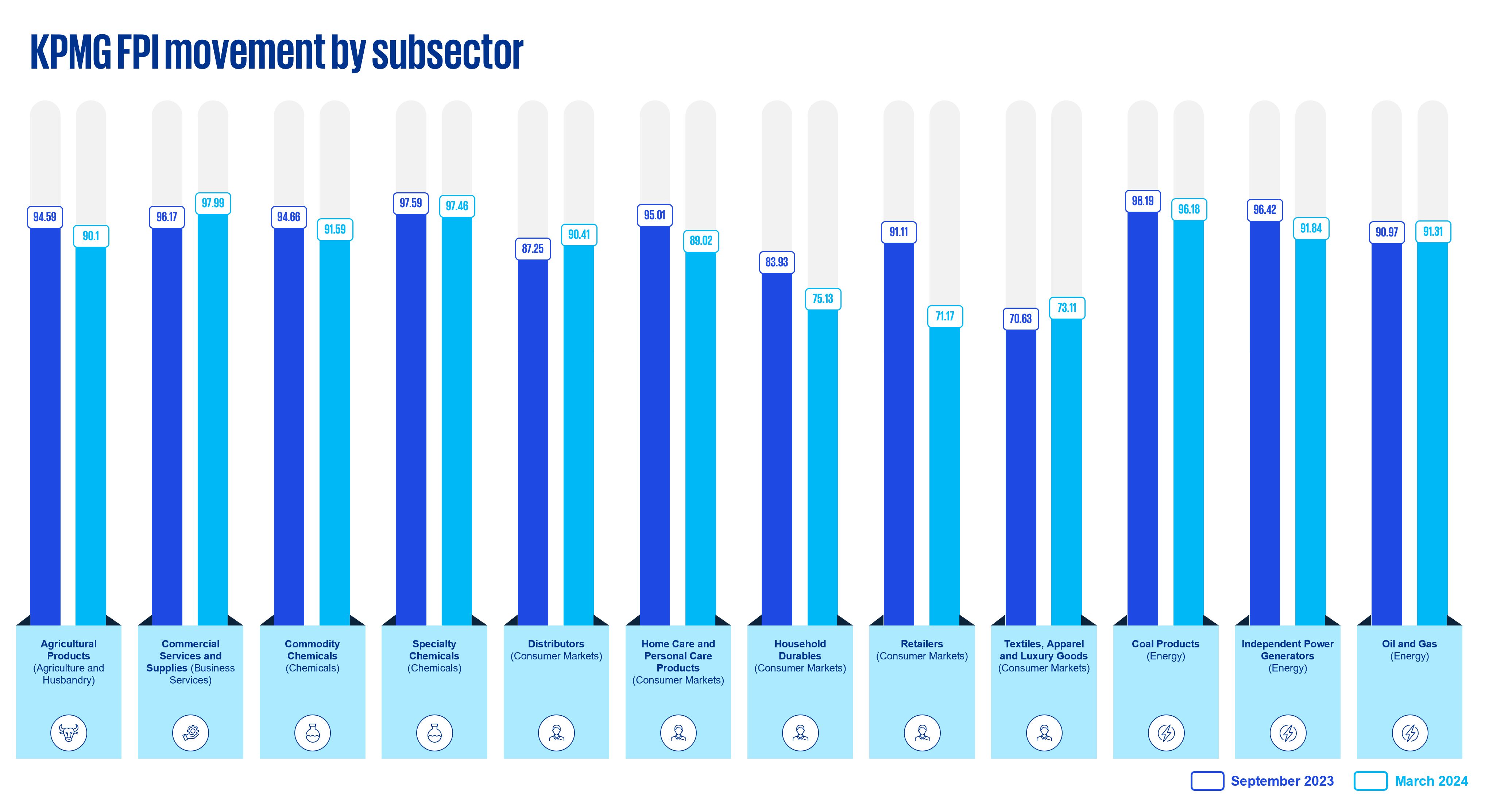

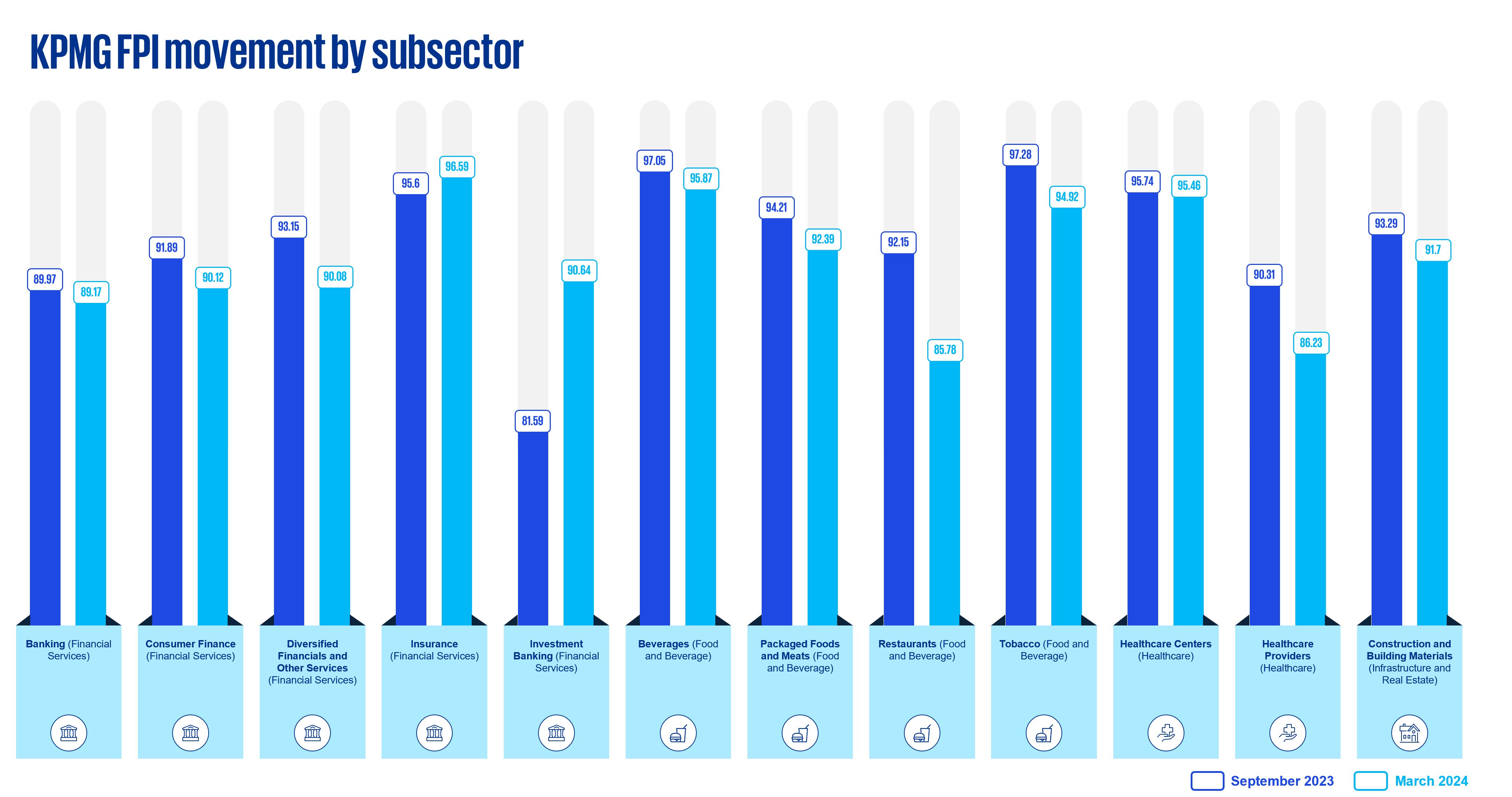

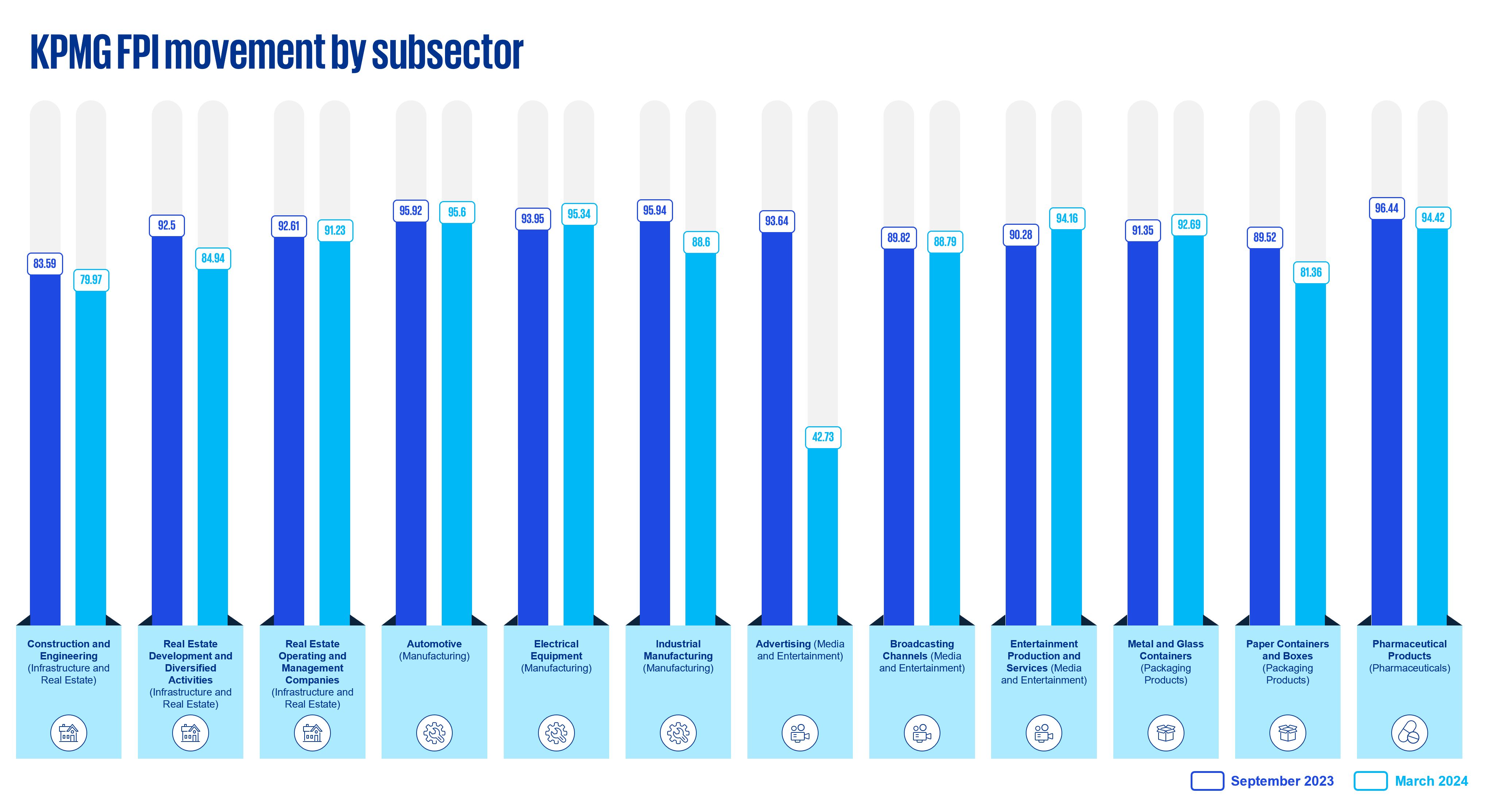

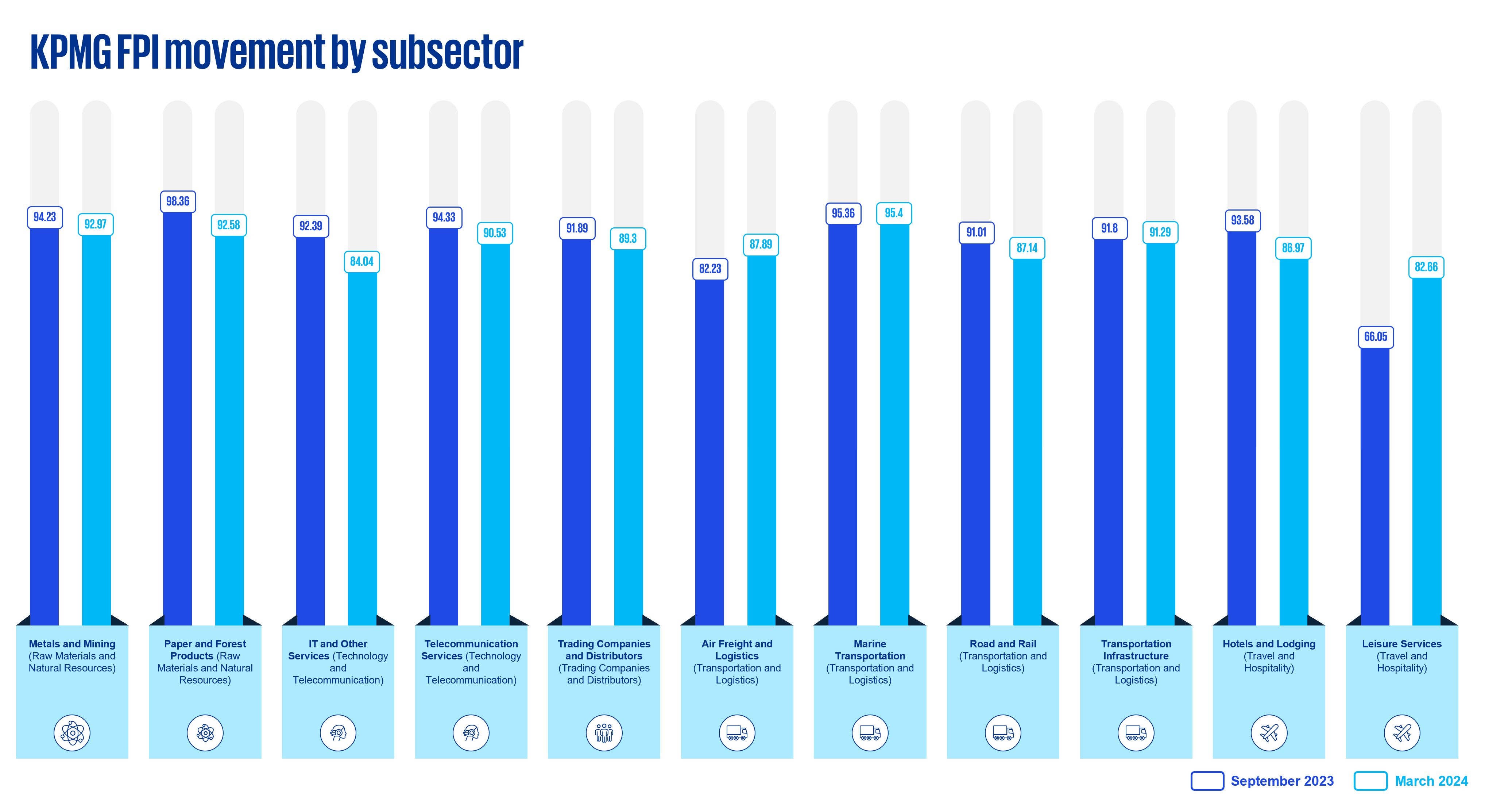

- Investment banking as a sub-sector of financial services sector experienced high growth by more than 11 percent, similarly, commercial services and supplies, as a sub-sector of business services supported the sector with high FPI score of above 95 points across the past six months.

- Consumer markets, infrastructure and real estate, and packaging products experienced significant declines in FPI sector scores in Q1 2024, largely due to significant downfall in retailers, real estate development and diversified activities and paper