T+1 in Europe – Navigating uncharted waters

After the US market transitioned to T+1 settlement in May 2024, it is now Europe’s turn to undertake this transformative shift in securities processing by October 2027. As preparations get underway, it is becoming evident that the old continent is not only more diverse but may also reveal some unforeseen challenges for the asset management sector

T+1: Europe‘s transformative shift in securities settlement

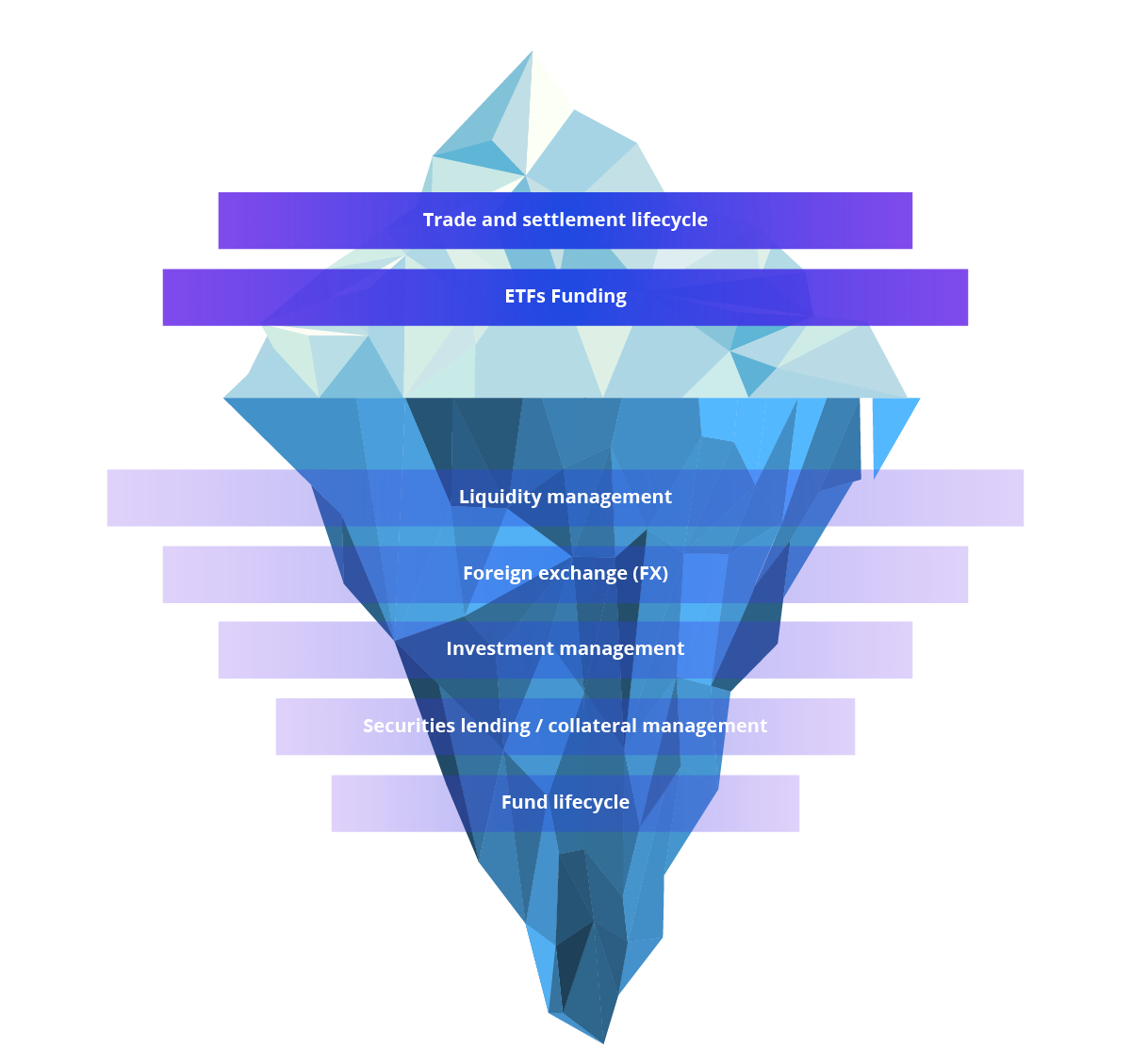

Following the lead of the US and other financial markets, the European Securities and Markets Authority (ESMA) has proposed moving from the current T+2 to a T+1 settlement cycle, with 11 October 2027 set as the target implementation date in the European Union. This initiative is being coordinated with both the UK and Switzerland, which plan to adopt the new regime on the same day, marking a significant step forward in enhancing market efficiency across the continent. The regulatory framework for this transition will be established through an update to the Central Securities Depositories Regulation (CSDR). It is important to note that while almost all publicly traded securities will fall within the scope of T+1, traditional investment funds are currently excluded, as – apart from Exchange Traded Funds (ETFs) – they are generally not listed on official trading venues.

Navigating Europe’s complexities

While the advantages of T+1 settlement are evident, the transition also presents significant challenges. Despite substantial harmonization efforts in recent years, Europe’s financial landscape remains a patchwork of fragmented regulatory frameworks, diverse national market practices, and distinct infrastructural characteristics. In contrast to the relatively uniform securities market in the US, Europe comprises multiple trading venues, central counterparties (CCPs), payment systems, and central securities depositories (CSDs), each with its own unique features. Furthermore, the presence of nine different currencies (including the UK and Switzerland, but excluding Bulgaria) adds complexity, creating an immediate need to enhance foreign exchange (FX) processing capabilities well beyond the current recommendations of the EU T+1 Industry Committee.