Key findings

- Permanent placements fall at sharpest rate since August

- Temp billings decline at quicker, but mild rate

- Starting salary inflation improves and temp pay returns to growth

Data collected 4-17 December

Key findings

Data collected 4-17 December

Summary

Uncertainty around the economic outlook and rising costs weighed on recruitment activity at the end of 2025, according to the latest KPMG and REC, UK Report on Jobs survey, compiled by S&P Global. Permanent staff appointments fell at the quickest rate in four months, while temp billings also declined at a faster pace.

December data also showed that demand for staff continued to weaken, with vacancies for permanent staff falling more sharply than for temporary positions. Fewer job opportunities and widespread reports of redundancies meanwhile drove a further substantial rise in candidate availability. There was a tentative improvement in pay trends, however, with starting salary inflation hitting a seven-month high, while temp wages rose for the first time in three months.

The report is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Staff appointments continue to fall in December

The latest KPMG/REC UK Report on Jobs survey showed another reduction in permanent staff appointments at the end of 2025, extending the current downturn to 39 months. The rate of contraction was the steepest since August, with a number of panel members linking the fall to weak business confidence and concerns around costs. Concurrently, temp billings fell for the second straight month, albeit modestly.

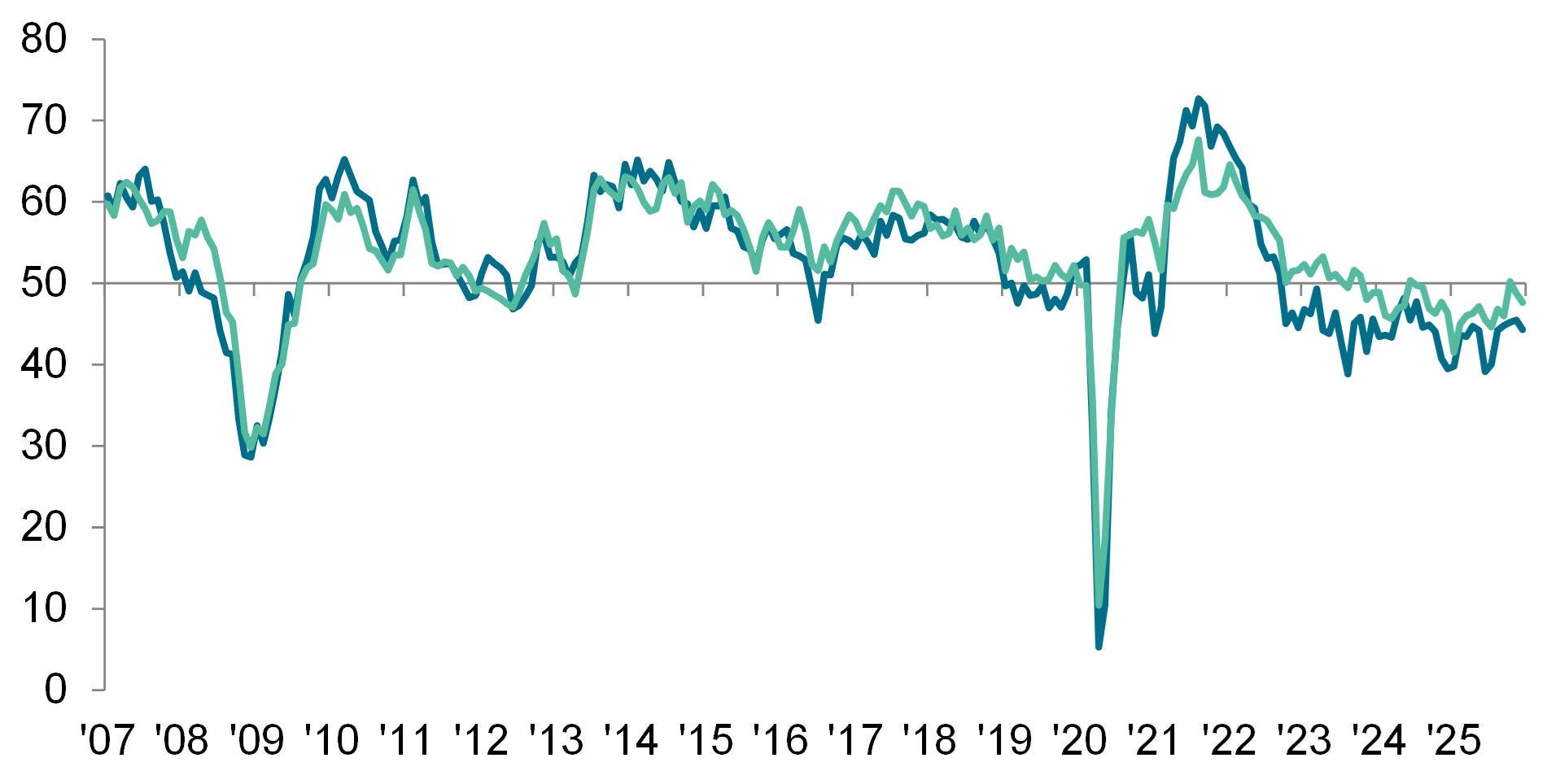

Permanent Placements Index

Temporary Billings Index

50.0 = no-change

Sources: KPMG, REC, S&P Global PMI.

