- Weaker growth to leave less room for the Chancellor in the Autumn Budget

- Consumer spending to remain weak as preference for savings rise

- Geopolitical risks could lower UK GDP growth by over 0.3%

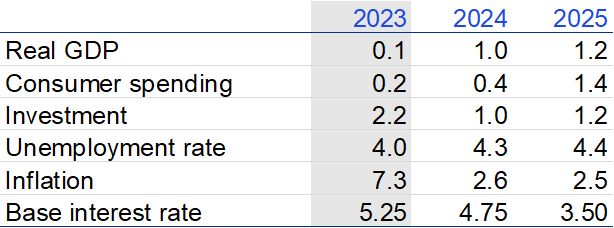

Weaker UK GDP growth will make the Chancellor’s task harder as she finalises the details of her first Autumn Budget. Following a strong start, UK GDP growth is expected to have slowed in the second half of the year, with the economy on course to grow by 1.0% in 2024 overall, and pick-up slightly to 1.2% in 2025 (up from 0.5% and 0.9% predicted in July respectively), according to KPMG’s latest UK Economic Outlook.

The newly elected Government faces a range of urgent spending needs, particularly in health. However, it has very limited headroom to raise revenues, as many of the largest yielding tax increases have been ruled out in the elections manifesto commitments. Minor changes to the fiscal targets, such as switching to a debt measure that includes the Bank of England borrowing, could add only around £16bn of extra headroom.

Yael Selfin, Chief Economist at KPMG UK, commented on the report:

“The Autumn Budget represents the first opportunity for the Chancellor and the new Government to start building the base for stronger growth, one of their principal objectives. It will inevitably require higher levels of public investment. However, the current fiscal framework will make it hard for the government to borrow significantly more. The current set of fiscal targets represents some of the least stringent constraints on public borrowing over the past decade, and relaxing these further could undermine the ultimate rationale of them altogether.”

Source: ONS, KPMG forecasts. Average % change on previous calendar year except for unemployment rate, which is average annual rate, while interest rate represents level at the end of calendar year. Investment represents Gross Fixed Capital Formation, inflation measure used is the CPI and the unemployment measure is LFS.

Inflation could rise to 3% in early 2025, driven by higher energy prices, however slowing pay growth should see a gradual easing in services inflation, allowing headline inflation to return to target by the end of next year. A relatively hawkish Bank of England is expected to cut interest rates only once this year but see base rate fall to 3.5% by the end of 2025.

The series of economic shocks over the last four years and higher interest rates may have contributed to the rise in savings by UK households. The report finds that the significant increase in the proportion of income they put aside for savings could be more permanent, influencing consumer spending patterns over the medium to longer term. KPMG forecasts consumer spending growth of just 0.4% in 2024 and 1.4% in 2025.

UK exports performance has been weak, with goods exports still 15% below the level prior the pandemic. Geopolitical headwinds could put further pressure on exporters performance, as well as overall economic growth. The report finds that, for example, a flat 10% tariff imposed by a country like the US could lead to a reduction in UK GDP growth of around 0.3%. It may also cause firms to postpone investment due to higher levels of uncertainty, further damaging growth.

Yael Selfin concludes:

“Shifts in consumers behaviour, elicited by response to the recent series of shocks as well as by longer-term trends such as an ageing population, coupled with the rise in the complexity of geopolitical risks, mean that businesses will need to closely re-examine both their customer and production strategies.”