Overview

On the heels of the pandemic, CEOs are now facing another turbulent period. Our latest CEO Outlook is being released amid a business environment marred by high inflation, geopolitical tensions and fears of a recession. But the resilience shown during the most challenging days of COVID-19 bodes well for the future.

Featuring insights from more than 1,300 CEOs at large companies globally, including 400 in the United States, the survey finds a majority of U.S. CEOs confident about growth over the next three years and the resilience of their companies in the near term, as they have been preparing for a recession by implementing new strategies to drive efficiency and expansion. They are set on transformative growth via mergers and acquisitions, with a majority considering making strategic deals to propel their businesses.

CEOs are balancing the priorities that have been foundational to our CEO Outlook and looking to turn risk into opportunity by focusing on technology, ESG and talent.

Determined to be first movers or fast followers in digital transformation, CEOs recognize the importance of changing at the right pace and selecting relevant emerging technologies. Having made significant strides in tying ESG to profitability, they also recognize the critical importance of connecting their ESG and digital strategies to achieve their goals.

The pursuit of growth is happening at a time when pandemic-related fatigue is CEOs’ main concern. To promote employee well-being, CEOs are evolving the employee value proposition to align employee expectations with their companies’ business needs. They are using technology to ensure connectedness, providing flexible work models and focusing on corporate purpose to give work a deeper meaning.

Having demonstrated tremendous fortitude in navigating various challenges over the past several years, they see opportunity in uncertainty as they mitigate risk and recession fears with a deep focus on planning and resilience—to succeed and grow in the years ahead.

Paul Knopp

Chair and CEO

KPMG U.S.

Confidence and growth

CEOs are preparing for economic turbulence but remain confident in long-term business growth

CEOs have weathered the challenges of the pandemic, having had to adapt their businesses over the past two years. Many emerged with new strategies to drive growth and transformation.

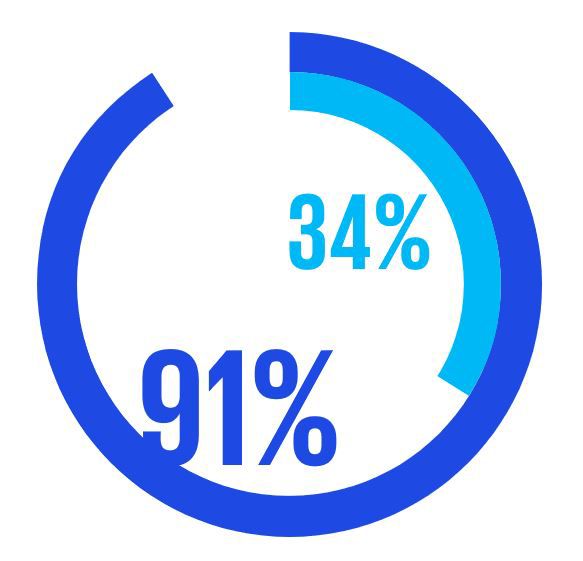

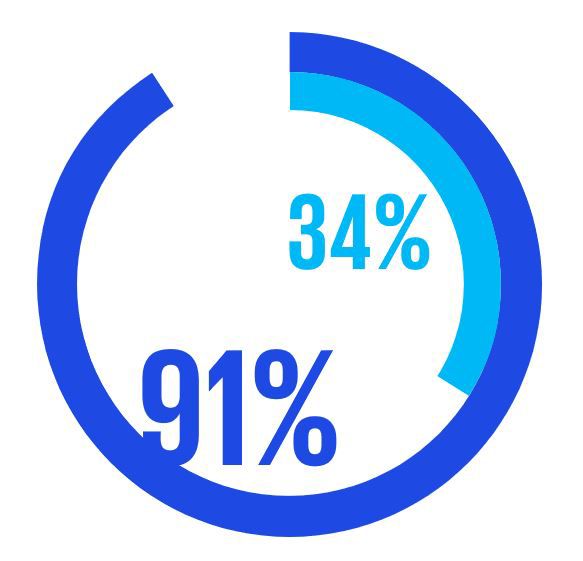

Just when it seemed there was a light at the end of the tunnel with pandemic-related disruptions subsiding, the vast majority of U.S. CEOs (91%) are convinced we are heading toward a recession in the next 12 months.

Moreover, only about a third of U.S. CEOs (34%) believe this recession will be mild and short.

“Understandably, consumers were concerned we were in a recession in the first half of this year since they lost—on average—all that they gained in wages since the economy reopened and then some to inflation,” says KPMG Chief Economist Diane Swonk. “The losses the U.S. suffered in the first half of the year were not dispersed enough to qualify for what an economist terms a recession. Employment rose by 2.8 million jobs in the first six months of the year alone, double the annual pace of the 2010s,” says Swonk.

The key issues to overcome in the next 12 months are inflation, higher interest rates and a potential collapse in demand, says Swonk, noting that the Fed is opting to increase interest rates to derail inflation. Even at the risk of a slowdown, raising rates is a better option than allowing a more corrosive and entrenched inflation to take hold, which could cause a deeper recession with larger scars, she adds.