containers and boxes sub-sectors, respectively. Consumer markets experienced its lowest FPI score since Q1 2022 with 74 FPI points in Q1 2024.

- Amongst sub-sectors, leisure services in travel and hospitality and air freight and logistics in transportation and logistics showed positive momentum with gains of 25.15 and 6.88 percent in FPI score. The growth in leisure services can be attributed to a surge in tourism activities.

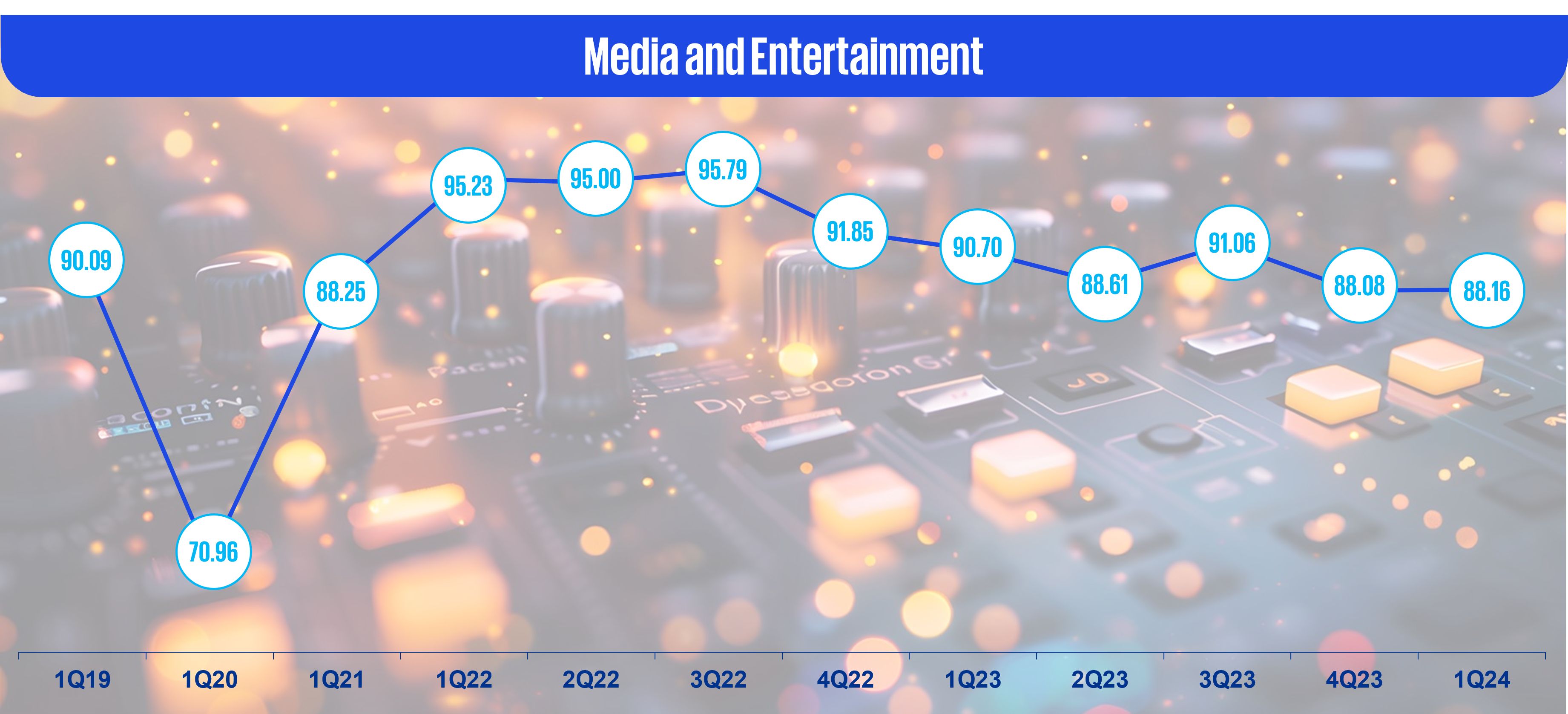

- On the contrary, advertising (a sub-sector in media and entertainment) witnessed a steep decline in KPMG FPI score with downfall of 54.37 percent which can be attributed to factors including the anticipation of an economic downturn. As a result, marketing and advertising budgets are becoming increasingly vulnerable to cuts, leading to reduced investments in advertising activities.

- Over the period, from Q3 2023 to Q1 2024 only 12 sub-sectors witnessed growth and 36 sub-sectors witnessed decline. However, of the declining sub-sectors, only seven sub-sectors reported FPI scores below 85 points.

KPMG FPI Movement by subsector

Indonesian economy:

- Indonesia's GDP growth eased slightly to an average of 4.9 percent over 2024-2026, down from 5.0 percent in 2023, primarily due to the reduction of commodity prices. This slowdown reflects the end of the commodity boom that had previously fueled rapid economic expansion.

