Retail media has experienced buoyant growth over the past few years, driven by demand and supply side tail winds. However, achieving the next wave of growth will require careful thinking as existing inventory will inevitably begin to run short.

From side hustle to centre stage: The rise of retail media

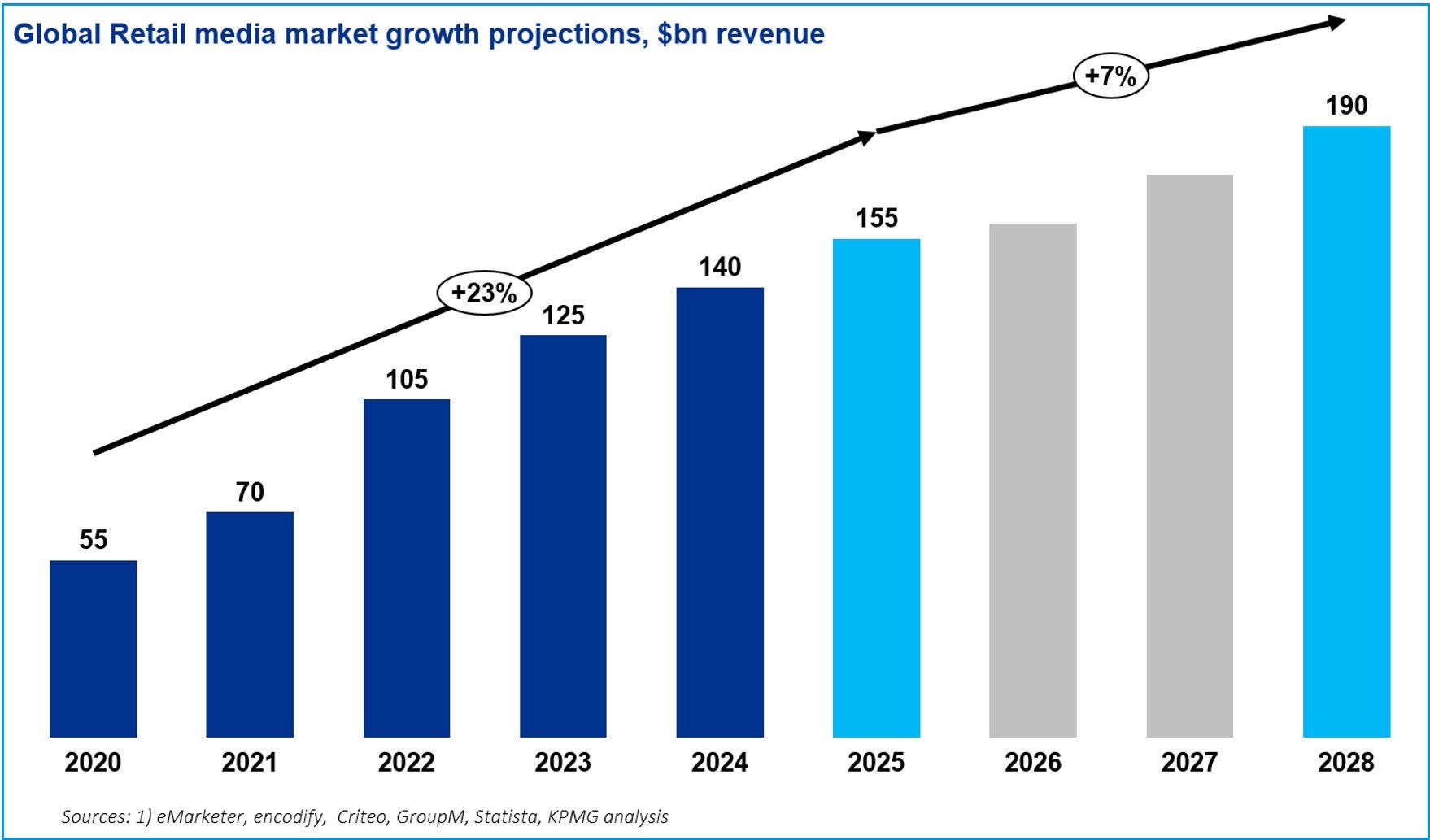

The retail media market has been booming. Globally, the sector enjoyed annual growth of around 23 percent since 2020. In the UK alone, advertiser spend on retail media is expected to top £4.8 billion in 2026 – up from an estimated £4 billion this year[1]. And the data suggests it is capturing a greater share of advertising budgets (16 percent today versus just 11 percent in 2022).

