Europe's transformative shift in settlement cycles

In the evolving global finance landscape, Europe is preparing for a transformative shift. The European Securities and Markets Authority (ESMA) has proposed the transition to a T+1 settlement cycle, targeting 11 October 2027 as the implementation date. This move is aligned with both the UK and Switzerland, who are planning to transition on the same date, redefining market efficiency and security across the continent.

According to ESMA, equities, Exchange-Traded Funds (ETFs), as well as related securities lending and borrowing activities are expected to experience the most significant effects. Repurchase agreements (repos) and sovereign debt will also be impacted, though to a somewhat lesser extent. It’s worth noting that while nearly all publicly traded securities will be in scope, traditional investment funds are currently not directly impacted by the T+1 requirement, as they are generally not traded on public markets.

Europe’s move to T+1 seeks to build on the lessons learned during the successful U.S. transition to T+1 in May 2024, when market participants experienced productivity gains through new levels of automation.

The imperative for change and related benefits

The transition to T+1 settlement is driven by a compelling need for greater efficiency, reduced risk, and global alignment. One of the primary objectives of this shift is to achieve a significant reduction in the post-trade processing period, making real-time exception handling and automated reconciliation fundamental priorities. As financial markets evolve, T+1 offers transformative benefits that will enhance operational effectiveness and strengthen market stability. Several benefits will be harvested:

- Risk reduction: Faster settlements minimize exposure to counterparty defaults and market volatility, strengthening financial stability.

- Technological advancement: The move encourages financial institutions to modernize their IT infrastructure, enhancing overall system reliability and performance through STP and automation while reducing manual interventions.

- Liquidity enhancement: By expediting settlements, capital will be freed up sooner, increasing liquidity and fostering more market activity.

- Global integration: Aligning with key markets like the U.S., Canada, and Mexico reduces fragmentation while strengthening Europe’s competitiveness and investor confidence.

- Operational & cost efficiency: By streamlining workflows and integrating systems, operational costs will be reduced and resource allocation optimized.

Although the transition poses challenges, T+1 is a pivotal leap toward a more resilient, efficient, and globally synchronized financial market—one that fosters stability, boosts liquidity, and defends Europe’s competitive edge.

Navigating the complexities

Europe’s financial market complexity

While the benefits of T+1 are clear, the transition does not come without its challenges. Europe's financial landscape is a mosaic of diverse currencies, regulatory environments, and infrastructural idiosyncrasies. Unlike the more centralized markets of the US, Europe features numerous trading platforms and central securities depositories (CSDs), each with its unique features.

Figure 1. US and Europe financial landscape (TPlus1Settlement, April 2022, AFME)

Operational processing complexity

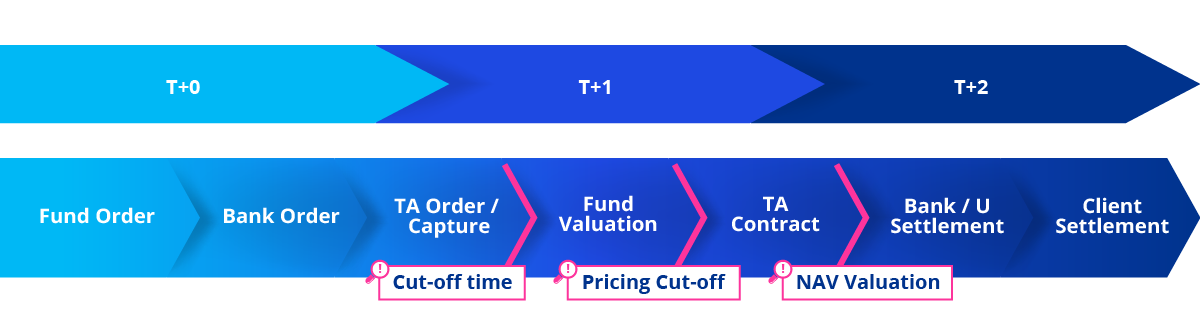

Under the new regulation, the securities' life cycle shortens from two days to one day after trade execution. Consequently, a compressed settlement will require significant changes to the European financial sector’s infrastructure and processes. The planned acceleration will be achieved by shifting allocation, confirmation, and trade-level matching to the trade date, a goal that can only be reached by targeting close to full automation.

Figure 2. Securities life cycle, T+2 settlement

Achieving T+1 will require extra effort from the European side:

- Trade-date affirmation and matching: Shifting these processes to the trade date is essential.

- Near-full automation: Seamless integration is critical, as manual processing won't meet the compressed timelines.

- Enhanced error handling: New processes and tools are required to quickly reconcile trade matching fails

- Better coordination: Improved collaboration among market participants is needed.

- Significant technology upgrades: Substantial investments in technology and process enhancements are necessary.

Additionally, challenges such as the timing mismatch with FX transactions must be addressed to ensure smooth transitions under the compressed schedule.

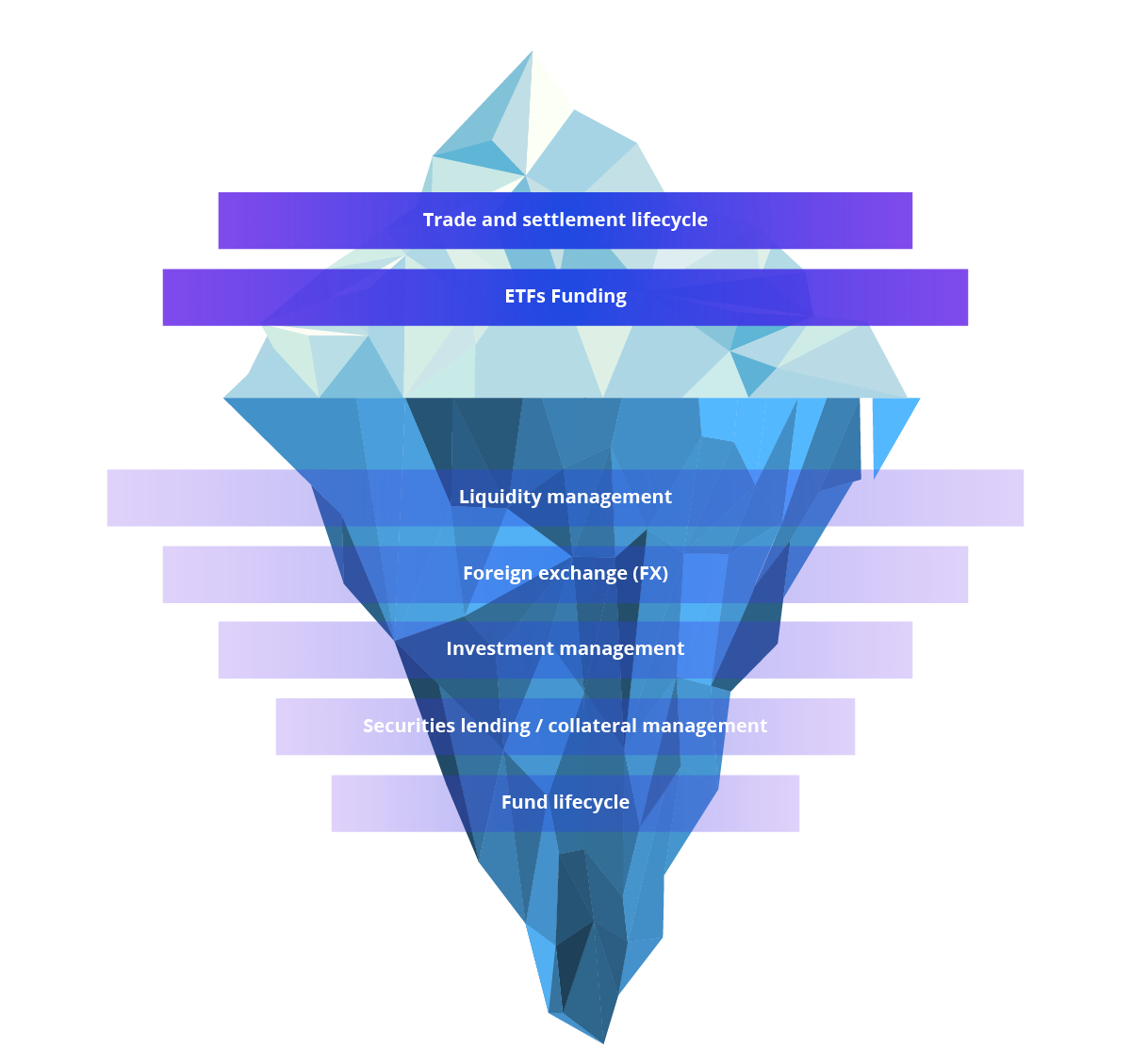

Figure 3. Iceberg challenge

T+1 – A classical iceberg challenge for investment funds

When considering the funds industry, the transition to a T+1 settlement cycle represents a significant challenge akin to an iceberg, as it will influence every aspect of the asset management value chain. The effects will permeate through trading cycles, exchange-traded fund (ETF) funding, liquidity management, and foreign exchange activities.

To navigate this complexity, the industry must adopt a strategic approach, leveraging robust infrastructure, advanced technology solutions, and collaborative effort. As stakeholders prepare for this shift, it's clear that the successful implementation of T+1 will not only streamline market operations but also establish a new benchmark for global financial practices.

This transition will predominantly affect asset servicers such as fund administrators, depositaries and custodians, but at the same time it will have broader ramifications across the entire financial ecosystem. It will particularly impact asset managers as the overall operating model needs to adjust.

| Asset servicers | Asset Managers |

|---|---|

|

|

Impacts on the fund life cycle

As the financial landscape evolves with the impending T+1 settlement cycle, it is crucial to examine how these changes will ripple through the funds industry. We have outlined the high-level benefits and challenges of T+1 – but it is also key to understand the indirect impacts on the fund life cycle.

Figure 4. Fund processing, T+2 settlement

While fund units typically settle on T+2 or longer, the securities held in the investment portfolio will soon settle on T+1. This misalignment will create operational, liquidity, and pricing challenges. Consequently, fund managers, transfer agents, and market participants will feel the pressure to adapt their processes to meet these faster settlement requirements across the financial sector.

| Main impacts on fund life cycle |

|---|

|

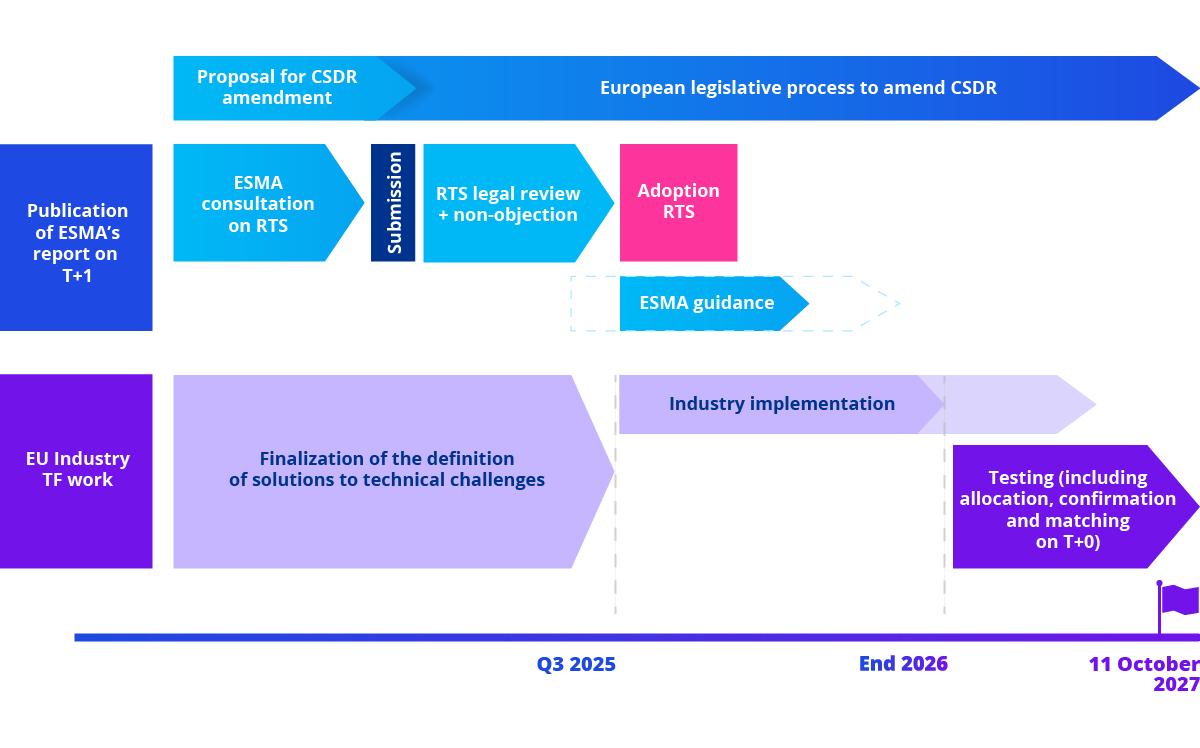

Timeline for the T+1 transition in Europe

As with any complex initiative, the success of the T+1 transition lies in the detail. While the end date recommended in ESMA's report may seem distant, especially compared to the 15-month transition period in the US, it will quickly pass. Regulators will need to finalize changes, firms must understand the implications, and preparations for testing and go-live will need to commence promptly.

ESMA has outlined a three-phase action plan:

1.Q1 2024 to Q3 2025: Finalization of solutions to technical changes

a. Identify and address technical challenges.

b. Draft amendments to the Central Securities Depositories Regulation (CSDR) and associated regulations.

2. Q4 2025 to end of 2026: Industry implementation with ESMA guidance

a. Develop and deploy necessary system upgrades.

b. Stakeholders align on operational processes.

3. From 2027 onwards: Testing phase

a. Conduct end-to-end testing involving all stakeholders (banks, depositories, CCPs, etc.).

b. Resolve cross-border settlement issues.

Figure 5. Transition timeline, ESMA 18.11.2024

In a similar fashion, the Luxembourg regulator CSSF has urged market participants in a recent communication[1] to address the following critical topics in a timely manner:

- Assessment of current processes

- Upgrading of IT systems

- Staff and internal organization

- Coordination with counterparties and service providers

- Management of liquidity

ESMA and national regulators are under pressure to mitigate the indirect effects of T+1 on the fund life cycle. Since funds are not traded on a T+1 basis, regulatory adjustments may be needed to align operational processes and minimize disruption. The goal is to reduce inefficiencies and ensure market stability while balancing the benefits of a faster settlement cycle with the complexities it introduces for funds and asset managers.

Looking ahead: A call to action

The transition to T+1 settlement marks a pivotal moment for Europe's financial markets. As the continent stands on the brink of this transformative shift, the imperative is clear: preparation and coordination are key. Market participants must act now, reviewing processes, investing in technology, and ensuring compliance with the new settlement cycle. With concerted efforts across the EU, UK, and Switzerland, the transition to T+1 can be seamless and impactful, ushering in a new era of financial efficiency and security.

Our suggested calls to action for the different parties in the market are:

- Infrastructure and market participants – Embrace automation and efficiency!

- Asset managers – Rethink your trading and liquidity strategies! The shift to T+1 means faster settlements, tighter post-trade deadlines, and no room for delays. Automate, optimize, and stay ahead!

- Asset servicers - Strengthen your infrastructure! Settlement fails will be costly, NAV calculations will be under pressure, and corporate actions must be processed faster. Invest in resilience now!

Firms must promptly initiate activities to thoroughly understand their current processes and technology, assessing when these were last reviewed and preparing for necessary changes. Although T+1 may not increase trade volumes, it will intensify internal workflows, heighten the need for exception management, and introduce systemic changes, such as new notification processes. Market participants should prepare for these changes and not underestimate their complexity.

Footnotes

[1] Source : AFME_Tplus1Settlement_2022_04.pdf

[2] Source: T+1 Settlement: Preparing for the future of European financial markets – CSSF