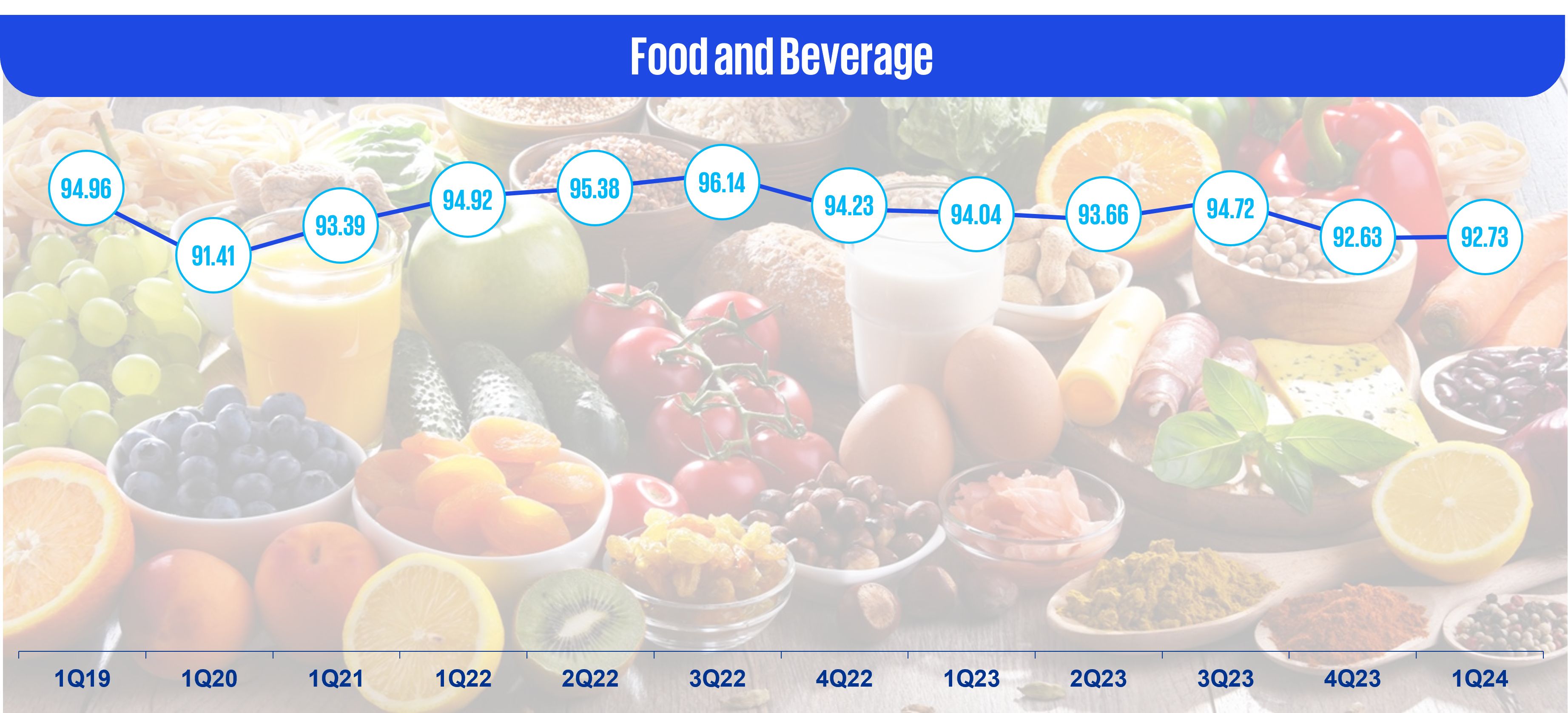

- Private consumption is anticipated to be one of the major drivers in the economy and growth are expected in sectors linked to private consumption such as consumer markets, packaging products, and food and beverages amongst others.

- Business investment and public spending are also expected to pick up because of reforms and new government projects. Inflation is projected to moderate to 3.2 percent in 2024, down from an average of 3.7 percent in 2023, aligning with Bank Indonesia's target range. The easing inflationary pressures stem from softening commodity prices and a normalization of domestic demand growth following the post-pandemic rebound.

- Services exports are expected to benefit from a continued recovery in tourism, while lower commodity prices and weaker global growth will hamper exports of goods. The government's efforts to attract greater levels of investment through labors reforms, aim to fuel job creation and economic growth, although these efforts face opposition from various groups.

- Indonesia is actively addressing climate change challenges and aiming for a green transition. However, upward risks to food prices persist due to the potential disruptions caused by the El-Niño weather pattern, which could impact food production in certain regions.

- The Indonesian government has implemented policies aimed at improving infrastructure, diversifying the economy, and reducing barriers to doing business.