Not surprisingly, the market has become increasingly crowded. At last count, there were more than 270 retail media networks (RMNs) active globally and at least 28 active in the UK.[4]

In part, the rapid growth of the sector has much to do with its innate attributes. Unlike traditional advertising channels that primarily drive awareness, retail media delivers full-funnel benefits – from upper-funnel brand building to lower-funnel conversion optimisation – all within environments where consumers are actively shopping.

This unique value proposition, combined with superior measurement capabilities and direct sales attribution, has attracted significant advertiser investment, with inventory being expanded to keep pace with demand.

Consider, for example, how increasing privacy regulation has impacted demand for first-party data assets. Or how the acceleration of ecommerce has increased the number of digital surfaces where brands can connect with consumers. Going forward, many expect AI to propel the targeting of retail media to a new level in the next few years.

Growing pains: Why RMNs risk running out of headroom to grow

The low-hanging fruit of converting existing physical and digital shelf space into advertising opportunities have largely been harvested. Physical and digital shelf space is finite. And the marginal value of additional inventory is diminishing.

Similarly, those seeking new growth through offsite expansion are finding limitations. Recent analysis suggests that retailer margins for offsite channels (such as non-retail social, CTV, Digital out of Home and so on) offers materially lower margins – 20 to 40 percent versus the 80 to 90 percent retailers can achieve on their own channels.[5] For many, ongoing integration challenges are eroding the slim margins they are already achieving.

Even where growth is on the rise, increasing levels of competition make the fight for market share fierce. For example, in 2024, most brands dealt with 6 RMNs. This is expected to jump to 11 RMNs by the end of 2026.[6] Yet data also suggests many brands are seeking to reduce their complexity with just 35 percent saying they worked with a new RMN in 2024, down from 58 percent the year before.[7] In particular, smaller retailers late to the party are finding it increasingly difficult to capture meaningful advertiser budgets.

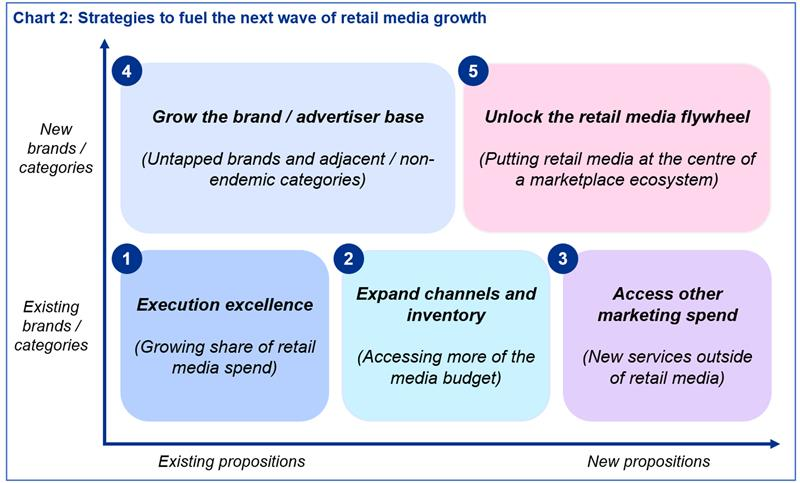

New frontiers: Strategies to fuel the next wave of retail media growth

Based on KPMG’s extensive experience working with the UK’s top retail media players and CPGs, here are five ideas to consider acting on to drive sustainable long-term value creation.

