Overall vacancy growth improves to four-month high

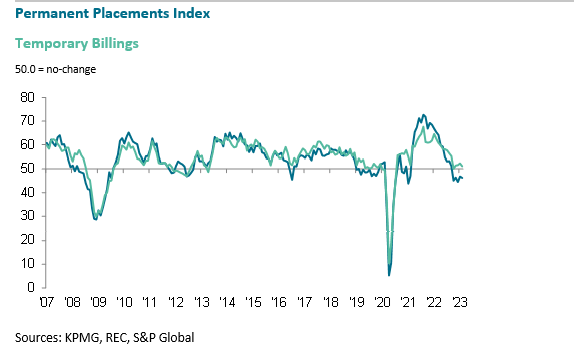

The latest survey indicated that overall vacancies continued to increase during February, with the rate of growth the best recorded for four months. Nevertheless, the upturn remained softer than that seen on average since the survey's inception over 25 years ago. Underlying data signalled that demand for permanent workers expanded at a quicker pace, while temp vacancy growth softened slightly.

Softest fall in candidate supply since March 2021

Recruitment consultancies signalled that the current downturn in candidate availability continued to ease midway through the first quarter. Overall staff supply fell at a mild rate that was the slowest seen for nearly two years, which was underpinned by softer falls in both permanent and temp candidate numbers. Panel members often commented that workers were reluctant to seek out new roles in the current economic climate, while ongoing skill shortages also weighed on staff availability. However, some recruiters noted that the supply of workers had improved due to recent redundancies.

Rates of starting pay continue to rise sharply

The rising cost of living and difficulties attracting and securing suitably skilled staff drove further increases in starting pay for both permanent and temporary roles in February. Permanent starters' salaries continued to rise at a quicker pace than that seen for temp pay, though in both instances the rate of growth was the second-softest for nearly two years.

Regional and Sector Variations

Three of the four monitored English regions recorded lower permanent placements, led by London. The North of England bucked the overall trend and saw a modest upturn.

The North of England saw the steepest increase in temp billings during February. The only monitored English area to report a fall was the Midlands.

Demand for staff continued to expand across both the private and public sectors midway through the first quarter. The quickest increase in vacancies was signalled for temporary staff in the public sector, closely followed by permanent workers in the private sector. The softest upturn in vacancies was recorded for temporary roles in the private sector.

Demand for permanent workers increased across all ten monitored job categories during February. Nursing/Medical/Care topped the rankings once again, while Secretarial/Clerical saw the softest expansion in vacancies.

February survey data indicated that demand for short-term staff rose quickest for Nursing/Medical/Care roles, followed closely by Hotel & Catering. Retail was the only employment area to see a fall in demand for temporary workers.

Comments

Commenting on the latest survey results, Claire Warnes, Partner, Skills and Productivity at KPMG UK, said:

"The current economic outlook continues to impact hiring activity as employers keep playing the short game by focusing on temporary hires, while permanent appointments fall for the fifth month in a row.

"Despite the rate of vacancy growth picking up to the best recorded in four months, candidate shortages remain, with recruiters citing hesitancy to move roles and longstanding, systemic skills shortages. Nursing, care and medical topped the rankings once again with highest demand for workers - both temporary and permanent.

"These factors combined continue to play into pay inflation as employers try to compete with the rising cost of living.

"What the economy needs now more than ever is a skilled workforce."

Kate Shoesmith, REC Deputy Chief Executive, said:

“This is further proof of ongoing demand in the UK jobs market, coming on the back of our most recent Labour Market Tracker report which showed new job adverts at a 14-month high in February.”

Commenting on today’s report, Kate Shoesmith continued:

“As hirers work out what variable economic forecasts might mean for their business and staff, it makes sense that we continue to see temp billings hold up so well. Temporary staffing ensures firms can continue to provide goods and services, and people can grow their careers - even when the economic outlook is unclear. Demand for staff continued to expand across both the private and public sectors. The rising cost of living, plus difficulties attracting and securing suitably skilled staff are also driving increases in starting pay. It will be particularly important to watch for any early trends coming from this data on regional disparities in supply and demand in the labour market.

“What this latest Report on Jobs shows is serious labour and skills shortages are not behind us. The economy stands to lose up to £39 billion in GDP every year from 2024 unless business and government act now. Many businesses are doing what they can but the Spring Budget is the ideal opportunity to find a way forward together. The Chancellor must put people issues first, with innovative and refreshed policies on skills and tackling economic inactivity, and from immigration to childcare.”