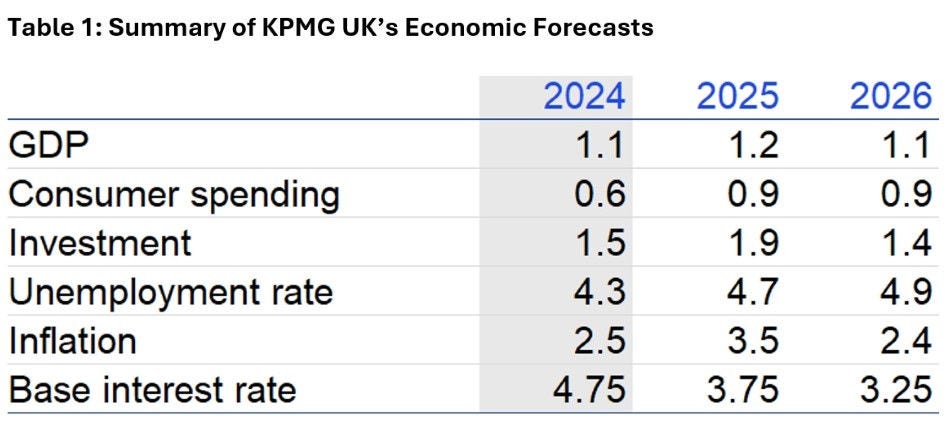

Source: ONS, KPMG forecasts. GDP, consumer spending and investment are all measured in real terms. Average % change on previous calendar year except for unemployment rate, which is average annual rate, while interest rate represents level at the end of calendar year. Investment represents Gross Fixed Capital Formation, inflation measure used is the CPI and the unemployment measure is LFS.

Business investment is forecast to rise to 1.9% this year, but downside risk from policy uncertainty and higher taxation remains. Meanwhile, consumer spending growth is projected at below 1% in both 2025 and 2026, as households gradually reduce savings in response to falling interest rates.

Trade disruption is also a factor. Exports to the US dropped 21% year-on-year by mid-2025 following the imposition of new US tariffs, reversing early gains in Q1.

Yael Selfin, Chief Economist at KPMG UK, said: “While the economy showed resilience at the start of the year, the second half looks more uncertain. Elevated tax burdens, weaker global trade and cautious consumers are likely to keep growth subdued into 2026.”

Inflation to stay above target into late 2026

Inflation is expected to peak at 4% this autumn, with high food prices, labour costs and lingering global supply shocks all adding pressure. Domestic services inflation remains particularly stubborn, with higher employer National Insurance contributions feeding through to prices. KPMG UK forecasts inflation will return gradually to the Bank of England’s 2% target by the mid 2026, helped by easing import costs from a stronger pound and falling oil prices.

One more rate cut likely in 2025

Despite elevated inflation, the Bank of England is still anticipated to lower interest rates once more in 2025, bringing the base rate to 3.75% by year-end. Two additional cuts are projected in 2026, taking the rate down to 3.25%.

Yael added: “With inflation set to remain above target in the near term, the Bank is likely to proceed cautiously. However, with growth slowing and labour market slack increasing, further easing looks likely.”

Labour market continues to soften

UK labour market conditions are predicted to deteriorate further in 2025 and 2026. Vacancies are down 44% from post-pandemic highs, particularly in manufacturing, retail and hospitality. Unemployment is projected to rise gradually to 4.9% by 2026. Wage growth is also slowing, having declined to 4.8% in July. It is forecast to fall to 3.8% by the end of 2025 and return to 3% by mid-2026, more in line with inflation targets.

Fiscal headwinds to shape Autumn Budget

Tight fiscal conditions remain as the Autumn Budget approaches in November. The Chancellor will be aiming to strike a balance between growth focused policy and fiscal discipline, but the challenging environment may suggest tax rises and public spending restraint.

Yael added: “The government faces a tough balancing act. Mounting pressures on health and defence spending, combined with weaker growth, mean difficult fiscal choices ahead.”

Productivity gap with global peers widening

UK productivity remains sluggish with output per hour still below pre-pandemic trends. A 6% drop in intellectual property investment since 2020 as business focus shifted towards tangible assets, raises concerns about innovation and future competitiveness. Only 5.2% of UK firms are currently using AI in production, compared to 8.8% in the US—highlighting a gap in technological adoption.