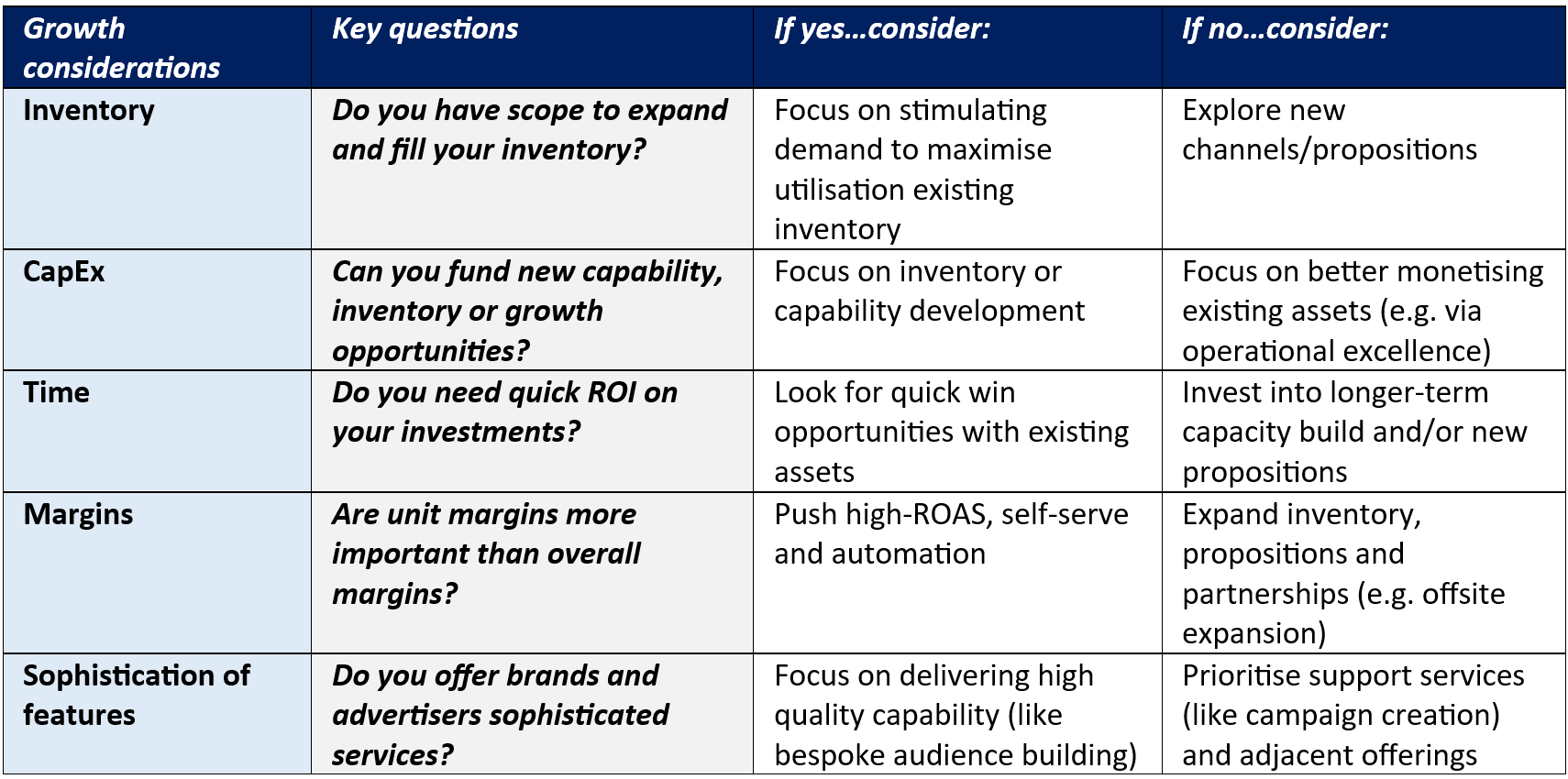

Considerations for growth: Key considerations going forward

While each organisation will need to develop their own unique strategy based on their maturity, ambition and constraints, here are five considerations to help shape your thinking.

The path forward

The shifting market for retail media and the looming inventory ceiling represents both a challenge and an opportunity for retail organisations active in the sector.

At KPMG, our team of strategy, consumer and retail professionals have deep experience helping retailers and brands develop comprehensive retail media strategies that unlock sustainable growth. Contact us today to discuss your unique growth objectives.

Our strategy and growth insights

Something went wrong

Oops!! Something went wrong, please try again

Our people

[1] Retail Media Advertising in France, Germany, and the UK, eMarketer, 22 May 2025

[2] Retail Media Is Now 11% Of Total Ad Spend, Forbes, 7 October 2022

[3] Budgets 2025: Retail media and CTV will dominate adspend, MM+M, 14 February 2025

[4] https://airtable.com/appv96up7Z8K6OL5w/shrTT2rEfH7kfg00K/tbl8dGWUcAul1JBW7?viewControls=on

[5] Retail Media Networks Face Offsite Challenges, MartechView, 2 August 2024

[6] The state of retail media report, skai, December 2024

[7] The future of Retail Media Networks (RMNs) in marketing, okoone, 5 September 2024

[8] More than Half of Retail Media Networks Advertisers Are Reallocating Budgets to RMNs, According to New IAM Study, IAB, 13 September 2023

Get in touch

Discover why organisations across the UK trust KPMG to make the difference and how we can help you to do the same.