“Over the long term, the reality of a more fragmented world, punctuated by disruptions due to climate change and geopolitical risks, are the primary threat,” says Swonk. “I am hopeful about how resilient we proved to be in a pandemic. While not all was executed well, it was truly remarkable how rapidly we took technologies that had been around a long time and leveraged them to keep our economies going. This is what massive change requires.”

We changed how we think about what kind of business we're in, which is a complete ecosystem of solutions rather than vehicle sales. The way I see it, it’s about how fast we can grow, and not about the external factors that can drive us down.

Companies thrive long term if they can meet customers’ expectations irrespective of the economic conditions. To do that, Bank of America has adopted the approach it calls responsible growth. “We have a straightforward strategy of serving three groups of clients—people, companies of all sizes and institutional investors—through eight lines of business. We deploy our capabilities, expertise and balance sheet to help our clients achieve their financial goals. This approach positions us well to serve our clients through all economic conditions while, at the same time, continuing to invest to support the needs of our teammates and our communities,” says Bank of America CEO, Brian Moynihan.

At Ford Pro, the division of Ford that serves government and commercial customers, new ways of working, infrastructure investments and the Inflation Reduction Act in the United States are contributing to customer growth, says Ford Pro CEO Ted Cannis.

Those factors and Ford Pro’s business model, more importantly, make Cannis confident about the future. “We changed how we think about what kind of business we’re in, which is a complete ecosystem of solutions rather than vehicle sales,” says Cannis. Taking into account its integrated solutions offering, agility and ability to scale, Ford Pro has a winning proposition despite the uncertain economic and geopolitical environment, he says. “The way I see it, it’s about how fast we can grow, and not about the external factors that can drive us down,” he says.

Anticipating a recession

A majority (91 percent) of U.S. CEOs believe that there will be a recession in the next 12 months; and only 34 percent think it will be mild and short.

The economy might best be described as sending mixed signals, with historically low unemployment levels combined with declining GDP growth rates, high inflation and recession fears. In this context, inflation-proofing capital and input costs has become the second most important operational priority for U.S. CEOs (22%). These economic concerns are exacerbated by political divisions and social tensions in the U.S., capped by the suspense around the midterm elections and the regulatory environment that may come about.

How companies fare during these turbulent times depends, to a large degree, on their industries and the secular trends affecting them. Wind River, a leading intelligent systems software company that powers the next generation of mission-critical intelligent machines, is benefiting from the momentum of digital transformation in the Internet of Things, or IoT. “There are a number of secular trends that are putting wind in our sails at a time when many are experiencing significant macroeconomic headwinds,” says company CEO Kevin Dallas.

International Seaways, which provides tankers for the transportation of crude oil, is extremely susceptible to geopolitical tensions and economic cycles. Lois Zabrocky, the company's CEO, says the altering of trade routes caused by the Russia-Ukraine war, a looming energy crisis in Europe and supply chain disruptions brought on by Chinese lockdowns and recessionary concerns are “all headlines that are linked to our bottom line.”

“Appropriately navigating a down cycle is what allows us to thrive in an up cycle when demand for seaborne transportation is high. Presently, we are in an up cycle, the value of our ships is worth far more than values two years ago, and we are reaping the benefits of our thoughtful capital allocation during the down market,” says Zabrocky.

In this season of change, with the prospect of a recession casting a shadow, CEOs continue to show a commitment to transformational growth.

More than three-fourths of U.S. CEOs have expected and planned for a recession. Many have adjusted their strategies to build resilience: 83% are confident in the resilience of their companies and industries over the next six months, 80% about the domestic economy and 72% about the global economy.

At the same time, the vast majority believe a recession will further disrupt their business, making it difficult to rebound from the pandemic. Eighty percent believe a recession will upend their organization's anticipated growth over the next three years.

The top steps that companies are planning to take over the next six months to prepare for the anticipated recession are pausing or reconsidering their ESG efforts (59%) and downsizing their employee base (51%).

