Permanent salary growth slows to modest pace

Starting salary inflation slowed for the second month in a row in July, falling to its lowest level since March 2021. While there were reports of some companies offering greater salaries for highly skilled candidates, other panellists commented that lower demand for staff, greater candidate availability and concerns around costs had weighed on growth. Temp pay inflation also softened, with wages expanding at a marginal pace that was the weakest in five months.

Availability of candidates continues to improve sharply

The overall availability of staff increased further at the start of the third quarter. Furthermore, the rate of expansion softened only slightly from June, and was the second-sharpest since December 2020. Redundancies, as well as concerns over job security, were reported as key drivers of growth. Permanent staff supply increased at a quicker pace than for temporary workers, but both rose markedly overall.

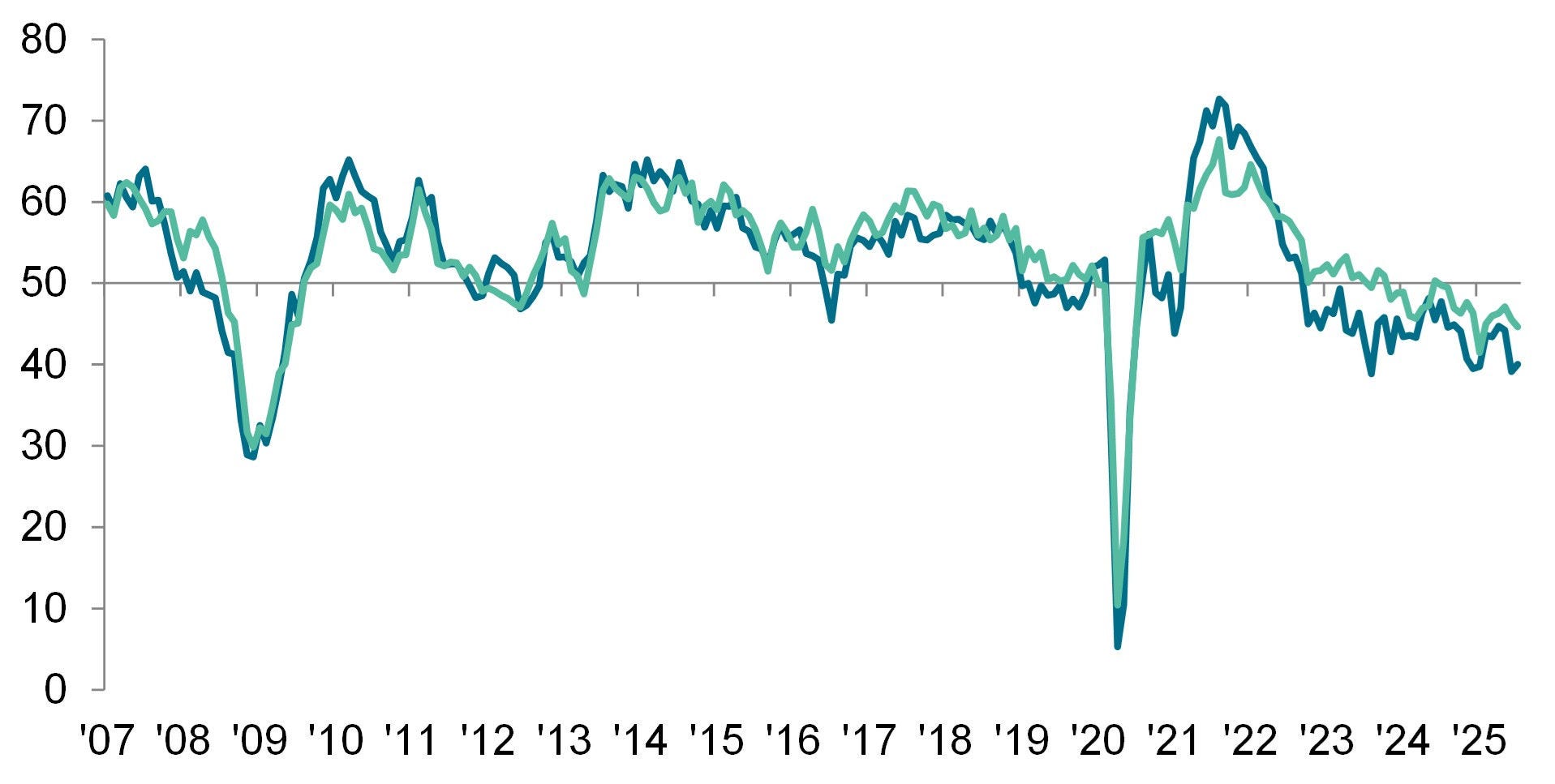

Vacancies fall at quicker rate

As has been the case since November 2023, demand for staff fell during July. Notably, the rate of decline was the most pronounced in three months and rapid overall. Underlying data indicated that permanent vacancies fell at the quickest pace since February, while demand for temp workers dropped at the steepest rate since April.

Regional and Sector Variations

Permanent placements fell across all four monitored English regions for the second month in a row in July. The steepest reduction was seen in the South of England.

Led by London, the decline in temp billings was broad-based across all four monitored English areas, with the Midlands posting its first reduction in three months.

All ten monitored employment categories bar Engineering registered lower demand for permanent staff during July. Retail remained at the bottom of the rankings, posting a rapid fall in vacancies, while the softest decline was signalled for the Construction sector.

Construction and Blue Collar were the only monitored job sectors to post increases in short-term vacancies during July. Of the eight categories to see a drop in demand, Retail and Executive/Professional recorded the most pronounced rates of contraction.

Comments

Commenting on the latest survey results, Jon Holt, Group Chief Executive and UK Senior Partner KPMG, said:

“The labour market cooled in July as chief execs held back from increasing their recruitment budgets. Economic uncertainty, the complexities of AI adoption and global headwinds are all weighing on business planning.

“A larger talent pool has helped temper wage inflation, which helped convince the Bank of England to cut interest rates. While UK plc remains resilient, a further loosening of monetary policy could help boost business confidence. But many firms will continue to pause major investment decisions until there is greater clarity in the Autumn.”

Kate Shoesmith, REC Deputy Chief Executive, said:

"There is a path to jobs market recovery – but it will take co-ordinated action from Government, the Bank of England and business to maximise on any potential upswing.

“With starting salaries and temp pay rising only modestly, it was right to cut interest rates last week. More action like this, to stabilise the business cost-base, is what will support growth and boost the jobs market this year. That is what the Chancellor should be keeping firmly in mind when preparing this year’s Autumn Budget.

“Fluctuations in permanent and temporary job placements signal a labour market that remains resilient but uneven. Construction, a key economic bellwether, has seen a rise in temp vacancies, an early sign of confidence returning. Demand for blue-collar temp roles and permanent engineering jobs also remains steady, offering another glimmer of optimism.

“At the same time, hiring in retail and hospitality are down. Employers in these sectors are pausing due to cost pressures and uncertainty around employment law, although when the turn comes, these industries typically rebound quickly.

"Meanwhile, widespread skills shortages remain, which indicates the need for urgent support from government to upskill and retrain people; while businesses need to act now to secure the talent they will require when hiring picks up later this year, as our separate employer sentiment surveys suggest it will.”