Demand for staff declines at slightly quicker pace

Latest vacancy data signalled another marked reduction in demand for workers at the end of the fourth quarter, with the rate of decline quickening slightly from November. This reflected a stronger fall in permanent staff vacancies, as temporary job opportunities decreased at the softest rate since last June.

Candidate availability rises sharply

Overall candidate numbers continued to expand at a substantial pace in December, with the rate of growth edging down only slightly from November. Redundancies were cited as the main driver of rising candidate supply. Divergent trends were seen by job type, as permanent worker availability increased at the quickest rate in four months, while temporary candidate numbers grew at the softest pace since last April.

Starting salary inflation hits seven-month high

The rate of starting salary inflation continued to recover from September's multi-year low, with permanent pay rising to the greatest extent since last May. However, the increase remained well below the survey's long-run trend. At the same time, temp pay increased at the end of the year after broadly stagnating over the prior two months. The marginal increase in wages was also comfortably below the historical average, however.

Regional and Sector Variations

Marked falls in permanent placements were seen across all four monitored English areas bar the Midlands, where appointments rose slightly and for the first time May.

The Midlands was the only English region monitored by the survey to record an increase in temp billings in December, with the rate of growth sharp overall. However, this was not enough to offset steep declines in London and the North and South of England.

The reduction in demand for permanent staff at the end of the year was broad-based by sector. The sharpest drop in vacancies was signalled for Secretarial/Clerical roles, followed by IT & Computing. Meanwhile, Engineering saw the softest fall in demand for permanent workers.

December survey data indicated that short-term vacancies fell across all ten monitored job categories except Nursing/Medical/Care, where demand stagnated following a mild increase in November. The steepest reduction was seen for Executive/Professional roles.

Comments

Commenting on the latest survey results, Jon Holt, Group Chief Executive and UK Senior Partner KPMG, said:

“The jobs market at the end of 2025 was still signalling caution. After a long stretch of rising cost pressures and higher global economic uncertainty, many firms continue to pause hiring and are flexing where they can by using temporary staff.

“As we head into the New Year, this restraint is likely to remain in the near term. Chief execs who have been prioritising increased investment in tech to improve resilience and productivity, will be looking for signs of greater confidence in the wider economy before turning the hiring taps back on.”

Neil Carberry, REC Chief Executive, said:

“It’s always difficult to draw conclusions from jobs data in December, but the fact that the market slipped back a little on November is a reminder of the pressure employers are under. Nevertheless, the second half of 2025 showed some signs of a long run of negative data softening, and with placements falling at a slower pace than the 2025 average in December there is some hope that we are seeing a December dip, rather than a change in the trend. There is certainly a wider range of experience now, with recruitment in the Midlands growing for both temp and perm roles last month. Activity kicked off this month is what will really tell us if the tide is turning.

“Making this a better year for hiring will require a focus on building business confidence to invest. With the Budget behind us, the government needs to set out a clear path that firms can believe in, from the industrial strategy to pragmatic approaches on the Employment Rights Act, which is worrying many firms.”

Group Chief Executive, KPMG in the UK and Switzerland and Senior Partner

KPMG in the UK

-ENDS-

Contact:

KPMG

Claire Barratt

Deputy Head of Media Relations

T:+44 (0)7923 439264

claire.barratt@kpmg.co.uk

REC

Hamant Verma

Communications Manager

T: +44 (0)20 7009 2129

hamant.verma@rec.uk.com

S&P Global

Annabel Fiddes

Economics Associate Director

S&P Global Market Intelligence

T: +44 (0)1491 461 010

annabel.fiddes@spglobal.com

Hannah Brook

EMEA Communications Manager

S&P Global Market Intelligence

T: +44-7483-439-812

hannah.brook@spglobal.com

press.mi@spglobal.com

Methodology

The KPMG and REC, UK Report on Jobs is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

For further information on the survey methodology, please contact economics@spglobal.com.

Full reports and historical data from the KPMG and REC, UK Report on Jobs are available by subscription. Please contact economics@spglobal.com.

About KPMG UK

KPMG LLP, a UK limited liability partnership, operates across the UK with approximately 17,000 partners and staff. The UK firm recorded a revenue of £2.99 billion in the year ended 30 September 2024.

KPMG is a global organisation of independent professional services firms providing Audit, Legal, Tax and Advisory services. It operates in 143 countries and territories with more than 275,000 partners and employees working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

About REC

The REC is the voice of the recruitment industry, speaking up for great recruiters. We drive standards and empower recruitment businesses to build better futures for their candidates and themselves. We are champions of an industry which is fundamental to the strength of the UK economy. Find out more about the Recruitment & Employment Confederation at www.rec.uk.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world.

We are widely sought after by many of the world’s leading organisations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organisations plan for tomorrow, today. www.spglobal.com.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information (“Data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.