Making the most of your technology is vital in the current climate.

Tax reporting is going digital worldwide. The compliance burden is increasing exponentially. And the ESG agenda has put the tax function firmly in the spotlight.

But while the demands on tax functions reach new heights, budgets remain tight.

With little additional resources to help address these pressures, technology will play a central role in the tax function of the future.

The right solutions, properly implemented, will shift your focus from statutory reporting to forecasting and business partnering – adding greater value to the organisation.

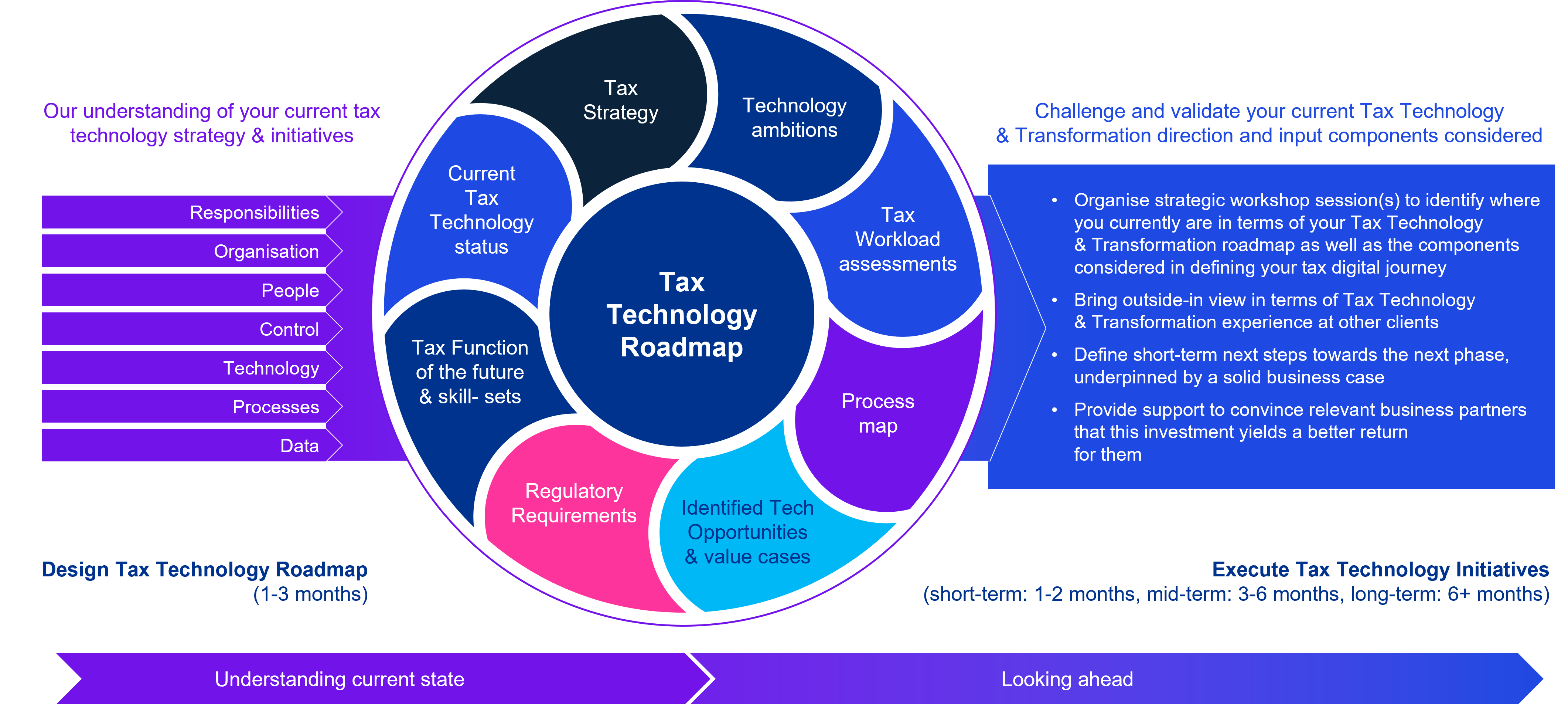

That’s why you need a tax technology strategy and roadmap.