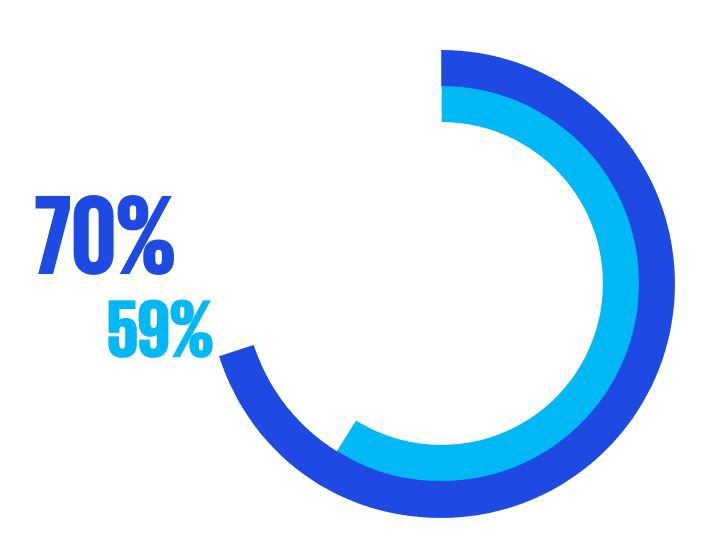

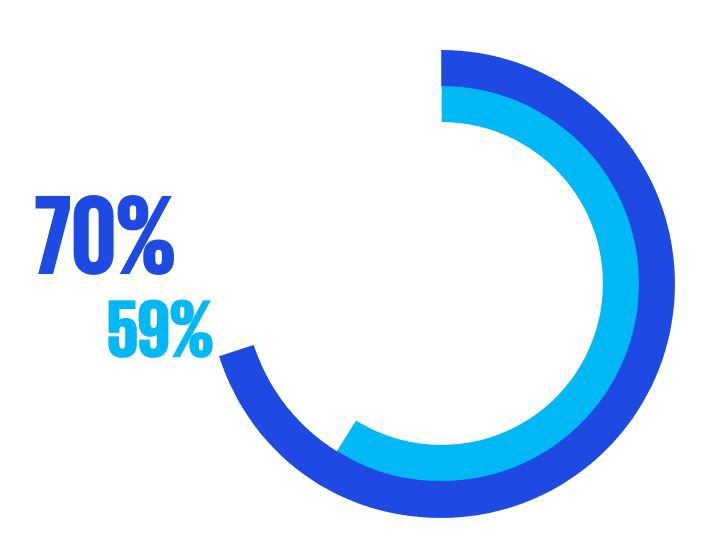

With the potential recession testing CEOs' commitment to their ESG strategies, reducing investment may lead to long-term financial risks. This test comes at a time when CEOs have made significant strides in tying ESG to profitability, with 70% of U.S. CEOs saying that ESG improves financial performance, compared to 37% last year.

“It's a classic moment of prioritizing short-term and long-term returns,” says Rob Fisher, KPMG U.S. ESG Leader. “CEOs will decide whether they will prioritize next quarter's results or recognize that in the future there is only going to be one kind of economy—a low- carbon economy—and investments they make now will position them not only to compete, but also to thrive throughout this transition.”

The biggest risk of not meeting stakeholders' expectations in terms of ESG was around access to capital, with 28% of U.S. CEOs stating that letting down stakeholders in this area can lead to higher finance costs and difficulties raising funds. That's especially relevant as credit tightens and interest rates rise.

While more than half of CEOs are considering downsizing their workforce over the next six months, 92% of U.S. CEOs expect their companies' head counts to increase over the next three years. Swonk advises that firms work judiciously in how they execute layoffs, as higher unemployment will not likely end the demand for talent. “The aging of the Baby Boom [generation], earlier retirements, a dearth of younger workers and incidences of long COVID are all taking a toll on labor supply,” she points out.

Long term, U.S. CEOs remain positive about growth. Looking three years ahead, the vast majority of U.S. CEOs are confident about the growth of their companies (95%), industry (94%), domestic economy (93%) and the global economy (71%). About half (52%) anticipate earnings growth of 2.5% or more over the next three years.

“In this season of change, with the prospect of a recession casting a shadow, CEOs continue to show a commitment to transformational growth,” says Laura Newinski, KPMG Deputy Chair and Chief Operating Officer. “As the pandemic has shown us, the opportunity that disruption brings to transform business models and develop a future-ready foundation is unlike any other. In moments where, traditionally, many tend to pull back, CEOs can unlock new strategic growth opportunities by accelerating their investments in digital and impactful M&A deals.”

Much of the future growth will be generated inorganically, with more than half (56%) of U.S. CEOs expressing a high appetite for M&A over the next three years that will have a significant impact on their overall organization.

of U.S. CEOs are confident

about the growth of their companies over the next three years.

“The best M&A opportunities are happening right now,” says Carl Carande, Vice Chair – Advisory for KPMG U.S. and Global Head of Advisory. “Those companies that can be strategically aggressive in this environment and participate in mergers and acquisitions are going to leapfrog their competitors and win in the long term.”

In January 2022, Aptiv announced the acquisition of Wind River for $4.3 billion. Dallas believes Wind River’s growth will be further fueled by this transformative merger. Aptiv is a global technology company focused on making mobility safer, greener and more connected. “Combining Wind River's industry-leading software, customer base and talent with Aptiv's complementary technologies, global resources and scale will realize our vision of the new intelligent machine economy,” Dallas says.

Zabrocky credits the merger of International Seaways with Diamond S Shipping for the company’s transformative growth. The deal created the second largest U.S.-listed tanker company by vessel count. “As a result of our merger last year in a down market, we earned our highest ever net profit in Q2 2022 when the market recovered. This merger doubled our fleet, which allowed us to realize synergies for a highly accretive deal,” she says.

Carande notes that asset valuations are stabilizing, as attractive assets still have interested buyers. In a depressed market, M&A activity is one way to mitigate resource scarcities. “M&A enables growth in a no-growth environment,” says Carande. “It is an opportunity to prepare for an economic rebound, as growth coming out of a recession is likely to be greater than before it.”

As a result of our merger last year in a downmarket, we earned our highest ever net profit in Q2 2022 when themarket recovered. This merger doubled our fleet, which allowed us to realize synergies for a highly accretive deal.