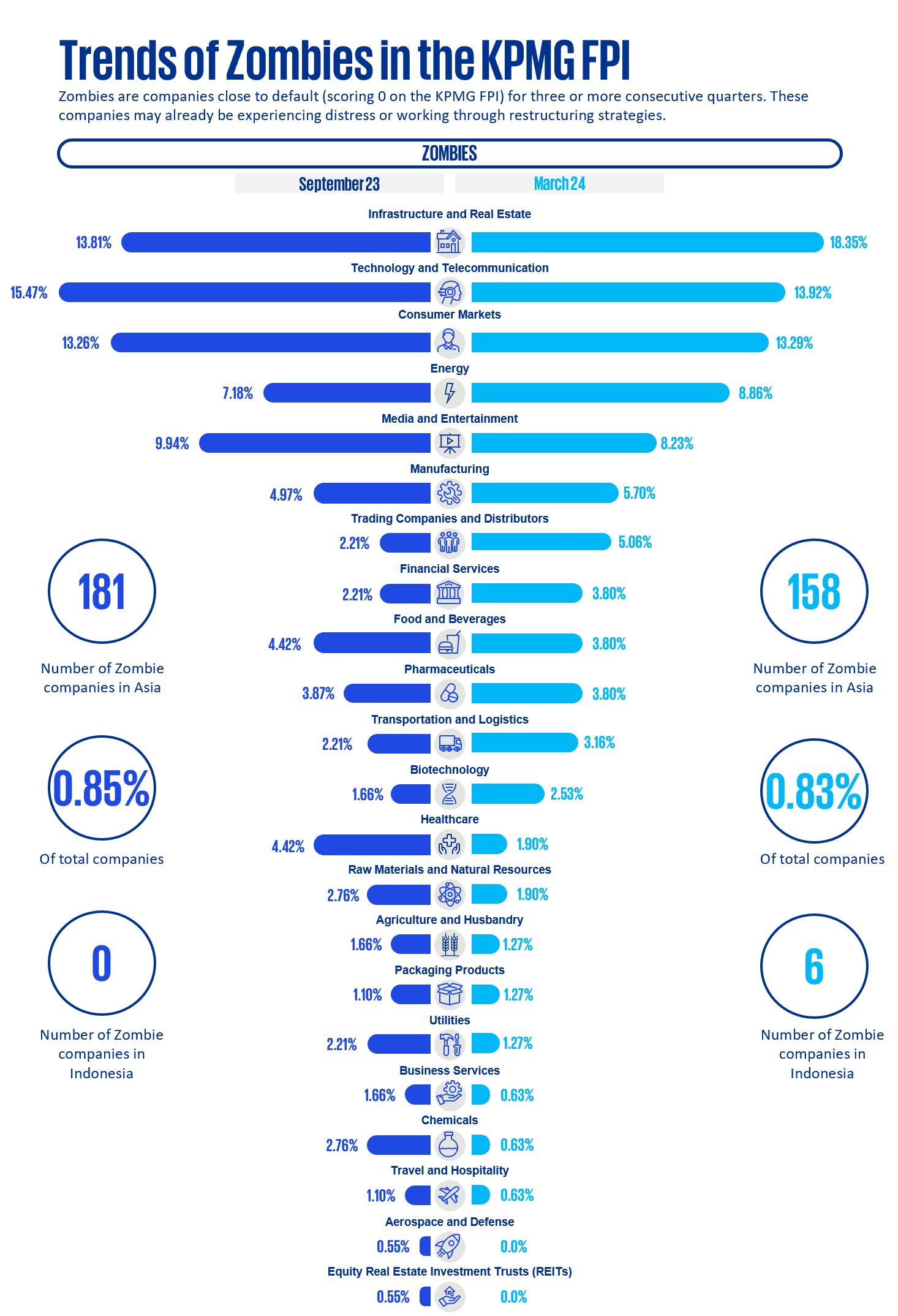

Zombie:

- Zombies are companies close to default (scoring 0 on the KPMG FPI) for three or more consecutive quarters. These companies may already be experiencing distress or working through restructuring strategies.

- In the Asian financial market, the number of zombies has reduced quarter over quarter from 181 in Q3 2023 to 158 in Q1 2024. The highest zombies share has been accounted for infrastructure and real estate (with 18.35 percent contribution), technology and telecommunication (with 13.92 percent contribution) and consumer market (with 13.29 percent contribution).

- For Indonesia, a trend reversal has been observed with respect to the Asian market, where the number of zombies increased from 0 in Q3 2023 to 6 in the latest quarter Q1 2024. However, in case of Indonesia, infrastructure and real estate despite accounting for highest number of companies, witnessed no zombies.

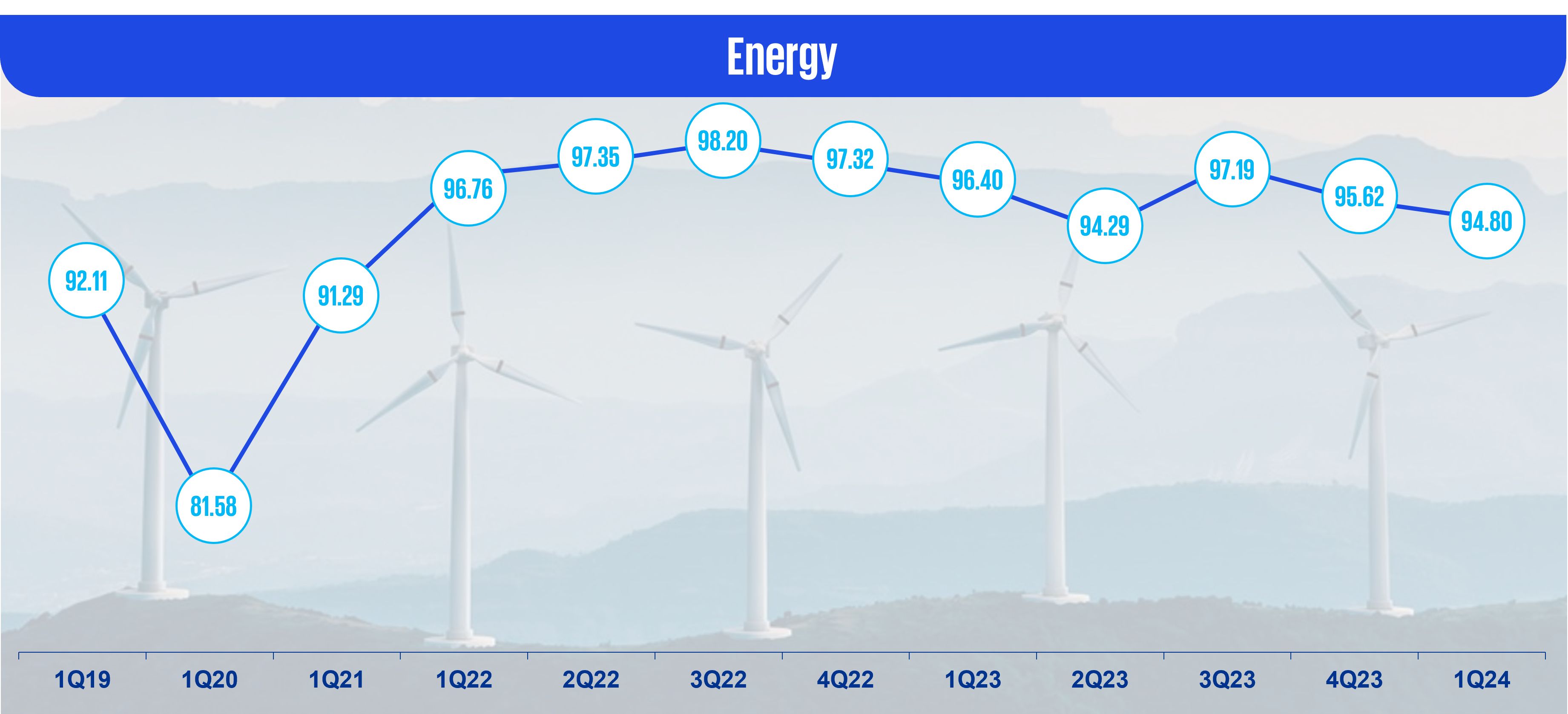

- Consumer market, energy, transportation and logistics, technology and telecommunication, media and entertainment and packaging products witnessed one zombie company each in Q1 2024.

