Under the current withholding tax (“WHT”) regime provided under Taiwan's Income Tax Act, if tax withholders fails to properly and timely withhold taxes in accordance with relevant WHT rules, they not only have to pay the under-withheld tax but also will be subject to a penalty up to three times of the amount of the under-withheld tax, which presents the severity of the responsibility for WHT obligations in Taiwan.

In the scenario where the payors are entities, the WHT regime designates "natural person" such as responsible person of a business or responsible supervisor for withholding of an organization or institution, as the “obliged tax withholders”. Therefore, when a violation of withholding obligations occurs, these individuals, rather than the “legal person” themselves (i.e., the entities), were liable for additional WHT payments and penalty on behalf of the payors. However, given that these individuals are not the payors, and they might not be the actual executors of the withholding process or were limited by their respective positions, it was difficult to expect these people to have a comprehensive understanding of relevant rules to properly and timely fulfill WHT obligations.

This issue has been fiercely discussed over time, critics argue that there is a mismatch between rights and responsibilities under current WHT regime, leading to frequent disputes in the courts and multiple Constitutional Interpretations by the Judicial Yuan.

In August of this year (2024), major amendments were made to the Income Tax Act (“the Amendment”) which was primarily to optimize the WHT regime. The Amendment is set to take effect on January 1, 2025. The key changes are summarized below.

Key Point 1 of the Amendment: Tax withholder has been changed from the responsible person of an entity to the entity itself

In the 2024 Amendment, the responsibilities for WHT on income paid by entities such as businesses, institutions and organizations, including the liabilities for non WHT compliances, will be borne by "legal entity" itself. This change aims to align the responsibilities of tax withholder with the corresponding rights, thereby resolving the foresaid long-standing disputes.

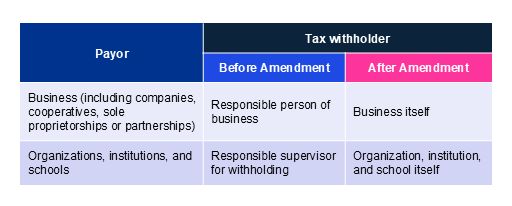

We use the following table summarizes the differences in tax withholder before and after the amendment for various types of income payments:

Key Point 2 of the Amendment: Revision of penalties for the violations related to filing or issuing Withholding (or Non-Withholding) Tax Statements

The Income Tax Act stipulates the following three penalties for violations of withholding obligations:

- Failure to withhold taxes as required;

- Has already withheld taxes as required but failed to file the "WHT statement" within the statutory time limit;

- Failure to timely or accurately file the “non-WHT statement”.

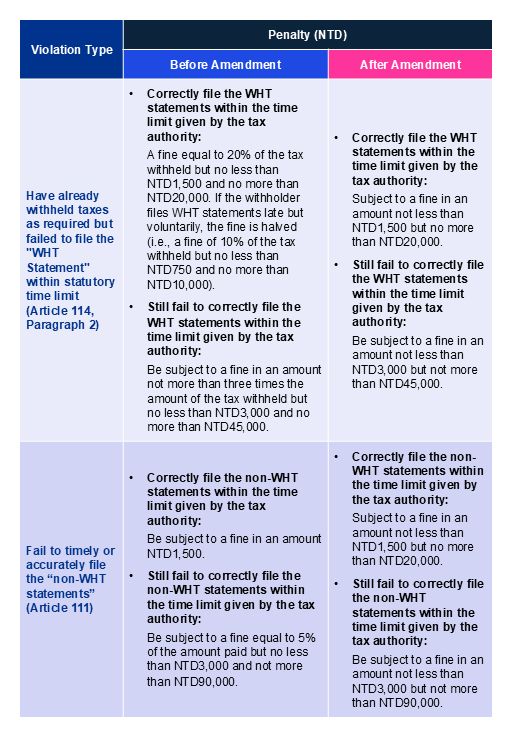

This Amendment revises the penalties for the second and third types of violations above. The original fixed-rate or fixed-amount fines have been amended to allow penalties within specified upper and lower limits based on the severity of the violation determined by tax authorities.

This gives tax authorities greater discretion to consider specific case circumstances (e.g., the amount of tax, intent, or negligence, whether the tax withholder voluntarily corrected the report, whether the violation repeats).

The following table summarizes the withholding penalty regulations before and after this amendment:

KPMG Observation

The Amendment is set to take effect on January 1, 2025. Therefore, until December 31, 2024, the obliged tax withholders will still be the responsible person or other person in charge of entities. So that these natural people must still ensure the fulfillment of withholding obligations.

Although this Amendment has revised the penalties for failing to file WHT (or non-WHT) statements by removing the original fixed-rate fines and granting tax authorities the discretion to impose different fines based on specific case circumstances, the "Reference Table for Penalty Amounts or Multiples for Tax Violations" has not yet been correspondingly revised. In practice, it will take time to further observe whether tax authorities will still impose fines based on a fixed percentage of the withheld tax amount.

Once the Amendment is enforced, as the responsibility of tax withholder will be transferred to entity itself, entities will be liable for WHT payments or penalties arising from non-compliances of WHT. Hence, it is recommended that companies take this opportunity to comprehensively review and revisit their WHT policies. In addition to updating relevant internal control regulations, it is also advised to assign responsible personnel to oversee and ensure WHT compliance. This will help prevent the company, as the tax withholder, from facing additional WHT payments, delay interest and fines for violating withholding obligations in the future.

Lastly, as this Amendment does not ease the penalties for un/under-withholding, the importance of applying the correct withholding rate cannot be overstated. In practice, common disputes arise over the classification of income types, as different types of income may be subject to different withholding rates. It is common for taxpayers to have different views from tax authorities on the classification of income, leading to under-withholding violations. Therefore, when determining the applicable withholding tax rate, it is highly recommended to prepare relevant transaction contracts and service evidence, seek professional tax advice from experts, and explore potential tax incentives to reduce or eliminate withholding obligations.

Authors

Shawn Lin

Manager

E:seanlin2@kpmg.com.tw

T:(02) 8101 6666 #18431

Sophia Wu

Assistant Manager

E:sophiawu2@kpmg.com.tw

T:(02) 8101 6666 #22896