Introduction

On the rise: Turbulence and transparency

Heading into the final quarter of a tumultuous year, one thing is clear: The more challenging and opaque the operating environment becomes, the more intense the focus-by investors, stakeholders, and regulators-on corporate transparency.

In this edition, we explore the role of management's disclosure committee in helping to ensure the quality and relevance of disclosures-particularly around ESG-related issues. We also consider the evolving expectations of the chief audit executive as the "eyes and ears" of the audit committee and a champion of the company's risk and compliance culture. And Wilmer Hale Partner Ronald Machen shares his views on civil rights audits as more companies take a deeper, unvarnished look at whether their policies and practices support their efforts around diversity, equity, and inclusion (DEi).

A lingering question is whether (and to what extent) an economic downturn will impact the momentum and priority that ESG issues including employee empowerment, climate, and supply chain sustainability-have attained since the pandemic began. As our 2022 KPM G U.S. CEO Outlook survey shows, CEOs have their hands full: Aside from preparing for a recession, CEOs cite ongoing pandemic fatigue, political uncertainty, disruptive technology, talent and workforce issues, and supply chain as top worries on their agendas. To help boards think through some of these issues, we include recent conversations with Eurasia Group President and Founder Ian Bremmer on the state of geopolitics, and with author and venture capitalist Matthew Ball on what the metaverse means for business and the future.

We also provide an overview of the financial reporting and auditing developments that audit committees should watch this quarter.

John H. Rodi

Leader

KPMG Board Leadership Center (BLC)

Article 1: Financial reporting and auditing update

Current quarter financial reporting matters

All eyes are on the SEC as it sorts through the voluminous feedback on its climate disclosure proposal and moves toward final rulemaking. Significant changes in tax policy due to new legislation also made headlines this quarter. Key provisions include a new 15% corporate alternative minimum tax, a 1% excise tax on stock repurchases, and new options for monetizing certain credits.

ESG reporting: Proposals from the SEC and others

Three sets of sustainability standards are under development by the SEC, the International Sustainability Standards Board (ISSB), and the European Financial Reporting Advisory Group (EFRAG). The comment periods on the proposals have now closed, and companies await the outcome of redeliberations and the final rules or standards.

SEC developments

The proposed climate rules are intended to provide more consistent, comparable, and reliable information so that investors can better evaluate the impact of climate-related matters on an issuer. Specifically, the proposal would require new disclosures in the annual report (Form 10-K or 20-F) or registration statements and in the financial statements. The extended comment period closed on June 17.

The SEC received over 4,000 unique responses, with the vast majority coming from individual members of the public. KPMG analyzed 150 responses that represented a variety of industries and respondents, but weighted toward issuers (including foreign private issuers) and industry groups.

Although over three-quarters of these respondents supported climate-related standard-setting in general, this did not translate to general support for the SEC's proposal, and concerns were raised in all areas. Key findings included the following:

- 63% believed that the financial statement disclosure threshold should be based on investor materiality and not a bright line

- 87% that commented on the disclosure of Scopes 1 and 2 greenhouse gas (GHG) emissions were in support.

- 92% that commented on the time required for transition requested a delay in implementing at least some disclosures (e.g. GHG emissions).

The SEC's Spring 2022 regulatory agenda shows publication of the final rule this month. This timing appears ambitious in view of the volume of feedback received.

Regardless of the outcome, issuers should expect continued scrutiny of climate-related disclosures based on the SEC staff guidance issued in 2010 and following the sample comment letter published in September 2021. To date, over 200 comments have been sent to more than 40 issuers, with nearly two thirds of issuers being asked about the consistency of disclosures in their sustainability reports versus their SEC filings.

ISSB developments

Earlier this year, the ISSB released proposals on (1) general sustainability-related matters and (2) climate-related matters. Under the proposals, companies would report-as part of general purpose financial reporting-on all relevant sustainability topics across four content areas (governance, strategy, risk management, and metrics and targets), and include industry-specific disclosures. The aim of the ISSB standards is to create a global baseline for investor -focused sustainability reporting that local jurisdictions (e.g., the U.S.) can build on.

The comment period ended July 29 and the ISSB received more than 1,300 responses that are now being analyzed. In August, the IFRS® Foundation appointed four new members to the ISSB, bringing the total to 14 and completing composition of the full Board ready to deliberate final standards. It is expected that the final standards will be issued early next year. The ISSB held its first meeting in September and discussed the themes of comment letters received; the ISSB agreed on areas where change is needed before the standards are finalized, and discussed in more depth financed emissions and the scalability of the standards for all types of global companies.

Once the ISSB finalizes the standards, the International Organization of Securities Commissions (!OSCO) will start its review. At its latest board meeting, !OSCO discussed the ISSB's proposed standards and the criteria it will use to decide whether to endorse the final standards. If the ISSB standards pass this endorsement assessment, !OSCO will recommend the standards to its 130 members.