Over the next three years how would you describe your organization's M&A appetite?

| 6% | Low: Unlikely we will make any acquisitions |

|---|---|

| 33% | Moderate: We will make acquisitions, but with moderate impact to my overall organization |

| 56% | High: Likely to undertake acquisitions which will have a significant impact to my overall organization |

| 6% | We are seeking to be acquired ourselves: Likely we will be the target of an acquisition or merger |

Technology

Neither the economy nor other risks can distract CEOs from their focus on digital transformation

While U.S. CEOs have had to make some short-term adjustments, they indicated that advancing digitization and connectivity across the business is the top operational priority for achieving growth over the next three years.

“Emerging technology is disrupting how consumers work, play, think and live, proving to be a potential concern for companies that fail to keep up with their competitors,” says Newinski. “Thinking one step ahead on how disruptive technologies such as blockchain and the metaverse can augment the employee, customer and product experience will provide an opportunity to outpace the competition and create a future-forward positioning.”

“Stitch Fix is in a constant state of digital transformation,” says Elizabeth Spaulding, CEO of Stitch Fix. “Whether that's using customer feedback, data analysis and stylist expertise to predict style and shopping trends for our clients or updating our platform experience through product updates that improve the client experience, we'll continue approaching digital transformation like we always have—as an essential part of our entire business.”

A majority of U.S. CEOs (74%) believe they need to act more quickly when shifting investment to digital opportunities and divesting in areas that face digital obsolescence; 78% have an aggressive digital investment strategy intended to secure first-mover or fast-follower status. “There's a big push to either be leading or a fast follower,” says Carande. “A lot of companies can be outmaneuvered if they can't keep up with disruptive technology.”

Our continued growth in digital enrollment and engagement across lines of business has been instrumental to our deepening client relationships, as well as in reducing costs and driving efficiencies in how we deliver for our clients.

Which of the following will be your top operational priority to achieve your growth objectives over the next 3 years?

“Fashion moves fast,” says Spaulding. “We've found that effective use of cutting-edge technology ensures we can move the retail industry forward, meet customer needs and anticipate future trends and market movement.”

The pandemic has seen many companies devise technology-driven solutions to sustain and grow their businesses, mainly by focusing on meeting customer and employee expectations.

“In 2021, we saw record client engagement across our digital platforms,” says Moynihan. “Our continued growth in digital enrollment and engagement across lines of business has been instrumental to our deepening client relationships, as well as to reducing costs and driving efficiencies in how we deliver for our clients.”

Post-pandemic, the big questions have been: To what degree will pandemic-driven expectations and behaviors become permanent? And how should businesses allocate technology investments accordingly? CEOs are also considering which new potentially disruptive technologies, like Web3 and embedded, intelligent software systems, make sense for their companies. Deciding on the right technology and knowing how to keep pace with change (both at 63%) are the two top factors holding back progress on business transformation.

When selecting the right technologies for your organization, start with thinking about what you are trying to achieve. If you are trying to modernize your tech stack, then there are a lot of new cloud-based enterprise providers to choose from,” says Carande. “But if you are trying to open up new markets and connect with a new customer base, then you may want to consider the potential opportunities from the emerging metaverse and the investments taking place to create a more decentralized internet, referred to as Web3. Within the metaverse, consider what it means to you: Is it a better way to connect with customers and access new talent? Is it a way to create a new marketplace to sell products and services? Can you better serve and support your customers? Or, is it about the ability to better recruit talent and engage with your employee base? Knowing what you're trying to do is going to help orient you to the types of technologies that offer the most transformational potential in your particular environment.”

While U.S. CEOs have often favored technology over people in terms of their technology investing, this year the trend is reversed, with 54% placing more capital investment in developing workforce skills and capabilities and 46% focusing on buying new technology. In 2021, it was 44% and 56%, respectively.

There's a big push to either be leading or a fast follower. A lot of companies can be outmaneuvered if they can't keep up with disruptive technology.

“We don't see people and technology as a true tradeoff—we see the two working together as a force multiplier,” says Spaulding. “Technology and humans bring out the best in each other. We're amid a multiyear endeavor to change the way people shop, and that requires a strong team armed with the best tools.”

“The success of digital transformation hinges on having a clear strategy and communicating the objectives of your digital transformation strategy throughout your whole organization, from the C-suite to your call-center employees,” says Carande. “It takes a transformation of culture to succeed at digital transformation.”

Such a cultural transformation needs to run deep and often uproots the status quo. Fifty-five percent of U.S. CEOs believe the act of managing the cultural impact is holding back the progress of business transformation in their organizations. Recognizing the importance of change management—and supporting cultural transformation from the very top—are key elements of success.

“We want to make sure that we drive the right culture in the company that is based on a growth mindset and a customer focus,” says Dallas. “That means having the right tools to identify when we're in a fixed mindset and shifting so that we get creative when working with customers on new solutions.”

Change management is key for Ford Pro, which is making truck ownership a digital experience that provides customers with software, battery charging, financing and support. Expanding from only selling vehicles to offering integrated, software- driven ownership solutions required the company to rethink its internal structures and how it pursues digital transformation. The new integrated offer has “completely changed how we work, what we measure, what kind of talent we employ,” says Cannis.

