An indicator of corporate health for companies across Indonesia

We are pleased to share with you the second quarter (Q2) of 2023 edition of our quarterly KPMG Financial Performance Index (FPI) publication. We provide our insights into the changing state of corporate health across all Indonesian markets and sectors, following the end of the reporting season for the three months to June 2023. KPMG FPI data is refreshed on a quarterly basis. For more information, visit the KPMG FPI page.

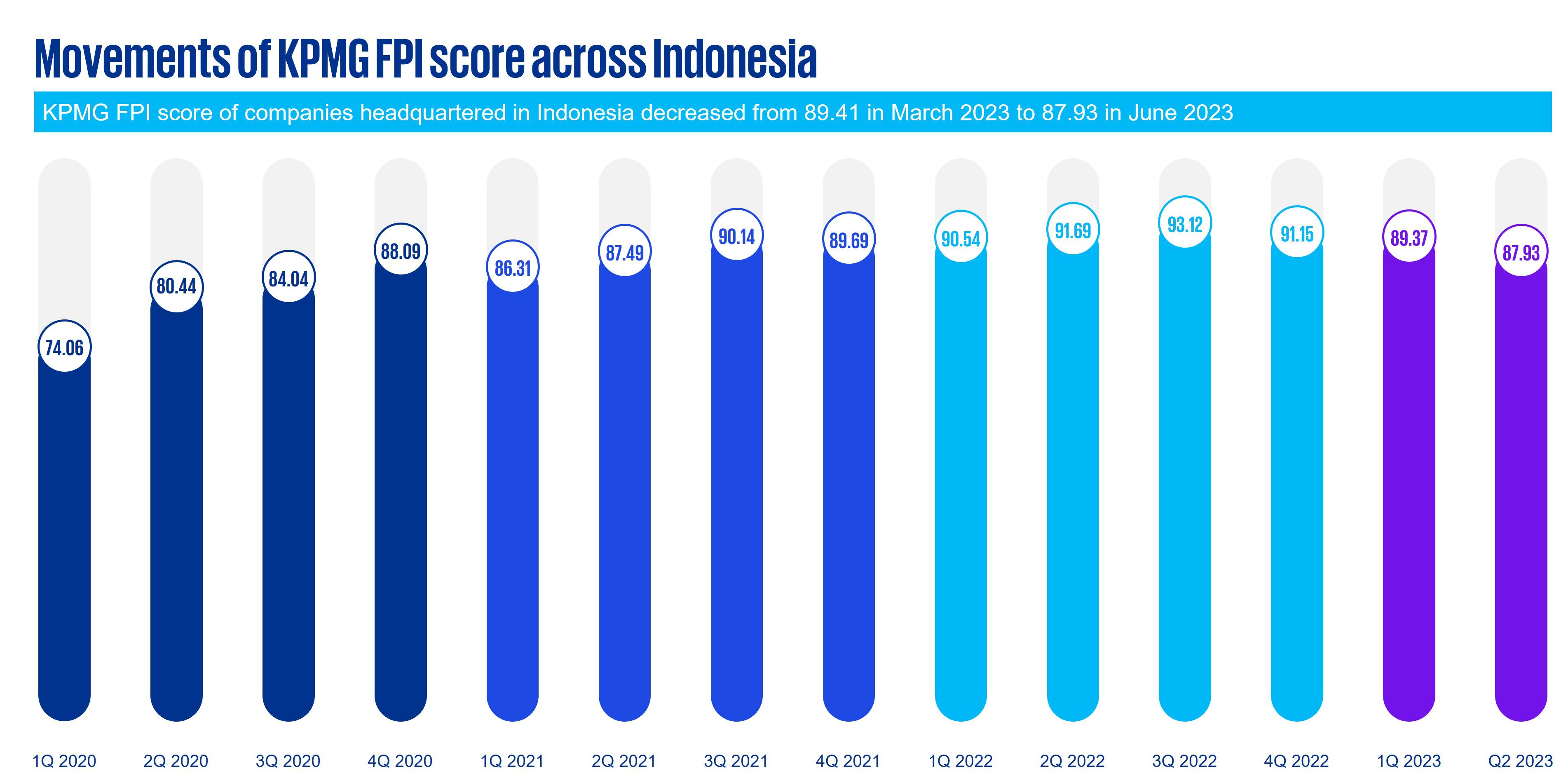

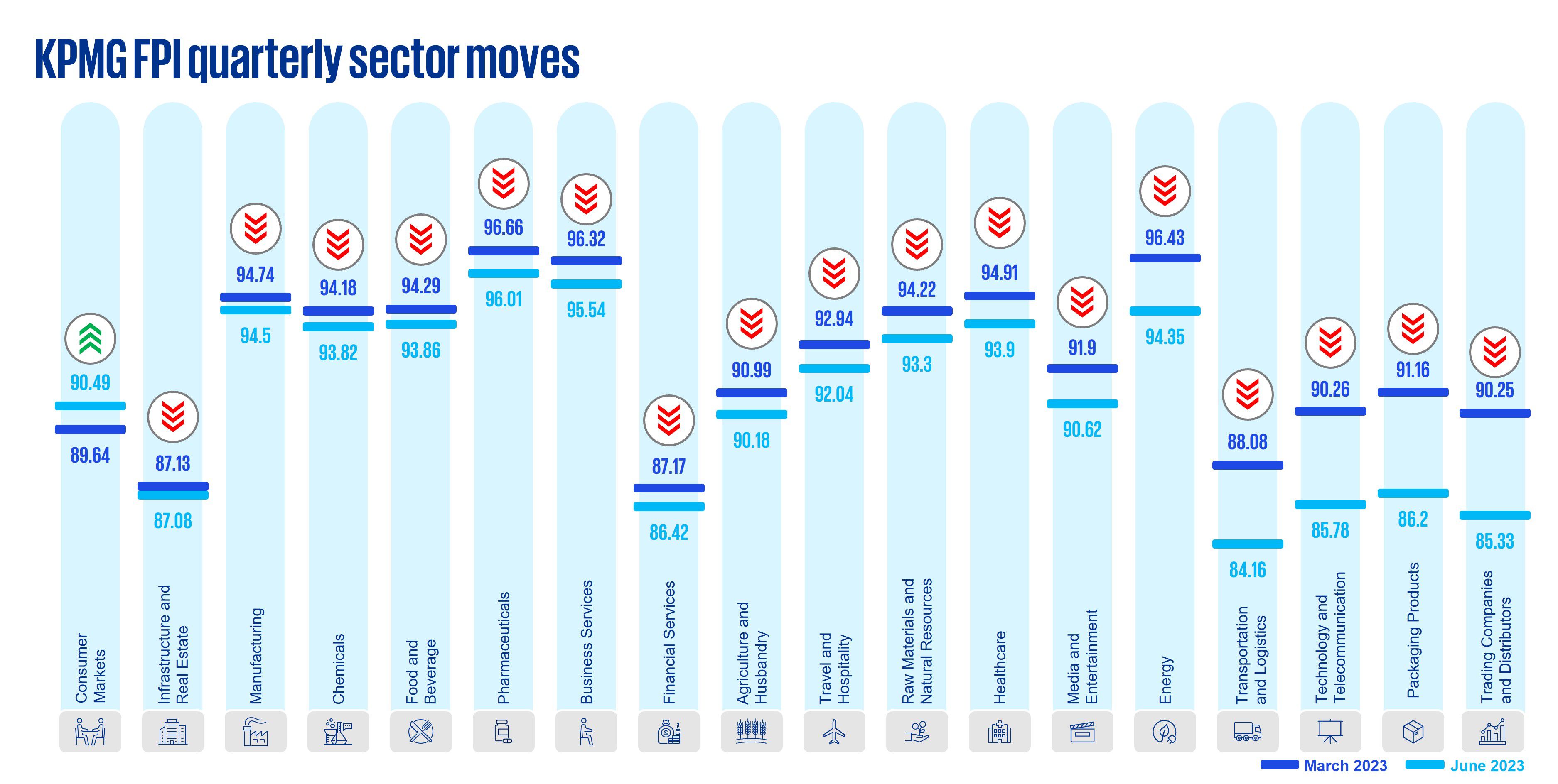