European Union (EU) developments

In April 2021, the European Commission adopted a legislative proposal for a Corporate Sustainability Reporting Directive (CSRD). One of the proposal's provisions would require companies to report sustainability information based on European Sustainability Reporting Standards (ESRSs). In May 2022, EFRAG issued the first set of proposed ESRS s. The comment period ended August 8, with more than 750 submissions received. Following redeliberation, the European Commission is expected to consider final standards in November 2022.

In June 2022, the European legislative bodies reached a provisional agreement on the CSRD, which includes clarification about how it would apply to non-EU companies. In general, the ultimate non-EU parent company would provide a sustainability report (beginning in 2029, for information as of 2028) if it:

- has generated net turnover (revenue) of €150M or more in the EU for each of the last two consecutive years; and

- has at least:

- one subsidiary that meets the general scoping requirements of the CSRD; or

- one "branch" that generates net turnover (revenue) of more than €40M in the EU.

New tax legislation

The Inflation Reduction Act (IRA) of 2022 and

the CHIPS and Science Act of 2022 (CHIPS) were signed into law by President Biden in August. The IRA introduces a new 15% corporate alternative minimum tax (Corporate AMT) and includes a substantial package of energy and climate-related provisions, among other revenue raisers and incentives. CHIPS adds a one-time investment tax credit equal to 25% of a company's investment facilities that manufacture semiconductors or semiconductor manufacturing equipment.

The new laws also introduce mechanisms for monetizing some credits that are novel to U.S. tax law-including elections for "direct pay" and third party transfer. The IRA also allows for bonus credits if a company meets certain criteria.

Accounting impacts

Although no changes have been made to the U.S. federal corporate statutory tax rates, several provisions in the new laws may affect companies' forecasts of future income tax liabilities and the realizability of deferred tax assets. Considerations for preparers include the following:

- 15% Corporate AMT. Companies should account for the incremental tax owed under the Corporate AMT as it is incurred and continue to measure their deferred taxes at regular tax rates-at enactment and going forward. A company's AMT status also may affect its ability to realize deferred tax assets under the regular tax system. The Corporate AMT is effective for tax years beginning after December 31, 2022.

- 1% excise tax on stock repurchases. The excise tax is levied on a non-income-based measure and is therefore not in the scope of Topic 740 (income taxes).

- New options for monetizing certain credits. Companies in the energy space may elect a transferability election through which they can sell certain tax credits to third parties. In addition, both the IRA and CHIPS introduce a direct pay mechanism for certain credits and certain taxpayers under which the credits are considered a direct payment of tax and are refundable.

SEC adopts final amendments to require pay versus performance disclosures

The SEC has issued a final rule that amends Reg S-K Item 402 to require registrants to disclose- in proxy or information statements-executive compensation information ("pay") and financial performance measures ("performance") over the most recent five years in a tabular format, and describe key relationships between the two. Smaller reporting companies are subject to scaled disclosure requirements.

The final rule is effective on October 11, 2022. Registrants must comply with the new disclosure requirements for fiscal years ending on or after

December 16, 2022.

For more detail about these and other issues potentially affecting you in the current period or near term, see the KPMG 03 2022 Quarterly Outlook.

Article2: Ian Bremmer on geopolitical risk

"Every quarter:' That's the prescription Ian Bremmer gives for a discussion of geopolitical risk on the board agenda. Bremmer, founder and president of geopolitical risk consultancy Eurasia Group, said on a recent KPMG BLC webcast that the best companies explicitly task a board member with real-tim e monitoring of geopolitical activity, especially those companies with more than 10 percent of their revenue earned outside of the United States.

Joined by KPMG BLC Senior Advisor Susan Angele, Bremmer delivered a high-level take on the current state of geopolitics and the issues on which directors might query management. "From energy security to cyber security, these risks intertwine and multiply, but they also create opportunities for global businesses;' said Angele.

Watch the webcast replay

1. Globalization adrift. "Fifty years of globalization are not over, but the trajectory is slowing;' said Bremmer. As goods, services, and the movement of people was happening faster and more easily across international borders, global growth surged and helped to create a global middle class. While grass -roots protectionism has taken hold around the world, it is incremental. At the same time, new trade agreements are being implemented and tariffs are coming down, even amid a U.S. dollar surge. In this climate, Bremmer said, "It is critical that your CEO and/ or chair are aware and are building relationships geopolitically that matter for the outcomes for the company:'

2. Impact of the Russia-Ukraine war. "Russia has been forcibly decoupled from the G7 economically, diplomatically, culturally;' said Bremmer. Europe is going to go through a

significant recession as Russia cuts off remaining energy supply. Bremmer said he expects a 2-3 percent contraction in EU economies, but not a reduction of sanctions. The EU is economically more vulnerable, but politically stronger. "Over the last 6 months, Russia went from being a small China to a large Iran-completely cut off by advanced industrial economies;' said Bremmer. Food and fertilizer prices will continue to move higher. Distribution challenges could lead to food stress and forced migration in developing economies.