During the pandemic, many companies equipped employees with new digital tools, opening new pathways for cybercriminals. This year's survey reveals that just 39% of U.S. CEOs believe their organizations are well prepared for a cyberattack, which is less than in previous years.

Kyle Kappel, KPMG U.S. Leader for Cyber Security, sees the low number of CEOs who believe their organizations are prepared for cyberattacks as a positive sign. “I view this as an increase in awareness about the importance of cyber security that is taking place at the highest levels of the organizations,” he says.

Technology and humans bring out the best in each other. We’re amid a multi-year endeavor to change the way people shop, and that requires a strong team armed with the best tools.

The next step is to translate that awareness into action. “Being better prepared for cyberattacks will take a culture that puts the highest value on cyber security,” says Kappel. “The tone from the top plays a huge role in creating a cyber-aware culture, which needs to take hold across the whole organization, not just IT.”

Kappel believes the lack of cyber preparedness should drive, not derail, digital transformation. As an example, he says, organizations that are moving from legacy on-premises technologies to cloud-based solutions stand to benefit in terms of cyber security provided by hyperscale cloud providers.

Digital transformation can also alleviate other risks, such as those imposed by economic and geopolitical factors. Sixty-eight percent of U.S. CEOs agree that current issues, including Russia's invasion of Ukraine, the climate crisis, deglobalization and risk of stagflation, are cause for concern as those issues may interfere with their digital transformation strategy.

“Since mid-pandemic, when the fragility of the supply chains was exposed, CEOs have had a much bigger recognition of the importance of their supply chains to deliver on their brand promise,” says Brian Higgins, KPMG U.S. Customer & Operations Practice Leader, Commercial Industries. “Additionally, the organizations are now subjected to more risks and a wider set of consequences when their supply chains are disrupted, including cyber security, pandemic- related issues or ESG.” Having more visibility and digital connectedness within their supply chains can help companies with their ESG initiatives, since the complexity of decarbonizing supply chains is currently the top barrier (30%) to achieving net zero or similar climate ambitions at global corporations.

But while the recognition of the importance of the supply chains is higher, many companies have not yet taken the necessary steps to digitalize their supply chains and eliminate the structural issues that can lead to disruptions, says Higgins. As a result, many companies are “flying blind” because they don't have enough visibility into their supply chain and are unable to manage its increasing complexity.

Higgins says the modernization deficit facing supply chains has been exacerbated by companies being forced to operate in a permanent crisis mode. But the crisis mode is not sustainable long term if companies want to avoid risks and use their supply chain as a competitive advantage. Companies should use the lessons revealed by the pandemic and invest further in digitalizing their supply chains, says Higgins.

In addition, 80% of U.S. CEOs say the proposed global minimum tax (GMT) regime is of significant concern to their organization's growth goals. “As governments continue to iron out details on the potential implementation of the OECD's proposal for a GMT, now is the time for companies to leverage data to model its potential impact and scenario plan,” says KPMG Tax Vice Chair Greg Engel. “The failure to do so in a timely manner could significantly limit their ability to prepare for the adoption of a GMT and put them at a competitive disadvantage.”

Cyber security and geopolitics

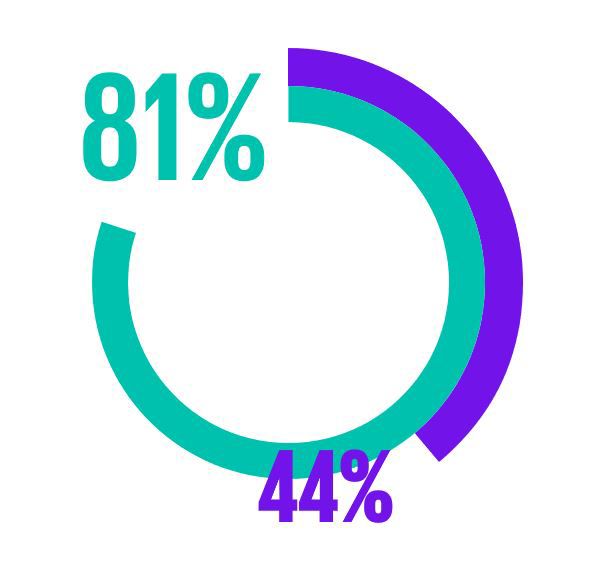

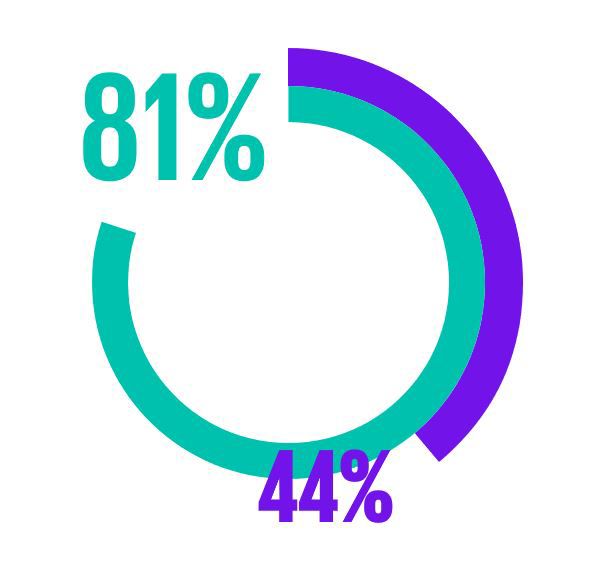

While 44 percent of U.S. CEOs felt their organizations were under prepared for a cyberattack, 81 percent said that geopolitical uncertainty was raising concerns of a cyberattack.