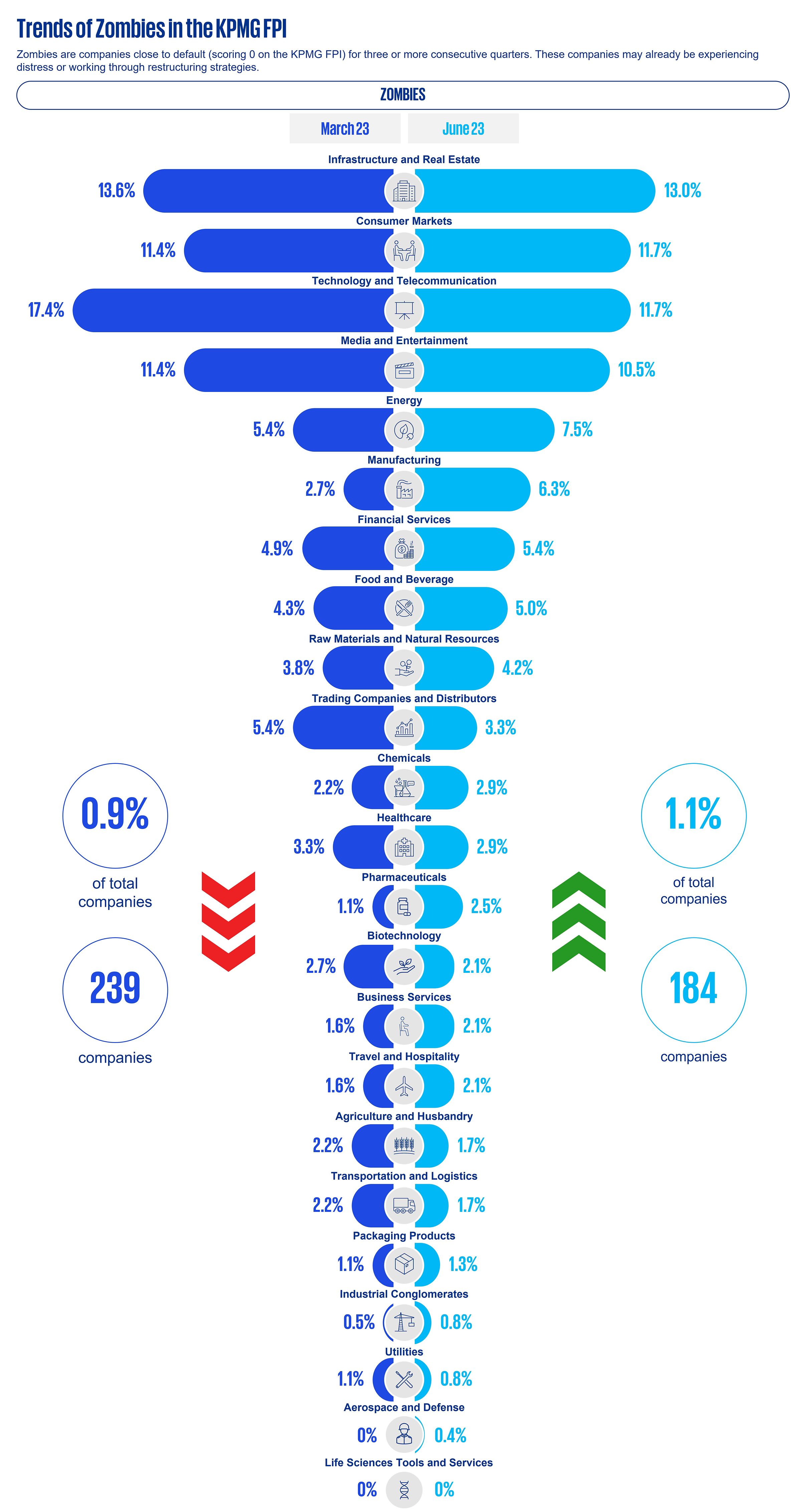

Between March 2023 and June 2023, we observed a decrease in the Indonesian KPMG FPI from 89.37 to 87.93. This denotes a decline in financial corporate health of companies headquartered in Indonesia. Out of the 18 sectors analyzed, only the consumer markets sector experienced an increase in its KPMG FPI during the three months ended June 2023. FPI scores for sectors, such as packaging products and trading companies and distributors decreased the highest with a decline of 5.4 percent and 5.5 percent, respectively.

Indonesia FPI performance comparison

Key highlights:

