Global VC investment dropped to $75.9 billion across 7,520 deals in Q1’24

Global VC investment dropped in Q1’24, despite four $1 billion+ megadeals. The total number of VC deals globally also declined quarter-over-quarter, particularly Series D+ rounds. Ongoing market challenges — including the lack of exits, high interest rates, and continued geopolitical uncertainties — kept VC investors cautious during Q1’24. In addition to scrutinizing potential deals more heavily, VC investors also showed less willingness to provide bridge funding to their existing portfolio companies, driving startups to increase their focus on cost cutting and achieving profitability.

Read more on the global trends page ›

Despite large AI deal, VC investment in US falls amid exit drought

VC investment in the US fell from $40.1 billion in Q4’23 to $36.6 billion in Q1’24, while deals volume dropped from 3,457 to 2,882 over the same period, as VC investors continued to show caution when making large deals given the protracted lack of exit opportunities. AI and cleantech accounted for the biggest deals of the quarter, with AI firm Anthropic raising $4 billion, a $704 million raise by battery company Ascend Elements, and a $675 million raise by Figure AI.

Read more on the US trends page ›

VC investment and deals volume both decline in Americas

VC investment in the Americas dropped from $43 billion across 3,878 deals in Q4’23 to $38 billion across 3,205 deals in Q1’24. No key jurisdiction was immune, with the US, Canada, Brazil and Mexico all attracting lower investment in Q1’24 compared to Q4’23.

Read more on the Americas trends page ›

VC investment in Europe rises on back of mega-deal

VC investment in Europe rose from $15.1 billion in Q4’23 to $17.9 billion in Q1'24, buoyed by a large $5.2 billion raise by H2 Green Steel in Sweden. With few exceptions, VC investors in Europe continued to show caution given the challenging geopolitical and macroeconomic environment, including the high interest rate environment; while interest rates have smoothed, there is little sign that they will decline to a significant degree in the near future

Read more on the Europe trends page ›

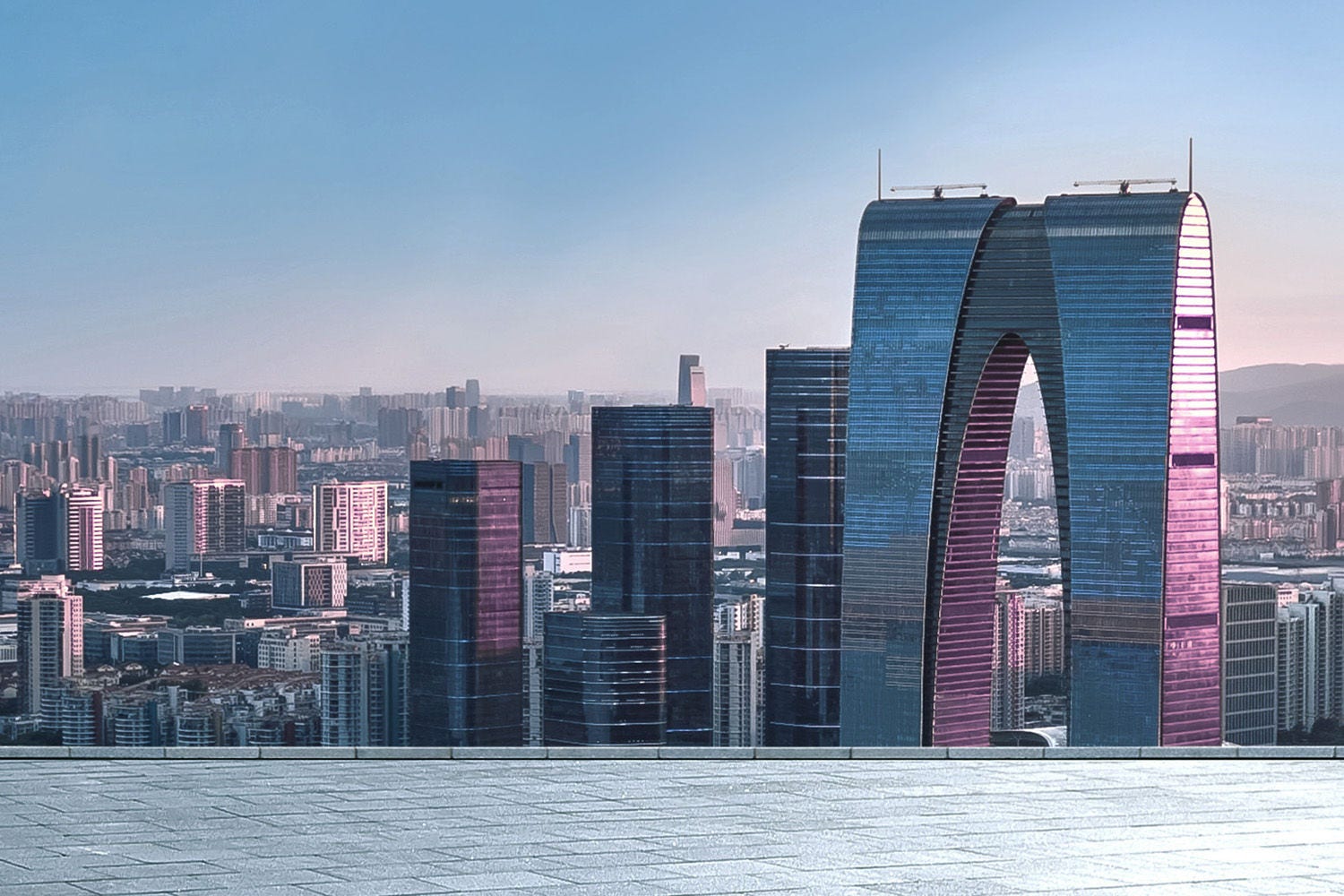

VC investment in Asia Pacific region sees weak start to 2024 despite three $1 billion+ deals

Both VC investment and the total number of deals in Asia dropped quarter-over-quarter, falling from $22.9 billion across 2,920 deals in Q4’23 to $18.9 billion across 2,305 deals in Q1’24. This decline came despite three large deals in China, including a $1.1 billion raise by EV company IM Motors, a $1 billion raise by AI-powered smart chatbot company YueZhiAnMian, and a $940 million raise by internet and communications satellite company Yuanxin Satellite.

Read more on the Asia trends page ›