Key findings

Staff appointments continue to fall

Pay rates up again, albeit at slower rates

Further uplift in candidate numbers

Data collected July 11-25

Summary

The KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, indicated a decline in permanent staff placements again in July, extending the current downturn to nearly two years. Recruitment consultants reported an increased volume of redundancies at clients. Temp billings also fell, albeit fractionally, as firms chose not to renew or replace expiring temporary contracts.

Nonetheless, permanent salaries continued to increase as firms remained willing to raise starting pay for suitable candidates, which in some cases remained in short supply. However, inflation fell slightly and was below trend. Moreover, as demand for staff fell, temp pay rates rose only slightly and to the weakest degree for nearly three-and-a-half years.

The report is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

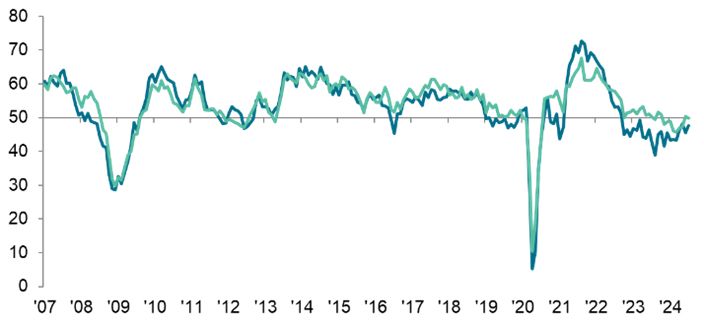

Concurrent declines in permanent and temporary staff appointments

The KPMG/REC Report on Jobs data showed that permanent staff appointments continued to fall in July, albeit at a slower rate. A reduced number of vacancies and subdued demand for staff was reported to have led to the decline in placements. There was also a reduction in temp billings in July, although the rate of contraction was marginal. There was evidence of firms choosing not to replace workers whose contracts had expired.

Permanent Placements Index

Temporary Billings

50.0 = no-change

Pay rates continue to rise

Despite making fewer appointments in July, companies continued to raise permanent staff salaries. The rate of inflation was again marked, though a little softer than in June and below the survey average. Panellists noted that firms were willing to raise pay to attract workers amid a dearth of suitable candidates. Temp pay also increased, although the rate of inflation was marginal and the weakest for nearly three-and-a-half years. Higher temp staff availability weighed on pay rates.

Marginal decline in demand for staff

Vacancy numbers in the UK labour market continued to decline during July extending the current period of contraction to nine months. The pace of reduction was however marginal and slower than in June. Moreover, there was some divergence between permanent and temp staff demand. Whereas the latter recorded slight growth, a modest contraction was seen for permanent workers.

Staff availability rises again in July

The availability of candidates for both permanent and temporary positions continued to rise in July. Rates of growth were softer than in June, easing in each instance to the lowest for five months. Higher staff availability reflected a combination of increased redundancies at firms and a reduction in demand.

Regional and Sector Variations

Latest data showed that permanent placements fell most noticeably in the South of England. In contrast, a modest increase in placements was seen in London.

Temp billings rose in the Midlands and the North of England but fell in London and the South of England.

Half of the sectors covered by the survey showed growth in permanent staff vacancies during July. The strongest increase was for Nursing & Medical Care staff, followed by Engineering. The steepest decline in permanent staff was for IT & Computing.

Temp vacancies were up across seven sub-categories in July, led by Blue Collar and Engineering. The steepest decline in temp vacancies was seen for Executive & Professional workers.

Comments

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“While the Bank of England's easing of interest rates will have provided a much-needed lift to businesses and the investment market, the impact on the economic outlook will not be felt immediately. This latest survey data was gathered before the rate cut, and it gives a subdued picture of the labour market as the downturn moves into its second year.

Despite the stability of a new Government and easing inflationary pressures, employer confidence to recruit has not yet returned, leading to delays with permanent hiring and even a small contraction in the temporary market as worker contracts are not renewed. In the sectors where employers are still hiring, a lack of skilled talent continues to drive pay growth.

With forecasts for economic growth improving and potential further interest rate cuts over the coming months there are green shoots of economic recovery. But it’s still early days for this new Government and businesses may be cautious to hit go on their full recruitment and investment strategies until they have heard more from the Chancellor in her Autumn Budget.”

Commenting, Kate Shoesmith, REC Deputy Chief Executive, said:

“Employers are gradually emerging from the woods, gaining optimism for their businesses and the broader economy.

London is setting the pace with a growth in permanent placements signalling the potential for an economic bounce back elsewhere in the country.

In the private sector, permanent staff vacancies rose in July and temp vacancies grew for the fourth consecutive month – to the highest levels since October last year.

Anecdotes suggest growing demand during this big summer of ‘live’ sport, culture and music has led some in hospitality and leisure to shake off their early season caution on hiring.

The weaker growth in both salaries and temp pay suggests that employers are keeping pay in line with inflation as the Bank of England want and the interest rate cut is welcome. Employers will need more of the same to maintain confidence.

The new government must grasp this greater sense of optimism with labour market reforms that are both pro-worker and pro-business, and that don’t jeopardise the temporary workforce. Agency work allows for the flexibility many people need to work, and employers need access to these types of workers given ongoing skills shortages. Listening to employer concerns about some of the government’s ‘Make Work Pay’ plan is crucial and will underpin future success via productivity gains and economic growth.”