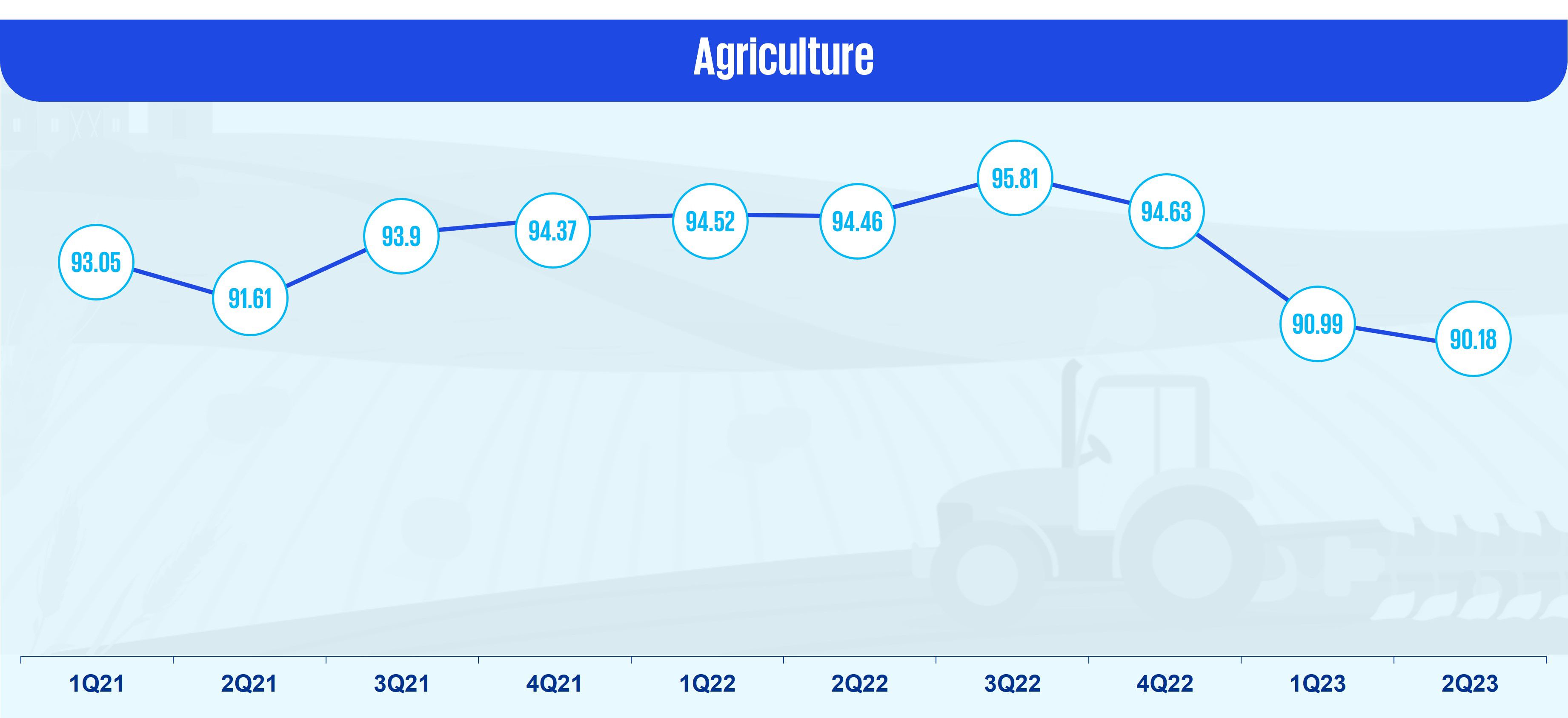

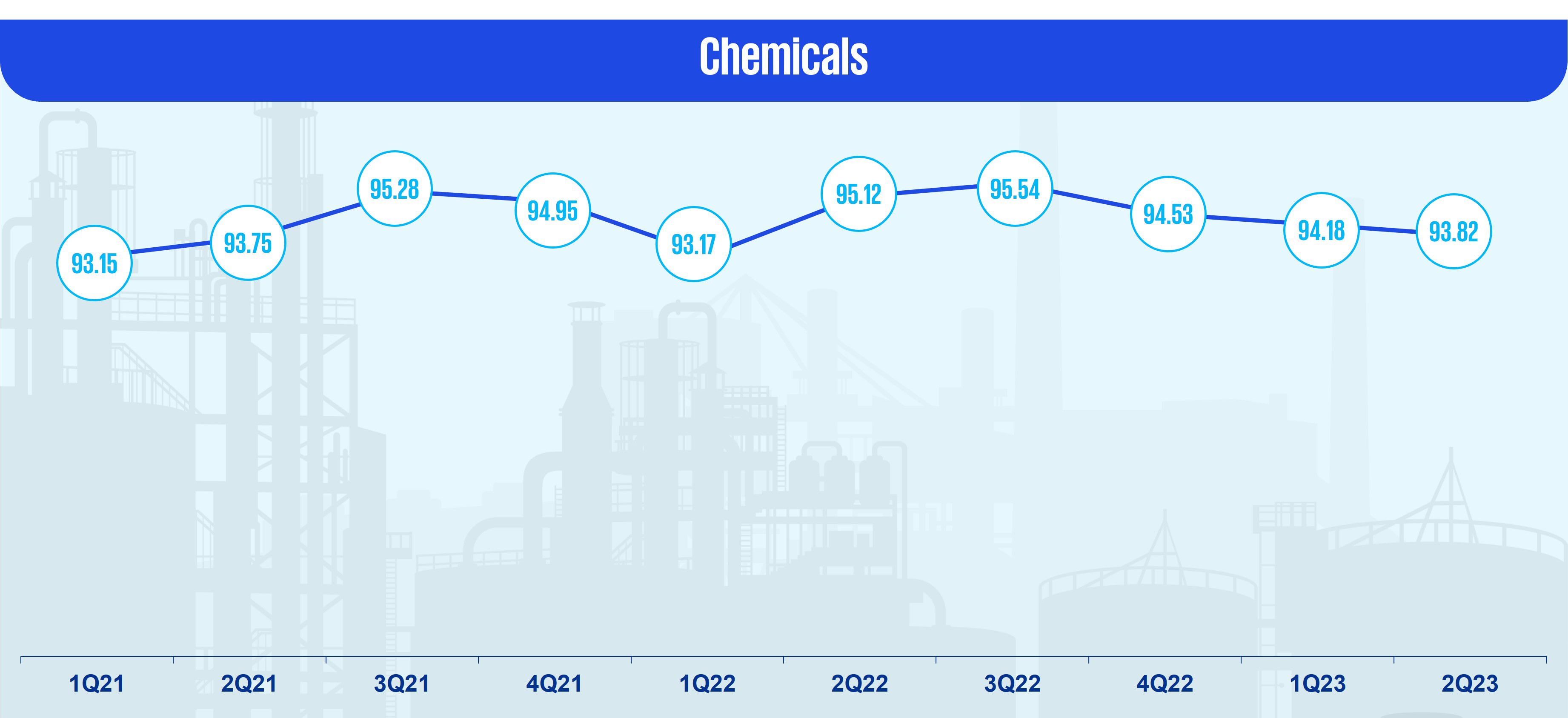

- Following a sharp decline in Indonesian corporate’s FPI scores due to Covid in the first quarter (Q1) of 2020 (FPI 74 score), the index had steadily grown to a level of around 93 in the first three quarters of 2022.

- However, after the peak in the third quarter (Q3) of 2022, the index had steadily declined over the last three quarters and now sits at 88 at the end of Q2 2023. This decrease is primarily due to continued interest rate increases, concerns around inflation, and general slowdown in economic activity ahead of the Indonesian presidential and parliamentary election scheduled to take place in February 2024.

Sector movers:

- The overall lower FPI score compared to the previous quarter is also reflected by the individual sectors scores. Only three out of 18 scored higher compared to the fourth quarter (Q4 ) of 2022, while all of the other sectors scored lower.

- Travel and hospitality improved the most, led by the lifting of Covid travel restrictions, as well as the busy travel period during Ramadhan.

