Meet EVA - the future face of the invisible bank

Meet EVA

Banking today is hidden from view, obscured behind our day-to-day lives, only surfacing at pivotal moments; getting a job, moving home, retirement. By 2030, technology will drive a fundamental shift in banking. It will change from being hidden to completely invisible. This ‘Invisible Bank’ will be buried in a broader, more digital, connected way of life. Meet EVA, Enlightened Virtual Assistant, our vision of the future of invisible banking.

Driven by the evolution of artificial intelligence, EVA will combine banking seamlessly with our everyday routine. She will be constantly available and can be personalised to your needs, helping you live a comfortable, efficient and well-balanced life.

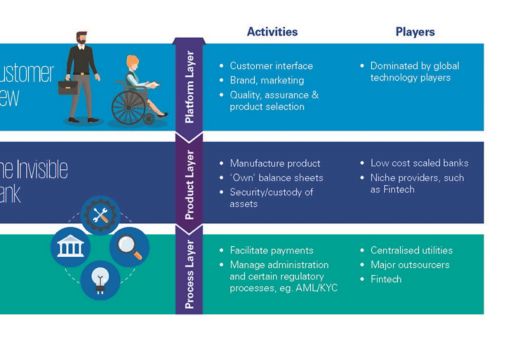

Our vision for retail banking in 2030 is one of a disaggregated industry – with three distinct components.

- The first layer, EVA, is the platform layer. She combines all of the many other services provided by smart tech with banking.

- The second layer is the product, which will become more flexible and customer centric.

- The process layer will bring a new wave of utilities to operate the transactional infrastructure of banks.

Technology is an unstoppable driving force and banking is only at the beginning of its transformational journey. The Invisible Bank is one possible future of how that journey will play out and EVA is a challenge to examine the potential challenges and opportunities it may bring.

EVA represents a future challenge to banking but if navigated well, it has the potential to offer an array of opportunities for your business. Our report outlines how you can exploit those opportunities.

Read the full report