Key findings

Candidates placed in permanent positions fall again

Fastest rise in permanent pay for eight months

Staff availability continues to climb

Data collected June 12-24

Summary

The KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, signalled a further decline in permanent placements in June as general election uncertainty and reduced demand for workers weighed on hiring activity. Companies instead looked to temporary solutions for their staffing needs, with the latest survey data signalling a marginal rise in temp billings for the first time since last October.

Meanwhile, permanent salary growth accelerated since May, hitting an eight-month high as firms remained willing to bolster starting pay to attract candidates and in response to continued cost-of-living pressures. Temporary pay rates also rose further, albeit at reduced pace when compared to May.

The report is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Permanent staff appointments fall again, but slight rise in temp billings

Permanent staff appointments continued to fall in June, according to the latest survey data. Moreover, the rate of contraction accelerated to the steepest for three months amid reports of a lack of demand for staff. There was also evidence that the general election had caused some uncertainty and acted as a brake on recruitment activity.

Firms were instead keener to offer temporary contracts, with the latest data showing a rise in temp billings (albeit marginal) for the first time since last October.

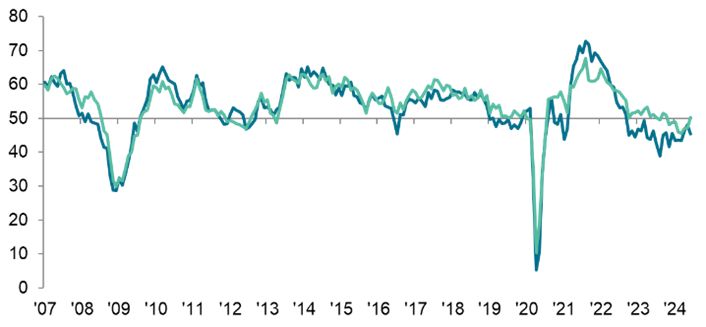

Permanent Placements Index

Temporary Billings

50.0 = no-change

Permanent salary inflation accelerates to eight-month high

Amid reports of a dearth of suitable candidates, plus a recognition of the ongoing cost of living pressures for workers, permanent staff salaries increased again in June. Moreover, the rate of inflation was the steepest recorded by the survey since last October. Temporary staff pay also rose, albeit to the weakest degree for three months.

Demand for staff declines modestly

Overall demand for staff continued to fall in June, extending the current downturn to eight months. The rate of contraction was a little steeper compared to May, though remained modest overall. The contraction was also broadly centred on permanent workers as temp vacancy numbers increased – albeit fractionally – for the first time since January.

Second-fastest rise in staff availability since last November

The availability of candidates to fill roles continued to increase in June, extending the current period of growth to 16 months. Permanent and temporary staff availability both rose sharply, though in each case to lesser degrees than in May. Recruitment consultants reported that the latest increase in the supply of staff reflected a combination of redundancies, slow decision-making amongst clients and a lower number of job openings.

Regional and Sector Variations

Reduced placements were seen across England, albeit to varying degrees. The steepest fall was seen in the South of England, whilst only a marginal reduction was registered in the Midlands.

Growth in temp billings was seen in the Midlands and North of England. In contrast, declines continued to be reported in the South of England and London.

June’s survey revealed that six out of ten broad sectors recorded a drop in permanent staff demand. Secretarial/clerical saw the steepest reduction followed by IT & Computing. In contrast, there was strong demand growth for Engineering.

In line with permanent staff, temporary vacancies declined in six broad categories in June. The steepest fall was for IT & Computing. Where growth was registered, Engineering led the way, followed closely by Blue Collar.

Comments

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“Despite robust national employment data, the latest survey results indicate that employers are still hitting the brakes on recruitment with the general election period causing some uncertainty. Permanent hiring has taken a particular hit, as companies either delay or focus on temporary appointments. This lack of demand means competition for the few roles available continues to drive pay growth.

“There are signs of momentum in the UK's economic outlook with overall inflationary pressure easing and consumer confidence growing as we look towards potential interest rate cuts in the coming months.

“Our economy is slowly turning a corner and the key task for this new Government is to create fiscal policy that improves both long-term macroeconomic conditions and creates stability. This will deliver increased confidence for business investment in the UK - accelerating growth, including in the jobs market.”

Neil Carberry, REC Chief Executive, said:

“Recruiters report companies delayed some permanent hiring decisions during the election campaign. Now a new government has been elected, recruitment firms are looking for that investment to be unlocked. The return of temporary worker demand to positive territory, driven particularly by the Midlands and North, is a sign that the gentle improvement of the last few months is still with us despite the political noise. As policy uncertainty abates, and interest rates drop, we expect permanent hirers to return to the market this summer.

“The incoming government has been clear that growth and prosperity will be their core goal. But only business can deliver this for them – a partnership is necessary. Working with business to make sure the new deal for workers is delivered in a way that businesses can adopt, and which supports the agility workers and employers need, is key. As is reforming the flawed Apprenticeship Levy. There can be no successful industrial strategy that does not have a stable workforce strategy at its heart.”