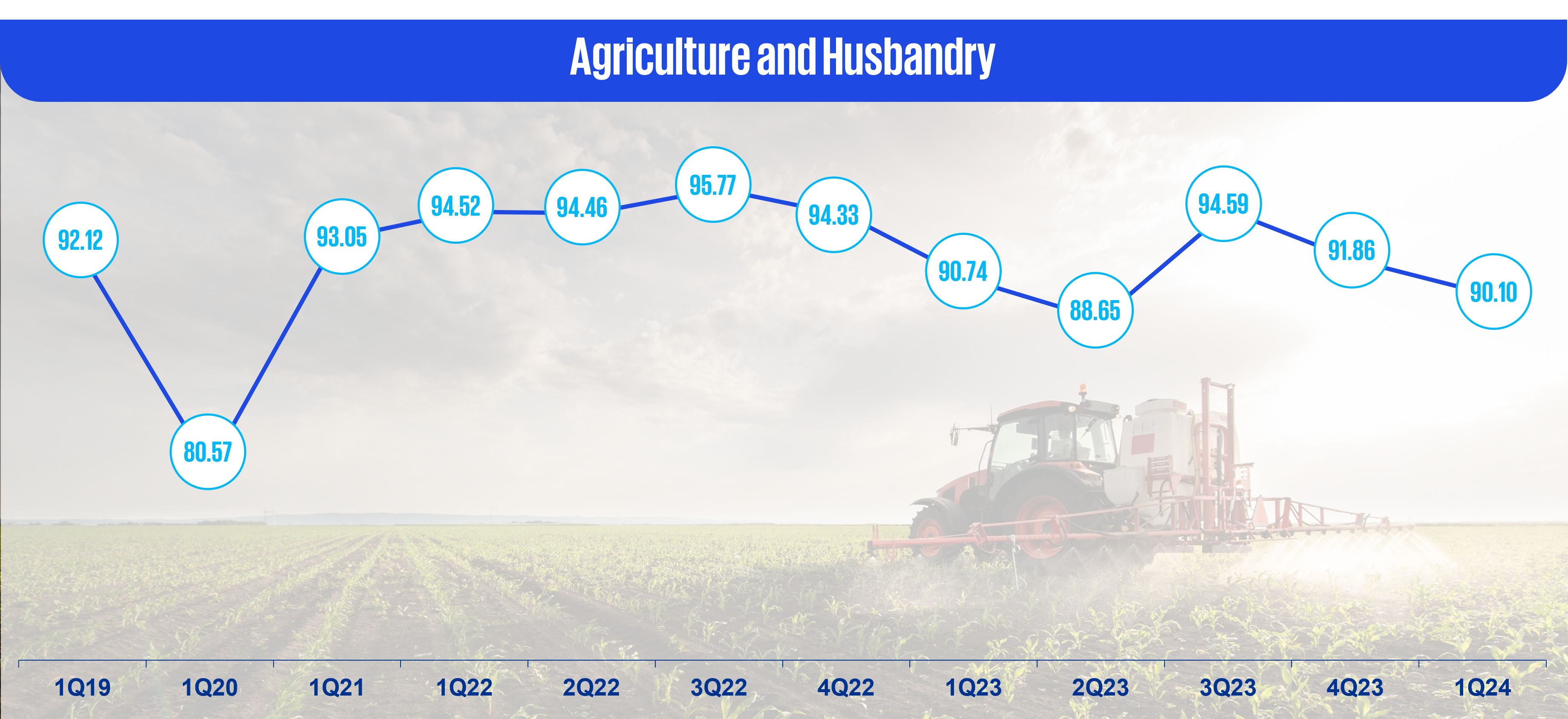

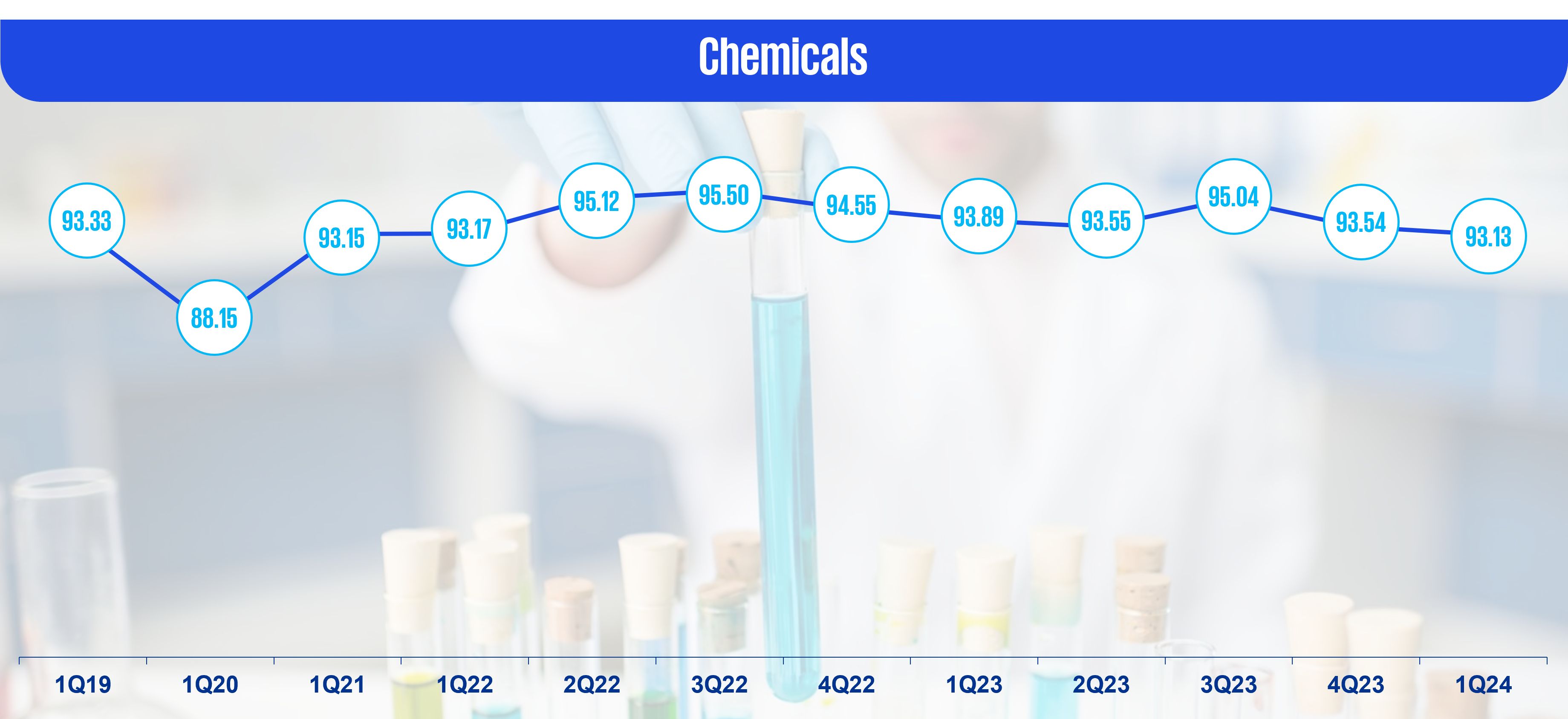

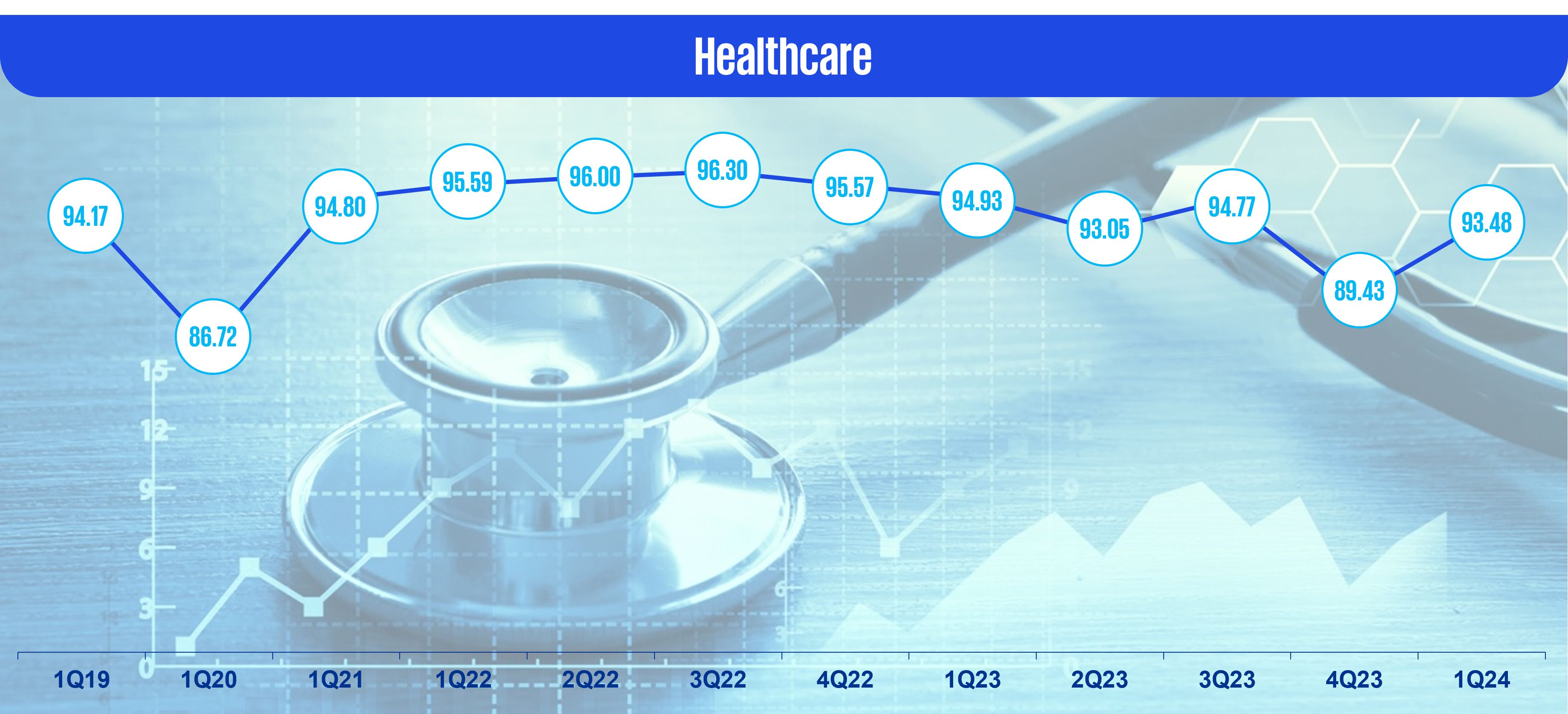

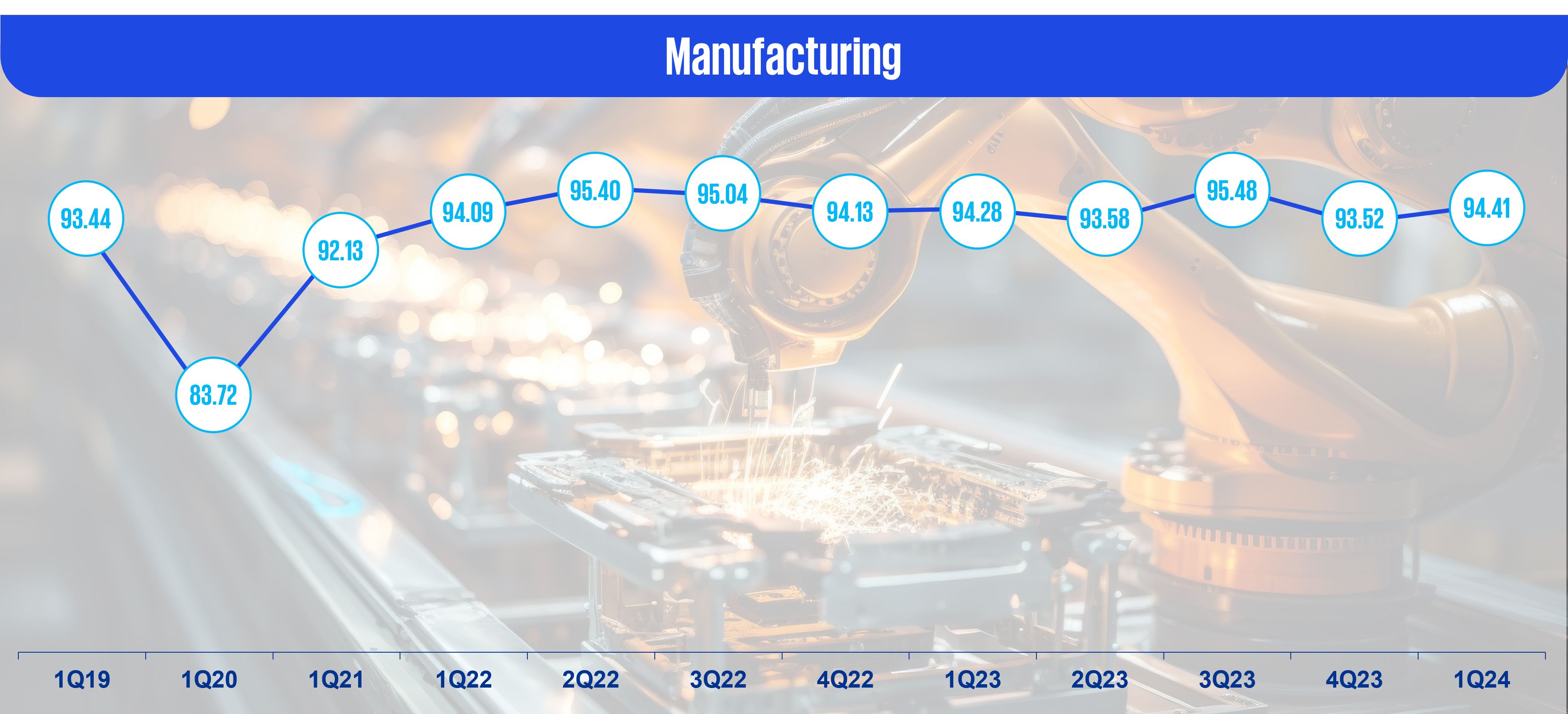

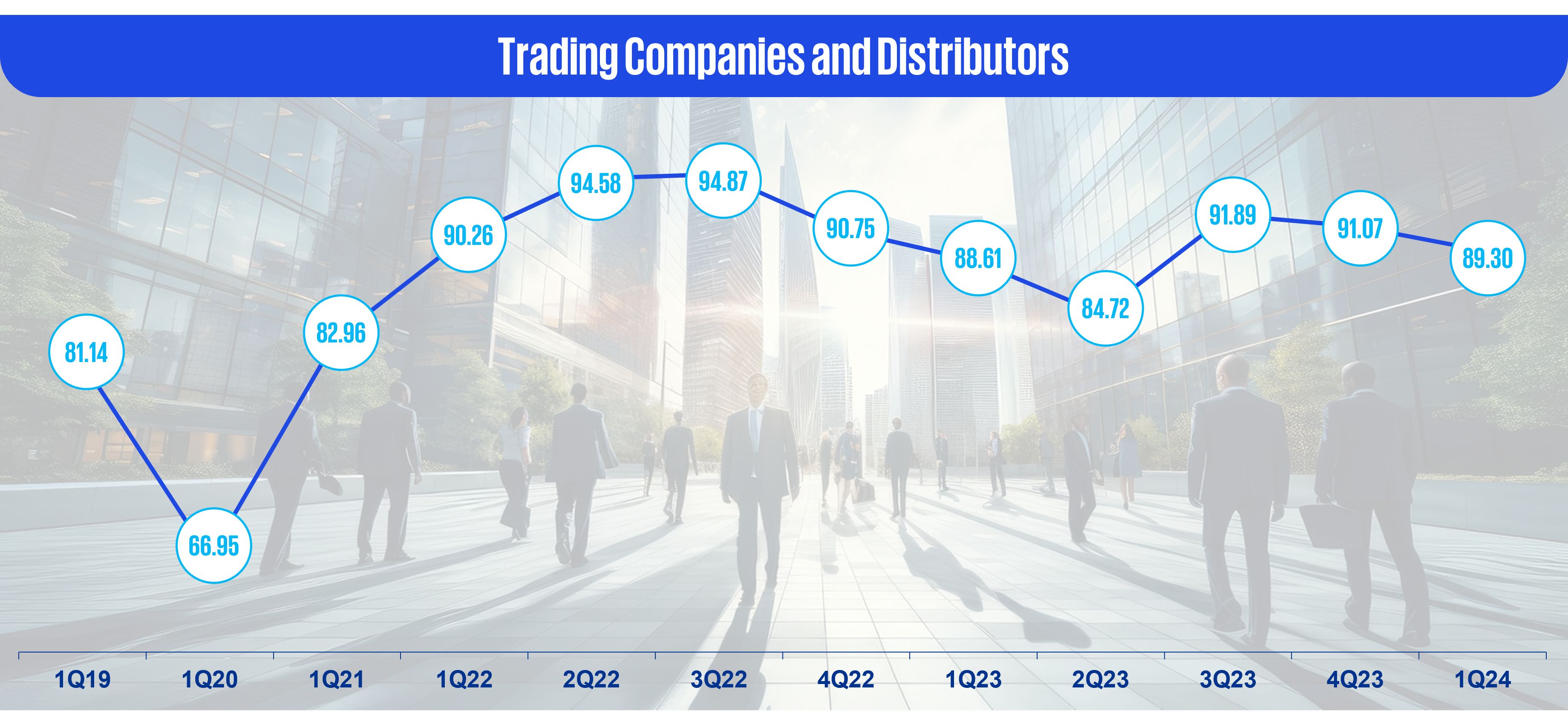

KPMG FPI trends across key industries for the Indonesian economy

About KPMG FPI:

The KPMG FPI is a metric used to measure a company’s financial health by its ‘probability to default’. The analysis has been prepared using John Y. Campbell, Jens Hilscher, and Jan Szilagyi’s probability to default formula which takes into account financial information and market data. The KPMG FPI score ranges from 0 - 100. The lower the KPMG FPI score, the more likely a company is to default. In contrast, the higher the score, the less