- UK growth is expected to slow over the remainder of this year and into 2024.

- With interest rates reaching their potential peak, attention will turn to fiscal policy, however the upcoming general election could prolong the uncertainty for businesses and delay investment.

- Post-pandemic imbalances are starting to normalise, while long-term growth remains a concern.

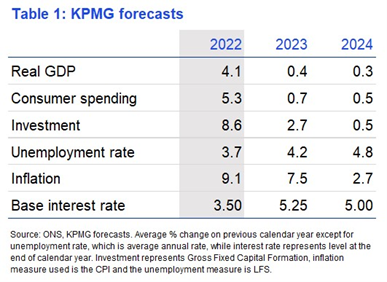

High interest rates, continued uncertainty and low productivity could see the UK struggle to keep its head above water in the second half of the year – with GDP growth forecast at 0.4% in 2023 and 0.3% in 2024, according to KPMG’s latest UK Economic Outlook.

While the labour market is gradually returning to balance, household excess savings are broadly used up and the effect of higher interest rates is now feeding through to investment intentions, transaction volumes and corporate insolvencies, with the full impact on households and housing sectors yet to be felt.

Inflation continues to ease, although it remains above the levels in many western economies. The resolution of global supply chain bottlenecks and the fall in wholesale energy prices have supported the easing of price pressures, however, domestic influences – supported by strong pay growth – have kept inflation higher for longer. This could see inflation returning to its 2% target only by the latter part of 2024.