Contacts

KPMG

Claire Barratt

Deputy Head of Media Relations

T: +44 (0)7923 439264

claire.barratt@kpmg.co.uk

REC

Hamant Verma

Communications Manager

T: +44 (0)20 7009 2129

hamant.verma@rec.uk.com

S&P Global

Annabel Fiddes

Economics Associate Director

S&P Global Market Intelligence

T: +44 (0)1491 461 010

annabel.fiddes@spglobal.com

Hannah Brook

EMEA Communications Manager

S&P Global Market Intelligence

T: +44-7483-439-812

hannah.brook@spglobal.com

press.mi@spglobal.com

Methodology

The KPMG and REC, UK Report on Jobs is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

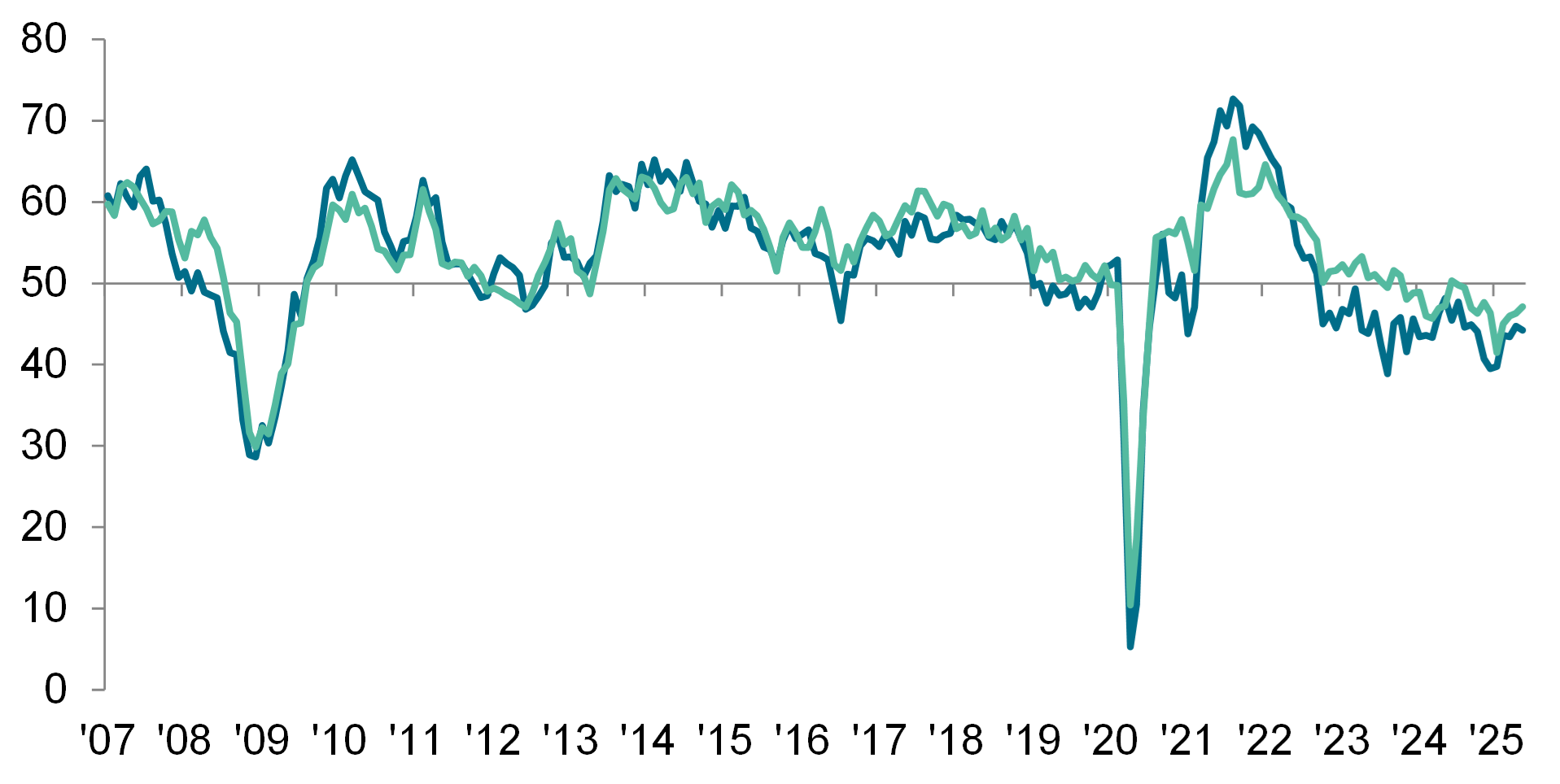

Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

For further information on the survey methodology, please contact economics@spglobal.com.

Full reports and historical data from the KPMG and REC, UK Report on Jobs are available by subscription. Please contact economics@spglobal.com.

About KPMG UK

KPMG LLP, a UK limited liability partnership, operates across the UK with approximately 17,000 partners and staff. The UK firm recorded a revenue of £2.99 billion in the year ended 30 September 2024.

KPMG is a global organisation of independent professional services firms providing Audit, Legal, Tax and Advisory services. It operates in 143 countries and territories with more than 275,000 partners and employees working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

About REC

The REC is the voice of the recruitment industry, speaking up for great recruiters. We drive standards and empower recruitment businesses to build better futures for their candidates and themselves. We are champions of an industry which is fundamental to the strength of the UK economy. Find out more about the Recruitment & Employment Confederation at www.rec.uk.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world.

We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today. www.spglobal.com.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information (“Data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.