Within the Autumn Budget published on 26 November 2025, HM Treasury (HMT) announced changes to business rates policy.

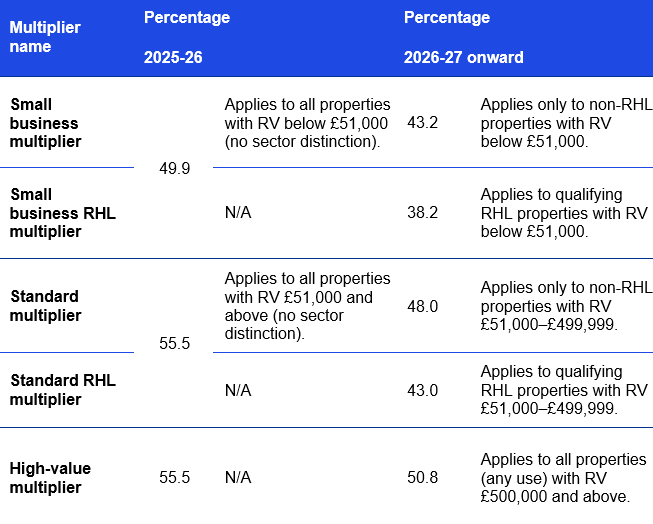

From 1 April 2026, business rates bills in England will be updated to reflect changes in property values as part of the 2026 revaluation, with the last valuation being in 2023. As a result of the revaluation, the Government has adjusted the business rates multipliers that are applied to a property’s rateable value (RV).

HMT has stood by its policy proposals from the Transforming Business Rates Interim Report to permanently lower retail, hospitality and leisure (RHL) multipliers, to deliver the manifesto commitment to rebalance the business rates system and support the high street. HMT also announced a transitional relief package that will support businesses as they transition to their new bills, as well as changes to other reliefs that will support policy objectives.