The world is evolving at a pace of change that is unprecedented. Economic uncertainty is pressuring companies to cut costs and drive efficiencies; customers and tax authorities expect greater levels of transparency, disclosure, and governance and continue to innovate how they administer and collect tax using technology and data. The environment tax and finance leaders operate in has dramatically changed and these catalysts require different solutions and thinking.

How can KPMG help?

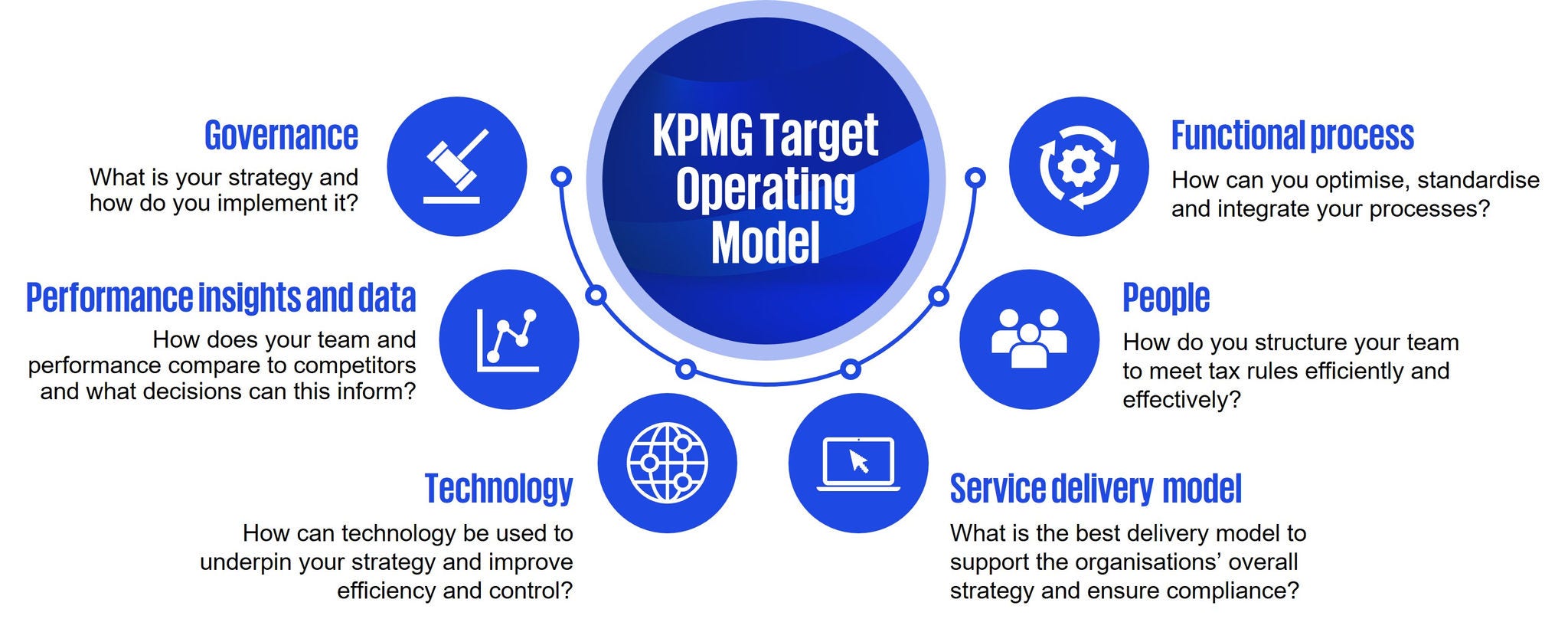

Tax Transformation starts with a clear tax vision and strategy aligned to the business objectives of the wider organisation. We can help you to co-design a leading operating model to enable you to unlock value while you manage tax compliance, tax risk and reputation. We have the right team underpinned by local and global subject matter experts across tax, transformation, IT and governance disciplines. We also have a range of analytics tools that can be used to elevate the insights from your tax function.

Why transform?

Tax today is attracting attention like never before. It’s no secret that there’s a lot of pressure on tax and finance teams. These teams are experiencing increasing compliance demands, while facing a changing digital world, but the capacity to manage and quickly adapt to changes can easily lag behind due to increased businesses’ workloads, and constrained resources and a war for talent.

Building a sustainable and responsive tax and finance function demands the right mix of skills and technology. Processes, systems and tools must focus on effective data management and control to avoid the consequences of data fragmentation. Tax and finance teams should be upskilled in critical technology areas at the time they must embrace an innovation mindset.

Common triggers for Transformation often include:

- New legislative and/or regulatory requirements such as real-time reporting or e-invoicing

- ERP system changes

- End-to-end operations or finance transformation

- Internal and/or external audit findings

- Changes in key tax or finance staff

- Budget pressures

- Mergers and acquisitions activity

By preparing the tax and finance function for the future, companies will be in a stronger position when facing market disruptors. They’ll be able to add a greater level of value to the business whilst encouraging an innovating and strategic mind set.

Some of the tools we use to gain quantitative insights and visibility on your tax data include the following:

To find out more about how KPMG can help you with your tax function, please contact us.