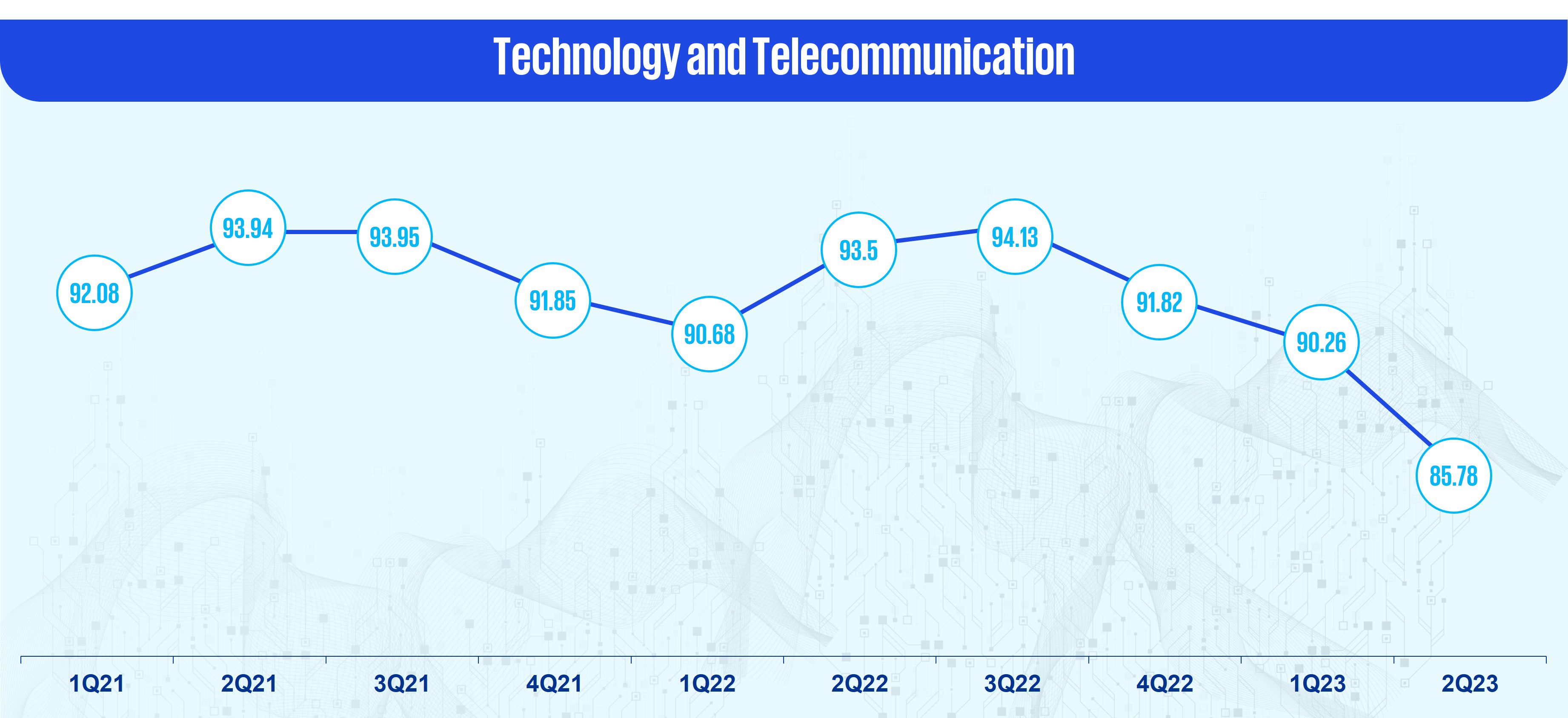

- Transportation and logistics, technology and telecommunication, and trading companies and distributors were the worst performing FPI scores in the first half of the year, all of which ended with FPI scores between 84 and 86.

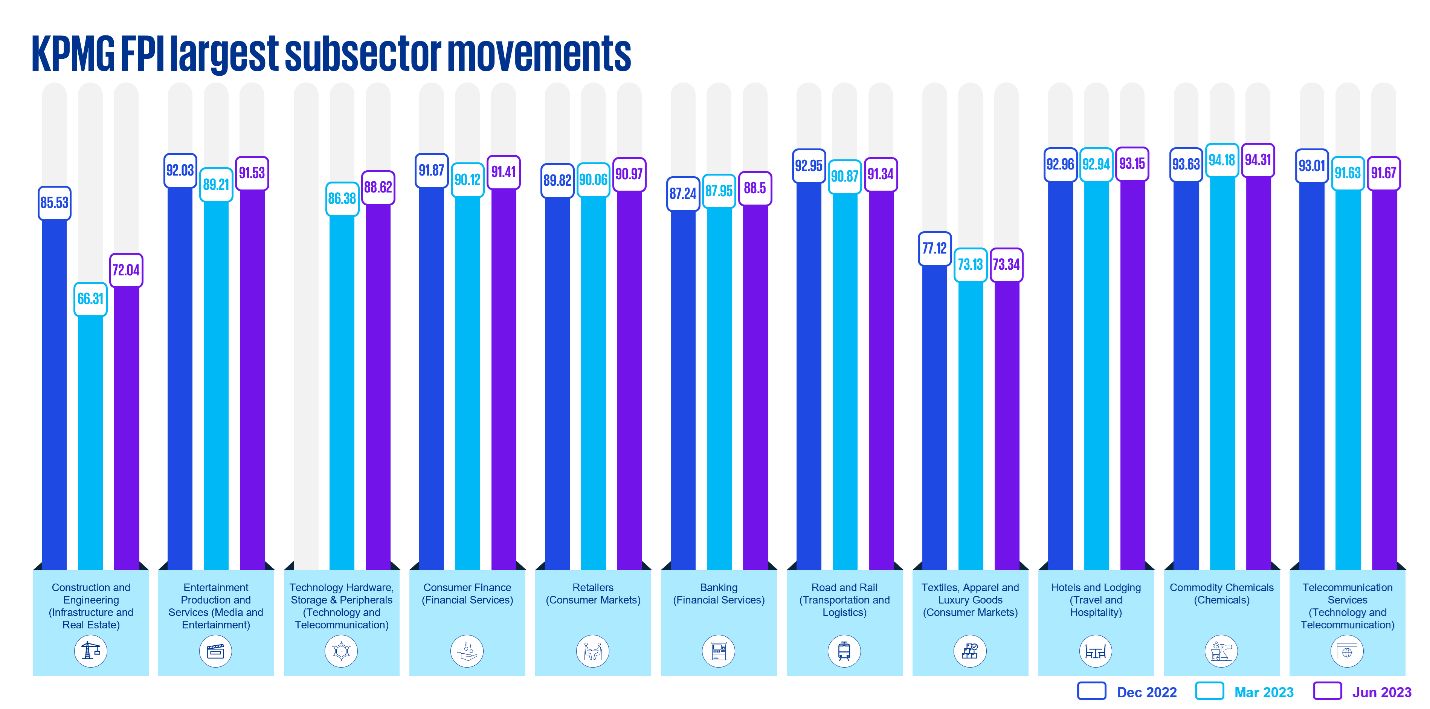

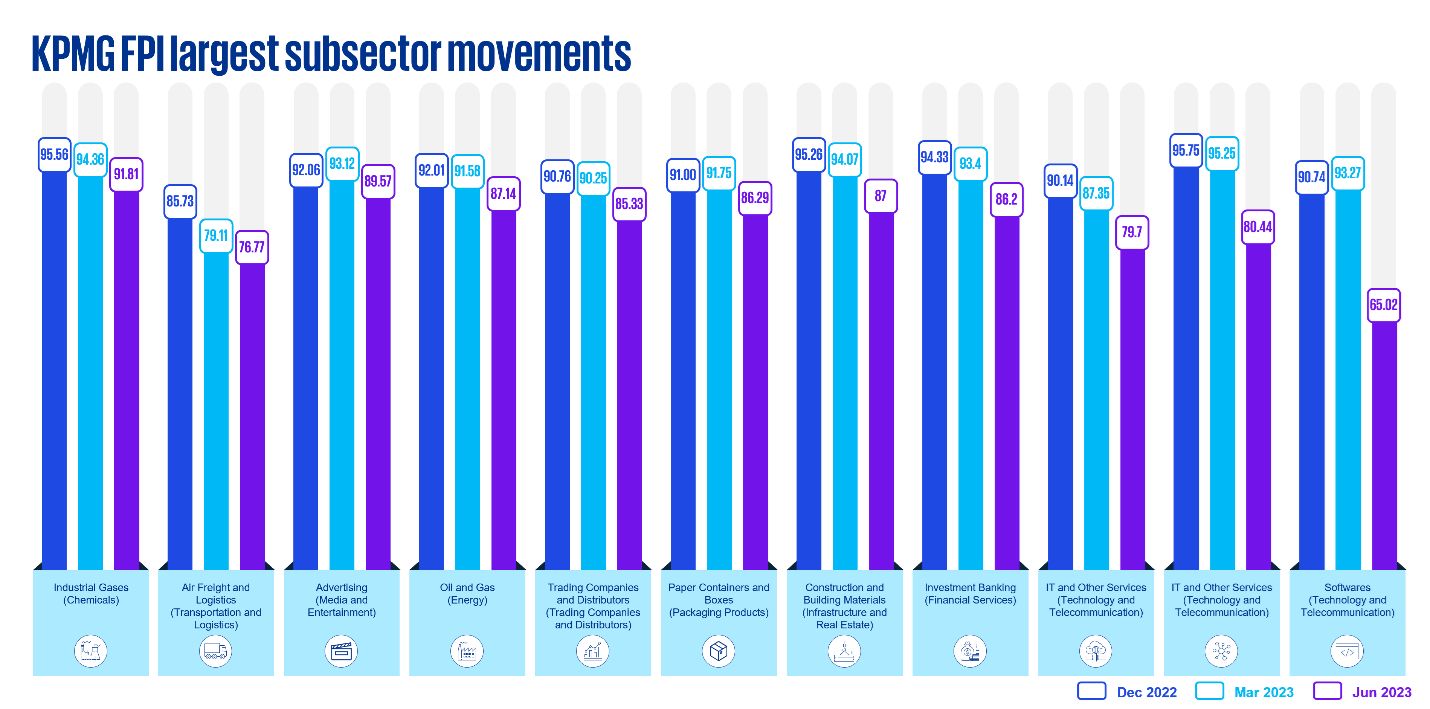

- Amongst sub-sectors, software, technology distributors, and IT and other services (all included in the technology and telecommunication sector) were the worst hit, as all decreased by more than 8 percent.

- Investment banking, driven by lower deal volumes, and construction and building materials, driven by inflationary pressure and working capital issues, also saw significant decreases in the first half of the year.

KPMG FPI quarterly sector moves & strongest sector movers

Indonesian economy:

