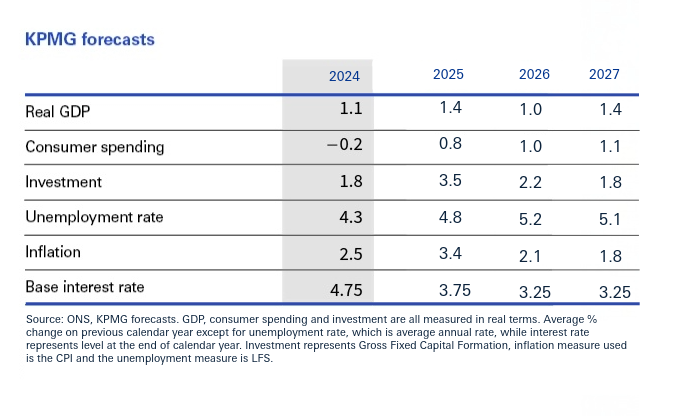

In our UK Economic Outlook – December 2025, we look at the potential impacts from the Autumn Budget, as well as the outlook for inflation and interest rates and the implications for UK economic growth in 2026 and beyond.

Download the report for our full analysis. Or read on for a summary.