* FTEs = Full-time equivalents

Welcome to the 5th edition of the KPMG Large-scale Management Companies & Alternative Investment Fund Managers Survey. The past 12 months have been characterized by an increased level of economic and political uncertainty, which is also reflected by Management Companies (ManCos) and Alternative Investment Fund Managers (AIFMs) in their quest to re-evaluate existing operations and enhance efficiency.

We have observed a strategic shift among ManCos and AIFMs towards business simplification and cost optimization. This transition emphasizes a renewed focus on their core business activities while also addressing initiatives related to non-core functions.

We extend our sincere thanks to all participants - both our long-standing contributors who continue to share their valuable insights each year, and the new voices who have joined us for the first time.

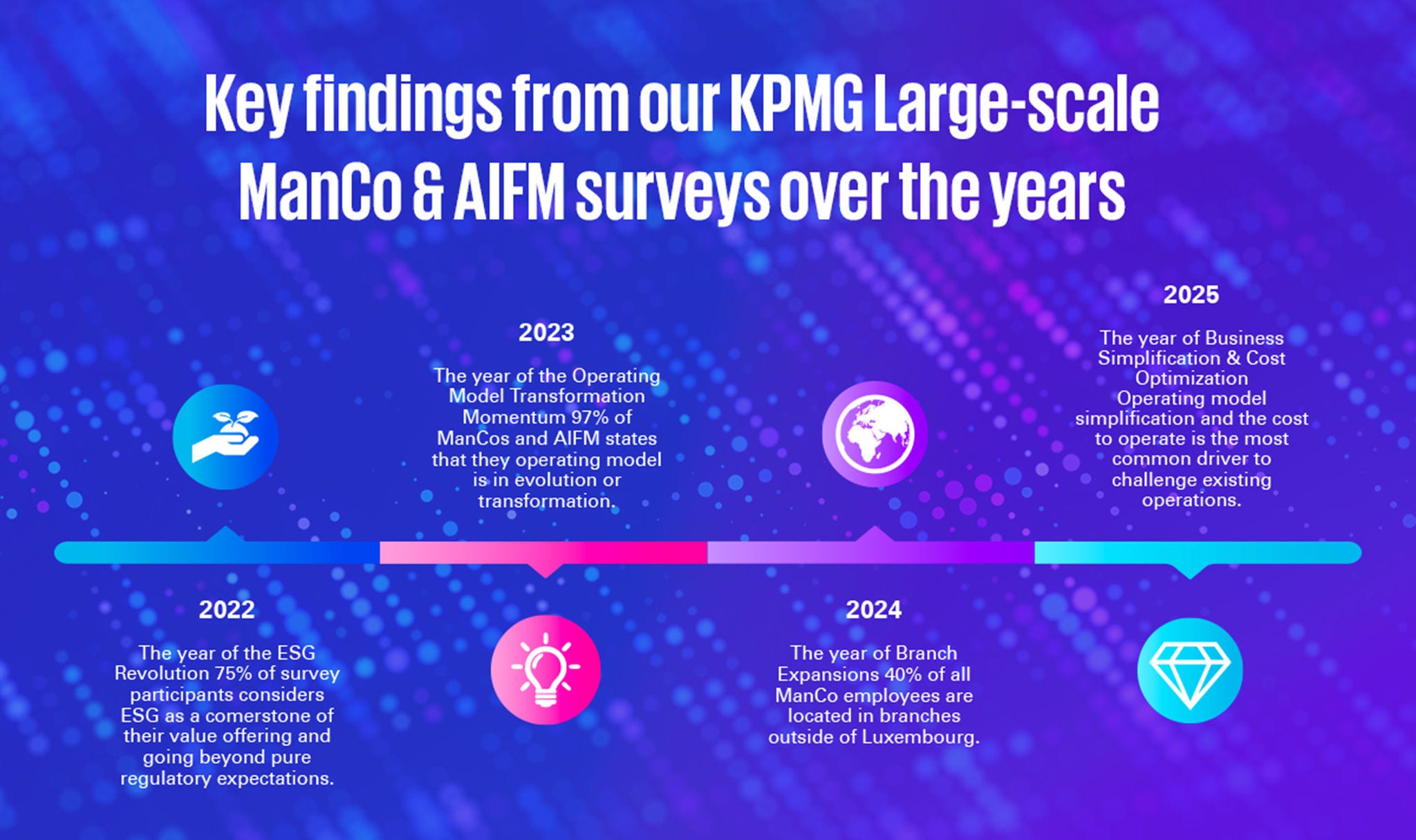

The evolution of the ManCo operating model since 2022

Our Survey in numbers

Our methodology

For our Survey, we deliberately targeted a population of survey participants sharing common characteristics by focusing on the largest in-house ManCos and AIFMs in their respective peer groups, as well as by excluding pure-play third-party ManCos. Beyond the pure size of the book-of-business, our Survey focuses on qualitative operating model themes that lead to practical complexities operations, notably the complexity of the delegation network, the breadth of ancillary services provided by companies (such as MiFID services), the nature and activities performed in branches, and the integration of major transformation initiatives.

Based on this complexity assessment, our Survey benchmarks the operating model complexity of survey participants against their peer group, highlighting both characteristics that are aligned to common peer group practice and unique drivers of business complexity that are specific to the service offering.

The three dimensions of the ManCo operating model transformation journey

In the ever-evolving landscape of Management Companies and AIFMs, staying competitive requires continuous adaptation and transformation. The journey of the ManCo operating model transformation can be understood through three distinct dimensions:

- Dimension 1

- Dimension 2

- Dimension 3

Protect the core

ManCos need to ensure that their foundational operations remain robust and compliant, providing a stable base for further growth and innovation:

- Regulatory risk mitigation and preparedness for regulatory inspections

- Strengthening governance and local substance

- Re-calibration of ESG strategies in relation regulatory expectations and realities of available data

Re-think and evaluate the core

A majority of ManCos dedicated to offer a broader range of ancillary activities and client services beyond the pure regulatory remit to adapt to changing market demands:

- Becoming a Center of Excellence for strategic and deliberate value-add activities that are performed locally

- Expand branches activities towards a European Business Management Center

- Manufacturing and managing an evolving product spectrum and target market (ELTIFs, UCI Part II, Active ETFs, tokenized funds, etc.)

Operate the non-core

By identifying and subsequently outsourcing non-core operations, ManCos can streamline their processes, reduce costs, and improve overall efficiency while focusing expertise and resources on core activities:

- Rationalization of the universe of delegates and third parties to streamline oversight responsibilities

- Expansion of Managed Service Outsourcing to offload volume-driven reporting obligations

- Exploring centralized data management solutions and dedicated tools as well as increasingly leveraging AI applications to automate processes