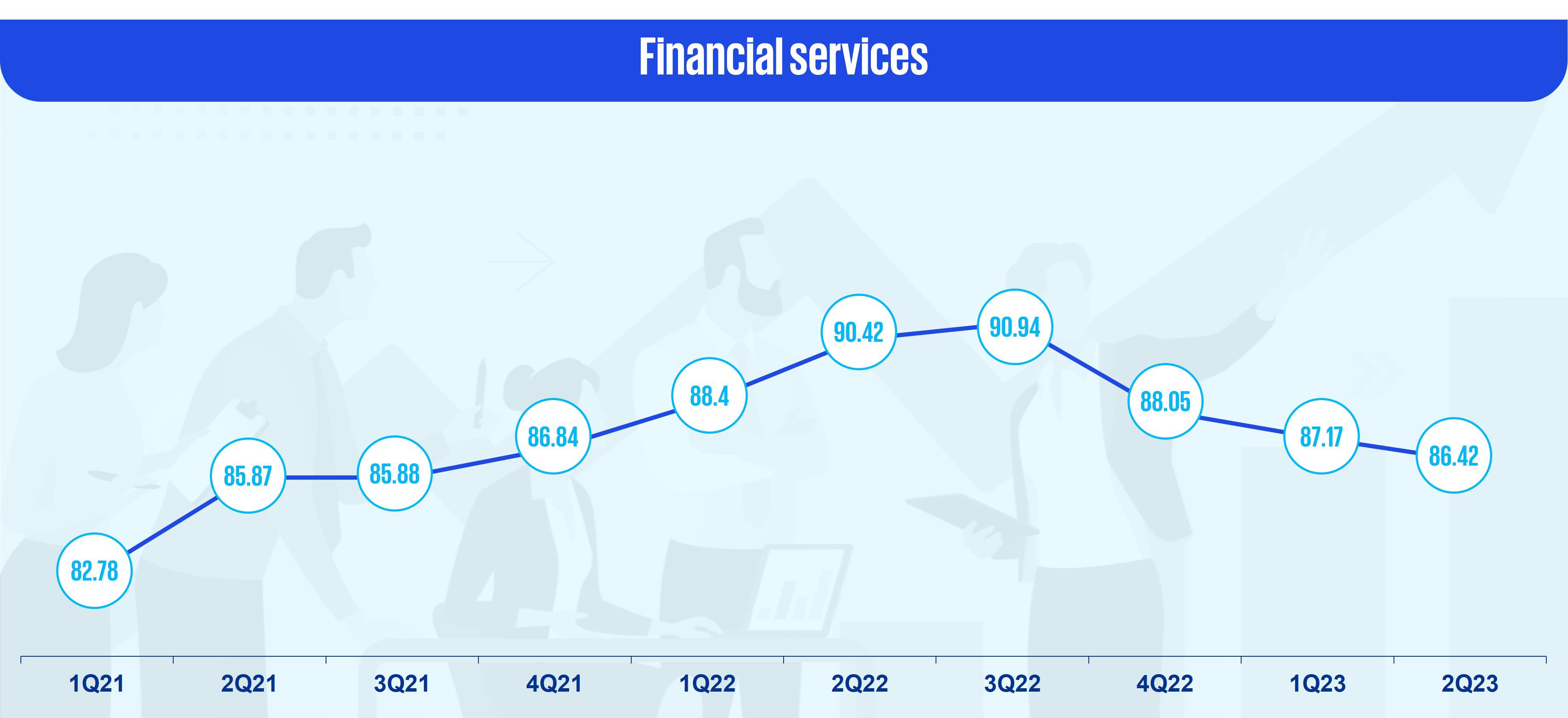

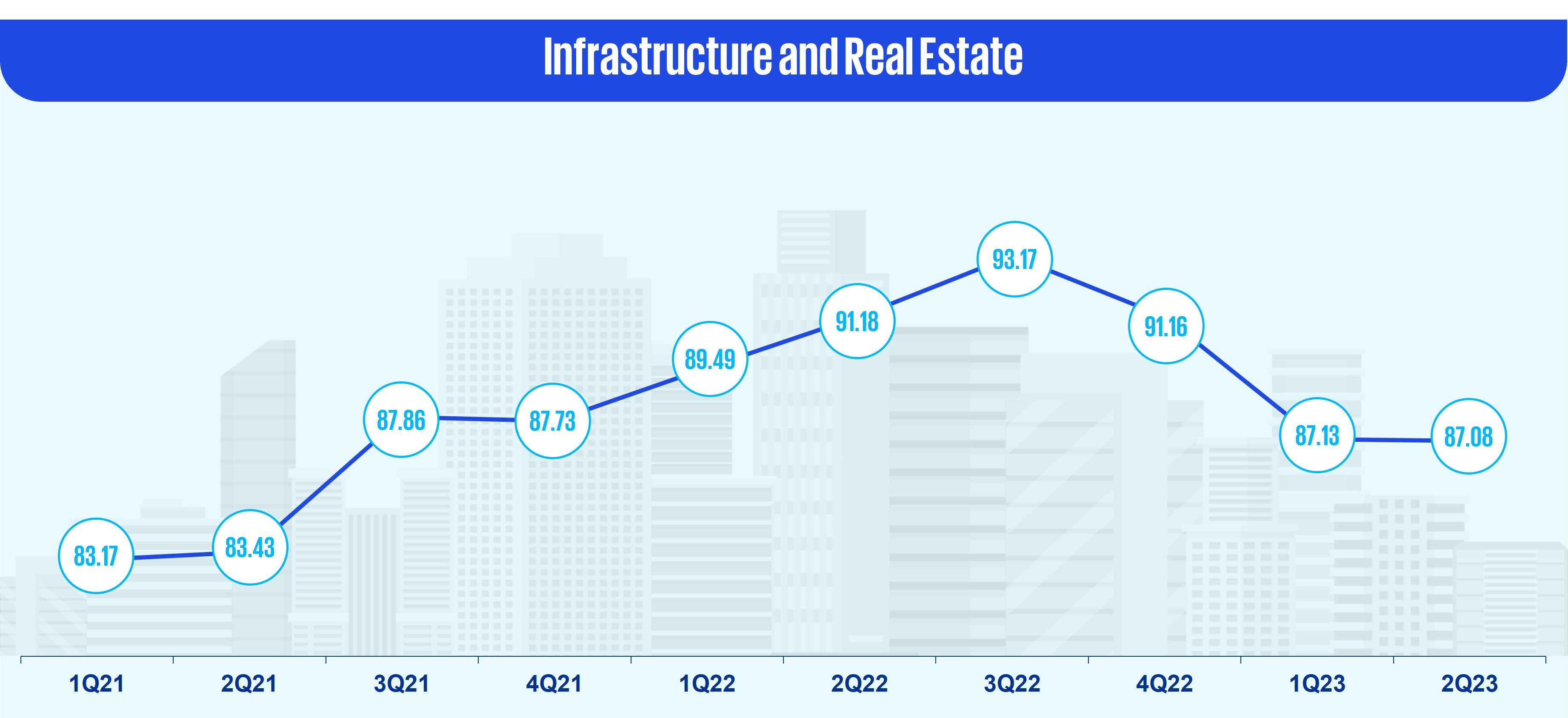

- Of the nine largest sectors by market cap, all had a FPI score greater than 90, except for technology and telecommunications (86), financial services (86), and infrastructure and real estate (87).

- The Indonesian economy is expected to grow at about 5 percent this year, although the second half of the year is expected to be slightly worse than the first half, as investments are expected to slow down ahead of the February 2024 elections.

- This slowdown is expected to be temporary, with growth in 2024 expected to continue to be strong after the elections, which will provide greater certainty on the future of Indonesia’s economy.

- Additionally, pressure on the Rupiah driven by the Federal Reserve’s interest rates hikes and global inflationary concerns could by the primary causes of further FPI score declines.

