The Carbon Border Adjustment Mechanism (CBAM) is one of several carbon pricing initiatives proposed under the European Green Deal. It forms another piece of the European Union's climate puzzle, following on from the 2015 Paris Climate Agreement and the EGD strategy, presented four years later. Its introduction is intended as one way of reducing greenhouse gas emissions and promoting climate-friendly action at a global level.

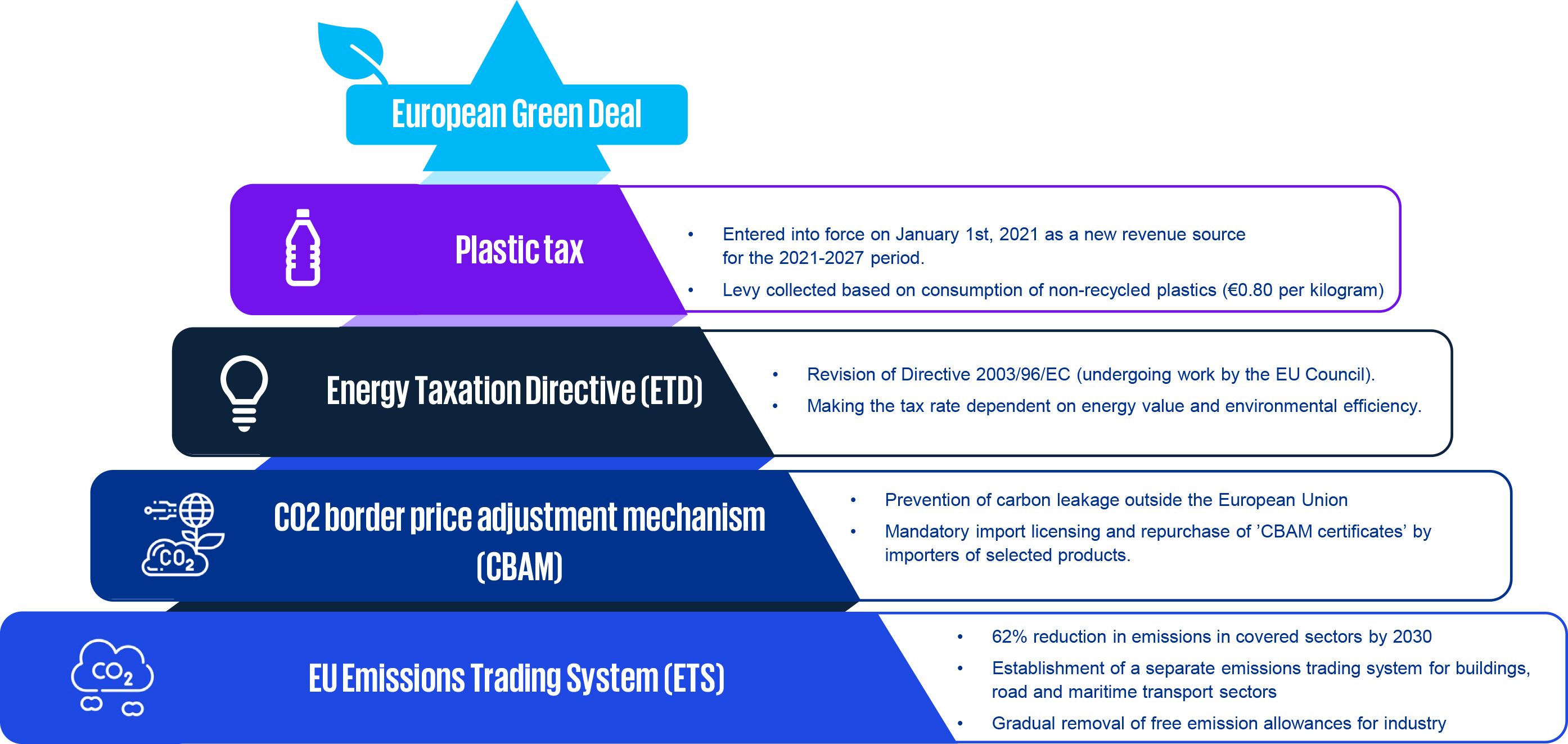

Key elements of the green tax reform and emissions-related levies in the context of the European Green Deal include:

- Extension of the Emissions Trading Scheme (ETS), including the planned phasing out of existing free allowances. An initial agreement between the European Commission, the European Parliament and the EU Council on EU ETS reform was reached in December 2022.

- Introduction of a border mechanism focusing on selected carbon-intensive products (CBAM).

- Reform of the Energy Taxation Directive (ETD).

- Plastic tax (introduced in 2021).

CBAM. A response to the risk of European deindustrialisation?

As mentioned in our article, the European Union's growing decarbonisation ambitions have raised concerns about the potential risk of carbon leakage. This risk occurs when consumers and producers operating within the European Union (which declares its high ambition with regards to reducing GHG emissions) would be encouraged to buy goods or relocate production to countries outside of the EU with significantly lower environmental standards and production costs. In such a scenario carbon leakage would reduce the effectiveness of carbon reduction efforts. In an extreme situation this could even lead to an overall increase in emissions, as the result would be an increase in production in non-EU countries with lower climate standards. It could also lead to job losses and reduced competitiveness of carbon-intensive industries operating in the EU.

To counter this risk, CBAM will require importers of selected commodities to purchase 'CBAM certificates', the purpose of which will be to subject regulated imported goods to the same carbon price as imposed on producers under the EU ETS. The Union will seek to force importers to bear the same regulatory costs as European producers. In addition to carbon leakage, CBAM will aim to incentivise foreign producers to reduce emissions and support non-EU governments to set their own carbon prices. The mechanism will apply to all non-EU countries except those shown in Annex 2 of the regulation:

Current stage of CBAM implementation

The European Commission, Council and Parliament reached a political agreement in December 2022 stipulating that the CBAM would already enter into force on October 1st, 2023. Following the trialogue, an updated wording of the Border Price Adjustment Mechanism (CBAM) Regulation was published on January 25th, 2023, formally approved by the European Parliament on April 18th and by the Council of the European Union on April 25th.

Products covered by the mechanism

CBAM was originally intended to cover selected product categories deemed to be most carbon intensive and vulnerable to carbon leakage: cement, electricity, fertilisers, iron and steel and aluminium. The latest version of the regulation has expanded and further defined this scope to include:

- hydrogen (CN 2804 10 000),

- screws, bolts, nuts, coach screws, screw hooks, rivets, cotter pins, cotter pins, washers (including spring washers) and similar articles of iron or steel (CN 7318),

- other articles of iron or steel (CN 7326),

- aluminium structures and parts of such structures (CN 7610),

- aluminium tanks, reservoirs, vats and similar containers (CN 7611 - 7613),

- strands, cables, plaited bands and the like, of aluminium, not electrically insulated (CN 7614),

- other aluminium articles classified in CN Chapter 7616.

Due to the transitional period in the functioning of the mechanism, which is expected to last between October 1st, 2023 and December 31st, 2025, the scope of the above-mentioned product categories will not change. However, it is expected that by 2030, the scope of CBAM-regulated commodities will cover all sectors falling within the scope of the EU Emissions Trading Scheme (EU ETS).

How will CBAM work in practice?

An entity that will be preparing to implement this regulation in its day-to-day operations must keep in mind three, important points: