Navigating the transformation of your business functions

Technology can transform the way business is done, from strategy through to delivery. Using new and emerging technologies you can maintain competitive advantage and succeed in your digital transformation journey. Conversely, outdated and disparate technology, processes, and service models, can hold you back and make it a struggle to achieve your strategic objectives.

You need the right approach, to transform your business and drive greater value.

Companies that do transform successfully ask the hard questions:

- Are our business functions manual, slow and siloed?

- Is our dysfunctional technology driving the wrong behaviour?

- Is our current technology a barrier?

- Is outdated technology causing profit leaks?

- Can we use data-driven insights to drive value?

- Why have our previous transformation efforts failed?

Powered Enterprise helps answer such questions and consists of a set of solutions that help clients transform their business functions. Drawing on our deep functional expertise, we’ve built a wide-ranging set of solutions covering different aspects of a function’s operating model. It’s designed to help businesses get to ‘best practice’ quickly and securely, so that they can drive sustainable change and avoid a lot of the pitfalls that can come with traditional approaches to digital transformation.

How to elevate finance value through Generative AI

Find out more about our finance transformation capabilities.

Download PDF (892 KB) ⤓

Build better outcomes

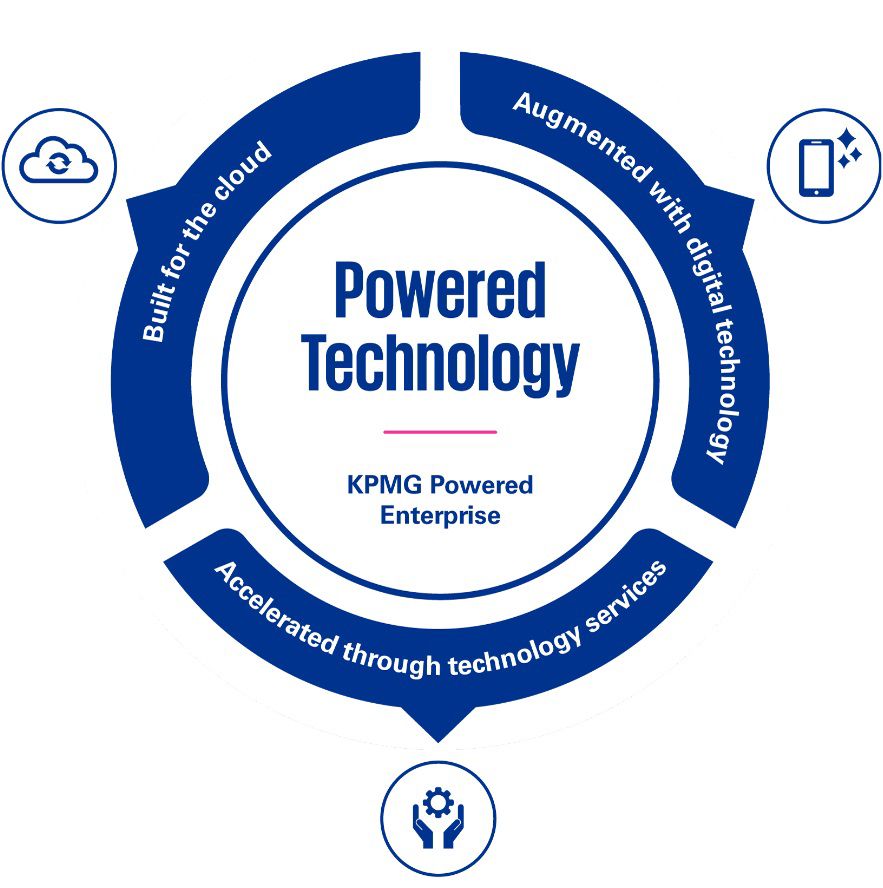

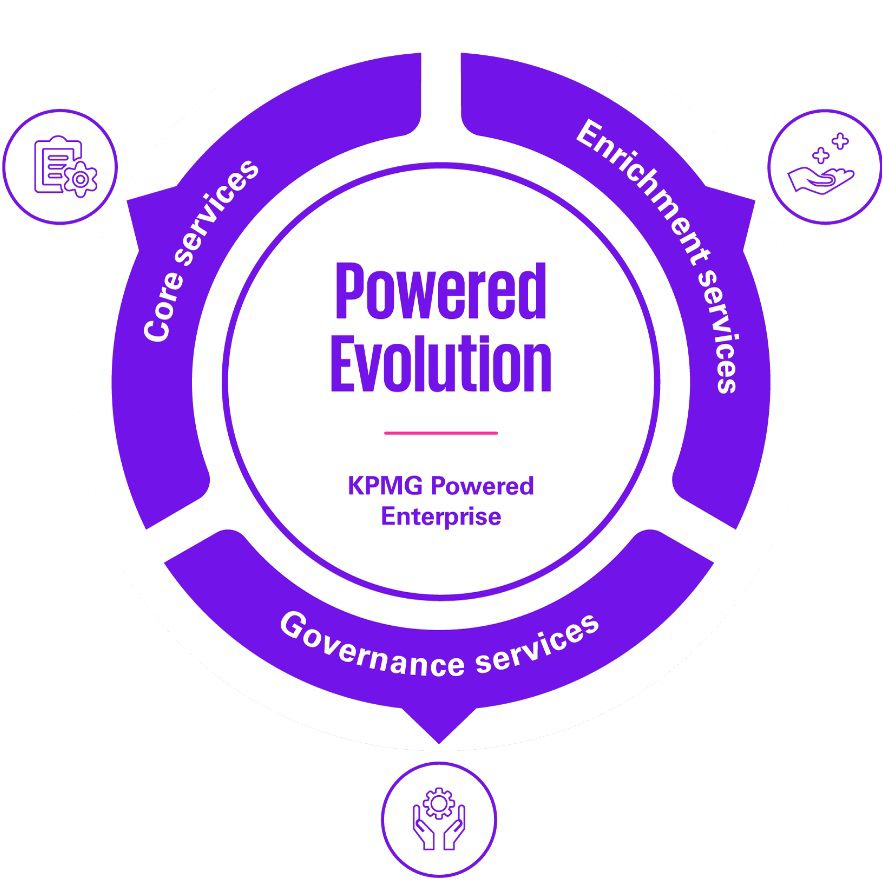

Powered Enterprise includes our Target Operating Model, Powered Technology and Powered Evolution. Together they can make your business more responsive, resilient, and competitive—and bring the future within reach, today.

The Target Operating Model helps you establish the design for what your function should look like across processes, people, the service delivery model, technology, performance insights and data, and governance. Through Powered Technology, we work with the world’s leading SaaS companies, to implement pre-built tools and methods that reflect leading practice and incorporate AI and advanced automation to simplify functional transformation.

Powered Evolution is how we continue to support our clients after the initial transformation program is complete. An important characteristic of the cloud or subscription technology is that it’s constantly changing. When new features are delivered by the vendor, or there are changes to an organisation, we help to make those changes so that their operating model is up to date.

Powered solutions to support functional transformation

By using the power of leading practice and pre-built digital assets, KPMG Powered Enterprise offers tailored solutions, for better outcomes, across every business function, key industries and major technology platforms.

Functional transformation across the enterprise

Fresh insights on functional transformation

Powered Execution Suite

Program Management | Value Management | Change Management

Vision

Develop and align stakeholders around a common vision of the future target operating model.

Validate

Leverage Powered Enterprise assets to validate and document the ‘to-be’ TOM design layers.

Construct

Build and test each design layer of the TOM using an iterative testing process.

Deploy

Deploy the solution and implement the TOM to users enabled for the new way of working.

Evolve

Complete post go-live support, value realization analysis, project closure procedures and transition to managed services programs, as applicable.

Transforming for a future of value

The KPMG suite of business transformation solutions help clients get to a more productive and sustainable future. The solutions are designed to address different client challenges and different parts of a business or a operating model. Each one contains rich insights and is underpinned by our leading transformation methodology.