KPMG FPI largest subsector movements

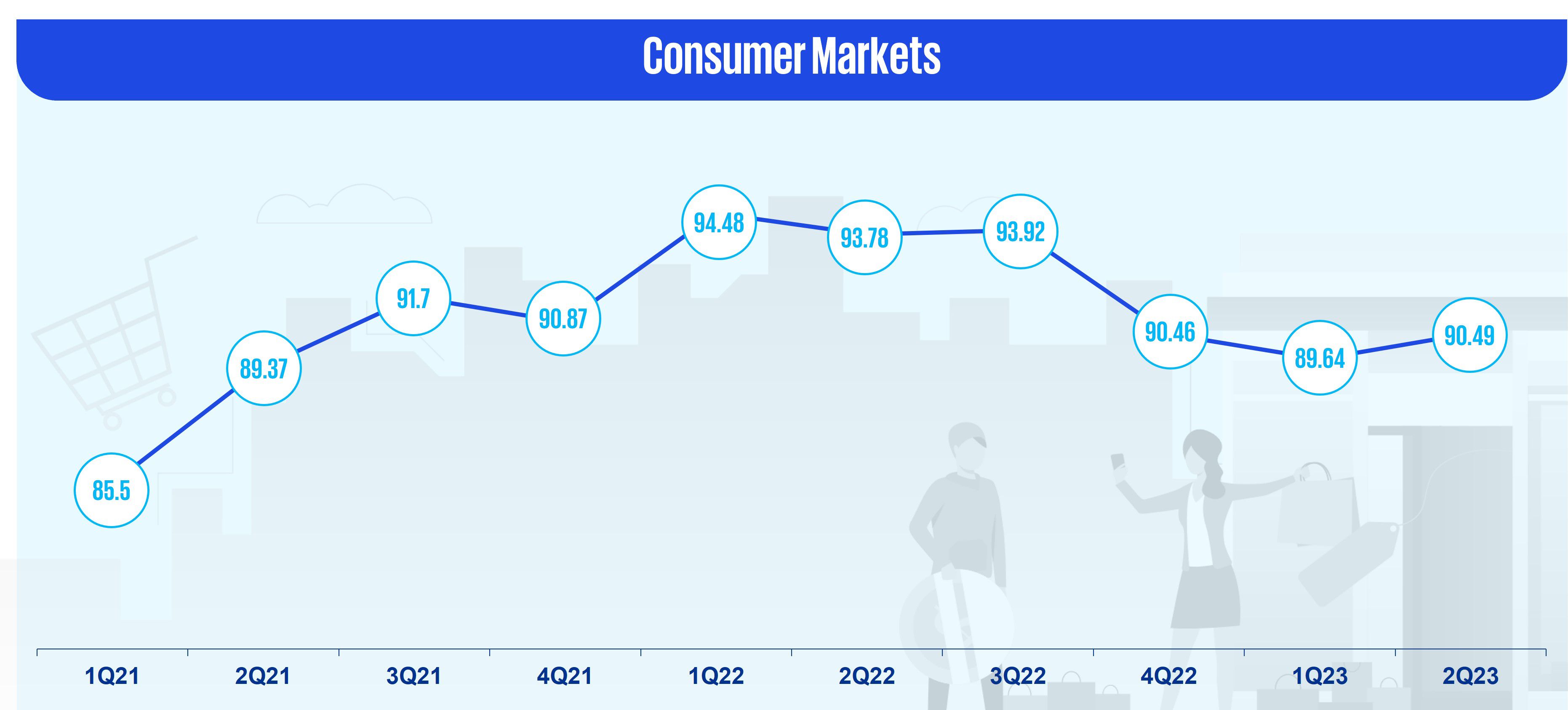

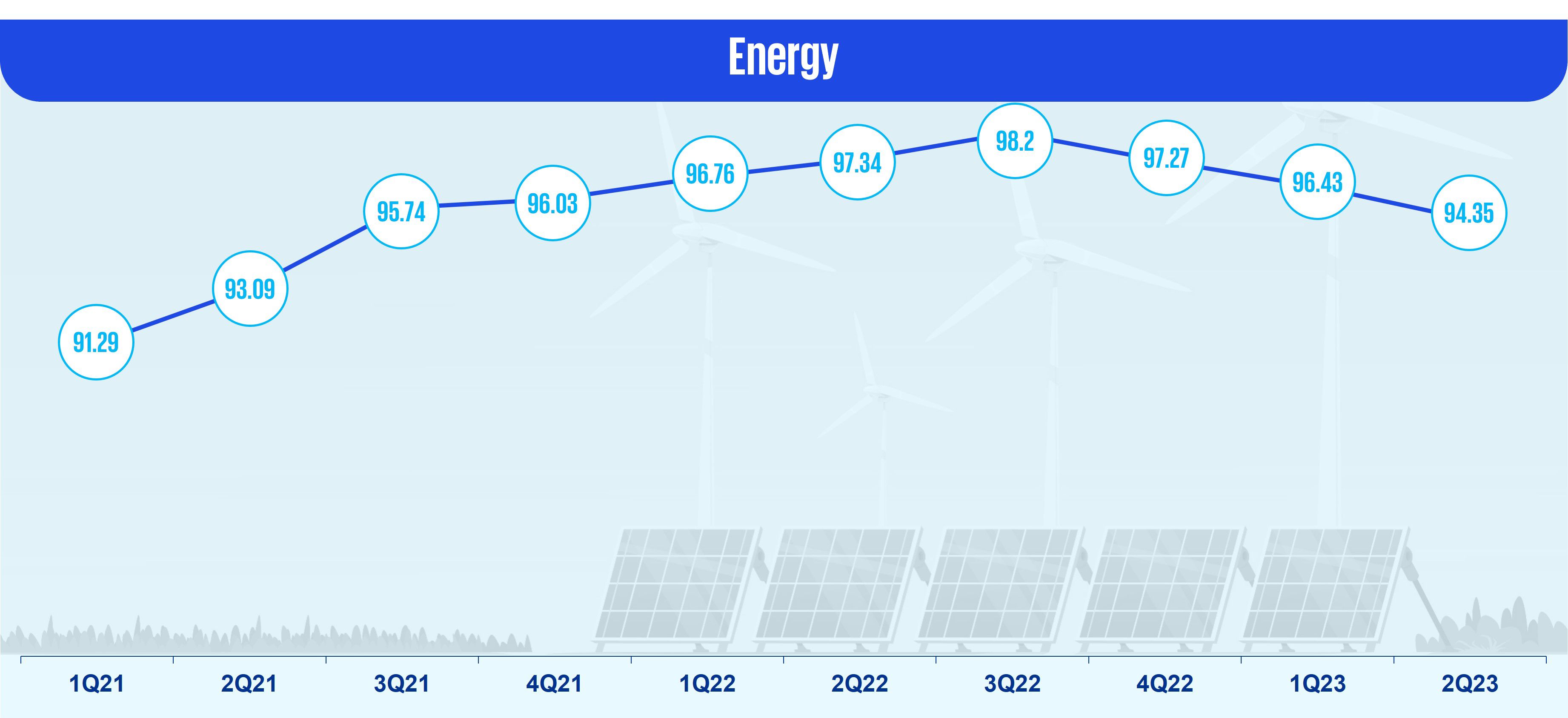

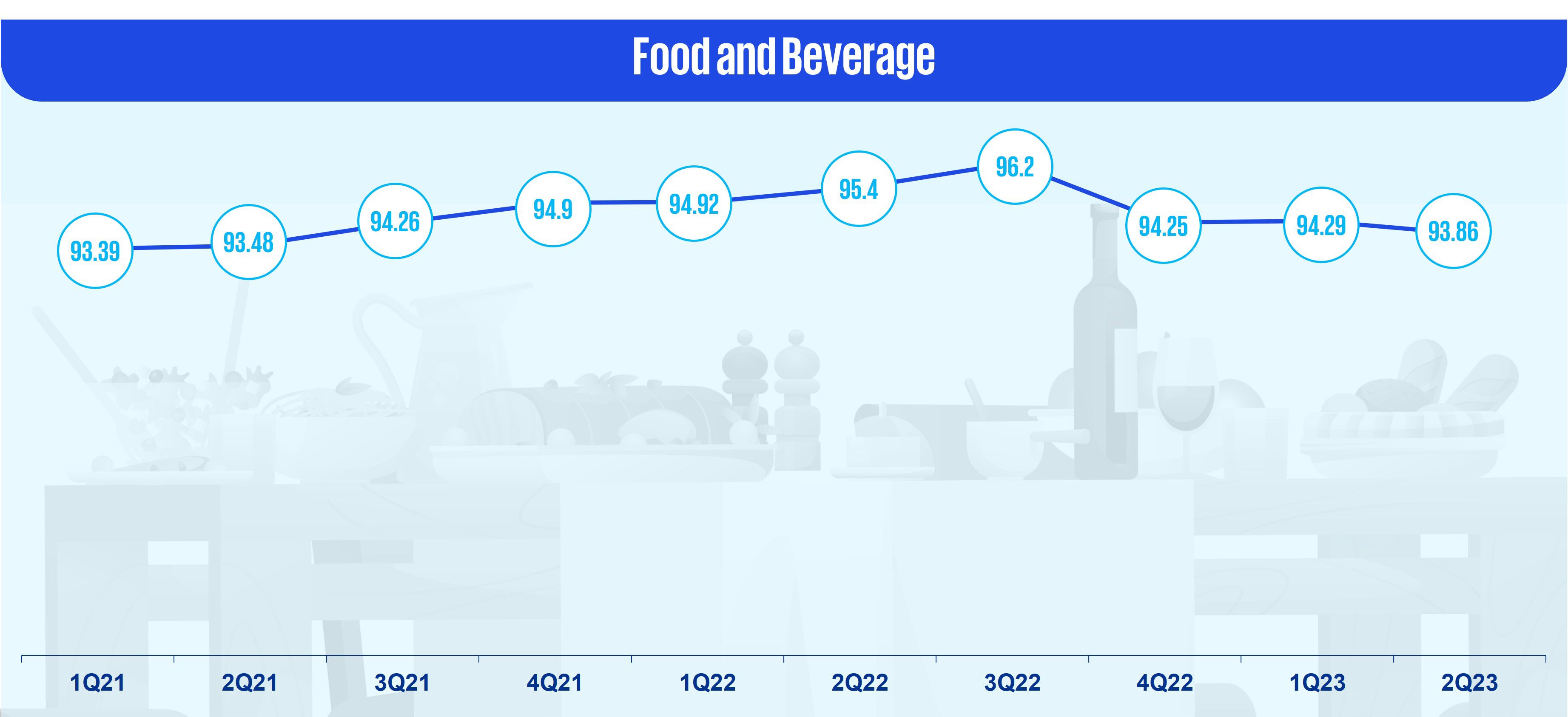

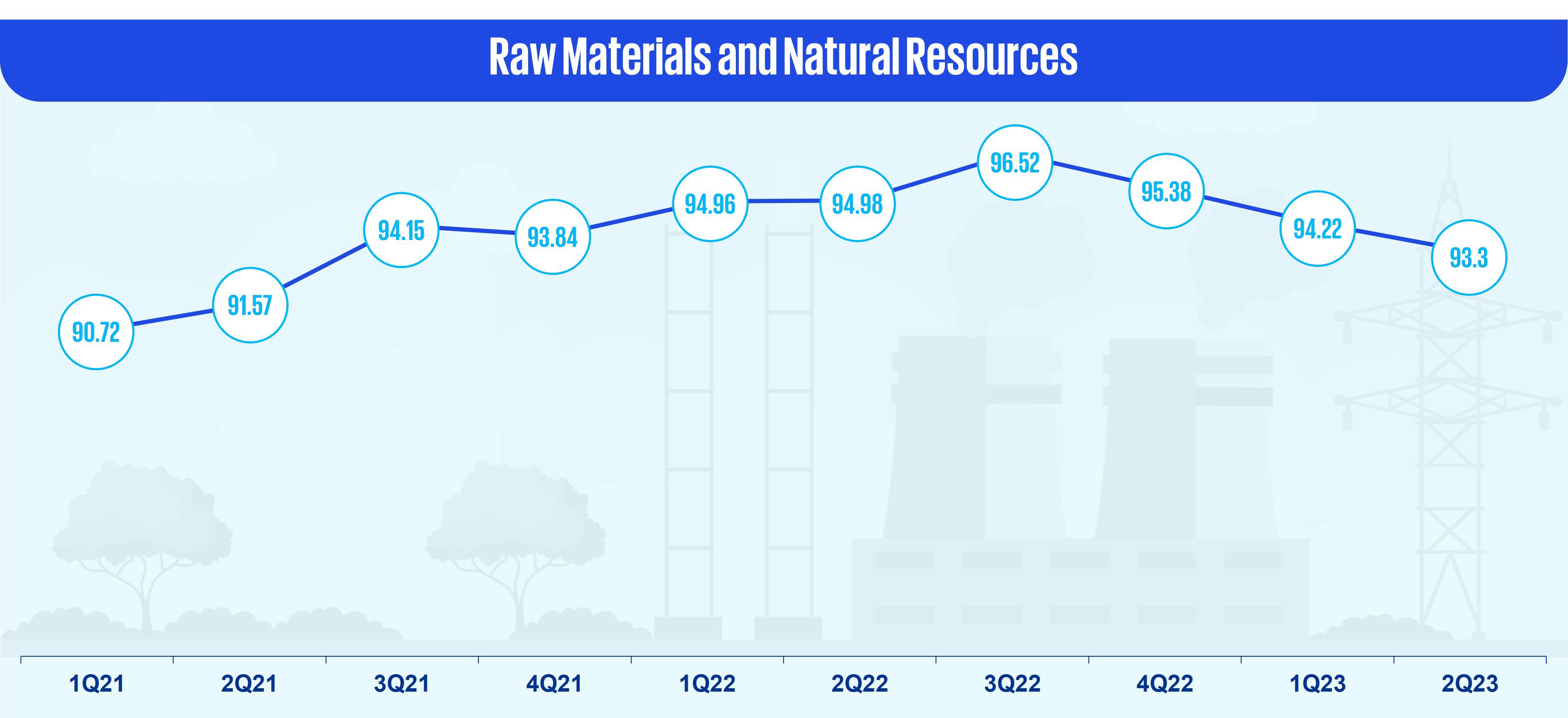

KPMG FPI trends across key industries for the Indonesian economy

About KPMG FPI:

The KPMG FPI is a metric used to measure a company’s financial health by its ‘probability to default’. The analysis has been prepared using John Y. Campbell, Jens Hilscher, and Jan Szilagyi’s probability to default formula which takes into account financial information and market data. The KPMG FPI score ranges from 0 - 100. The lower the KPMG FPI score, the more likely a company is to default. In contrast, the higher the score, the less likely it is to default. In this analysis, released every three months, we analyze the KPMG FPI score movements of publicly listed companies in Indonesia (following the reporting season of full year and half year results) to draw insights into corporate health across the Indonesian economy.

