- Economic performance has slightly improved, but structural headwinds will constrain growth.

- Weakening inflationary pressures should put the Bank of England in a position to begin cutting interest rates from the middle of the year.

- Narrow path to recovery in activity; the upcoming general election could prolong the uncertainty for businesses and delay investment decisions.

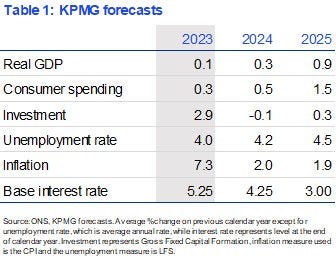

Although economic activity has picked up since the start of the year, the outlook remains weak by historical standards. GDP growth is forecast at 0.3% in 2024, accelerating to 0.9% in 2025, with longer-term economic growth expected to reach just 1% this decade, according to KPMG’s latest UK Economic Outlook.

Inflation is expected to return to its 2% target in the first half of the year, which should pave the way for interest rate cuts from the summer. Interest rates are forecast to fall by 100 basis points this year, settling at 3% in the second half of 2025.

Falling interest rates could spur partial recovery in liquidity conditions, with accumulated ‘dry powder’ aiding a bounce-back in private equity deals. However, the deterioration in access to finance pre-dates the current interest rate cycle and funding costs are expected to remain above earlier lows. So, while short-term recovery in liquidity conditions is on the cards, longer-term issues may be more persistent.