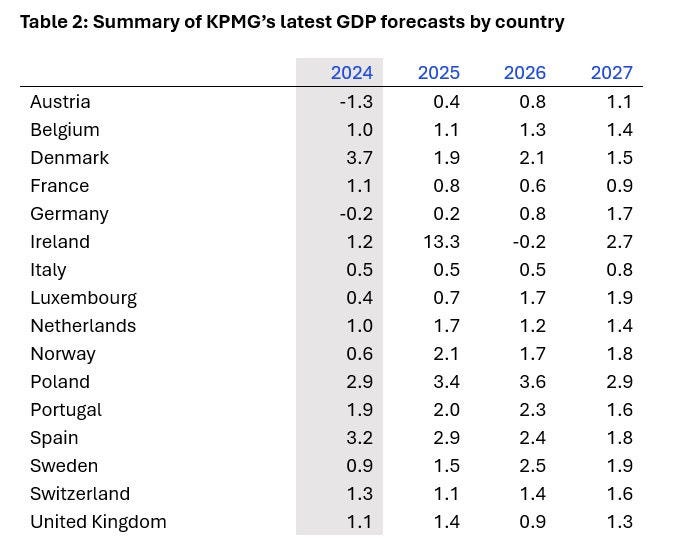

Yael Selfin, Chief Economist at KPMG UK, said: “The outlook for growth in 2026 remains subdued, reflecting the impact of a cooling labour market in northern and eastern Europe and muted household spending across the region. However, there are encouraging signs in the form of increased investment in digital infrastructure and the green energy transition, which are helping to underpin resilience in the medium term. The growth outlook could improve further if policy reforms accelerate project delivery and uncertainty for investors is reduced.

“While fiscal policy is expected to remain broadly neutral in 2026, the anticipated shift towards more expansionary measures in 2027, including increased defence and infrastructure spending, could provide a further boost to growth.”

2026 could mark the end of rate cutting cycle for European central banks

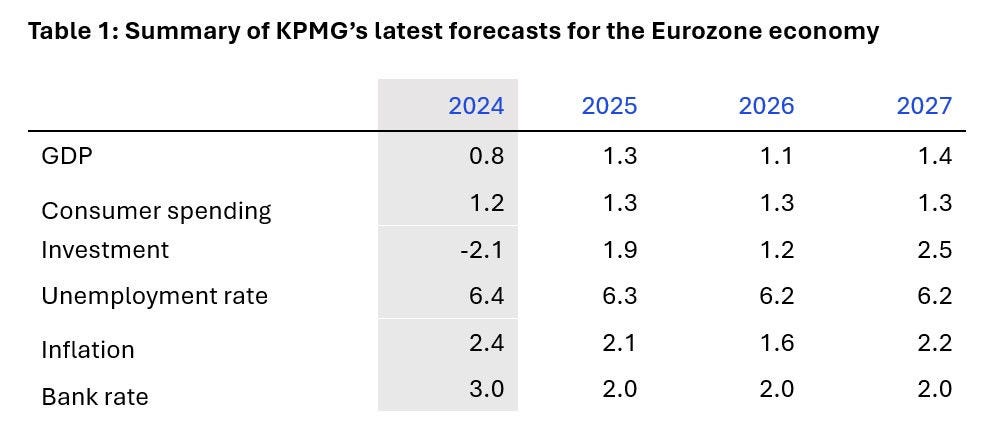

Eurozone inflation is projected to fall to 1.6% in 2026, below the ECB’s 2% target, before edging up to 2.2% in 2027. With inflation near target, major European central banks are expected to keep rates stable through 2026, marking the end of the current rate-cutting cycle.

High energy costs remain a challenge for European industry

Since 2021, industrial electricity prices have increased by an average of 58%, largely due to the shift from Russian pipeline gas to more expensive LNG imports.

While renewables’ share of electricity generation has grown from 34% in 2019 to 47% in 2024, natural gas remains a key marginal supplier, keeping prices elevated. The transition to renewables requires substantial investment in energy storage, grid interconnection, and demand-side management. Until these investments materialise, energy-intensive industries will continue to face competitive pressures, with some production shifting outside Europe.

Supply of rare earth metals pose a strategic supply chain risk

Similar to Europe’s dependence on gas imports, the Eurozone also relies heavily on China for critical raw materials, including rare earths. By 2030, the demand for rare earths is expected to be five times higher because of the growth of green technologies and defence needs. Although Europe has made progress in refining capacity and recycling, it remains dependent on external suppliers for both raw materials and processing. Diversifying Europe’s supply of rare earths away from reliance on China, through trade agreements and investing in domestic capabilities, will be essential to safeguard Europe’s strategic autonomy and support the energy transition.

Yael added: “Persistently high energy prices continue to challenge Europe’s industrial competitiveness, especially for energy-intensive sectors. At the same time, Europe’s reliance on imported rare earth metals highlights the need for greater supply chain resilience as the region accelerates its green transition. Addressing these vulnerabilities, by investing in renewables, storage, and strategic raw materials, will be critical for securing sustainable growth in the years ahead.”