KPMG FPI combines both market and financial information to determine a company’s relative financial distress levels. KPMG believes that combining the two types of information detects deteriorating corporate health more effectively than either source alone.

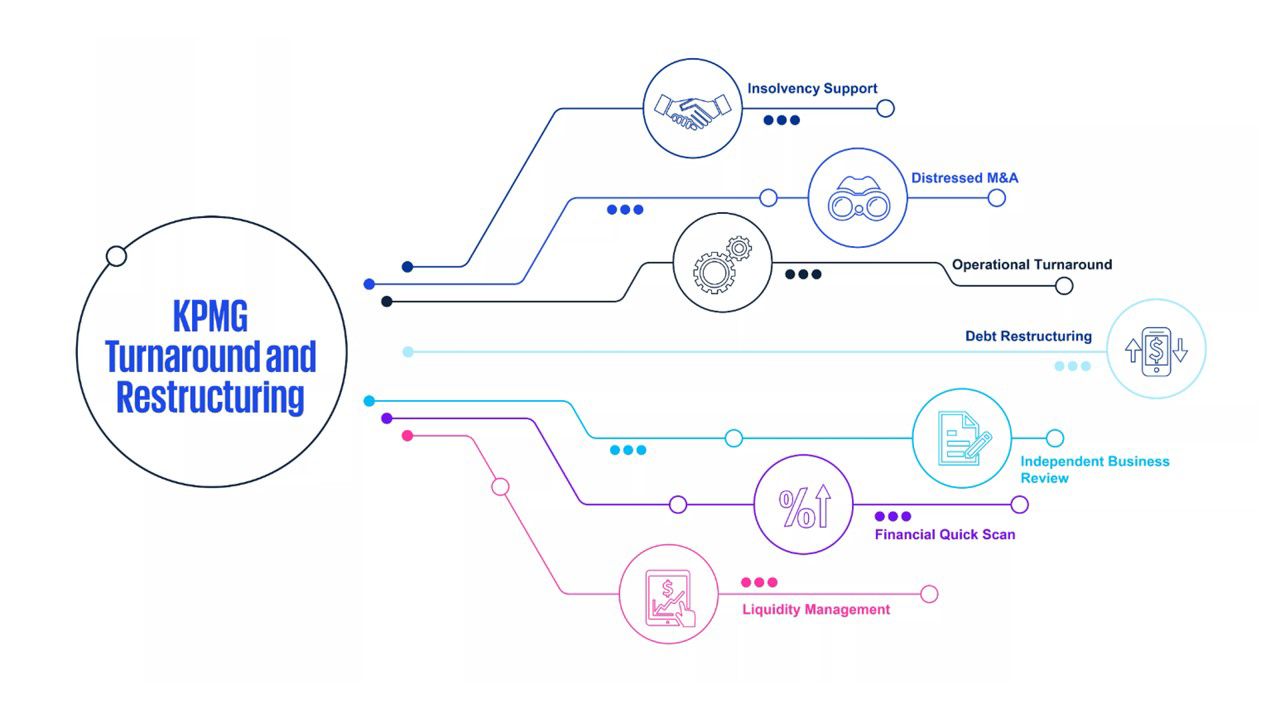

How can we help?

The information contained in this document is of a general nature and is not intended to address the objectives, financial situation or needs of any particular individual or entity. It is provided for information purposes only and does not constitute, nor should it be regarded in any manner whatsoever, as advice and is not intended to influence a person in making a decision, including, if applicable, in relation to any financial product or an interest in a financial product. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. To the extent permissible by law, KPMG and its associated entities shall not be liable for any errors, omissions, defects or misrepresentations in the information or for any loss or damage suffered by persons who use or rely on such information (including for reasons of negligence, negligent misstatement or otherwise).