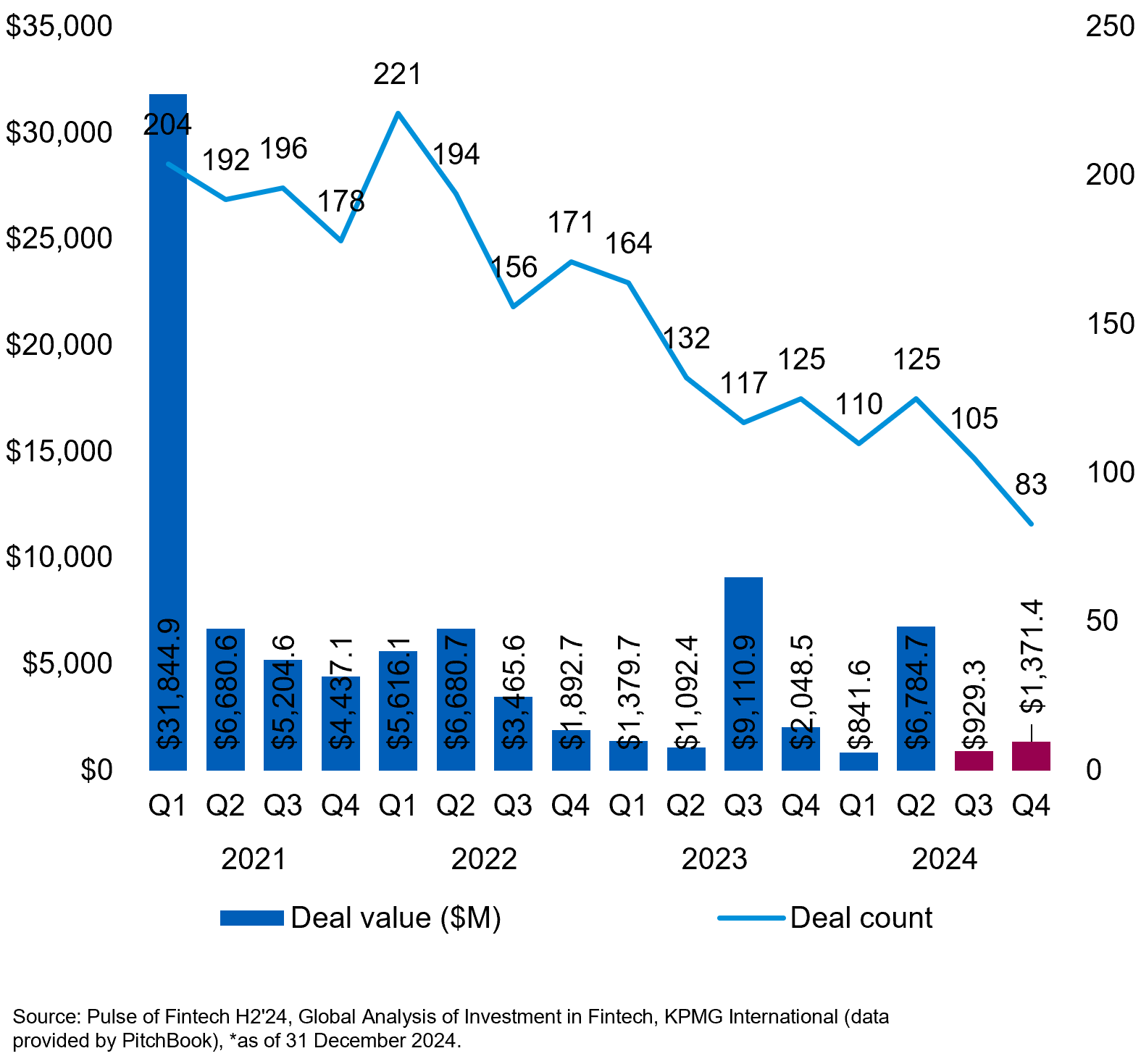

2024 proved to be another challenging year for the global fintech market. In the UK, fintech investment fell by more than a quarter in 2024, dropping from £10.95 billion in 2023 to £7.97 billion in 2024. UK fintech investment in 2024 was at its lowest level since 2020.

Geopolitical uncertainty, high levels of inflation and the higher interest rate environment all contributed to more subdued levels of UK fintech investment, compared to the record highs in 2021. However, the UK still attracted more funding than France, Germany, China, India, Brazil and Canada combined. The largest deal in the UK was the £215M venture funding round by money transfer provider Zepz in H2’24.