likely it is to default. In this analysis, released every three months, we analyze the KPMG FPI score movements of publicly listed companies in Indonesia (following the reporting season of full year and half year results) to draw insights into corporate health across the Indonesian economy.

KPMG FPI combines both market and financial information to determine a company’s relative financial distress levels. KPMG believes that combining the two types of information detects deteriorating corporate health more effectively than either source alone.

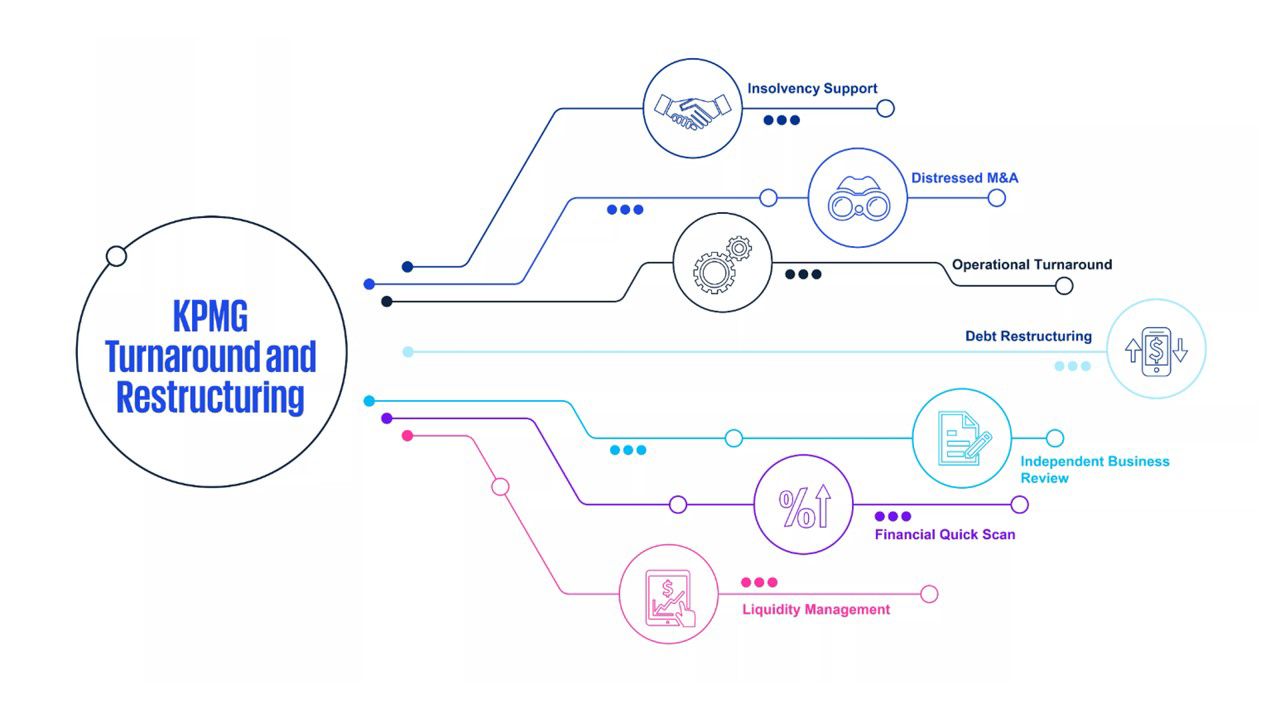

How can we help?

The information contained in this document is of a general nature and is not intended to address the objectives, financial situation or needs of any particular individual or entity. It is provided for information purposes only and does not constitute, nor should it be regarded in any manner whatsoever, as advice and is not intended to influence a person in making a decision, including, if applicable, in relation to any financial product or an interest in a financial product. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. To the extent permissible by law, KPMG and its associated entities shall not be liable for any errors, omissions, defects or misrepresentations in the information or for any loss or damage suffered by persons who use or rely on such information (including for reasons of negligence, negligent misstatement or otherwise).