ESG

Ability to deliver on ESG strategy and commitments will hinge on technology- driven solutions

A vast majority of CEOs believe that, as confidence and trust in governments decline, the public is looking to businesses to fill the void on societal challenges (79%) and that major ESG challenges, such as income inequality and climate change, are a threat to their company's long-term growth and value (76%).

But CEOs are also feeling pressure (59%) from stakeholders, be they investors, regulators or customers, who are demanding increased reporting and transparency on ESG issues.

“It's really important that all stakeholders are making their voices heard about their expectations of what a good organization looks like in terms of ESG,” says Fisher.

Amid deepening awareness of virtue signaling and greenwashing, having the necessary technology to effectively measure and track ESG initiatives is the top challenge in terms of delivering ESG strategy in three years (24%). Measurement is closely tied with technology solutions, and organizations tend to see their ESG strategy and digital investments as inextricably linked (81%).

“Digital transformation is urgently needed to meet the increasing challenges water utilities and users of water face,” says Patrick Decker, CEO of Xylem, a global leader in water technology and sustainability. These challenges include water scarcity, aging water systems and more intense storms.

“The task is to modernize water systems to … ensure communities are optimizing water management by preventing water loss, adding critical functionality to reduce costs and improve performance like remote sensing, and enabling decision intelligence,” says Decker.

Emerging technology is the backbone of ESG strategies across different industries. International Seaways, for example, has very large, dual-fuel crude carriers, which can run on conventional fuel as well as lower-emission liquid natural gas. These vessels are 40% more efficient than a 10-year-old conventional vessel of the same class.

“It's undeniable that new, sustainable fuel is the future of energy,” Zabrocky says. “But as these new technologies emerge, the demand for oil continues. We see a multi-fuel future, and embracing new technologies allows us to responsibly transition.”

ESG and financial performance

Although 70 percent of U.S. CEOs said their ESG programs improved their financial performance, 59 percent said they plan to pause or reconsider their ESG efforts in the next 6 months.

Taking a more proactive approach to societal issues, such as ensuring human rights and a “just transition” away from fossil fuels, meaning the benefits and costs of climate action are distributed equally, is the top factor (38%) that will accelerate ESG strategies over the next three years, the survey found. The second biggest accelerator is increasing measurement and governance to build a more robust and transparent approach to ESG initiatives (26%).

Part of the difficulty with measuring ESG initiatives is the complexity of the data, which often originates from disparate sources that are different from the traditional sources of financial data. The oil and gas industry, for instance, may use data gathered by sensors in pipelines, or devices embedded in meters, vehicles or machines, says Fisher. Additionally, comprehensive ESG data should cover all tiers of organizations’ value chains and track inter-related social issues, such as ensuring a just transition and human rights.

Workday, which offers enterprise software management systems for finance and human capital, helps its clients better account for their ESG efforts. “We are helping customers with ESG reporting and compliance, allowing them to track progress and identify opportunities for improvement in areas such as workforce composition, organizational health and supplier diversity,” says Chano Fernandez, Co-CEO of Workday. “When it comes to ESG, I see technology playing a central role in providing insights, informing action and bolstering measurement.”

Still, ESG reporting lags reporting that is conducted on other business imperatives. “Investors and standard-setting bodies are increasingly looking for more in-depth and better-quality disclosures. These will require more timely and rigorous reporting of ESG-related data than companies across industries may currently be used to, more in line with existing financial reporting requirements,” says KPMG Audit Vice Chair Scott Flynn. Despite the complexity of ESG data, a number of organizations are moving their sustainability reporting to the finance function to submit their ESG reporting to the rigors and controls of financial reporting, says Flynn.

ESG initiatives benefit when there is a high level of motivation and collaboration around efforts to improve the future of the planet, socially or environmentally. “In a tight labor market, being known as a sustainability leader and an inclusive and purpose-driven company is a huge advantage for recruiting,” says Decker. “Our colleagues have a choice about where to work. They choose to work at Xylem because they want to be involved in solving global water challenges.”

However, the field suffers from a lack of experts ready to tackle sustainability issues; universities are only now minting future professionals who will be able to lead companies to net-zero solutions, observes Fisher.

Xylem faces additional talent hurdles, since roughly one-third of the water sector workforce is eligible to retire in the next 10 years. This shift is one reason the company launched Xylem Ignite, a global program designed to help prepare the next generation of young people to solve water issues, says Decker.

“We want young people to understand firsthand that when they solve water [scarcity], they’re helping solve one of the biggest environmental, sustainability and global social stability challenges of our time,” he says.