3. The future for China. Amid underperformance for state-owned enterprises and the failed zero -COVID policy, China is seeing significant economic challenges amid the "worst demographic collapse of any major economy than we have experienced historically:' "As I look out five years, ten years, I no longer see a country that is going to dominate and capture the economies of other countries around the world;' said Bremmer. "I actually see an economy that's going to focus more on China in some of the analogous ways that the United States-for different reasons-is focusing more on the United States ... China is increasingly a developed country, oriented more toward the status quo:'

4. Climate change and the energy transition. Momentum is shifting due to the war in Ukraine. Renewable energy costs are decreasing and even "next generation" nuclear is being explored. "When we talk about transition, we should also be talking about bridge energies such as LNG [liquified natural gas], which are absolutely critical:' However, higher energy prices due to the Russia-Ukraine war will have an outsized impact on developing economies. Banks have returned to fossil fuel financing, a necessary but disappointing outcome for advocates of the 1.5°C target temperature rise (relative to pre industrial levels). "That goal is slipping away;' said Bremmer. "Ultimately, we're going to need massive redistribution to pay developing economies not to use coal:'

5. Cyber defense requires coordination. "The good news is that a number of U.S. technology companies are working closely with the U.S. government to try to improve defensive capabilities:' said Bremmer. "But there are number of major Silicon Valley companies that say, 'We don't want the U.S. government, we just want to do business. But there's no question that there are a lot of softer targets out there schools, hospitals, agricultural collectives, pipelines ... If you have committed actors out there and they want to go after you, you can be taken down:' Bremmer warned that state actors and international terrorist organizations will continue to attempt debilitating cyberattacks. So far, he said many haven't worked, "but they've come close:'

Webcast survey results*

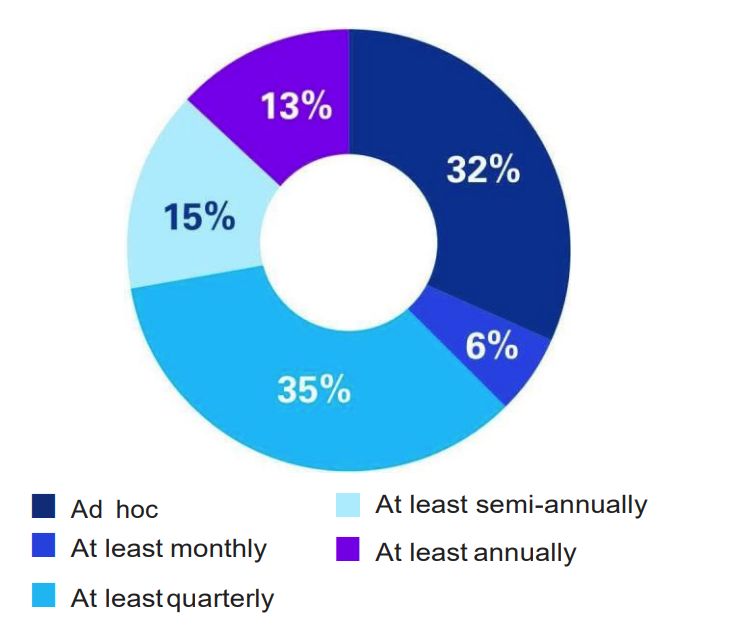

How frequently does your board actively assess geopolitical issues and their potential impact on strategy and risk?

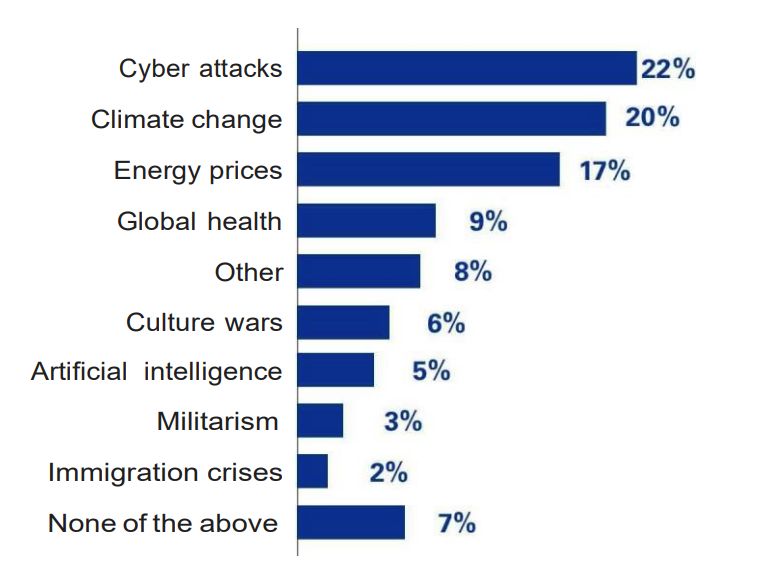

Which geopolitical issue do you believe will have the greatest long-term impact on your company over the next 3-5 years?

Among 393 self-identified corporate directors surveyed in advance of the September 15, 2022, KPMG BLC quarterly webcast. Does not equal 100% due to rounding.

The views and opinions expressed herein are those of the speakers and do not necessarily represent the views and opinions of KPMG LLP.

For more information, download the full report below.

- Directors Quarterly - October 2022 (PDF/0.3MB)