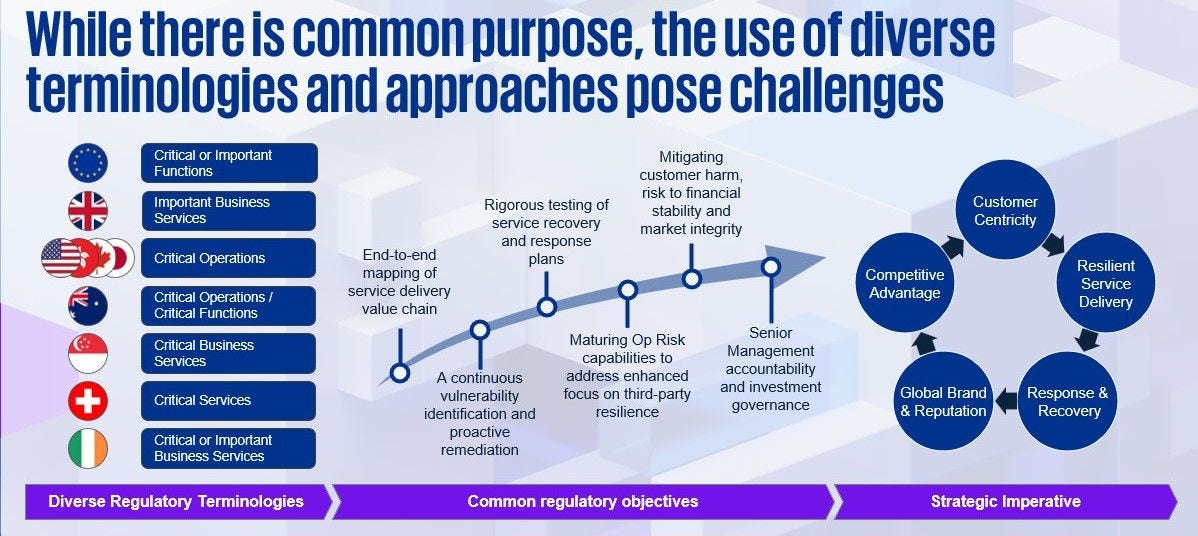

While regulatory terminology varies significantly across jurisdictions – the underlying regulatory objectives remain strikingly aligned. Regulators worldwide are focused on:

The regulatory landscape for operational resilience has evolved into a truly global imperative. What began with the UK's groundbreaking regulatory framework has now expanded across Europe, North America, Asia-Pacific, and beyond. Financial institutions operating across multiple jurisdictions are grappling with an increasingly complex web of requirements – each with distinct terminologies, timelines, and expectations, yet all driving toward remarkably consistent outcomes.

The challenge: Diverse regulations, common purpose

This convergence of regulatory intent, despite divergent approaches, creates both a challenge and an opportunity for global institutions.

The strategic imperative: From compliance burden to competitive advantage

Forward-thinking institutions are recognising that operational resilience represents far more than a regulatory compliance exercise – it is a strategic imperative that directly impacts five critical business outcomes:

Yet despite this clear strategic value, many organisations are undermining their own success through fragmented implementation approaches.

The pitfall of fragmented implementation

Many global firms are falling into a costly trap: establishing separate operational resilience programmes for each jurisdiction in which they operate – effectively creating five, six, or even more parallel programmes within a single organisation. This fragmented approach creates significant challenges:

The solution: Building an enduring integrated resilience capability

Rather than pursuing jurisdiction-specific compliance programmes, leading institutions are developing integrated operational resilience capabilities designed to serve their entire global footprint. This integrated resilience approach delivers multiple benefits:

Key considerations for building an integrated global operational resilience capability

Organisations embarking on this journey should focus on several critical elements:

The path forward

The proliferation of operational resilience regulations represents a watershed moment for global financial institutions. Those that view this landscape as a series of compliance hurdles to clear will find themselves trapped in perpetual catch-up mode, struggling to resource fragmented programmes while missing the strategic value integrated resilience can deliver.

By contrast, organisations that embrace operational resilience as a strategic imperative – building integrated, enduring capabilities that serve both regulatory requirements and business objectives – will emerge as industry leaders. They will demonstrate to regulators, customers, and stakeholders alike that their operational foundations are robust enough to withstand disruption while remaining agile enough to seize opportunities.

The choice is clear: fragmented compliance or integrated resilience. The institutions that choose wisely will not only meet regulatory expectations across jurisdictions but will transform operational resilience from a regulatory burden into a genuine competitive advantage.

KPMG's operational resilience specialists work with global financial institutions to design and implement integrated resilience capabilities that satisfy multi-jurisdictional regulatory requirements while delivering strategic business value. Ready to transform your approach? Connect with KPMG's experts to develop a global integrated resilience strategy that works across borders and drives competitive advantage.

Our advisory insights

Something went wrong

Oops!! Something went wrong, please try again

Get in touch

Discover why organisations across the UK trust KPMG to make the difference and how we can help you to do the same.