When it comes to ESG, I see technology playing a central role in providing insights, informing action and bolstering measurement.

Talent

Evolving the employee value proposition to align employees' individual needs with companies' growth strategies

The pandemic's impact on employees continues to be top of mind for U.S. CEOs, who identified pandemic- related fatigue as being the most pressing concern for their organizations today. Seventy-six percent of U.S. CEOs believe they need to address burnout from accelerated digital transformation over the past two years before continuing their transformation journey.

Expanding the concept of the employee value proposition has been one of the most important outcomes of the pandemic. During the pandemic, that value proposition for employees evolved into the total experience that companies offer—financially, mentally, socially and physically.

Today, on top of persistent pandemic burnout, companies are facing a challenging labor market with high inflation, low unemployment and acute shortages of certain skills. With recession fears causing layoffs and hiring freezes—and the need to position the workforce for future growth—companies are trying to balance their needs with the economic reality and employee expectations.

“While the most dramatic evolution in the employee value proposition took place during the pandemic, the evolving employee expectations are here to stay,” says Sandy Torchia, Vice Chair of Talent and Culture at KPMG, who calls the current labor market competitive. “Companies need to present employees with a value proposition that aligns with what an individual candidate finds the most valuable for their work life.”

Fulfilling employees' expectations starts with listening. “What has become clear these past few years is the importance of actively listening to your employees, taking action and having an open dialogue,” says Workday's Fernandez. “Without understanding the diverse and ever-changing needs of your people … you cannot expect to attract, engage or retain talent in this climate.”

Just as it serves its clients with personalization at scale, Stitch Fix applies the same approach to employee experiences. “At Stitch Fix, we know there is no one- size-fits-all approach, whether for clothing choice or working style,” says Spaulding. “Our personalized work model allows us to hire a diverse workforce centered in equity. We can hire a range of intersectionalities, such as caregivers for children or family members, more introverted team members, and people living outside of our original San Francisco HQ.”

Companies need to present employees with a value proposition that aligns with what an individual candidate finds the most valuable for their work life.

Bank of America stresses a long-term approach. “We want employees to develop a long, fulfilling career with our company, so we focus on providing support from their hire date through retirement,” says Moynihan.

“Our ongoing focus on employee health and safety was critical during the health crisis, and that continues today. During the pandemic, we continued and even expanded many of our benefits and programs to support employees, keeping medical premiums flat for employees earning less than $50K for the 11th year in a row and raising our U.S. minimum hourly wage to $22 in June as a next step in our plans to increase to $25 by 2025,” says Moynihan.

Pay remains important, especially in the current inflationary environment. The confluence of economic and talent management issues will exert the biggest impact on organizations over the next three years, with 73% concerned about their ability to retain talent with pressures of inflation and rising cost of living. Talent issues are high on U.S. CEOs' agenda, with attracting and retaining talent being the third biggest operational priority (21%).

In this challenging environment, companies are making sure they have the right skills to grow their organizations.

“Companies need to consider what type of workforce they need to achieve their growth objectives,” says Torchia. “They need to consider the right combination of recruiting and upskilling to be able to face the needs of tomorrow.”

Outside of financial benefits, Torchia points to flexibility as an important trait that employees are looking for. Such flexibility may be best delivered via the hybrid work model, which has been implemented by many companies during the pandemic and will continue to be the most popular way of working (45%) over the next three years.

The specifics of the hybrid model are not yet set in stone, as companies need to continue to evaluate how it's working—for employees and the business. “Technology will be critical in understanding what's working and where we may need to pivot,” says Fernandez.

We've put a lot of thought into the work environment, creating the best possible experience for the employees that align with the best results for the company.

U.S. CEOs believe continued flexibility will benefit employee well-being and help their organizations attract and retain talent. “We've put a lot of thought into the work environment, creating the best possible experience for the employees that aligns with the best results for the company,” says Dallas. Wind River's flexible approach includes anchor days, when employees can meet with others in the office, which has been redesigned specifically for collaboration.

At KPMG, Torchia is focused on combining flexibility with connectivity in a way that helps employees collaborate, develop and relieve stress at the same time. During the pandemic, KPMG started camera- free Fridays, when virtual meetings are audio only, and introduced the concept of meeting-free “heads-down” time, so that employees can focus on tasks that are best performed without interruption. Additionally, the default meeting time of a half hour has been switched to 25 minutes, and from an hour to 50 minutes, to give employees a breather between meetings.

While the work-life balance modifications help with the employee experience, companies must also appeal to something deeper. Company purpose–what a company stands for and how it treats its employees and the community—must align with employees' values. ESG efforts that create a sense of purpose and trust remain important for employees, and the results are a key metric of how organizations inject meaning and value into working.

For Bill McDermott, CEO of ServiceNow, ensuring that corporate purpose is both an effective and symbiotic method for business growth means making sure employees' personal values align with those of the company. “You must focus on recruiting properly to make sure there is a great match with the individual values of a person coming into your culture. Having that match also impacts diversity, equity and inclusion.”

Seventy-six percent of U.S. CEOs believe that progress on diversity and inclusion has moved too slowly in the business world, and 51% believe that corporate purpose will be important for strengthening employee engagement and the employee value proposition over the next three years. “Focus

on diversity, equity and inclusion is our business imperative,” says Torchia. “We are building an environment where people are able to show up being their authentic selves.”

CEOs understand that their employees—or potential employees—are looking at organizations' reputations as corporate citizens when making their decisions about where to work. Dallas also notes that the company's investment in a “social contract” positively impacts its local communities. The California-based Wind River has partnered with organizations like Oakland Promise and Blacks in Technology to empower underrepresented groups. “We realize that people who are joining our company are not doing it just for our technology vision and workplace culture, but also for how we contribute to the community,” says Dallas.

“We firmly believe our role is to drive both profits and progress,” Moynihan says. “We need to align capitalism to produce this progress because, as a practical matter, the only way progress is going to be made is through the involvement of the private sector.”

Thinking about today, which is the single most pressing concern for your organization?

1 Pandemic fatigue or continued uncertainty/restrictions

2 Political uncertainty

3 Emerging/disruptive technology

4 Economic factors like rising interest rates, inflation and anticipated recession

5 Supply chain

Conclusion

Technology

Bring your people and technology together by transforming your corporate culture: Organizations have invested so much in digital transformation that they need to make sure people adopt these technologies and use them to their full potential.

Get closer to customers: Orchestrating compelling customer experiences requires companies to begin with the customer and work backwards, taking an outside-in perspective to reverse-engineer and shape what the experience should be. They should then adopt an inside-out view to define how the experience should be delivered.

Choose the right speed and technologies for your digital transformation: Start with your strategic goals and work back. The scope and speed of change will depend on whether you want to modernize your tech stack or disrupt your business models.

View cyber security as a strategic function: Increasingly, cyber is no longer seen as a tech issue. It’s a fundamental business imperative. The exponential increase in cyber attacks, coupled with the difficulty of detecting an attack in time, calls for automation and innovation.

Use strategic M&A to bolster efforts: To open up new markets or acquire talent and new technologies, M&A can accelerate growth and digital transformation efforts.

Exploring opportunities for growth

ESG

Recognize ESG's impact on financial performance: ESG has become integral to long-term financial success. CEOs increasingly agree that ESG programs improve financial performance, which includes being able to secure talent, strengthen the employee value proposition, attract loyal customers and raise capital.

Invest in real-time technologies: Companies should monitor their supply chains more deeply (i.e., at the third and fourth levels). Global supply chain leaders are starting to double down on investing in technology— including real-time, end-to-end analytics—to identify where issues exist and improve visibility across the entire value chain.

Aim to measure the progress and effectiveness of your ESG initiatives: Increasing measurement and governance to build a more robust and transparent approach to ESG initiatives is among the top accelerators of ESG strategies (26%). Stakeholders increasingly want to know how companies contribute to society.

Build strong connections among functions: Resilient organizations have well-connected internal teams, allowing, for example, the finance function to know what the ESG team is doing. Consider moving some of your ESG reporting to your financial function to imbue ESG reporting with the rigors and controls of financial reporting.

Talent

Experiment with ways of working: As some organizations launch return-to-office plans, it’s important for CEOs to develop working structures that suit their people. It’s time to experiment and see what works best. Active listening, empathetic communication and a commitment to finding the right approach over the long term will be key.

Use technology to see what works and when to pivot: Technology is a good tool for understanding employees’ expectations, creating connectedness and relieving stress, as well as ensuring productivity. Use technology to monitor what works—for employees and for the company.

Tell your ESG story: A business’ ESG approach is increasingly seen as a differentiator when it comes to attracting and retaining talent. Fifty-one percent of U.S. CEOs believe that corporate purpose will be important for strengthening employee engagement and the employee value proposition over the next three years.

Methodology and acknowledgements

The eighth edition of the KPMG CEO Outlook, which surveyed 1,325 CEOs between July 12 and August 24, 2022, provides unique insight into the mindset, strategies and planning tactics of CEOs globally. All respondents led organizations with annual revenues exceeding $500 million, and over one-third had more than $10 billion in annual revenue. The U.S. part of the survey is composed of 400 U.S. CEOs. They came from companies with at least $500 million in revenues, with 36% representing companies with revenues of at least $10 billion and 11 industry sectors (asset management, automotive, banking, consumer and retail, energy, infrastructure, insurance, life sciences, manufacturing, technology and telecommunications)

Note: Some figures may not add up to 100% due to rounding.

KPMG would like to thank the following CEOs for their contributions:

Ted Cannis, Ford Pro

Kevin Dallas, Wind River

Patrick Decker, Xylem

Chano Fernandez, Workday

Bill McDermott, ServiceNow

Brian Moynihan, Bank of America

Elizabeth Spaulding, Stitch Fix

Lois K. Zabrocky, International Seaways

The views and opinions expressed herein are those of the survey respondents and do not necessarily repre- sent the views and opinions of KPMG.

*KPMG U.S. refers to KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.

For more information, download the full report below.

- KPMG 2022 U.S. CEO Outlook (PDF/0.8MB)